Introduction

Has that envelope from the Income Tax Department arrived at your doorstep? Your heart probably had a mini heart-attack. You’re not alone in this experience. Millions of taxpayers across India face this situation every year. The good news? Most income tax notices are simply routine checks rather than accusations of fraud.

Understanding these notices can save you from sleepless nights and hefty penalties. Time is always of the essence when dealing with tax authorities. Ignoring them is never an option.

In this guide, we’ll walk you through everything about income tax notices. From identifying different types to crafting perfect responses, we’ve got you covered. Whether you’ve received a scrutiny notice or a demand notice, you’ll find practical solutions here.

What is an Income Tax Notice?

An income tax notice is an official message from the tax department that demands your immediate attention. These legally binding documents require specific actions within strict deadlines. Failing to respond can lead to serious consequences.

The tax department issues notices for various reasons. They might want to verify your income details or point out discrepancies in your returns. Sometimes, they notice you haven’t filed returns at all. Other times, your reported income doesn’t match information from other sources.

The consequences of ignoring these notices can be severe. You might face penalties or even prosecution in extreme cases. The department can also freeze your bank accounts without warning. Therefore, prompt action is crucial.

How to Check Income Tax Notice Online

The Income Tax Department has digitised most processes, ending the wait for physical mail. You can now quickly check notices online, saving time and avoiding missed communications.

Here’s how to check the income tax notice online:

- Visit the official Income Tax e-filing portal

- Log in using your PAN number and password

- Go to the “e-Proceedings” section or check the “Pending Actions” tab

- Click on “View” next to any listed notice

- Download the notice immediately for your records

You can also receive notices through your registered email address. Just make sure you’ve opted for electronic communication. The “Compliance Portal” section on the e-filing website is another place to check. Many taxpayers also use the Income Tax Department’s mobile app for convenience.

Income Tax Notice Types:

The tax department issues various notices under different sections of the Income Tax Act. Each type serves a specific purpose and requires a unique response approach. Let’s explore the most common income tax notice types you might encounter.

Income Tax Notice Section 142(1)

An income tax notice section 142(1) comes when the Assessing Officer needs more information. This happens before they complete your assessment. Think of it as a request for clarification rather than an accusation.

The notice typically asks for specific documents or evidence. You might need to provide details about your assets and liabilities. Sometimes, they’ll request explanations for certain transactions. The officer might also ask about your various income sources.

The notice will clearly state what you need to submit and by when. Quick action with accurate information is your best strategy here. Delays or incomplete responses will only complicate matters further.

Income Tax Defective Return Notice (Section 139(9))

Have you received an income tax defective return notice? This means your tax return has errors or incomplete information. The department is giving you a chance to fix these issues.

Common reasons for this notice include mismatched personal details or incorrect tax calculations. You might have forgotten to sign your return form. Sometimes, required schedules or attachments are missing. Another frequent issue is claiming deductions without proper proof.

You usually get about 15 days to fix these defects. Missing this deadline means your return could be marked “invalid.” Essentially, it would be as if you never filed a return at all. So, act quickly when you receive this notice.

Income Tax Demand Notice (Section 156)

Most taxpayers dread receiving an income tax demand notice. This document states that you owe additional tax. Understanding the income tax demand notice procedure is crucial for a proper response.

The demand could arise from underreporting your income. Perhaps certain deductions were disallowed. There might be calculation errors in your return. Often, the TDS you claimed doesn’t match your Form 26AS records.

The notice clearly states how much you owe and when to pay it. Your income tax demand response should follow these steps:

- First, verify if the demand is accurate

- If it’s wrong, file a rectification request under Section 154

- For partly correct demands, pay the undisputed amount and contest the rest

- If fully correct, pay before the deadline to avoid extra charges

Always back your objections with solid documentation and relevant legal provisions.

Income Tax Department Cash Transaction Notice

Have you made large cash transactions recently? The income tax department cash transaction notice targets these activities. Since demonetization, the department closely monitors all major cash movements.

This notice might arrive if you’ve deposited large cash amounts in your bank. Making expensive purchases with cash can also trigger it. Receiving substantial cash payments often raises red flags. Failing to report large cash transactions is another common reason.

When responding, explain where the cash came from clearly. Show how it doesn’t qualify as taxable income or prove you’ve already accounted for it in your returns.

Notice for Scrutiny Assessment (Section 143(2))

Getting selected for scrutiny can feel intimidating. This selection might be random or based on specific risk factors. The department’s AI system often identifies cases for detailed review.

During scrutiny, the tax officer examines everything thoroughly. They verify all your income sources carefully. Every deduction and exemption gets validated. They cross-check information from third parties like banks. High-value transactions receive special attention.

Professional help is often necessary when facing scrutiny. The investigation is comprehensive and requires careful preparation. Don’t take this notice lightly – it demands your full attention.

Income Tax Notice for Salaried Employees:

Even with taxes deducted at source, salaried employees often receive tax notices. Understanding why this happens can help you avoid future issues.

The most common reasons for salaried employees income tax notice problems include:

- Changing jobs during the year without reporting all income sources

- Having additional income, like rent or interest, that wasn’t disclosed properly

- Discrepancies between the TDS claimed and what appears in Form 26AS

- Making major purchases that don’t align with your declared income

- Claiming deductions incorrectly without proper documentation.

Don’t panic if you receive a notice as a salaried employee. Usually, these are simple verification requests. Providing the right information or evidence resolves most issues quickly.

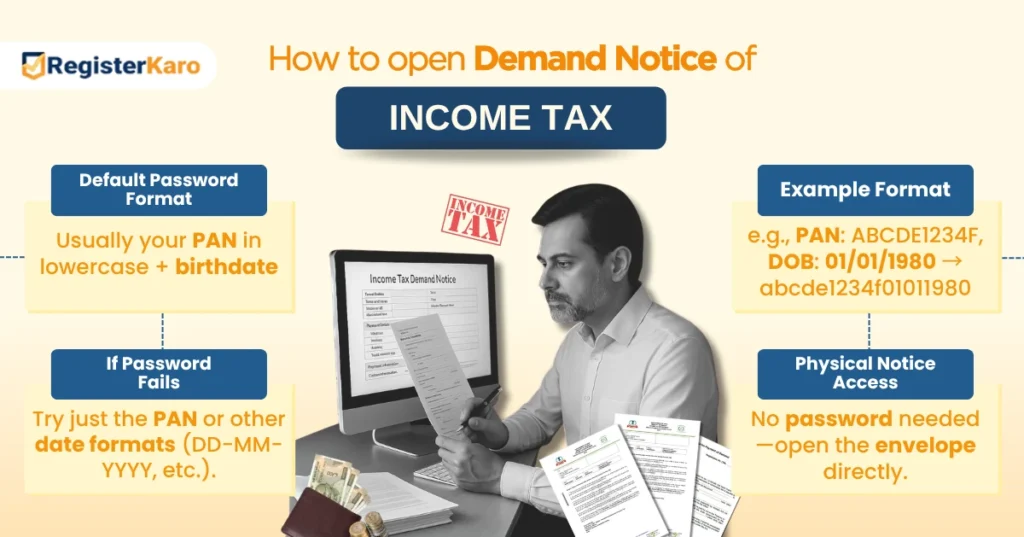

How to Open Demand Notice of Income Tax

Many taxpayers struggle with how to open demand notice of income tax when received. These notices typically come in password-protected PDF format for security reasons.

To open the notice:

- The default password is usually your PAN number in lowercase, followed by your birth date

- For example: if your PAN is ABCDE1234F and birth date is 01/01/1980, try abcde1234f01011980

- If this doesn’t work, try variations like just the PAN or PAN with date in different formats

- For physical notices, no password is needed – just open the envelope carefully

If you still can’t open the document, contact your jurisdictional tax officer immediately. You can find their contact details on the Income Tax Department website. Alternatively, visit your nearest income tax office with identification proof.

How to Respond to Income Tax Notices: Step-by-Step Guide

Responding to tax notices doesn’t have to be stressful. Follow this structured approach for your income tax demand notice response:

Step 1: Understand the Notice Thoroughly

First, identify which section the notice falls under. Note the response deadline immediately – this is critical! Understand exactly what information they’re requesting. Check if you need to submit specific documents with your response.

Step 2: Gather All Relevant Documents

Collect your income statements and Form 16 right away. Pull bank statements for the assessment year in question. Find investment proofs related to your tax-saving deductions. Get property documents if the notice mentions real estate. Organise any other evidence supporting your tax return claims.

Step 3: Draft a Clear Response

Begin by acknowledging receipt of the notice specifically. Reference the notice number and date for clarity. Address every query point by point without skipping anything. Explain any discrepancies with solid supporting evidence. Maintain a respectful tone throughout your communication.

Step 4: Submit Your Response Properly

Use the online portal whenever possible for faster processing. Always keep proof of your submission handy. Make copies of all documents before submitting them. Follow up if you don’t receive acknowledgement within a reasonable time.

Step 5: Stay on Top of the Process

Track your response status regularly on the online portal. Be prepared to answer additional questions if needed. Keep communication channels with the tax department open and responsive.

Remember that even if you need more time to gather documents, you must respond by the deadline. You can request an extension with a valid reason. Most reasonable requests for extra time are granted.

Common Mistakes to Avoid When Handling Income Tax Notices

Many taxpayers make costly errors when dealing with tax notices. Avoid these common pitfalls:

- Never ignore a notice – this is the worst possible approach. It can lead to one-sided assessment, penalties, and even legal action.

- Don’t miss deadlines. Late responses often get rejected outright, leaving you with unfavourable outcomes.

- Avoid providing incomplete information. Half-answers typically trigger more notices and drag out the process.

- Stay consistent with your previous submissions. Contradicting earlier statements raises immediate red flags.

- Never respond without fully understanding the notice requirements. This approach often backfires badly.

- Don’t hesitate to seek professional help for complex notices. Some issues require expert guidance.

- Never conceal information or provide misleading details. This can lead to severe penalties and legal consequences.

- Maintain a respectful tone in all communications. Aggressive language won’t help your case, even if you disagree.

At RegisterKaro, we’ve helped countless taxpayers navigate these challenges effectively. Our experience shows that most notice-related issues stem from these avoidable mistakes.

When to Check Income Tax Notice Status

After responding to a notice, monitoring its status is crucial. You should check income tax notice status regularly through the e-filing portal. This helps you stay ahead of any developments.

The best times to check your notice status include:

- One week after submitting your response

- When approaching any mentioned follow-up deadlines

- Before filing your next tax return

- If you receive any communication from the department

- Before making major financial decisions

Regular checks help you catch any new developments quickly. The income tax notice check online process takes just a few minutes but provides valuable peace of mind.

Preventive Measures: How to Avoid Income Tax Notices

The best strategy is to avoid notices altogether. Follow these preventive measures:

- Report all income sources completely and accurately. Nothing should be left out.

- Maintain organised records of all financial transactions. This is especially important for tax deductions.

- Always cross-check TDS credits with Form 26AS before filing returns. Mismatches are common triggers for notices.

- Keep your returns consistent across years. Unexplained variations often raise suspicions.

- Voluntarily disclose major financial transactions. Don’t wait for the department to discover them.

- File returns on time without fail. Late filing increases scrutiny chances significantly.

- Double-check all basic information like PAN and bank details. Small errors can cause big problems.

- Stay updated with changing tax laws regularly. Ignorance isn’t accepted as a valid excuse.

These practices will dramatically reduce your chances of receiving tax notices. Prevention truly is better than a cure when it comes to tax compliance.

Conclusion

Income tax notices don’t have to ruin your peace of mind. With proper understanding and prompt action, you can handle them effectively. Remember that most notices are routine verification procedures rather than accusations.

The key lies in quick response, thorough preparation, and honest communication. Whether dealing with an income tax defective return notice or a demand notice, good documentation and timely action prevent unnecessary complications.

Why wait? Get expert help from RegisterKaro to file your Income Tax Return! Contact us now!

Frequently Asked Questions (FAQs)

- What should I do immediately after receiving an income tax notice?

Read the notice carefully first. Note the deadline for response right away. Gather all relevant documents quickly. Prepare a detailed reply addressing all points raised.

- How long do I have to respond to an income tax notice?

Response times vary by notice type. Most notices give you 7 to 30 days from receipt. The exact deadline appears in the notice itself. If you need more time, request an extension from your Assessing Officer.

- Why did I receive a notice despite paying all my taxes on time?

Notices aren’t always about unpaid taxes. They often verify information or check discrepancies. Your return might have been selected for random scrutiny. High-value transactions sometimes trigger automatic verification.

- How do I respond to an income tax notice online?

Log in to the Income Tax e-filing portal with your PAN and password. Navigate to the “e-Proceedings” section. Select the relevant notice and click “Submit Response.” Upload your reply letter with supporting documents.

- What happens if I disagree with the tax demand in the notice?

Clearly explain your objections with supporting evidence. File for rectification under Section 154 if there’s a calculation mistake. For substantial disagreements, file an appeal with the Commissioner of Income Tax (Appeals) within 30 days.