Have you ever wondered what it takes for a private company to step into the public spotlight? In India, businesses don’t just grow; they evolve. This is where Section 18 of the Companies Act 2013 comes into being. It lays out the legal path for entrepreneurs who have completed a Pvt Ltd company registration to plan their growth journey by understanding this conversion process.

Converting from a private to a public company can unlock funding, attract investors, and enhance your brand’s reputation. But doing it right comes with understanding of rules and following the process carefully.

In this blog, we will explore Section 18 of the Companies Act 2013, break down the step-by-step conversion process, and highlight the benefits and challenges. Whether you are a startup founder or a business owner planning expansion, this guide can help you navigate the journey smoothly.

What is Section 18 of the Companies Act, 2013?

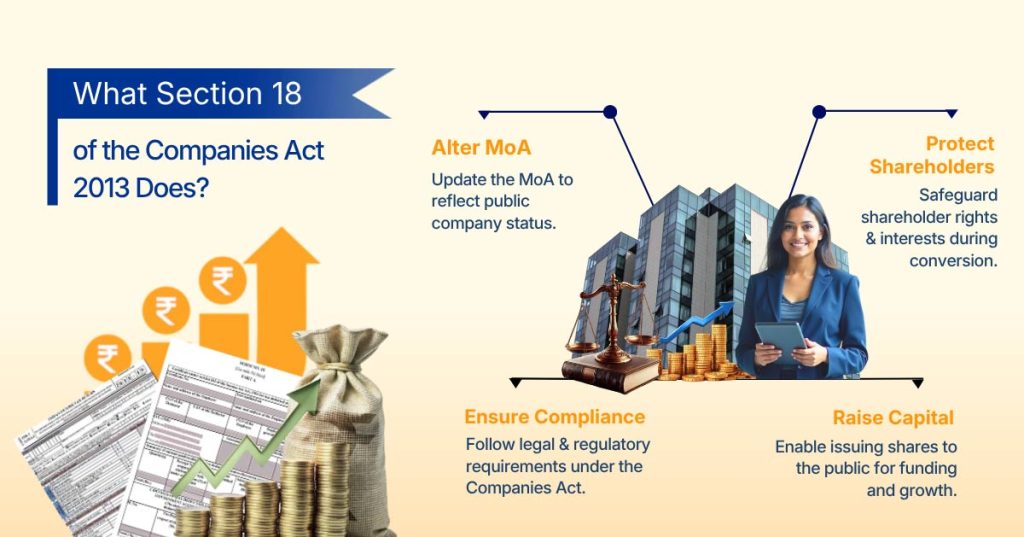

Section 18 of the Companies Act 2013 guides private companies on how to convert into public companies. It focuses on changing the Memorandum of Association (MoA) while ensuring companies follow a legal process. When you change the MoA, the company starts operating legally as a public entity. It allows free transfer of shares, enables public capital raising, and aligns the company with public company regulations.

Understanding this section helps business owners plan the transition smoothly and stay compliant. Section 18:

- Allows a private company to alter its MoA to reflect public company status.

- Requires approval from the board of directors and shareholders through formal resolutions.

- Protects pre-existing liabilities like debts and obligations incurred before conversion remain enforceable.

- Mandates filing forms and documents with the Registrar of Companies (ROC).

- Ensures the company meets all regulatory requirements before conversion.

- Protects shareholder interests through a structured legal process.

- Serves as a roadmap for raising capital, gaining credibility, and expanding the business.

Eligibility Criteria for a Private Company to Convert into a Public Company

There are differences between public and private companies in India. Not every private company can convert into a public company. The law sets rules to ensure a company is ready for the added responsibilities. Meeting these requirements keeps the transition smooth and compliant.

Key eligibility requirements:

- Must be a private company registered under the Companies Act, 2013.

- Needs at least two shareholders and two directors. If there are fewer than seven members, the company must increase membership. Moreover, if there are only two directors, they must appoint at least three.

- Must meet the minimum capital requirements set by law.

- Cannot have ongoing legal disputes that block the conversion process.

- Must comply with all provisions of the existing Memorandum of Association (MOA) and Articles of Association (AOA).

- Cannot have restrictions on share transfer that conflict with public company rules.

- Must clear all statutory dues, including taxes and employee contributions.

- Should have a clean record of filing annual returns and financial statements with the ROC.

- Outstanding borrowings or debts must comply with public company regulations.

- Cannot have a history of serious regulatory violations.

Following these criteria ensures your company can legally convert, raise capital, and expand its operations confidently.

Unsure if your company meets the criteria? RegisterKaro can review your eligibility and guide you through every step of the conversion process.

Rules for Conversion of a Private and Public Company

Converting a private company into a public company, or vice versa, requires following specific rules and statutory provisions. Companies must adhere to these rules to ensure legal compliance and smooth approval.

- Companies (Incorporation) Rules, 2014: Rule 33 and related provisions govern the conversion process. These rules outline procedural requirements for filing applications, resolutions, and other necessary documents with the RoC. Additional rules like Rule 7, 37, and 39 apply to OPCs, unlimited companies, and guarantee companies.

- Alteration of MoA: Section 13 of the Companies Act, 2013, requires companies to alter their MoA during conversion. The MoA must reflect the company’s new status and objectives.

- Alteration of AoA: Section 14 of the Companies Act mandates changes to the AoA to align with public or private company regulations. These changes include governance rules, quorum requirements, and share transfer provisions. Adopting a fresh AoA is recommended to fully comply with public company norms.

- Role of the Registrar of Companies (ROC): The ROC reviews the application, scrutinizes the filed documents, and approves the conversion. After verification, the ROC issues a new certificate of incorporation, officially changing the company’s status.

By following these rules carefully, the company ensures a legally valid conversion and avoids delays or rejection.

How to Convert a Private Limited Company into a Public Limited Company?

Converting a private company into a public company requires following a structured legal process. Completing each step carefully ensures compliance and avoids delays or penalties.

1. Conducting the Board Meeting

The board meeting is the first formal step in the conversion process. Directors discuss the plan to go public and approve necessary changes.

- Send Notices: Issue board meeting notices at least 7 days in advance, following Section 173 of the Companies Act and Secretarial Standards.

- Pass Board Resolution: Approve the conversion plan, including changes to the MoA and AoA. Ensure quorum and voting thresholds are met as per law.

This ensures that the company’s leadership is aligned and officially approves the move.

2. Holding the General Meeting of Shareholders

Next, shareholders must approve the conversion through a special resolution. This step ensures all owners consent to the change.

- Send Notices, Confirm Quorum, and Set Agenda: Notify shareholders at least 21 days in advance. Ensure you meet the quorum requirements; 2 shareholders minimum or as per the AoA.

- Pass Special Resolution: At least 75% of shareholder votes must favor the conversion. Approve the AoA and MoA alteration for conversion.

3. Filing Required Documents with the Registrar of Companies (ROC)

After approvals, the company files all necessary ROC forms for conversion. Correct filing confirms legal recognition of the conversion.

- Form MGT-14: Submit the special resolution to the ROC within 30 days of passing.

- Form INC-27: Submit the conversion application with prescribed fees.

- Form INC-28: File this form after the ROC order is issued to officially record and validate the conversion in the company’s public records.

- Attachments: Include copies of the updated MoA and AoA, board resolution, and special resolution.

- Director Declarations: Submit declarations confirming legal compliance.

- Special Cases: For companies with foreign shareholders, debenture holders, or regulatory requirements, include relevant consent letters or NOCs.

Before filing, verify that all statutory dues are cleared, no pending legal disputes exist, and the MoA and AoA are fully updated and signed.

4. Obtaining the New Certificate of Incorporation

The ROC reviews the application and, upon satisfaction, approves the conversion.

- The ROC cancels the old registration and issues a new Certificate of Incorporation (CoI), reflecting the public company status. The company officially becomes “public” only after this certificate is issued.

- This certificate legally establishes the company as a public entity, enabling it to raise capital and operate under public company regulations.

5. Completing Post-Conversion Formalities

After ROC approval, the company must update records and adopt new rules to ensure smooth operations as a public company.

- Update Statutory Registrations: Revise PAN, bank accounts, letterhead, GST, TAN, and other statutory records.

- Adopt New MoA and AoA: Ensure these reflect public company requirements, including quorum rules, share transferability, and compliance obligations.

- Inform Stakeholders: Notify investors, lenders, and government authorities about the conversion.

- Update Contracts and Signatories: Revise agreements, company seals, and authorized signatories to align with the new public status.

Completing all these steps ensures a smooth transition. The company stays legally compliant and gains access to funding, credibility, and growth opportunities.

Need help with board meetings, resolutions, and ROC filings? RegisterKaro can manage the entire conversion process smoothly. Contact Now for a free consultation.

Documents Required to Convert a Private Company into a Public Company

Converting a private company into a public company requires proper documentation. Filing the right documents ensures smooth approval from the ROC and keeps the process legally compliant.

Key documents include:

- Board Resolution: Approving the conversion plan and authorizing filing with the ROC.

- Special Resolution of Shareholders: Passed in the general meeting to approve the conversion.

- Altered MoA: Updated to reflect the company’s new public status.

- Altered AoA: Revised rules to comply with public company requirements.

- Form INC-27: Official form submitted to the ROC for approval of conversion.

- Declaration by Directors: Confirming compliance with all legal requirements.

- Proof of Payment of Fees: Filing fees as prescribed under the Companies Act.

Additional documents may be required in special cases, such as:

- Consent letters from existing debenture holders or lenders.

- No Objection Certificate (NOC) from regulatory authorities, if applicable.

- Documents related to foreign shareholders, if any.

Compliance and Governance Implications after Conversion of Private Company to Public

Converting a private company into a public company brings new responsibilities. Public companies must follow stricter compliance and governance rules to operate legally and maintain investor confidence. Key implications include:

- Meet Minimum Capital Requirements: Maintain the minimum paid-up capital under the Companies Act. This ensures financial stability and credibility. Raising new capital may affect shareholding and require shareholder approval.

- Change Board Structure and Meeting Rules: Appoint more directors, including independent directors. Form committees like Audit and Nomination & Remuneration. Follow notice, quorum, and voting rules for meetings.

- Follow Disclosure, Reporting, and Audit Obligations: Publish annual reports and conduct statutory audits. Complete quarterly or half-yearly reporting if applicable. Maintain internal audits and compliance systems.

- Manage Share Transferability and Investor Relations: Allow free transfer of shares. Communicate regularly with shareholders. Address grievances promptly.

- Protect Shareholder Rights: Ensure fair treatment of voting, exit, and pre-emptive rights. Inform shareholders about new share issuance or capital changes.

- Regulate Loans and Related-Party Transactions: Obtain approvals and disclose transactions under Section 188. Prevent conflicts of interest and maintain transparency.

- Comply with Secretarial Standards and Governance Codes: Maintain statutory registers and hold meetings as required. Follow the codes of conduct for directors and key managers.

- Adhere to SEBI Rules (if listed): File shareholding patterns, quarterly results, and other disclosures. Follow insider trading regulations and continuous disclosure obligations.

- Handle Regulatory Scrutiny and Legal Liability: Directors must act diligently to avoid penalties. Consider D&O insurance to reduce personal risk.

Following these rules ensures smooth operations, strengthens credibility, and builds investor confidence. It also lays a strong foundation for growth and capital raising.

Regulatory MCA Updates & for Converting a Private Company into a Public Company

The rules for converting a private company into a public company continue to evolve. Staying updated helps businesses comply and avoid delays.

- Updates to Companies (Incorporation) Rules: The MCA amended the Companies (Incorporation) Rules, 2014, including changes to Rule 33. Key forms, like Form INC-27, have been revised to simplify filings. Some requirements for One Person Company conversions have been relaxed.

- Other Statutory Changes: The MCA extended deadlines for mandatory dematerialization of securities. Recent circulars updated rules for prospectus and allotment, which public companies must follow post-conversion.

- Case Law & Tribunal Decisions: Currently, no major NCLT or NCLAT rulings directly interpret Section 18. Businesses should monitor future judgments that may clarify MoA/AoA changes or conversion disputes.

Keep up with the latest rules and MCA notifications. RegisterKaro ensures your conversion follows current regulations without any hassle.

What are the Advantages of Converting to a Public Company?

Converting a private company into a public company brings many benefits. The change opens new opportunities and strengthens credibility.

Key advantages include:

- Access to Capital: Public companies raise funds by issuing shares to the public. This fuels expansion and large projects.

- Enhanced Credibility: Going public improves the company’s reputation with investors, customers, and lenders.

- Better Borrowing Capacity: Companies that complete a public limited company registration can access wider funding options and enjoy greater market recognition.

- Attracting Talent: Public companies can offer stock options to attract and retain skilled employees.

- Market Visibility: Public companies gain recognition in the market, which helps in partnerships and growth.

- Structured Governance: Reporting and disclosure norms improve corporate governance and operational discipline.

Converting to a public company lets businesses scale efficiently, raise funds, and build trust with stakeholders.

What are the Challenges and Risks of Converting to a Public Company?

Converting a private company into a public company comes with challenges. Companies face higher responsibilities, compliance requirements, and scrutiny.

Key challenges and risks include:

- Increased Compliance: Public companies’ compliance is strict. They must follow strict reporting, disclosure, and auditing requirements.

- Higher Costs: Legal fees, filing fees, and administrative expenses can add up during and after conversion.

- Loss of Control: Owners may lose some control as shareholders gain voting rights and influence decisions.

- Regulatory Scrutiny: Public companies face oversight from regulators, stock exchanges, and shareholders.

- Pressure to Perform: Public companies must meet market expectations and deliver consistent growth.

- Transparency Demands: Companies must disclose financial and operational information regularly, which can expose sensitive data.

Despite these risks, careful planning and proper compliance help companies handle the transition smoothly. Many businesses successfully overcome these challenges to access funding and expand their operations.

Conclusion

Converting a private company into a public company under Section 18 of the Companies Act 2013 opens doors to capital, credibility, and growth. Following the rules, completing the process carefully, and meeting compliance requirements ensure a smooth transition. With proper planning and governance, businesses can unlock new opportunities and scale confidently in the public domain.

Frequently Asked Questions

Not every private company can convert into a public company. The law requires companies to meet eligibility criteria, including minimum capital, at least two shareholders and two directors, a clean legal record, and compliance with MoA/AoA provisions. Meeting these conditions ensures a smooth conversion and regulatory compliance.