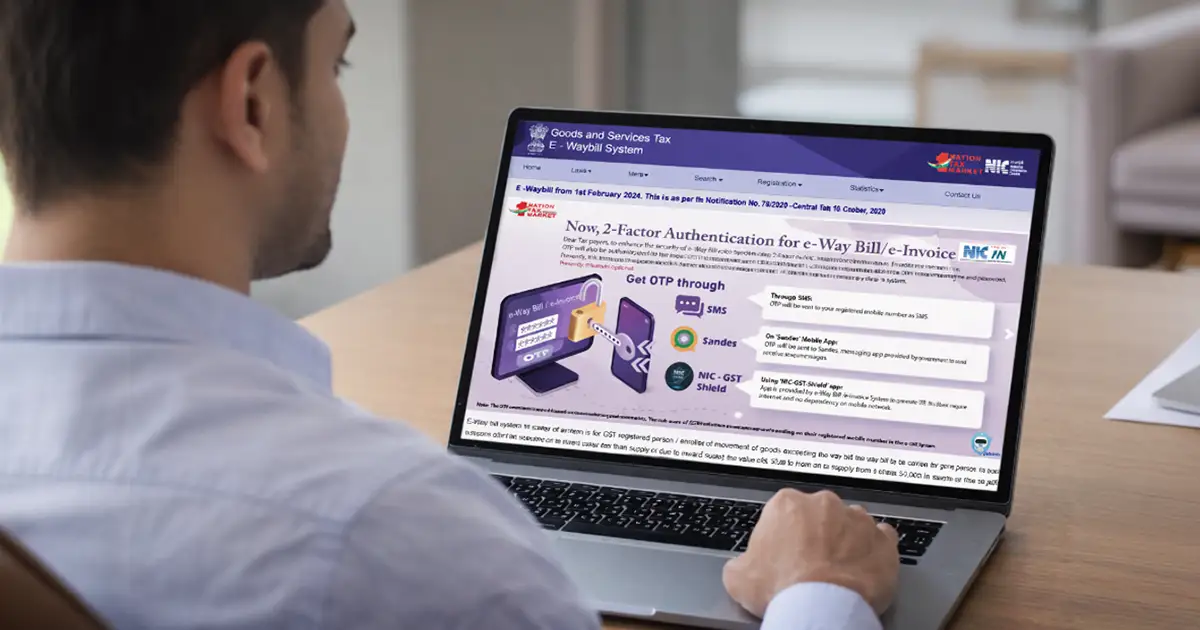

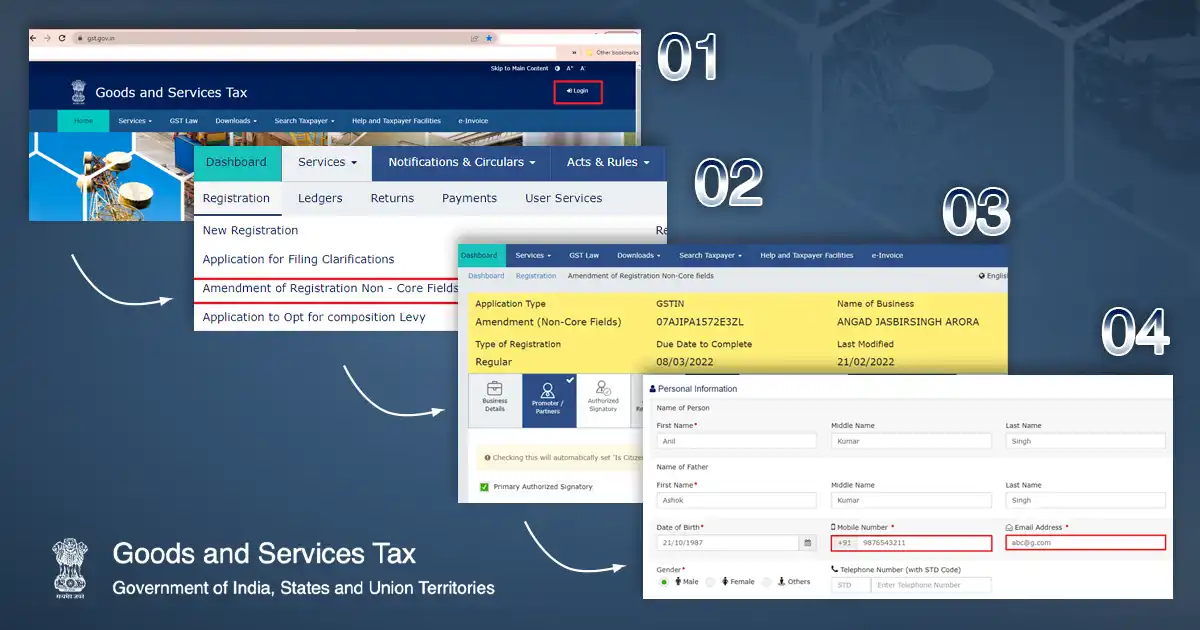

A GST (Goods and Services Tax) return is an official document providing a comprehensive record of a business's financial activities. It provides a summary of sales and purchases, including the tax collected on sales (output tax) and the tax paid on purchases (input tax). Businesses must submit these returns electronically through the Government of India's official GST portal.

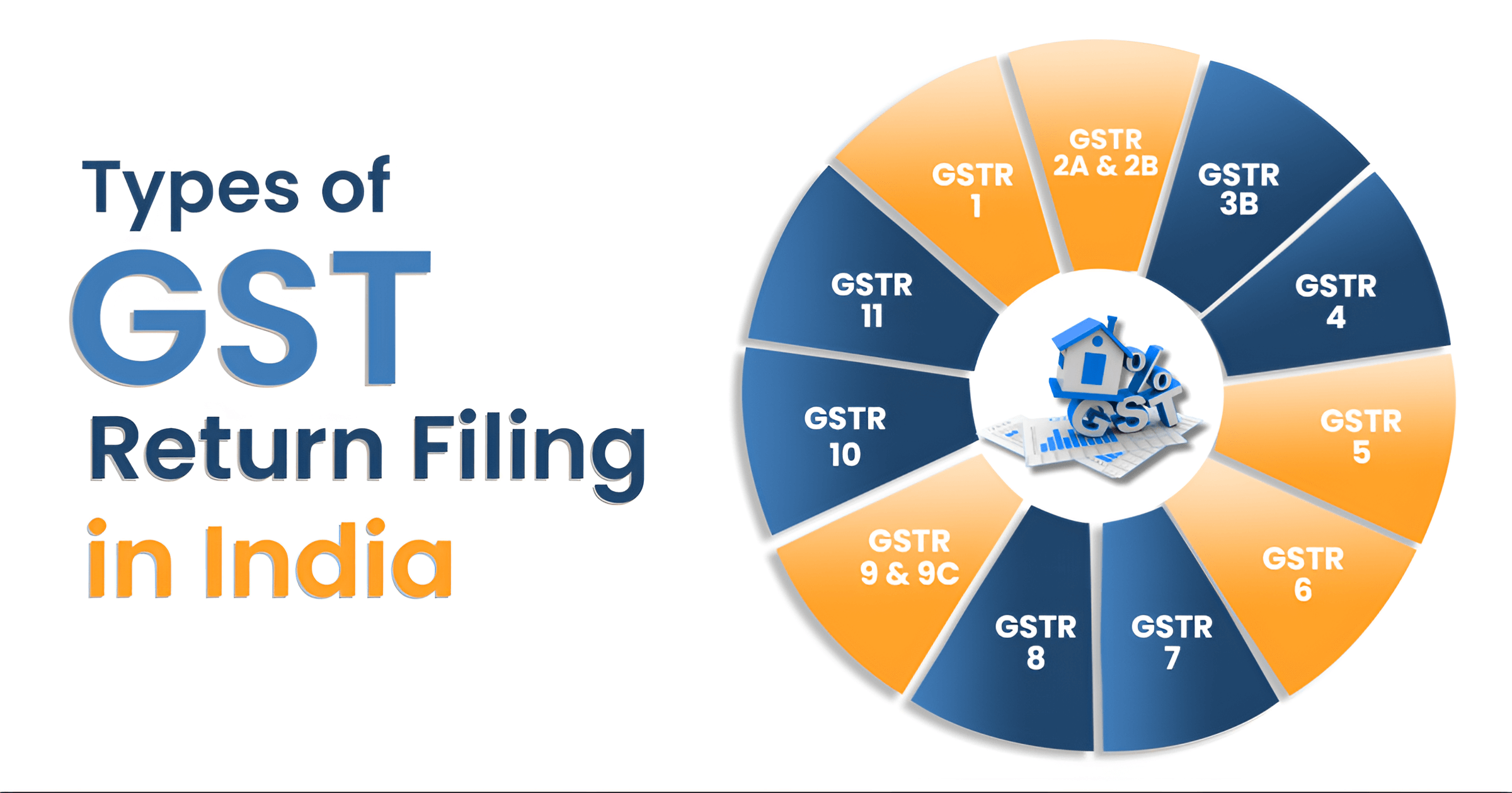

Under the GST regime, regular businesses with an annual aggregate turnover exceeding Rs. 5 crore are required to file two main monthly returns: GSTR-1 (details of outward supplies) and GSTR-3B (a summary return). In addition to these, most regular taxpayers must also file an annual return, bringing the total to as many as 25 returns per year for a monthly filer.

This process ensures compliance with tax regulations and forms the backbone of the Goods and Services Tax Network (GSTN). Even if a business has no activity during a tax period, filing a 'nil' return is mandatory to maintain compliance.

What Information is Submitted in a GST Return?

GST returns require detailed information on all sales and purchases of goods and services. Businesses report two key GST details: the GST they collect on sales (output GST) and the GST they pay on purchases, which they can claim as Input Tax Credit (ITC).

Key details required include:

| Category | Details to Submit |

| Basic Information |

|

| Outward Supplies (Sales) |

|

| Inward Supplies (Purchases) |

|

| Tax & Credit |

|

| Adjustments |

|

The Role of GST Return Filing in India's Tax System

The GST system transformed India's indirect tax landscape in 2017 by replacing multiple central and state levies with a unified structure. This change required businesses to file regular GST returns to comply with tax regulations.

Here’s why GST Return Filing has evolved the Indian Tax System:

- Enable accurate calculation of a business’s net tax liability

- Ensure compliance with Indian tax laws and regulations

- Maintain transparent, auditable records of business transactions

- Help the government monitor tax collection and track supply chains

- Aid in detecting and preventing tax evasion

- Allow businesses to claim Input Tax Credit (ITC)

- Prevent the cascading effect of taxes (tax on tax)

Importance of Accurate and Timely Filing

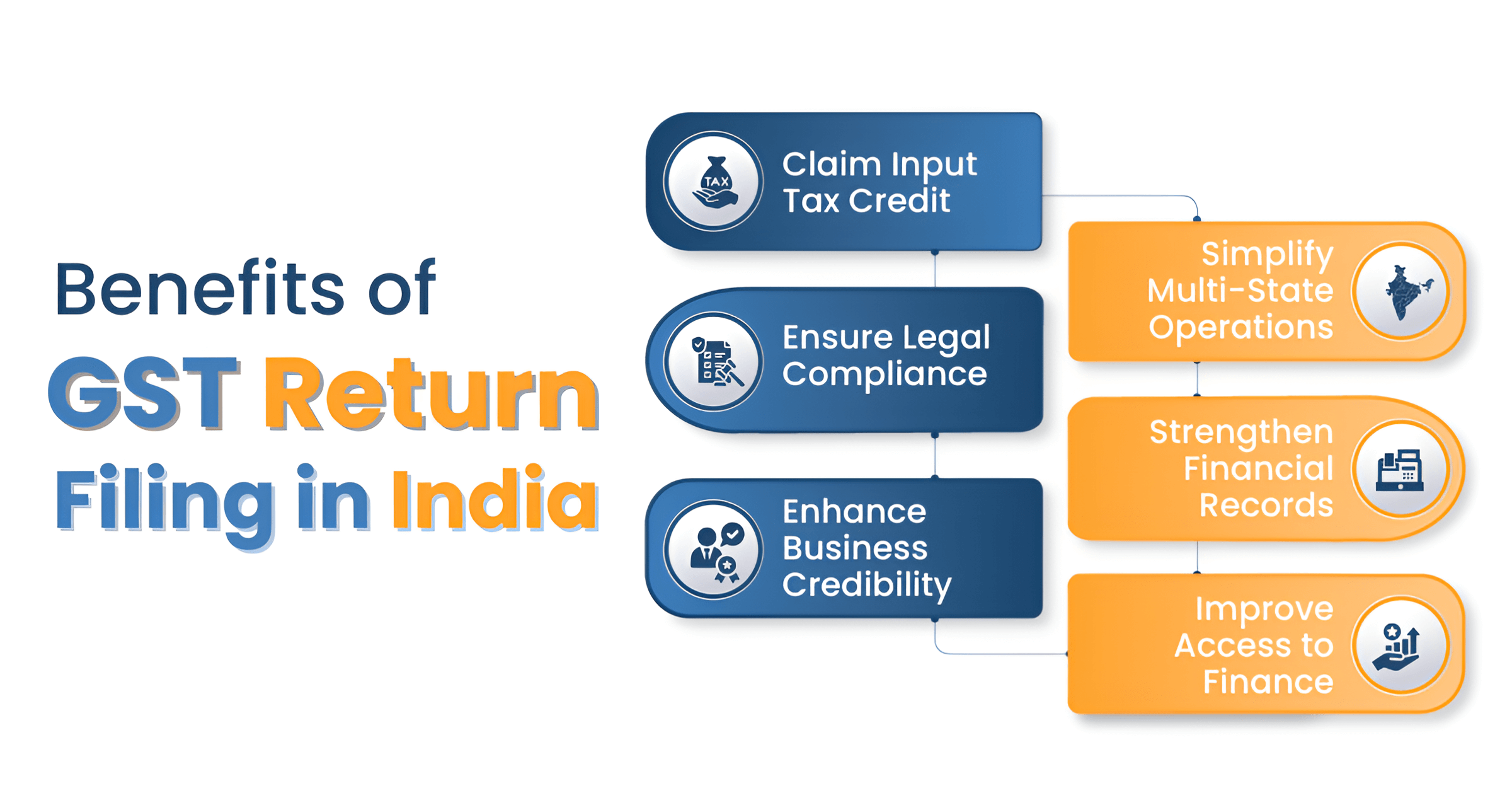

Filing GST returns within the specified deadlines is crucial to avoid financial penalties. Late filing incurs interest charges and late fees of up to Rs. 100 per day. Apart from avoiding fines, the return filing also presents a vital aspect of business operations and credibility.

- Avoiding Penalties and Late Fees: Timely submission prevents financial burdens from penalties and late fees. These charges can significantly impact a business's profitability.

- Claiming Input Tax Credit (ITC): ITC allows businesses to claim credit for the GST paid on purchases used for business purposes. This valuable credit can only be claimed if GST returns are filed on time.

- Maintaining Compliance and Credibility: Regular and accurate filing demonstrates a business's commitment to tax compliance. A good compliance rating enhances a business's reputation, which can be beneficial when applying for loans, tenders, or attracting investors.

- Tracking Business Performance: The data derived from regular checks offers a clear snapshot of sales, purchases, and tax flows, aiding strategic planning. Businesses can use this data to track their performance, spot areas that need improvement, and make smarter financial decisions.

- Reduced Risk of Audits: Timely and accurate filing significantly decreases the likelihood of a business being selected for an audit by tax authorities. This saves considerable time, resources, and potential stress associated with tax audits, allowing businesses to focus on core operations.

- Streamlined Business Operations: Consistent GST return filing helps maintain organized financial records. This simplifies overall tax compliance for a business, making operations smoother and more efficient.