A Limited Liability Partnership (LLP) Agreement is a crucial legal document that outlines the framework of how an LLP will function. It includes essential details such as business objectives, partner roles, responsibilities, profit-sharing ratios, and other operational terms. As the business grows or circumstances change, it may become necessary to update this agreement.

Step 1: Hold a Partner Meeting & Pass a Resolution

The first step in modifying an LLP Agreement is to hold a formal meeting with all existing partners. During this meeting, the proposed changes should be discussed and reviewed. Once all partners agree to the modifications, a resolution must be passed to approve the changes. It is important to record this resolution in the meeting minutes and ensure unanimous consent or majority approval as specified in the original LLP Agreement.

Step 2: Draft a Supplementary LLP Agreement

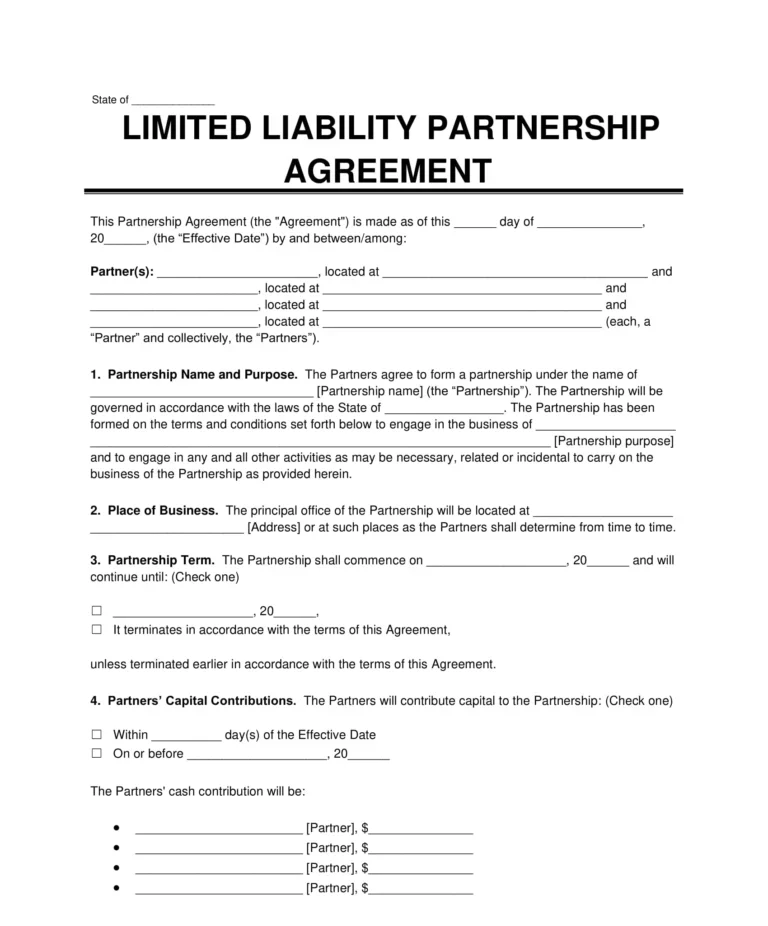

After passing the resolution, the next step involves drafting a Supplementary LLP Agreement. This document should clearly outline all the changes being made to the original agreement, such as alterations in business structure, responsibilities, or capital contributions. The supplementary agreement acts as an addendum, legally binding once executed, and should reflect the updated terms in a precise and unambiguous manner.

Step 3: Pay Stamp Duty & Execute the Agreement

Once the supplementary agreement is ready, it must be signed and executed by all the partners to give it legal validity. Additionally, the document must be stamped as per the applicable stamp duty regulations in your respective state. Proper execution also includes having the agreement witnessed by at least two individuals. This step ensures that the document is legally enforceable and acceptable to regulatory authorities.

Step 4: File Form LLP-3 with the RoC

Within 30 days of passing the resolution, the LLP is required to file Form LLP-3 with the Registrar of Companies (RoC) through the Ministry of Corporate Affairs (MCA) portal. This form must include the signed resolution and the supplementary LLP agreement as attachments. Filing Form LLP-3 officially informs the RoC about the changes and ensures that the modifications are legally recognized.

Step 5: File Form LLP-4 (If Applicable for Partner Changes)

If the changes involve the appointment, removal, or modification of details related to a partner or designated partner, then Form LLP-4 must also be filed in conjunction with Form LLP-3. This form captures key information about the individual or corporate entity being added or removed, including their name, address, and role within the LLP. It is mandatory to file Form LLP-4 whenever there is any alteration in partner-related details to ensure the official records are updated accurately.

Step 6: Receive RoC Approval

Once all required forms are submitted, the Registrar of Companies will review the documentation. If everything is found in order, the RoC will approve the changes and update the LLP records accordingly. An acknowledgment receipt will be generated, and the revised LLP Agreement will now be legally valid. It is advisable to store a copy of the updated agreement and the approval acknowledgment for future compliance or legal reference.