A One Person Company (OPC) is a business structure introduced under the Companies Act, 2013, that allows a single Indian citizen and resident to form a private limited company. It gives the sole owner full control while offering limited liability, separate legal status, and perpetual succession. OPCs must appoint a nominee who will take over if the owner is incapacitated or dies.

Combining the simplicity of a sole proprietorship with limited liability, an OPC has a single owner who acts as both shareholder and director, with a nominee appointed for succession. Initiated by a promoter, it is a separate legal entity that can own assets and enter into contracts.

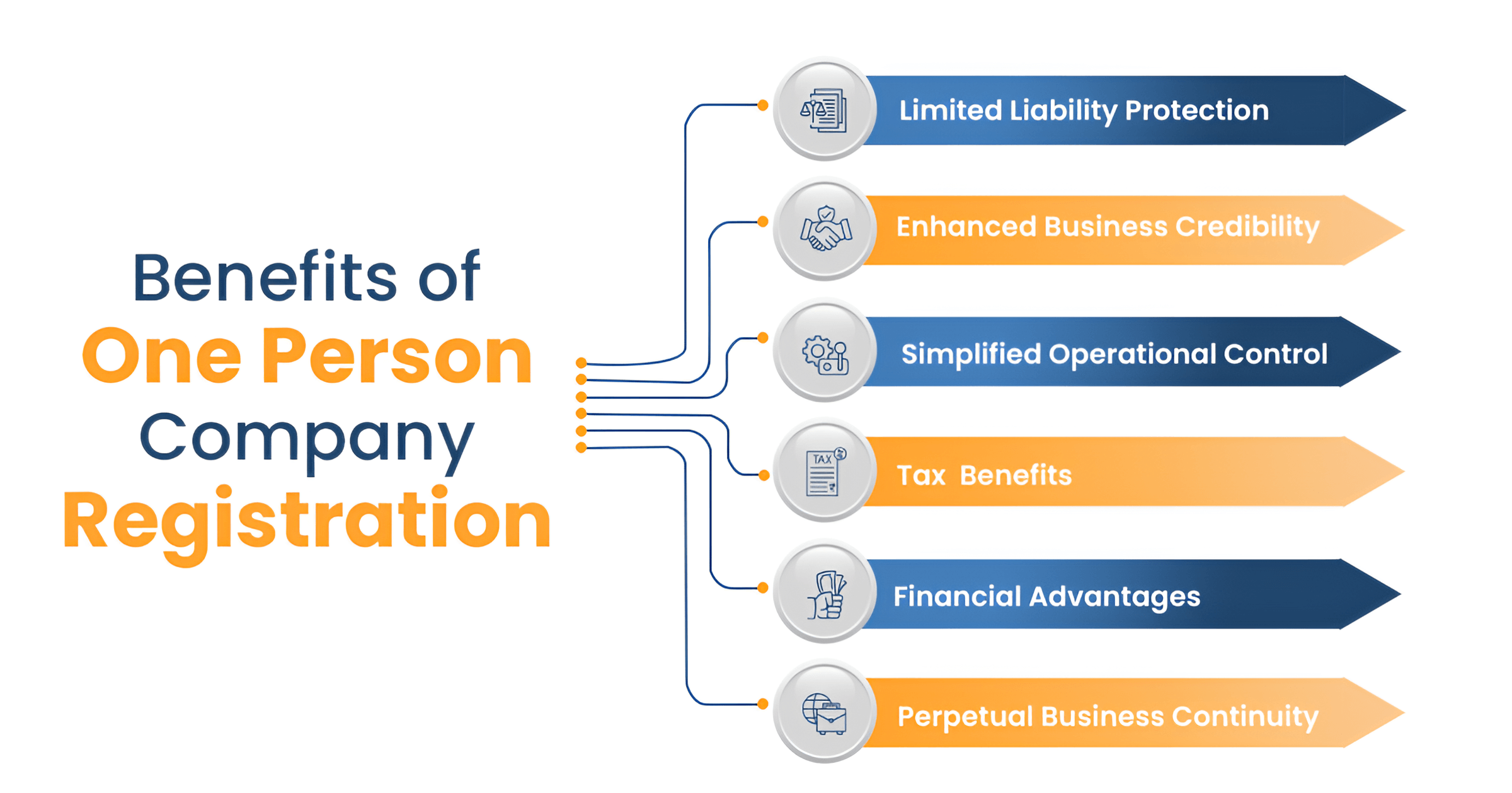

With minimal compliance, no capital requirement, and professional credibility, an OPC supports growth and can convert into a private or public company if financial thresholds are exceeded.

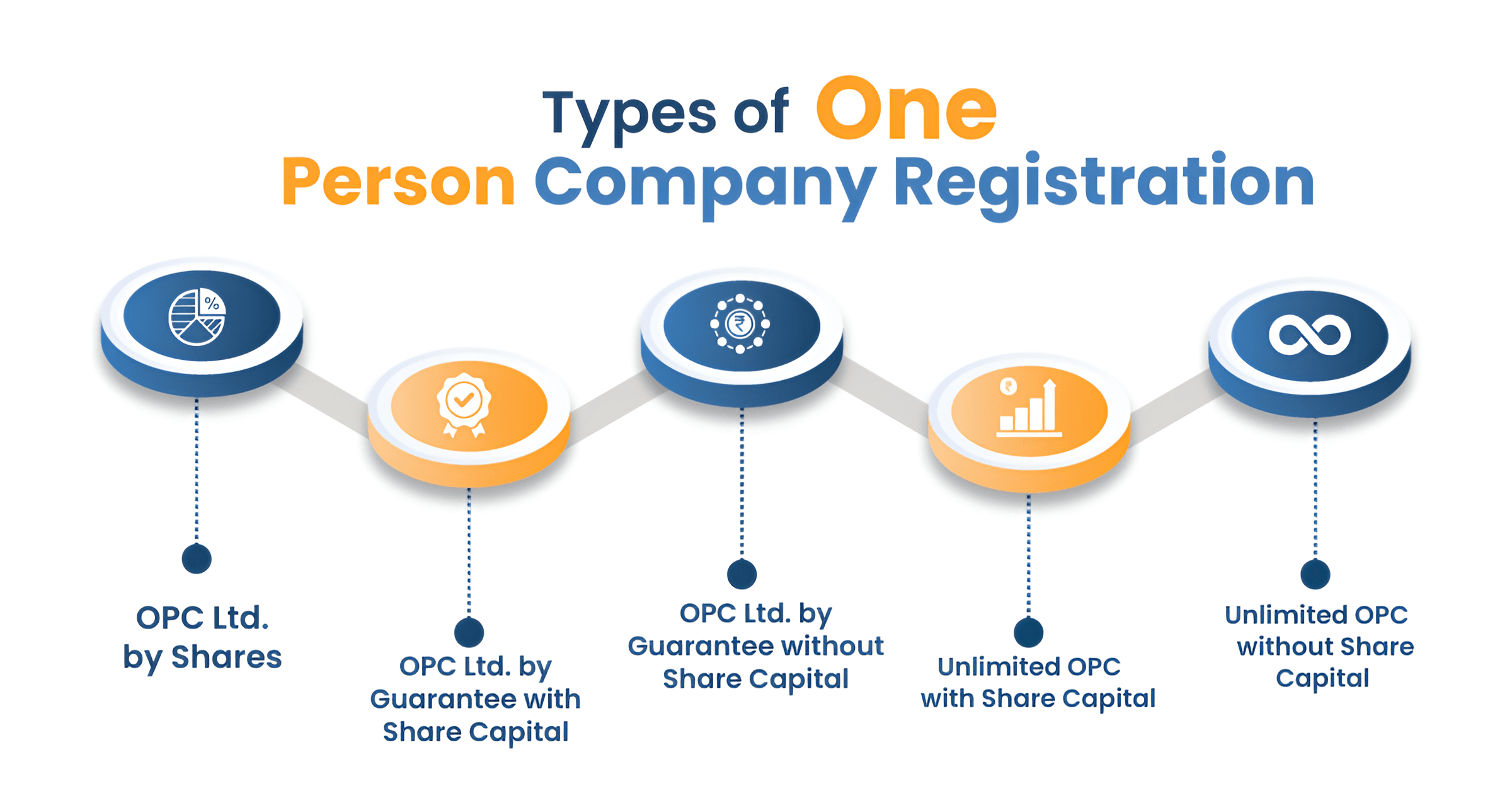

Types of One Person Company in India

Planning to register a one-person company in India? Let's check out your options:

- OPC Limited by Shares: It falls under Section 2(22) & 2(68). Your liability stays limited to your unpaid share value. This gives you solid protection from business debts. This is the most popular option amongst entrepreneurs for OPC registration.

- OPC Limited by Guarantee with Share Capital: This type combines shares with a guarantee clause. Your liability includes both unpaid shares and the guaranteed amount. It offers a flexible capital structure.

- OPC Limited by Guarantee without Share Capital: This type, under Section 2(21), creates an entity without shares. Your liability is based only on your contribution guarantee if the company shuts down.

- Unlimited OPC with Share Capital: This type includes share capital but offers no liability protection. You remain personally responsible for all company debts. High-risk option, but with flexible capital handling.

- Unlimited OPC without Share Capital: This has neither share capital nor liability protection. You face unlimited personal responsibility. Very few choose this due to the high personal risk.