It's crucial to understand that appointing an auditor and filing Form ADT-1 are two distinct steps. The appointment is the company's internal decision, while the form is the external notification to the government.

Think of it this way:

- The Resolution: This is like the "job offer" that legally appoints the auditor. It's the core document establishing their role.

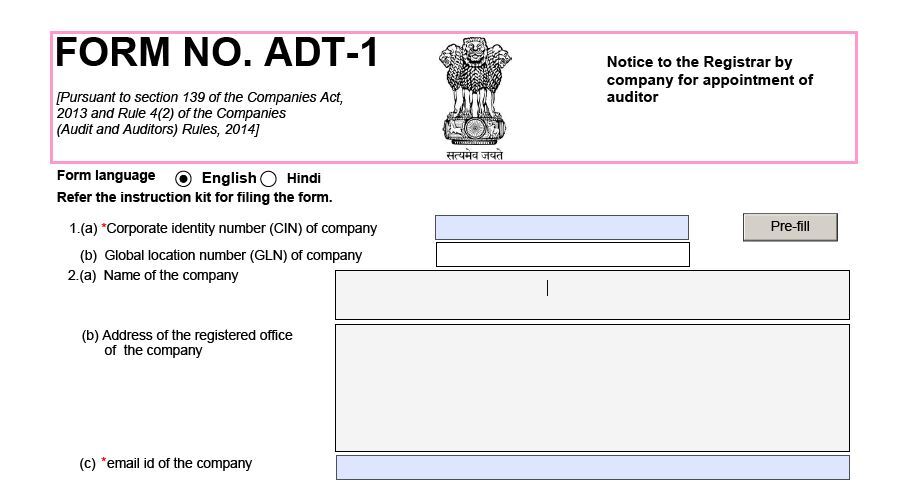

- The ROC form ADT-1: This is the "official announcement" or "registration" of that appointment with the Registrar of Companies (ROC). It's a regulatory formality to keep public records updated.

So, the role of the ADT-1 is purely to inform regulators. It makes sure the Ministry of Corporate Affairs (MCA) has a clear, updated record of who is auditing the company's finances. It's a critical compliance step after an auditor is appointed.

Who Appoints the First Auditor of a Company?

Appointing the first auditor is one of the earliest compliance steps a newly incorporated company must take to ensure financial transparency. The process involves a few key steps and mandatory filings, including the submission of Form ADT-1.

Here’s how the first auditor of a company is appointed, as per Section 139(6) of the Companies Act, 2013:

- Appointment by Board of Directors: The Board of Directors is initially responsible for appointing the first auditor. They must hold a meeting and make this appointment within 30 days of the company's incorporation date, as per Section 139(6) of the Companies Act, 2013.

- Appointment by Members (if Board fails): If the Board fails to appoint an auditor within those first 30 days, the power shifts to the company's shareholders (members). They must then call an Extraordinary General Meeting (EGM) and appoint the auditor within the next 60 days.

- Obtain Auditor's Consent: Before the appointment is final, the company must get a written consent letter and a certificate confirming the proposed auditor is eligible.

- File Form ADT-1: Once the resolution is passed and consent is received, the final step is the ADT-1 filing. The company must file Form ADT-1 on the MCA portal within 15 days of the resolution date.

Is Form ADT-1 Filing Mandatory for the First Auditor?

The ADT-1 filing requirement for the first auditor is not optional; it's a compulsory rule. Filing Form ADT-1 for the first auditor is a mandatory step under Section 139(1) of the Companies Act, 2013. This legal requirement highlights its importance.

Submitting this form within the set timeframe officially records the auditor's appointment with the MCA. Skipping this step is a direct violation and will lead to penalties (e.g., a fine ranging from ₹25,000 to ₹5,00,000 for the company under Section 147 of the Companies Act, 2013) for the company and its officers who are at fault.

Appointing Subsequent Auditors and Re-Appointing Existing Auditors

After the first auditor's term ends (5 consecutive years), all subsequent auditors are appointed by the company's shareholders during the Annual General Meeting (AGM).

- Appointment for a Five-Year Term: Auditors are usually appointed at an AGM to hold office until the end of the sixth AGM, serving a five-year term. This provides stability in auditing.

- Rotation of Auditors: To ensure independence and prevent conflicts of interest, the Companies Act mandates the rotation of auditors for certain classes of companies:

-

- All listed companies.

- Unlisted public companies with a paid-up share capital of Rs. 10 crore or more.

- Private limited companies with a paid-up share capital of Rs. 50 crore or more.

- Companies with public borrowings from financial institutions or public deposits of Rs. 50 crore or more. These companies cannot appoint an individual auditor for more than one term of five years and an audit firm for more than two consecutive terms of five years each. A mandatory "cooling-off" period of five years applies before they can be re-appointed.

- Timeline for Filing: The ADT-1 filing due date for a subsequent auditor is strictly within 15 days from the date of the AGM where they are appointed or re-appointed for a new term. This time limit for filing ADT-1 must be followed to avoid compliance issues.