The full form of LLP is Limited Liability Partnership, a business structure that combines the flexibility of a partnership with the limited liability protection of a company. It offers a separate legal identity, meaning partners aren’t personally liable for the firm’s debts.

LLPs are a preferred choice for startups and professionals who want shared management, minimal compliance, and legal protection without putting personal assets at risk.

Types of LLP Registration in India

Before we get into how to incorporate an LLP, let’s first know about the many options available to register as one. These forms of registration come in various types to accommodate different categories of businesses and operational needs:

-

Domestic LLP

For businesses operating within India with Indian partners.

Example: Two chartered accountants in Delhi forming an LLP to provide accounting services across India.

-

Foreign LLP

For LLPs with foreign partners or foreign LLPs establishing a place of business in India.

Example: A UK-based consulting firm establishing an LLP in India with both Indian and British partners.

-

Professional LLP

For professionals such as chartered accountants, company secretaries, and lawyers, etc.

Example: A group of architects forming an LLP to offer architectural design services.

-

Startup LLP

For innovative business ventures seeking recognition under the Startup India initiative.

Example: Three engineers forming an LLP to develop a new mobile application with innovative features.

-

Small LLP

For businesses with lower turnover and capital contribution thresholds.

Example: A small manufacturing business with a turnover of less than Rs. 40 lakhs forming an LLP.

-

Conversion to LLP

For existing partnerships or private limited companies converting to the LLP structure.

Example: An existing partnership firm dealing in textiles converting to an LLP structure for limited liability benefits.

-

One Person LLP

A recent provision allows single-member LLPs for a limited period, specifically six months in certain cases.

Example: A sole proprietor converting their business into an LLP under special provisions.

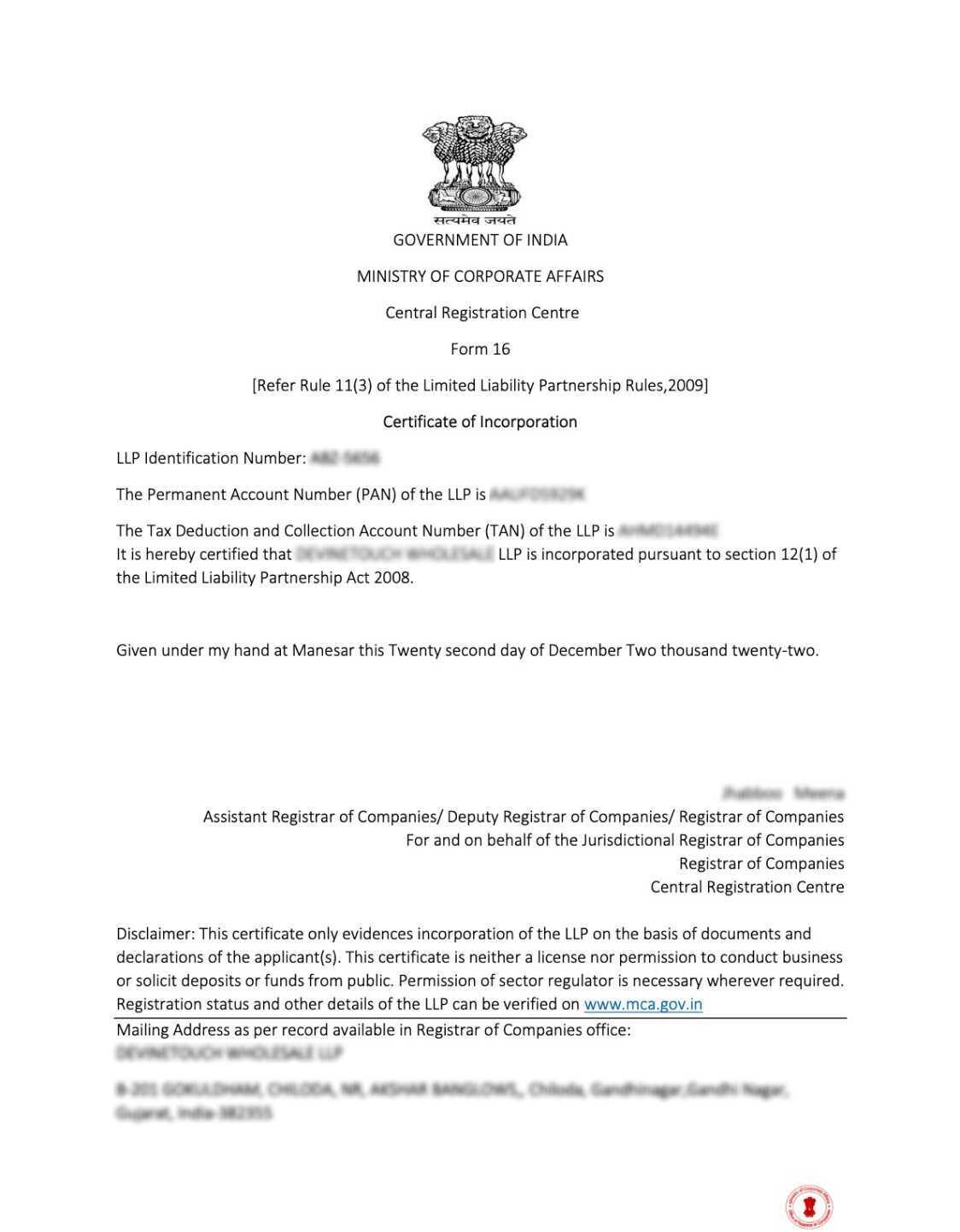

Every registered LLP receives a Certificate of Incorporation as official proof of registration.

Objectives of the LLP Registration in India

The objective of registering an LLP is to establish a legal business entity that provides limited liability protection while maintaining operational flexibility.

- Limited Liability Protection: Shield partners' assets from business liabilities.

- Legal Entity Formation: Create a separate legal entity distinct from its partners.

- Operational Flexibility: Enjoy the benefits of minimal compliance requirements compared to other companies.

- Perpetual Succession: Ensure business continuity regardless of changes in partnership.

- Tax Benefits: Avail of favorable tax treatment compared to private limited companies.

- Business Credibility: Enhance reputation and credibility with clients, vendors, and financial institutions.

- Capital Contribution Flexibility: Allow partners to contribute capital as agreed without minimum capital requirements.

- Simplified Compliance: Benefit from fewer regulatory requirements compared to other companies.

Laws and Rules Governing LLP Registration in India

LLP registration in India follows legal rules that ensure the proper setup and operation of these business entities.

- Limited Liability Partnership Act, 2008: Provides the foundational legal framework for the formation, operation, and dissolution of LLPs in India, ensuring compliance with necessary legal formalities.

- Limited Liability Partnership Rules, 2009: Details procedural aspects, including registration, conversion, and compliance requirements, offering clarity on the operational steps for LLPs.

- Companies Act, 2013 (for conversion): Contains provisions relating to the conversion of companies into LLPs, offering a legal pathway for businesses to transition from a company structure to an LLP.

- Foreign Exchange Management Act, 1999: Regulates foreign investment in LLPs and the establishment of LLPs with foreign partners, ensuring proper compliance with foreign exchange policies.

- Income Tax Act, 1961: Outlines the taxation framework applicable to LLPs, defining how LLPs are taxed and what deductions or exemptions they can claim under Indian tax laws.