If you’ve recently registered your business under GST or are planning to, you will receive a crucial document known as the GST Registration Certificate. This certificate is not just a formality; it’s your business’s official identity in the eyes of the tax authorities.

Whether you run a small shop, offer freelance services, or manage a growing enterprise, having your GST certificate handy is a must. On the same note, here’s the good news: you don’t have to run to a government office or stand in long queues. You can download your GST certificate online in just a few clicks!

The good news is that you don’t need to wait for a physical copy to prove the successful GST registration. You can easily download your certificate online through the GST portal.

At RegisterKaro, we help thousands of businesses with GST registration and compliance. One of the most common queries our experts address is: How can I download my GST Registration Certificate (REG-06)? This guide provides step-by-step methods for desktop, mobile, and app users, along with FAQs and troubleshooting tips.

Also Read: Understanding GST Registration

What is a GST Certificate?

A GST certificate is an official document issued by the GSTN (Goods and Services Tax Network) that verifies the registration of an individual or entity under GST laws. It contains key details like:

- GSTIN (Goods and Services Taxpayer Identification Number)

- Legal and trade name of the business

- Registration structure (e.g., regular, composition, casual taxable)

- Date of GST registration

- Additional branch information.

Business owners or taxpayers must securely keep this document, as vendors, clients, or regulatory authorities may ask for it as proof of compliance. If you’re wondering how to download a GST certificate, this guide covers all the steps in detail.

Downloading the certificate is simple and takes just a few minutes. Follow this step-by-step process to access the GST registration certificate download PDF from the GST portal.

1. Log in to the GST Portal

Visit the official GST website and log in using your valid credentials:

- GSTIN or assigned username

- Password

- Captcha code

The homepage will appear after successful login.

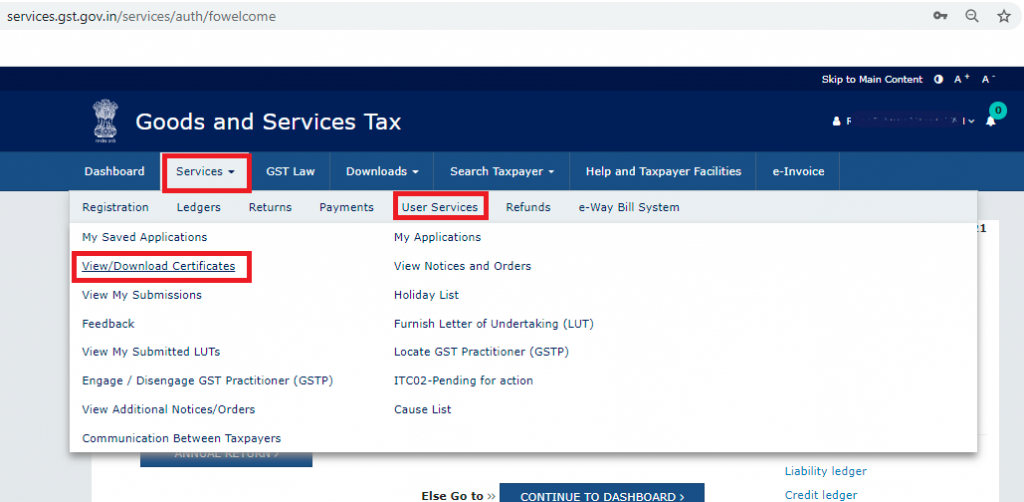

2. Access the Registration Tab

- Click on the “Services” tab available on the dashboard.

- Navigate to “User Services.”

- Select the “View/Download Certificates” option.

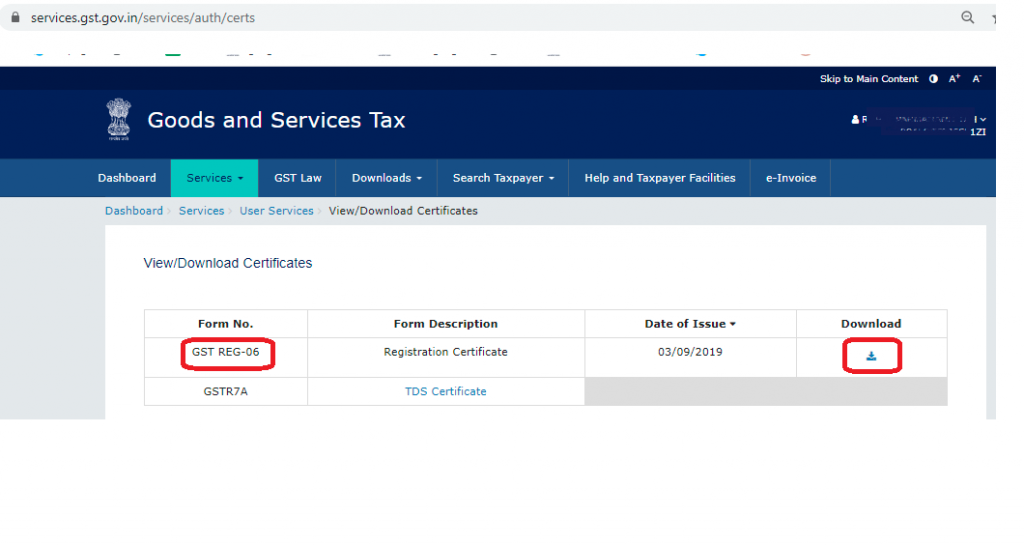

3. Download My GST Certificate

Once the certificate appears on the screen, click on the “Download” button to save it in PDF format. The file will be saved to your designated folder, ready for use.

If you’re wondering, “How can I download my GST certificate?” This quick process works for all registered taxpayers.

Download GST Certificate on Mobile Browser

Many business owners prefer accessing the GST portal directly from their smartphones. The good news is that you can download your GST certificate on your mobile device using any standard browser, such as Google Chrome, Safari, or Edge, without needing a laptop or desktop.

Steps to Download GST Certificate on Mobile

- Open Chrome/Safari on your smartphone and go to the official GST portal.

- Tap on Login and enter your username, password, and captcha.

- Enter the OTP received on your registered mobile/email (if prompted).

- Once logged in, go to Services → User Services → View/Download Certificates.

- Click on the Download button next to “GST Registration Certificate (REG-06).”

- The certificate will be saved as a PDF on your mobile device.

What’s Different from Desktop?

- The steps are the same, but the portal layout looks compact on mobile.

- Some features may require scrolling or zooming in on a small screen.

RegisterKaro Tip: Bookmark the GST portal login page on your mobile browser for quicker access in the future.

GST Certificate Download via GST App – Myths vs Facts

With the launch of the GSTN e-Services mobile app, many taxpayers assume they can directly download their GST certificate through the app. However, this is a common misconception.

What the GSTN App Offers:

- Verify GSTIN/UIN of taxpayers.

- View return filing status.

- Check e-invoice details using QR code.

- Track application status.

What the App Does Not Offer:

- Direct download of the GST Registration Certificate (REG-06).

- Filing of GST returns or amendments.

- Access to the full taxpayer dashboard, like the web portal.

Fact Check:

Currently, the only official way to download the GST certificate is through the GST portal (desktop or mobile browser). The app is helpful for quick verification, but not for downloading certificates.

RegisterKaro Advantage: If you face difficulties logging in or retrieving your GST certificate, RegisterKaro experts can securely download and share your GST REG-06, saving you time and avoiding compliance delays.

Things to Keep in Mind While Downloading the GST Certificate After Registration

If you’ve recently registered for GST and want to access your certificate for the first time, ensure the following:

- Successful submission of your GST registration application.

- Receive approval from authorities with a unique GSTIN.

- Once the GST certificate is issued, follow the same procedure detailed above for the GST registration certificate download PDF.

Remember, this process is only available electronically. You won’t receive a hard-copy certificate from the GST authorities.

For practical uses, you can always print the document later.

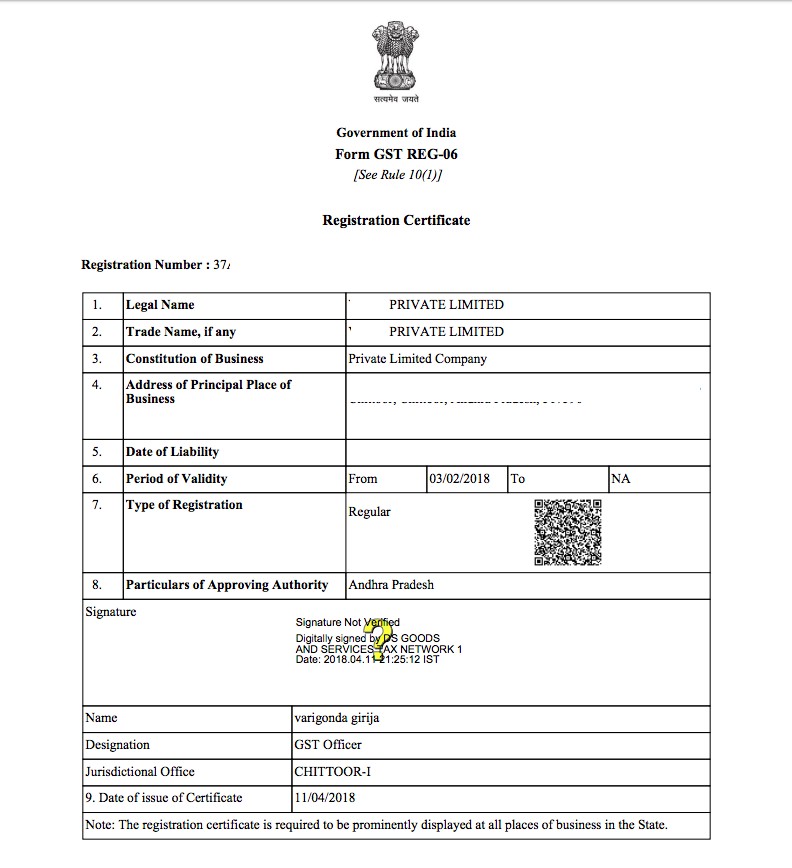

Here’s a general structure of how a GST certificate image looks:

| Field | Details |

| GSTIN | 15-digit unique taxpayer identification number |

| Legal Name of the Business | The registered business name as per the PAN |

| Trade Name | The brand or operational name (if different from the legal name) |

| Constitution of Business | Individual, Partnership, Company, etc. |

| Address of Principal Place | The primary business location |

| Date of Liability | The date from which GST liability starts for the business |

| Type of Registration | Regular, Composition Scheme, etc. |

| Signature & QR Code | Official signature with QR code verification |

This format is useful for verification purposes when showing your GST registration certificate to clients, suppliers, or officials.

If you’ve updated your business details and they differ from the original GST certificate, it’s necessary to amend the changes in your registration. Follow these steps:

1. Login to the GST Portal:

Access the GST website and log in using your credentials.

2. Go to Amend Registration:

Navigate to “Services” → “Registration” → “Amendment of Core Fields.”

3. Submit Changes:

Update the required fields, such as business name, principal place of business, or contact information. Once updated, submit the details and upload any supporting documents if necessary.

4. Approval of Amendments:

GST officials review your request. Upon approval, the changes will be reflected, and you can re-download your GST registration certificate with updated information.

Regularly updating your GST details ensures seamless compliance and avoids disputes during audits or filings.

For most businesses, the GST registration certificate is valid unless canceled or surrendered. However, there are exceptions:

1. Casual Taxpayers:

If you’ve registered as a casual taxable person, your certificate has a validity of 90 days. You can extend this by applying before expiration.

2. Voluntary Registration:

Businesses opting for voluntary GST registration retain the certificate indefinitely unless they decide to cancel their registration.

3. Cancellation by GST Authorities:

Non-compliance, tax evasion, or non-filing of returns may lead to cancellation by authorities.

Always ensure that your GST registration remains current by filing required returns and staying compliant.

Here’s why having a GST registration certificate is vital for business operations in India:

| Benefits | Description |

| Legal Recognition | Gain a legal identity as a GST-compliant business. |

| Input Tax Credit | Businesses can claim input tax credits on purchases. |

| Ease of Expansion | Operate seamlessly across state borders. |

| Credibility | Customers and suppliers trust GST-registered businesses. |

| Avoid Penalties | Stay compliant and avoid hefty penalties for non-registration. |

Possessing a valid certificate ensures smooth business operations and tax management.

Conclusion

Having access to your GST registration certificate is essential for staying compliant and proving your business’s legitimacy. By following the above steps, you can quickly perform your how to download GST certificate tasks and generate your certificate in PDF format. Moreover, timely updates and amendments to your GST registration ensure that your business operates without interruptions.

For businesses looking to simplify their registration, compliance, or amendments, RegisterKaro provides professional assistance tailored to meet industry standards. Reach out to us today for worry-free GST services!

Frequently Asked Questions

You can log in to the GST portal, navigate to “User Services,” and choose “View/Download Certificates” to generate your certificate as a PDF.