Businesses and individuals can complete the entire procedure through the official GST portal in the following manner:

Step 1: Generating Your Temporary Reference Number (TRN)

The first stage of GST registration involves generating a Temporary Reference Number (TRN), which acts as a temporary identifier for your application.

- Access the GST Portal: Begin by navigating to the official GST website: gst.gov.in.

- Initiate New Registration: On the homepage, click on the "Services" tab, then select "Registration," and finally choose the "New Registration" option.

- Fill Basic Details (Part A): On the registration page, select "Taxpayer", choose your State and District, enter your business name and PAN. Then add a valid email and mobile number, complete the Captcha, and click "PROCEED".

- OTP Verification and TRN Generation: You will receive separate One-Time Passwords (OTPs) on the provided mobile number and email address. Enter these OTPs for verification. Upon successful validation, a Temporary Reference Number (TRN) will be generated and displayed on your screen.

Step 2: Log in with TRN

Go to the GST portal, choose "New Registration" > "TRN", and log in using the OTP sent to your registered email and mobile.

Step 3: Access Saved Application

Click on "My Saved Application" and use the edit option to continue filling out Form GST REG-01.

Step 4: Fill in Business Details

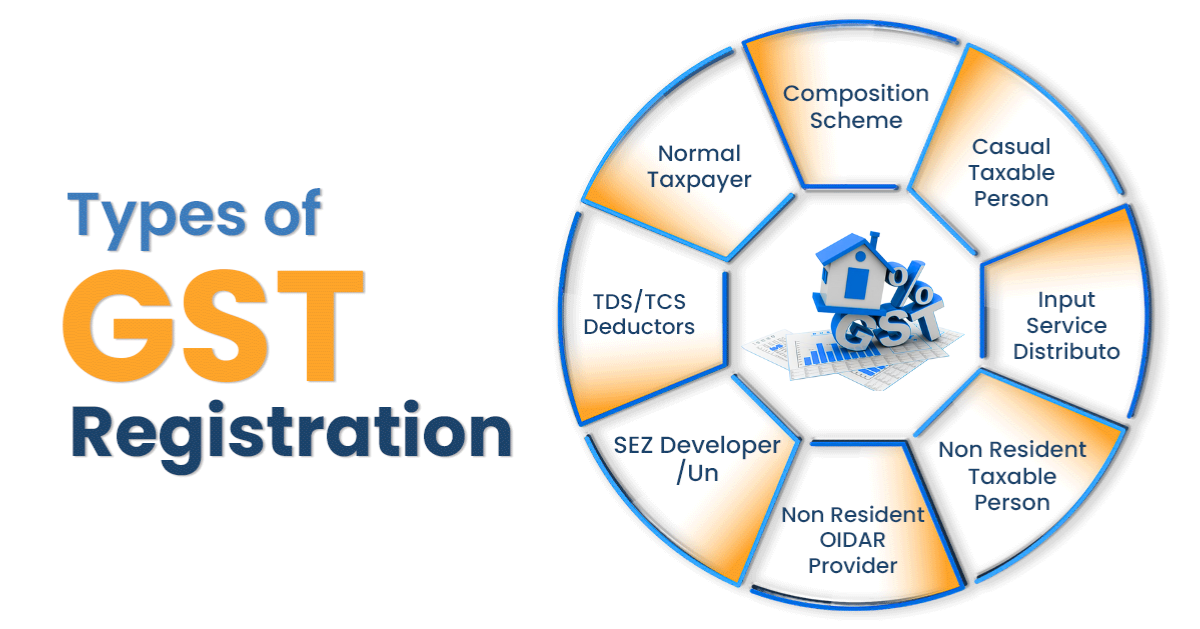

Enter your trade name, business type, district, codes, and dates for business start and GST liability. Choose the Composition Scheme if eligible.

Step 5: Promoter/Partner Info

Add details of promoters/partners like name, PAN, Aadhaar, contact, and DIN (if applicable).

Step 6: Authorized Signatory

Provide details and documents for the person handling GST compliance on behalf of your business.

Step 7: Business Address

Enter your main business address, upload proof, and mention any additional business locations.

Step 8: Goods & Services

List the goods/services you deal in with their HSN/SAC codes.

Step 9: Bank Details

Submit your bank account number, IFSC, and upload a cancelled cheque or statement.

Step 10: State-Specific Info

Add any additional information required by your state, if applicable.

Step 11: Aadhaar Authentication

Choose to verify via Aadhaar for faster processing, or skip and undergo manual verification.

Step 12: Final Submission

Review all details, tick the declaration, and submit using DSC, e-Sign, or EVC as per your business type. Once you successfully submit your GST registration application, you’ll receive an Application Reference Number (ARN) as confirmation.

This unique 15-digit number is crucial for tracking the status of your application online and will be sent to your registered email address and mobile number.