Starting a non-profit organization with a social impact? The Section 8 company incorporation process is a popular choice for many. In recent years, India has seen a 30% rise in Section 8 company registration, reflecting a growing trend toward establishing non-profits focused on education, charity, and social welfare.

In essence, the Section 8 company incorporation process is more than just paperwork; it is the gateway to turning your vision for social change into a legally recognized entity. By following the correct procedure, therefore, you can establish a non-profit that meets legal requirements while earning the trust of donors and partners.

In this guide, we will walk you through the procedure for incorporating a Section 8 company, clearly explaining each step. Whether you’re wondering who is eligible to form a Section 8 company or looking for details on how to register or incorporate a Section 8 company, we’ve got you covered.

What is a Section 8 Company?

A Section 8 Company is a non-profit organization created under the Companies Act, 2013. The primary goal of a Section 8 company is to promote charitable objectives that benefit society. Some objectives are:

- Education

- Social welfare

- Art, science, or sports

- Environmental protection

Unlike trusts and societies, which are governed by state-specific laws, a Section 8 company operates under a single, uniform national law. As a result, it ensures stricter regulation, greater transparency, and stronger accountability, making it a globally recognised structure for non-profit organizations.

For example, Teach For India improves education, while Selco India provides solar energy, using profits solely for their causes.

Note: Organizations can convert trust to a Section 8 company to expand operations, access CSR and foreign funding, and gain the advantages of a national-level legal structure.

Eligibility for Section 8 Company Registration

Starting a Section 8 company in India is open to individuals, HUFs, and groups who meet specific requirements. The process of incorporation of a Section 8 company is structured to ensure that the company serves public welfare and societal causes.

Here are the key eligibility criteria to register a Section 8 company:

- Minimum Number of Directors and Shareholders: The company must have at least two directors and two shareholders (members) to begin the process.

- Resident Director Requirement: At least one director must be a resident of India to fulfill the procedure for incorporation of a Section 8 company. A resident is someone who has stayed in India for at least 182 days during the preceding financial year.

- Purpose of the Company: The company must be exclusively formed for charitable or non-profit purposes, such as promoting sports, social welfare, education, or supporting lower-income groups with financial assistance.

- Profit Distribution: No profits can be distributed among the members or directors, either directly or indirectly. All surplus funds must be reinvested for furthering the company’s objectives.

- Name Reflecting Charitable Intent: The proposed name of the company must clearly indicate its non-profit nature and should not suggest any commercial or profit-oriented activity.

- Director Eligibility: All proposed directors must be legally eligible and should not be disqualified under the provisions of the Companies Act, 2013.

- Section 8 Licence Requirement: The promoters must obtain a licence under Section 8 of the Companies Act, 2013, from the Central Government through the Registrar of Companies (ROC) before the company can be incorporated.

By meeting the eligibility criteria for the Section 8 company, individuals and groups can successfully incorporate a company.

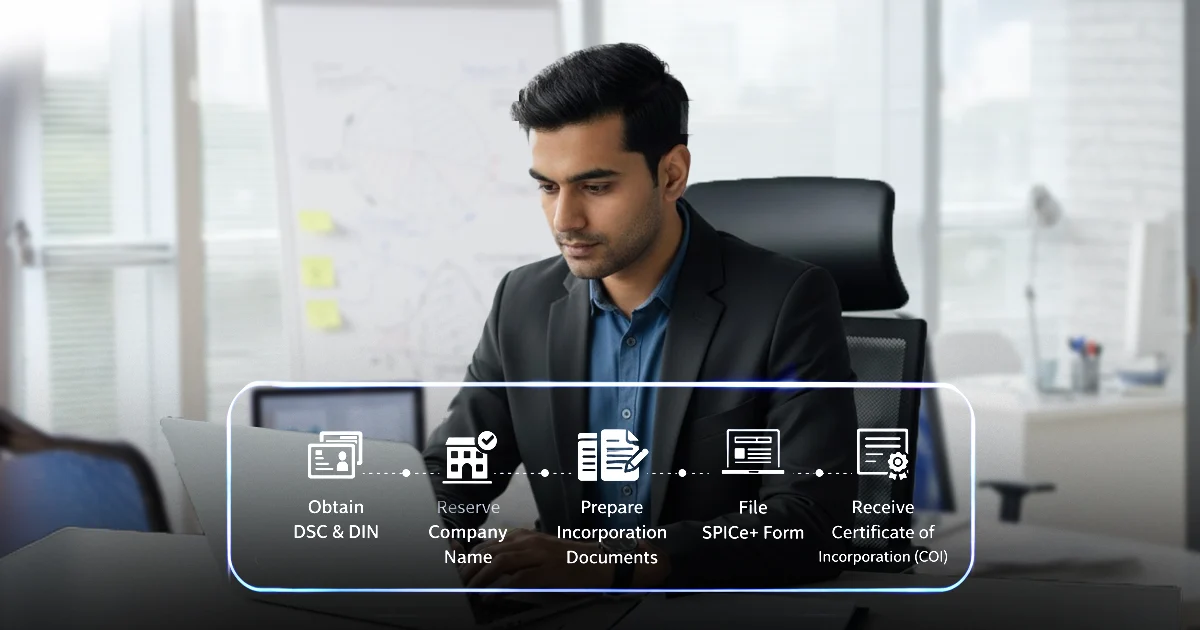

How to Register a Section 8 Company in India?

Incorporating a Section 8 company involves several steps that ensure compliance with the Ministry of Corporate Affairs (MCA) regulations. Here’s a comprehensive breakdown of the Section 8 company registration process.

Step 1: Decide the Purpose & Objectives of the Company

The first crucial step is to define the non-profit objectives of your Section 8 company that align with the requirements set by the MCA for approval. Clearly defining the business goals will increase your chances of smooth registration and help you in preparing the Memorandum of Association (MOA) and Articles of Association (AOA).

- Objectives must be non-commercial and oriented toward promoting a specific purpose, like charitable, educational, or social welfare activities.

- This step is important for the MCA approval process, as it ensures the company adheres to the principles of a Section 8 entity.

Estimated Timeline: 2-3 days

Step 2: Apply for Name Approval

Choose a name for the Section 8 company and seek approval from the MCA. The name should reflect the non-profit and charitable nature of the company and comply with the guidelines outlined in the Companies Act, 2013.

- Submit the name for approval through the RUN (Reserve Unique Name) service or SPICe+ Part A on the MCA portal.

- When choosing a name, avoid using commercial-sounding terms like “Solutions,” “Enterprises,” or “Industries,” unless they are clearly justified by the organization’s objectives. Instead, you can use words such as “Foundation,” “Association,” “Forum,” “Society,” “Trust,” and “Institute.”

- The MCA will confirm the name within a few days, allowing you to proceed with the next steps.

Estimated Timeline: 2-3 days

Step 3: Obtain DSC and DIN for Directors

Digital Signature Certificate (DSC) and Director Identification Number (DIN) are mandatory for the incorporation process of a Section 8 company.

- Obtain a DSC for all the proposed directors to digitally sign the documents required for registration.

- For new companies, DIN is auto-allotted through SPICe+ Part B during incorporation. As a result, directors no longer need to apply for DIN separately unless they are joining an existing company.

Estimated Timeline: 1-2 days

Step 4: Draft MOA & AOA (INC-13)

The Memorandum of Association (MOA) and Articles of Association (AOA) are critical documents for the registration process of a Section 8 company.

- The MOA must outline the company’s objectives, mission, and purpose, detailing the non-profit nature of the company.

- The AOA governs the internal structure and rules for managing the company.

Additionally, both documents must be signed by the subscribers and uploaded within the SPICe+ form. The INC-13 format is now incorporated within the SPICe+ filing process.

Estimated Timeline: 2-3 days

Step 5: Prepare Declarations and Supporting Documents

Ensure that all necessary documents are in order:

- Form INC-14: Declaration from a practicing Chartered Accountant. For efficient and convenient processing, online CA services can assist in preparing and filing Form INC-14.

- Form INC-15: Declaration from each applicant.

- Projected Financials: Estimated income and expenditure for the next 3 years.

- Registered Office Proof: Utility bills, No Objection Certificate (NOC) (if rented), and address proof.

- Director’s Proof: Identity proof and address proof for all directors.

These documents help validate the intent and operational framework of the company, making the registration process smoother. For a detailed list of all required documents, refer to the “Documents Required for Incorporating a Section 8 Company” section.

Estimated Timeline: 2-3 days

Step 6: File SPICe+ & INC-12 for License

After gathering all necessary approvals and documents, file for incorporation through the SPICe+ form. This form handles the entire company incorporation process.

- Use SPICe+ to file for incorporation, allot DIN to first-time directors, and issue PAN and TAN.

- If applicable, register with EPFO and ESIC and ensure all required documents, including the MOA and AOA, are uploaded.

- File INC-12 to apply for a license under Section 8.

Simultaneously, the following are processed through the combined filing of:

- Company incorporation

- Allotment of DIN to first-time directors

- Issue of PAN and TAN

- Registration with EPFO and ESIC (if applicable)

Once filed, the MCA will either:

- Approve the application

- Raise resubmission queries, or

- Reject the application.

Estimated Timeline: 3-4 days

Step 7: Receive COI and Section 8 License

Upon approval, the MCA issues the Certificate of Incorporation (COI) and Section 8 License.

- The COI confirms the company’s legal existence and includes the unique Company Identification Number (CIN).

- The Section 8 License authorizes the company to operate as a non-profit entity and grants it the privilege of limited liability.

Estimated Timeline: 2-3 days

At this stage, your company is officially incorporated, and you can begin its operations as a Section 8 entity.

Substantially, it is advisable to contact RegisterKaro, one of the top business service providers, to streamline the Section 8 company registration process. Our team will assist you at every stage, making the process smoother and faster.

Documents Required for Incorporating a Section 8 Company

Incorporating a Section 8 company requires specific documents to comply with MCA and SPICe+ guidelines, ensuring legal and operational compliance. Here’s the list:

- PAN of Subscribers: PAN cards of all Indian subscribers and directors are mandatory for verification.

- MOA and AOA: Prepare the Memorandum of Association in the prescribed INC-13 format and the Articles of Association defining governance rules. Both are filed through SPICe+.

- Proof of Identity and Address: Directors and subscribers must provide documents like an Aadhaar card, a Passport, a Voter ID, or a Driving License. Additionally, a recent address proof (bank statement or utility bill no older than two months) is required.

- Digital Signature Certificate (DSC): DSCs are required for all proposed directors and subscribers to complete online filings.

- Consent to Act as Director (DIR-2): Each proposed director must submit consent for their appointment.

- Declaration of Non-Disqualification (DIR-8): Directors must submit a declaration confirming they are not disqualified under the Companies Act, 2013.

- Registered Office Proof and Declaration (INC-22): Submit ownership or rent agreement and file registered office details through SPICe+ in Form INC-22.

- NOC: A NOC from the property owner is needed, allowing the premises to be used as the company’s registered office.

- Declaration from Subscribers (INC-15): A declaration from each subscriber confirming compliance with Section 8 requirements.

- Auto-Generated Declaration: SPICe+ generates the Auto-Generated Declaration (INC-9), which directors and subscribers must complete.

- Chartered Accountant Declaration (INC-14): A declaration from a practicing CA, CS, or CMA confirming adherence to Section 8 provisions.

- Projected Financial Statements: Estimated income and expenditure statements for the next three years.

- Section 8 Licence Application (INC-12): Application in Form INC-12, along with a brief description of the proposed charitable activities.

Once submitted through SPICe+, the ROC will process the application and issue the COI and Section 8 license upon approval.

The Section 8 company registration process involves various fees that can vary based on the complexity of your application and the state of registration.

Below, we break down the key costs involved in the Section 8 company incorporation process:

| Fee Category | Description | Estimated Cost |

| Government Filing Fees | Includes SPICe+ form filing, name reservation (RUN), MoA & AoA submission. | ₹500 – ₹8,000 |

| DSC & DIN for Directors | Required for digital signature and director identification number (DIN). | ₹1,000 – ₹3,000 per director |

| Stamp Duty | Exemption usually applies, but some states may charge a nominal fee. | Typically Exempt – ₹100 – ₹2,500 |

| Notary & Miscellaneous Charges | Covers document notarization, affidavits, printing, and courier services. | ₹200 – ₹1,000 |

| Professional Fees (CA/CS Services) | Includes consultancy, drafting MoA/AoA, and end-to-end registration assistance. | ₹10,000 – ₹25,000 |

| PAN & TAN Application Fees | Required post-registration for obtaining PAN and TAN. | ₹150 – ₹300 |

| Name Reservation (via RUN) (if used separately) | If reserved separately instead of SPICe+. | ₹1,000 |

| Incorporation Certificate Copy Fees (Physical/Certified) | For obtaining certified copies of the incorporation certificate. | ₹100 – ₹500 |

| GST Registration Fees (if applicable) | Applicable for revenue-generating activities or fundraising. | ₹1,000 – ₹2,500 |

| Bank Account Setup Assistance | Professional support for setting up the company’s bank account. | ₹500 – ₹1,000 |

| Post-Incorporation Compliance Fees (optional/first year) | Filing ADT-1, annual returns, and advisory for the first year. | ₹5,000 – ₹10,000 |

After completing the Section 8 company incorporation process, there are several important formalities to ensure full compliance with legal and regulatory requirements. These are:

- Appointment of Auditor: Within 30 days of incorporation, appoint a statutory auditor for your Section 8 company. This is a required step for essential compliance requirements for Section 8 companies and ensures proper financial management.

- First Board Meeting: Conduct the first board meeting within 30 days of incorporation. This meeting establishes your company’s operational framework and includes key decisions.

- Annual ROC Filings: Section 8 companies must file annual returns and financial statements with the ROC. These filings ensure continued compliance with the procedure for incorporating a Section 8 company and include key documents like annual returns and financial statements.

- Bank Account Opening: Open a company bank account in the name of your Section 8 company to handle all financial transactions, ensuring proper management of funds.

- Statutory Registers & Bookkeeping: Maintain statutory registers and books of accounts as per the Companies Act, 2013. This ensures your company operates smoothly and avoids legal penalties.

- 12A & 80G Registration: For most Section 8 companies, 12A and 80G registration are essential. These registrations allow for tax exemptions and enable donors to claim deductions.

- FCRA for Foreign Donations: For foreign donations, you must register under the Foreign Contribution (Regulation) Act (FCRA). Full FCRA registration requires your company to be in existence for at least 3 years and to have a proven track record of charitable activities.

- GST Registration (if applicable): Moreover, if a Section 8 company generates taxable revenue, it must apply for GST registration to comply with indirect tax regulations.

- CSR-1 Registration: Companies involved in Corporate Social Responsibility (CSR) must complete the CSR-1 registration with the Ministry of Corporate Affairs (MCA).

Note: Non-compliance may lead to penalties. The company may face fines between ₹10 lakh and ₹1 crore. Additionally, directors may incur fines between ₹25,000 and ₹25 lakh. In fact, severe non-compliance can lead to license revocation.

Final Note

Successfully incorporating a Section 8 company requires careful adherence to the Section 8 company registration process. Follow the steps for Section 8 company registration, including name approval, document preparation, and filing with the MCA. Post-incorporation, focus on mandatory compliance like annual returns, financial audits, and board meetings.

Failing to comply with legal requirements may result in hefty penalties or even license revocation. To navigate the procedure for incorporating a Section 8 company smoothly, seek professional assistance to ensure full compliance and timely filings.

Frequently Asked Questions

A Section 8 company is a non-profit organization formed under the Companies Act, 2013. It promotes social causes like education, welfare, and environmental protection. The company cannot distribute profits to its members. Its income must be used solely for advancing its charitable objectives, ensuring a focus on public welfare.