A company auditor is a Chartered Accountant who reviews your company’s financial records to ensure everything is accurate and legally compliant. In India, appointing a statutory auditor is required under Section 139 of the Companies Act, 2013. While the role is largely regulatory, it also brings trust and transparency to your company’s financial statements.

Sometimes, a change in auditor becomes necessary, not due to wrongdoing, but because of practical business needs, policy updates, or a shift in direction. However, it’s important to note that the new auditor must be a Chartered Accountant in full-time practice, not just any CA.

Role of a Statutory Auditor in Your Business

The statutory auditor provides an independent opinion on your financials. Their responsibilities include:

- Reviewing and signing off on the financial statements

- Ensuring compliance with applicable laws and standards

- Identifying errors or inconsistencies in reporting

- Reporting their findings to the shareholders

An auditor holds office for five years. However, companies may change auditors earlier by following a proper process. This often takes place during the Annual General Meeting (AGM).

Note: To ensure independence and avoid potential conflicts of interest, certain companies must follow mandatory auditor rotation rules. This involves a 'cooling-off' period before the same auditor or firm can be reappointed.

Top Reasons for a Change of Auditor in India

Companies may consider replacing an auditor for various reasons, such as:

- Completion of the auditor’s term under Section 139(2)

- Resignation, death, or disqualification of the existing auditor under Section 140

- Increased audit fees or reduced satisfaction with audit quality

- Delays in submitting audit reports or a lack of responsiveness

- Business restructuring or a change in registered office location

- The need for industry-specific expertise or a different audit approach

- Internal policy decisions requiring rotation

- If a company changes its registered office to a different city or state, the existing auditor may need to resign if they cannot effectively service the new location. They would file Form ADT-3, stating the reason for their resignation.

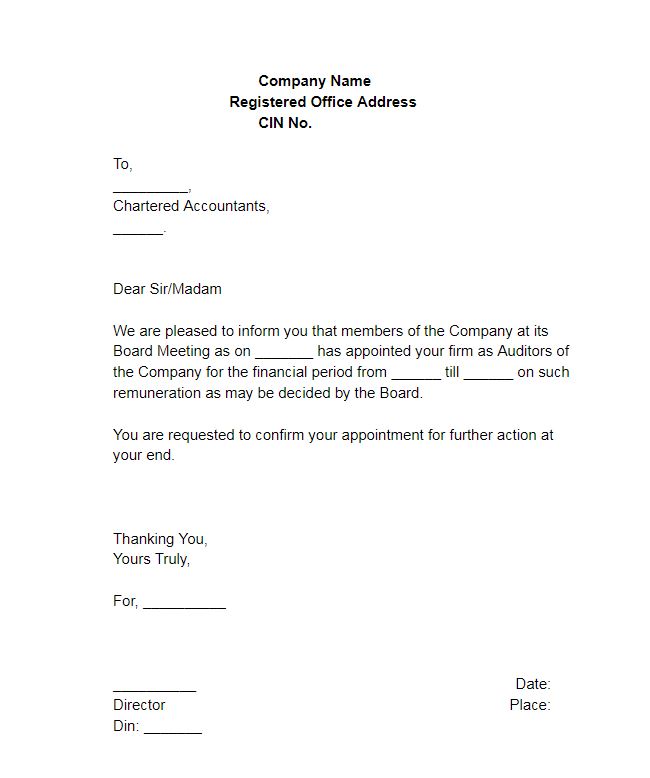

Once the decision is made, companies must report the change of auditor in the directors' report and mention it under the Notes to Accounts in the annual financial statements.

Note: It is mandatory to notify the Registrar of Companies (ROC) of these changes: Form ADT-3 must be filed by the auditor upon resignation, and Form ADT-1 must be filed by the company to report the appointment of a new auditor.