Obtaining your Make in India certificate involves a clear, multi-step process to verify your product's local content. This helps prove that your product is made in India and meets the government’s requirements.

Step 1: Choose the Product You Want to Certify

Start by identifying the specific product or group of products for which you want the certificate. Make sure these products are genuinely manufactured, assembled, or processed in India. You can apply for one product or multiple products, depending on your business operations.

Step 2: Understand the Local Content Requirement

Before applying, it's important to know how much of your product is made in India. This is called your Local Content Percentage. The government has set three categories based on this:

- Class-I Local Supplier: 50% or more of the product is made in India.

- Class-II Local Supplier: Between 20% and 50% is made in India.

- Non-Local Supplier: Less than 20% is made in India (not eligible for benefits).

You must meet at least 20% local content to qualify for the certificate.

Step 3: Calculate the Local Content

To find out your local content, you need to calculate the percentage of Indian value added to your product. Use this simple formula:

Local Content (%) = (Value of Indian Content ÷ Total Cost of Product) × 100

In Indian content, include:

- Cost of Indian raw materials

- Labour and wages paid in India

- Local manufacturing or assembly costs

- Indian service expenses like design, transport, testing, etc.

Be sure to exclude any imported materials, foreign labour, or overseas services from the calculation.

Step 4: Prepare the Necessary Documents

Once you have your local content percentage, gather all the documents needed to support your application. These include:

- Business registration proof (GST, PAN, MSME/Udyam certificate).

- Product details such as description, specifications, and photos.

- Detailed cost sheet showing Indian and total costs.

- Invoices or bills for Indian raw materials and services used.

- Proof of Indian labour, such as salary slips or contractor agreements.

- Utility bills like electricity or water are used in manufacturing.

- A declaration or affidavit stating that all details provided are correct.

Make sure all documents are accurate and up-to-date, as they will be verified by the certifying agency.

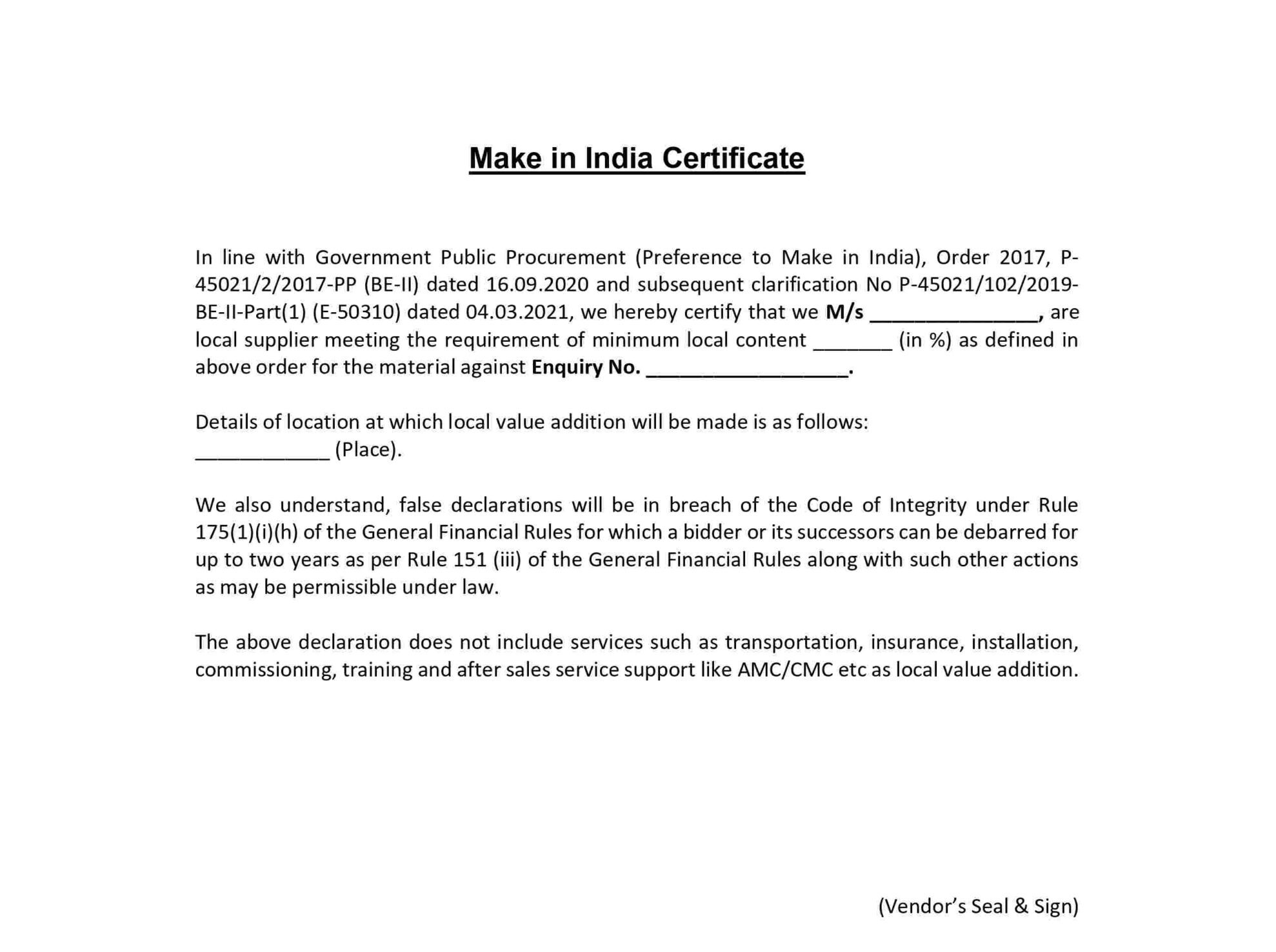

Step 5: Fill Out the Application Form

Get the official Make in India Certificate application form from an authorized body such as the Quality Council of India (QCI) or another approved certification agency. Fill in your business details, product name, manufacturing location, and calculated local content percentage. Double-check all information before submitting.

Step 6: Submit the Application to the Agency

Once your form and documents are ready, submit them to the certifying authority. Some agencies allow online submissions through their portal, while others may require offline/physical submission. Follow the instructions given by the specific agency you are applying through.

Step 7: Await Verification and Inspection

After submission, the agency will review your documents. In many cases, they may also conduct a physical inspection of your factory or manufacturing unit to confirm that production is taking place in India as claimed. They will verify your processes, raw materials, machines, workforce, and records.

Step 8: Receive Your Make in India Certificate

If your application is approved after verification, the agency will issue your Make in India Certificate. This document officially certifies that your product meets the required Indian content standards. You can now use this certificate for participating in government tenders, supplying to public sector companies, and promoting your product as "Made in India".

The certificate is usually valid for 1 to 3 years, depending on the certifying body’s rules. You should track its validity and apply for renewal before it expires to continue enjoying the benefits.