If your business is expanding to a new location, you need to update your GST registration by adding the additional place of business on the GST portal. This ensures proper compliance and avoids any legal issues.

Here’s a simple step-by-step process to add an “additional place of business” on the GST portal:

Step 1: Log in to the GST Portal

Go to the GST official website and log in using your username and password.

Step 2: Go to the Registration Section

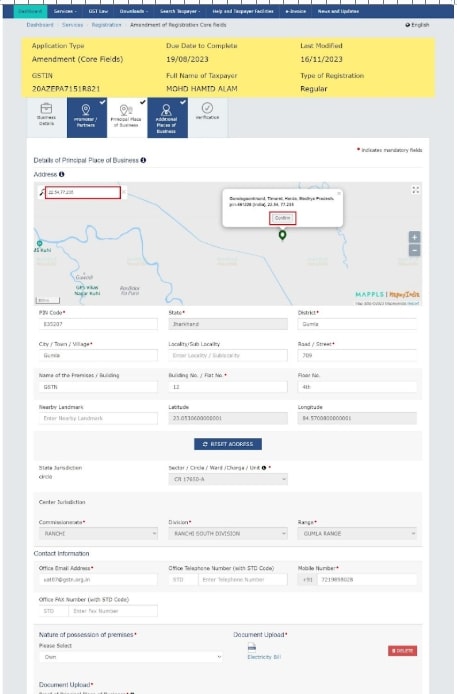

After logging in, click on the ‘Services’ tab. Then select ‘Registration’, and from the options, click on ‘Amendment of Registration – Core Fields’.

Step 3: Select the 'Additional Place of Business' Tab

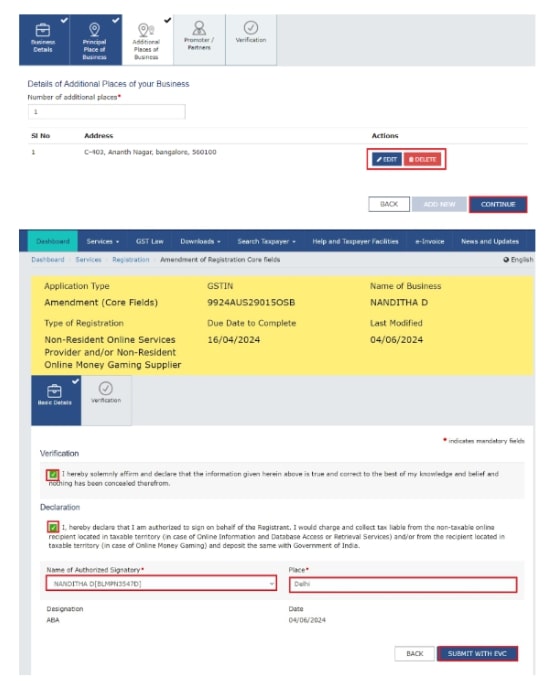

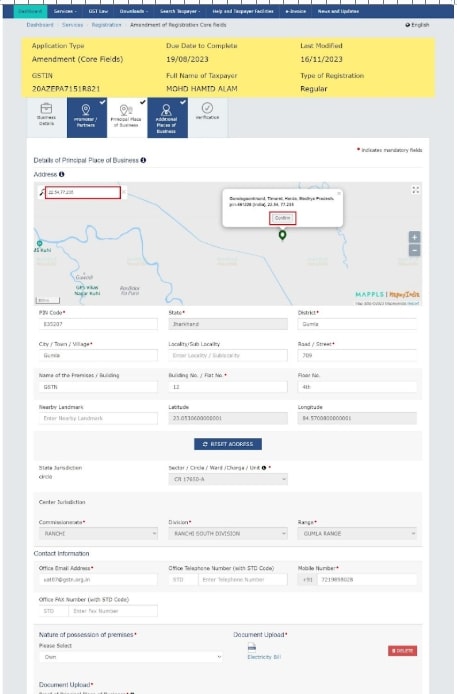

You will see different tabs to make changes. Click on the tab called ‘Additional Place of Business’ to update or add your new business location.

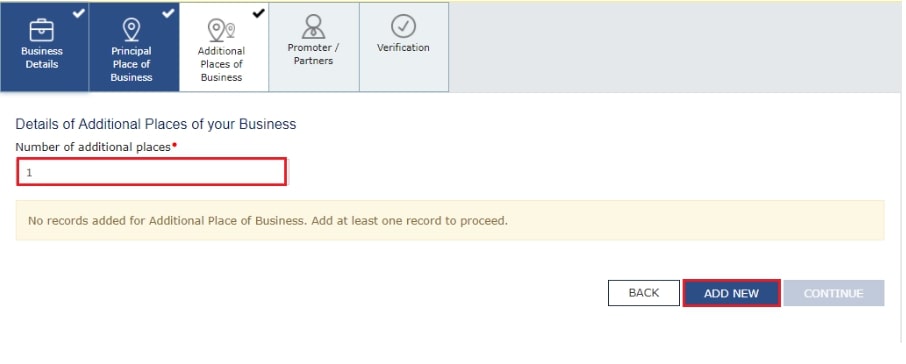

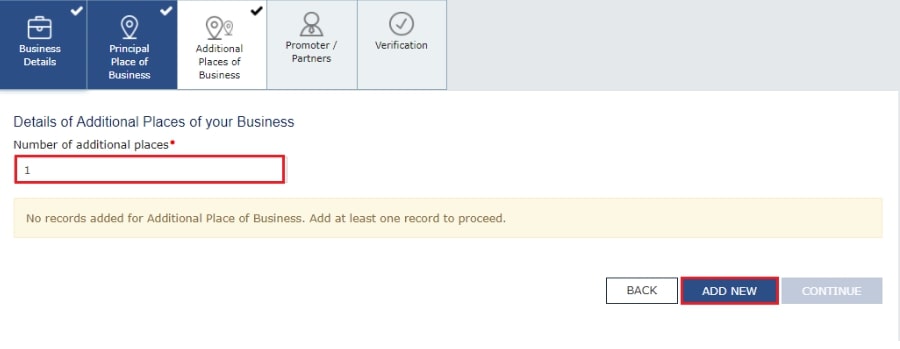

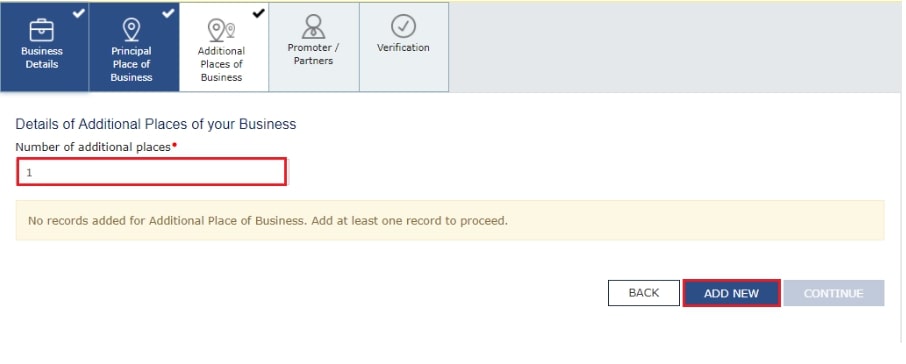

Step 4: View the Additional Place of Business Page

Clicking the 'Additional Place of Business' tab opens a new page where you can add or edit your locations.

Click on the ‘Add New’ button and fill in all the required details. You also need to enter the reason for the amendment and the date of amendment. After entering the details, click on ‘Save. ’

In the address section, you can either type the full address, PIN code, or latitude and longitude (for example: 22.48, 77.89, 22,7). When you enter at least 2 characters, the system will show auto-suggestions in the “Enter Address or Latitude, Longitude” search box on the top right corner of the map.

Note: If your business doesn’t have any Additional Place of Business added yet, first go to the ‘Principal Place of Business’ tab. Then, select ‘Yes’ under the option ‘Have Additional Place of Business’ to add a new one.

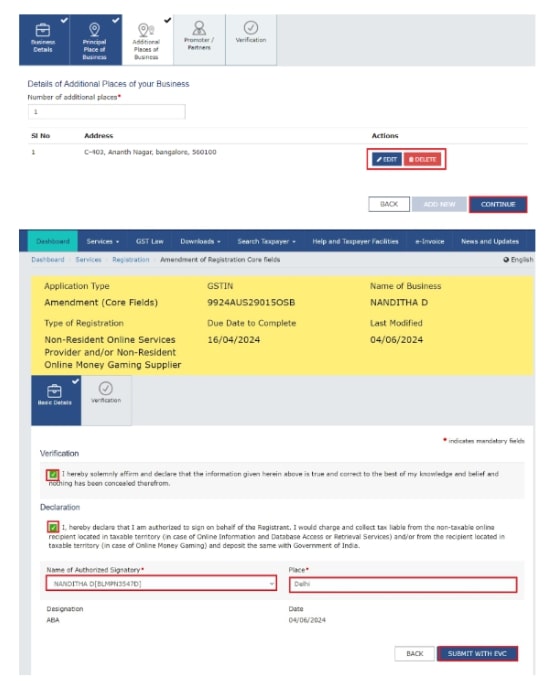

You can also edit the existing address of an already added Additional Place of Business if needed.

Step 5: Complete the Verification Process

Click on the ‘Verification’ option.

- Tick the checkbox to confirm the details.

- Choose the name of the authorised signatory from the drop-down menu.

- Enter the place (city or location) from where you're applying.

- Then, sign the application digitally using either DSC (Digital Signature Certificate) or EVC (Electronic Verification Code).

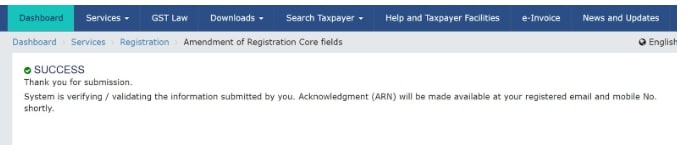

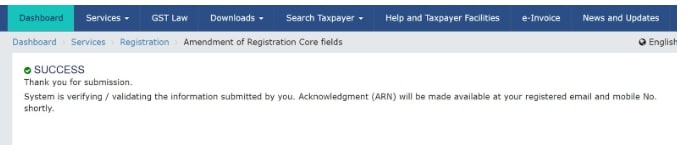

Step 6: Submit the Application and Wait for Approval

After you submit the application, a message saying ‘Successful submission’ will appear on your screen.

Within 15 minutes, you will get an acknowledgement on your registered email and mobile number.

Since this is a core field change, it needs to be approved by a GST officer. Once they review it, you will receive an SMS and email saying whether your request is approved or rejected.