The process of filing Form ITR 2 is designed to be user-friendly on the income tax e-filing portal.

1. Prerequisites Before You Start Filing

Before initiating the filing process, ensure the following documents and data are readily available:

- Permanent Account Number (PAN) and Aadhaar number

- Bank account details, including IFSC code

- Form 16 issued by your employer

- Form 26AS, Annual Information Statement (AIS), and Taxpayer Information Summary (TIS)

- Capital gains computation statements for listed securities, mutual funds, and property

- Details of house properties, including rental income, municipal taxes, and interest on home loans

- Information related to foreign income or assets (if applicable)

- Records of income from VDAs, such as cryptocurrencies or NFTs

- Details of any advance tax or self-assessment tax paid

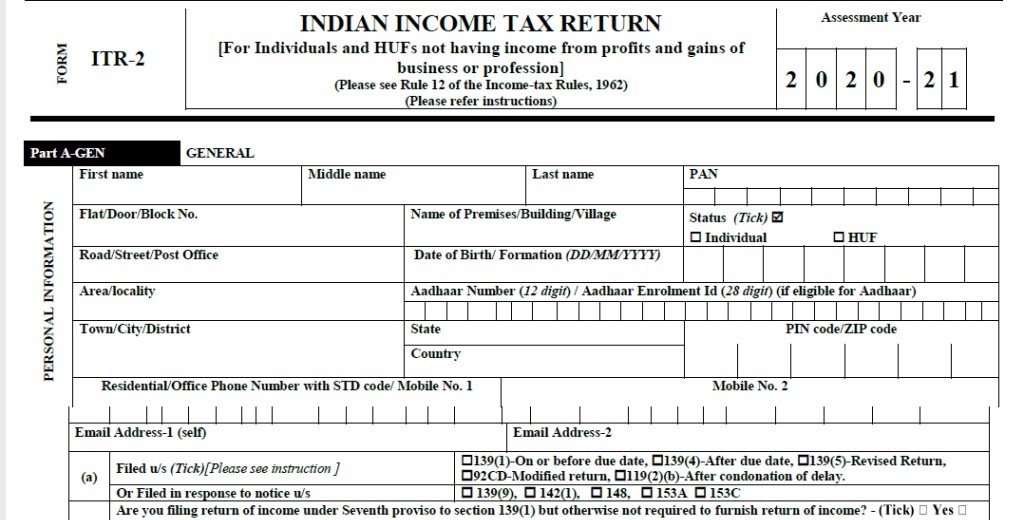

2. Logging into the Income Tax Portal and Selecting the ITR-2 Form

Visit the official Income Tax e-filing portal at incometax.gov.in. Log in using your PAN, password, and captcha, or use Aadhaar OTP or net banking for secure access.

The portal now automatically pre-fills data like Form 26AS, AIS, TIS, etc., in the ITR-2 form to simplify your filing process.

Once logged in:

- Go to e-File > Income Tax Returns > File Income Tax Return

- Select the appropriate Assessment Year

- Choose ‘Online’ as the filing mode

- Select the user type: Individual or HUF

- From the list of ITR forms, select ITR-2

Now you can easily download the ITR 2 form PDF from the portal.

3. Navigating the Pre-filled Data: Verification and Editing

The portal auto-populates data from your Form 26AS, AIS, and TIS. This includes:

- TDS deducted by employers and other deductors

- Bank interest income

- Dividend income

- Capital gains from listed securities

Each field must be thoroughly verified. If discrepancies exist, corrections should be manually made to ensure data integrity.

4. Filling Your Income Details: Salary, House Property, and Other Sources

Enter income details in the relevant schedules:

- Schedule S: Provide salary and pension details, based on Form 16

- Schedule HP: Report rental income, self-occupied property, interest paid on housing loans, and municipal taxes

- Schedule OS: Disclose income from dividends, savings interest, fixed deposits, lotteries, or VDAs

Ensure that all deductions under Chapter VI-A (Sections 80C to 80U) are correctly claimed.

5. Reporting Capital Gains Accurately

Use Schedule CG to report all capital gains:

- Provide ISIN, scrip name, acquisition and sale dates, and sale consideration

- Use the indexed cost of acquisition where eligible

- Enter exemptions claimed under Section 54, 54EC, 54F, etc.

- If multiple transactions exist, you may upload a CSV template provided by the portal for bulk entry

Maintain accuracy, as errors in capital gains computation can lead to notices or defective returns.

6. Completing the Filing: Tax Payment and Submission

After all income schedules are filled:

- The system computes the total tax liability or the refund amount

- If additional tax is due, pay via Challan 280 under self-assessment tax

- Review all schedules thoroughly and ensure data consistency

- Click ‘Proceed to Preview’ to generate a summary

- On confirmation, click ‘Submit’ to file the return

7. E-Verify Your ITR-2 Return

Post-submission, e-verification is compulsory for return validation. Choose from:

Note: E-verification must be completed within 30 days of filing the return. If not verified within this period, your ITR will be treated as invalid.