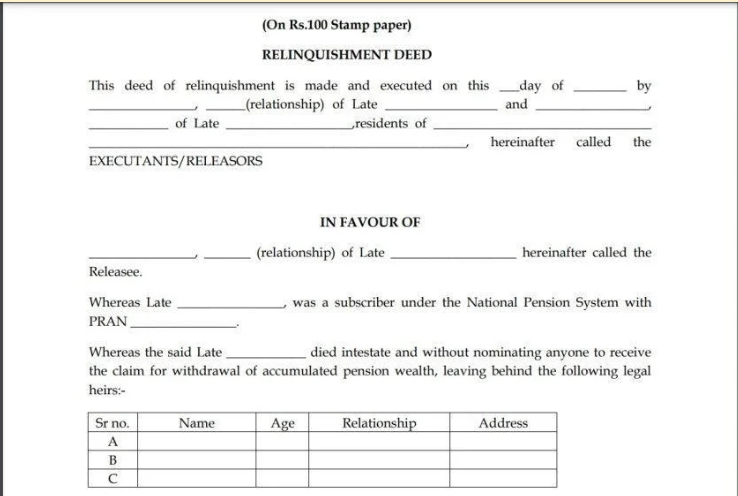

A relinquishment deed is a legal document used when one co-owner wants to give up their share in a property to another co-owner, which is a common practice among family members. It shows that the person giving up the share (known as the releasor) is doing it willingly. It is commonly used in inheritance matters to facilitate a smooth and issue-free property transfer.

To be legally valid and ensure the transfer is officially recognized by law, the relinquishment deed must be registered with the appropriate government office.

Rules Involved in Registering a Relinquishment Deed

When someone gives up their legal rights in property in favour of another co-owner, a Relinquishment Deed is made. To be legally valid, it must follow certain rules during registration.

- Must be in Writing: A relinquishment of property rights should always be written down in a proper deed. Oral agreements are not legally accepted for this purpose.

- Should be Signed by All Parties: Both the person giving up the rights (releasor) and the person receiving them (releasee) must sign the deed.

- Registration is Compulsory: Under the Registration Act, 1908, a relinquishment deed for immovable property must be registered at the local Sub-Registrar’s Office to be valid.

- Payment of Stamp Duty: The applicable stamp duty must be paid based on the property’s value or as per the state’s rules before registration.

- Witnesses are Required: At least two witnesses must be present during the signing of the deed, and their signatures should be included in the document.

- Only Co-owners Can Relinquish: A person can only relinquish rights if they are already a co-owner of the property. You cannot give up rights in a property you do not own.

- Irrevocable Once Registered: After registration, a relinquishment deed generally cannot be cancelled unless both parties agree or a court orders it for a valid reason.

What is the Difference Between a Relinquishment Deed and a Gift Deed?

Below is a simple comparison between a relinquishment deed and a gift deed:

| Relinquishment Deed | Gift Deed |

| Gives up a person’s rights to a property | Involves giving a property to someone as a gift |

| Used when a legal heir or co-owner wants to give up their share | Used when a person wants to gift property to someone else |

| No money is exchanged | May or may not involve money |

| The person gives up their share and rights in the property | The receiver gets full ownership of the property |

| Can be cancelled in some legal situations | Usually cannot be cancelled unless the law allows it |

| Used to settle property rights among family members or co-owners | Legally transfers property as a gift to another person |

| Generally not taxable when done among legal heirs or family under inheritance | May attract gift tax if the recipient is not a close relative under the Income Tax Act |

Tip: A Gift Deed can be used even if the property is fully owned by one person. In contrast, a Relinquishment Deed can only be executed by a co-owner or legal heir, not by someone who doesn’t hold any share in the property.