A succession certificate is a legal document mainly governed by Part X of the Indian Succession Act, 1925. It is a legal document given to the legal heir of a person who has died without making a will. This certificate helps confirm who the rightful successor is.

This certificate authorizes the heir to settle the deceased’s financial matters, such as collecting debts, accessing bank accounts, and transferring ownership of securities like shares and bonds. It acts as legal proof for financial institutions to release the assets to the rightful claimant.

Importance of a Succession Certificate

A succession certificate legally empowers heirs to access and manage the deceased’s movable assets, ensuring smooth transfers and avoiding disputes.

- Proves Legal Heirs: It clearly shows who the legal heirs are, removing confusion and chances of family disputes.

- Helps in Getting Assets: It allows the legal heirs to claim and transfer things like bank accounts, shares, mutual funds, and property like land or a house.

- Avoids Family Conflicts: By naming the rightful heirs, it helps prevent fights or court cases over the assets.

- Protects People Who Owe or Are Owed Money: It gives legal safety to those who owe money to the deceased, as paying the certificate holder is considered valid.

- Needed for Transactions: Many banks, financial companies, and other offices ask for this certificate to release money or transfer ownership of assets.

Note: A succession certificate is only for movable assets like bank balances, debts, and securities. It doesn’t grant ownership of land or houses, which require a will or a legal heir certificate.

Myths for the Succession Certificate in India

While a succession certificate is crucial for claiming movable assets, it has certain legal limitations that every applicant should be aware of. It does not grant permanent ownership rights and is not applicable to all types of assets.

- Does Not Confirm Ownership: The certificate only authorizes the holder to collect and manage the deceased’s financial assets. It does not determine legal ownership of those assets, which is decided under inheritance laws or through a will.

- Not Applicable to Immovable Property: Succession certificates are primarily used for movable assets like bank accounts, shares, and insurance claims. For immovable property such as land or buildings, a will, a legal heir certificate, or an inheritance through a court order is usually required.

- May Not Be Needed in Certain Cases: If the asset has a registered nominee (like in insurance policies or bank accounts), or if it is jointly held, the succession certificate may not be required for claiming it.

- Limited Legal Scope: The certificate allows recovery and transfer of debts and securities, but not all types of assets or legal rights.

Legal Aspects and Sections Involved in Succession

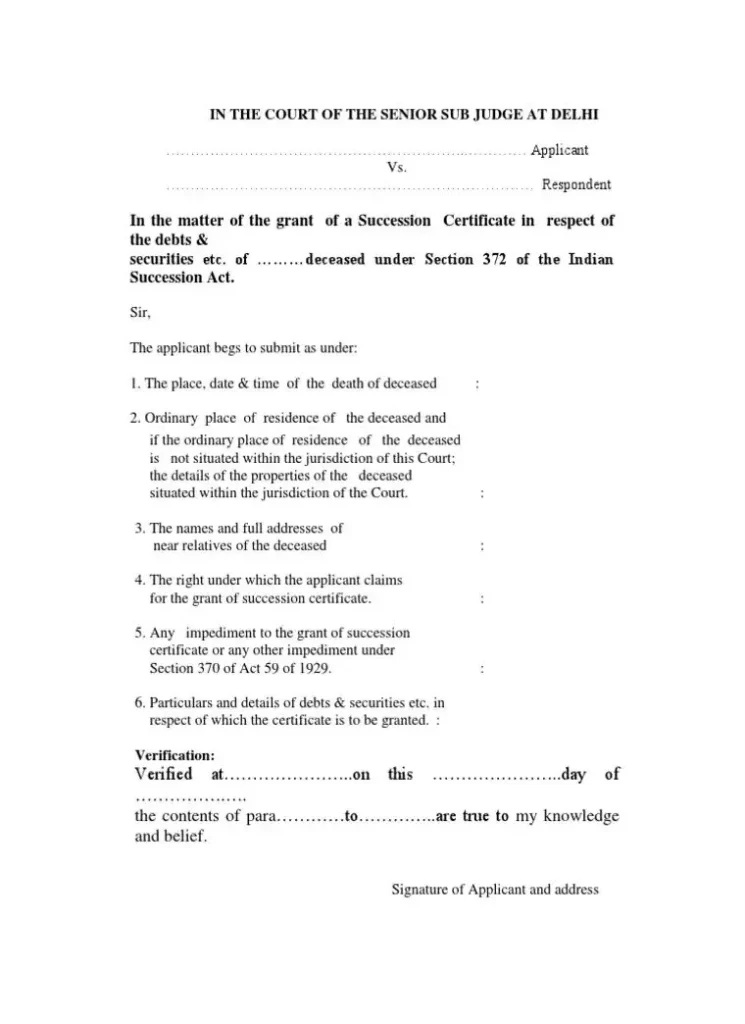

The process of obtaining a succession certificate is governed by specific legal provisions under the Indian Succession Act, 1925. These sections outline who can apply, what details must be included, and how the court handles the application.

- Part X of the Indian Succession Act, 1925: This part explains the full process for getting a succession certificate. It talks about how to apply, what powers the court has, and what the certificate allows the holder to do.

- Section 370 – Definition of Debts and Securities: This section explains what is meant by “debts” and “securities.”

-

- Debts include things like money owed to the person who has died, for example, money in a bank account or a loan someone had to return. It does not include rent or income from farm land.

- Securities include things like shares, government bonds, mutual funds, or fixed deposits, basically, any investment made by the deceased. These can only be claimed or transferred after getting a succession certificate.

- Section 372 – Details in the Application: This section lists the details that must be included when applying for a certificate. These include:

-

- Time and place of the person’s death

- Names and addresses of family members

- The applicant’s relationship with the deceased

- The debts and investments for which the certificate is needed

- Section 376 – Adding More Assets: If the certificate was already granted, but later, more debts or securities are found, this section allows the court to update the certificate to include those, too.

- Section 373 – Court’s Procedure: This section explains how the court handles the application. It includes sending notices to other possible heirs and holding a hearing to decide who should get the certificate.

- Section 31 of the Administrator General’s Act, 1913: Sometimes, instead of a succession certificate, a similar certificate can be given by the Administrator General. This section explains when and how that can happen.

- Other Useful Sections:

-

- Section 320 talks about the priority of paying for funeral and last illness expenses from the deceased’s money.

- Section 101 and other similar sections are helpful when the deceased left a will.

- Legal Heir Certificate: A Legal Heir Certificate is another document that proves the relationship between the deceased and the claimant. However, it is not a replacement for a succession certificate, especially when banks or financial bodies are involved.

- Court Fees: To get a succession certificate, the applicant must pay court fees. These fees are usually a small percentage of the total value of the debts and securities listed in the application.

Note: A succession certificate is granted by the District Court under whose jurisdiction the deceased last resided.