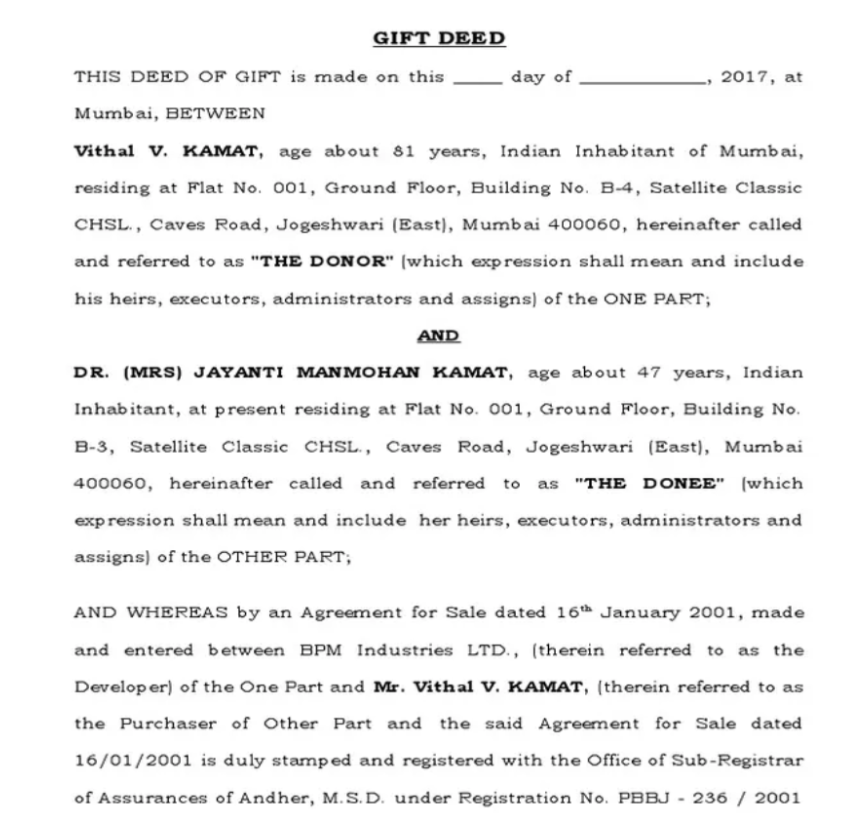

A gift deed is a legal document used to voluntarily transfer ownership of property, movable (like cash, jewellery, or shares) or immovable (like land or a house), from one person (the donor) to another (the donee) without any exchange of money. According to the Transfer of Property Act, 1882, the gift must be in writing, signed by the donor, and accepted by the donee during the donor’s lifetime. For it to be legally valid, it must also be registered.

Once registered, the donee becomes the legal owner of the property. While no payment is made, stamp duty and registration charges may still apply depending on the state and type of property. Under Section 56(2)(x) of the Income Tax Act, gifts from close relatives are tax-exempt, but gifts from non-relatives exceeding Rs. 50,000 in a year are taxable as income.

Key features:

- The property is given freely, without any money involved.

- It must be registered as per the Indian Registration Act, 1908.

- Both the donor and the donee (or their legally authorized representatives) must be present at the sub-registrar’s office during the registration process.

Why Use a Gift Deed?

A gift deed is a simple way to legally transfer property without involving money. Here’s why it’s useful:

- It provides legal proof of the transfer.

- It is crucial for avoiding future confusion or family disputes.

- Makes the process smooth, safe, and recognized by law.

- Useful for tax benefits in some cases (like gifts to close relatives).

Note: Gifts from relatives (as per the Income Tax Act) are tax-free, but gifts from non-relatives over Rs. 50,000 in a year are taxable as income.

What Should a Gift Deed Include?

To make a gift deed legally valid and clear, certain important details must be included in the document:

- Full details of the donor (giver) and donee (receiver), including their names and relationship.

- Complete description of the property being gifted – location, size, and boundaries.

- A clear statement that the gift is given voluntarily, without money or pressure.

- Signatures of both the donor and the donee.

- Signatures of at least two witnesses.

- The deed should be executed on a non-judicial stamp paper of appropriate value as per the state’s Stamp Act.

- Proper registration of the deed with the sub-registrar, along with applicable stamp duty and registration charges.

Important Clauses & Governing Laws in a Gift Deed

In India, a gift deed mainly focuses on the free and unconditional transfer of property, done out of love and affection, without taking any money in return. The deed should mention the people involved, property details, and other important terms to avoid legal issues later.

Key Clauses in a Gift Deed

To make a gift deed legally valid and complete, it must include certain key clauses that clearly define the terms of the gift and protect the interests of both the donor and the donee.

- Details of Donor and Donee: The gift deed must have the full names, addresses, and the relationship between the person giving the gift (donor) and the one receiving it (donee).

- Description of the Gift: It should include a clear description of the property being gifted—its location, size, boundaries, and any other important details.

- Transfer Clause: A statement confirming that the gift is being given willingly and without any pressure or money involved.

- Consideration Clause: It must be clearly stated that the gift is made out of natural love and affection, not for any kind of payment.

- Acceptance Clause: The deed should confirm that the donee has accepted the gift.

- Revocation Clause: If the gift can be taken back under any conditions, those conditions should be mentioned clearly.

- Rights and Responsibilities: The deed should explain any rights, duties, or responsibilities linked to the property that the donee must follow.

- Delivery of Possession: It should state how and when the property will be handed over to the donee.

- Witnesses: At least two people must sign the deed as witnesses to make it legally valid.

- Irrevocability Clause: The deed should confirm that once the gift is made and registered, it cannot be cancelled.

Note: Although a gift deed is usually irrevocable, Section 126 of the Transfer of Property Act, 1882, allows revocation in specific cases.

- If the gift was made with certain conditions and the donee violates them.

- If the gift was made due to fraud, coercion, or undue influence.

Laws Governing Gift Deeds

Gift deeds in India are governed by a combination of laws to ensure that the transfer is legal, enforceable, and properly documented. These laws define how a gift should be executed, registered, and taxed:

- Transfer of Property Act, 1882: Sections 122 to 129 mention the rules and conditions for gifting immovable property.

- Indian Contract Act, 1872: This Act ensures that the fundamental principles of a valid contract, such as the donor's competence and free consent (absence of fraud or coercion), are met.

Note: Gifts to non-relatives exceeding Rs. 50,000 are taxable in the hands of the receiver under Section 56(2)(x) of the Income Tax Act, 1961.

- Registration Act, 1908: This Act mandates the registration of any gift deed involving immovable property, making registration essential for legal validity.

- Stamp Act: This law decides how much stamp duty needs to be paid for the gift deed, which can be different state-wise.