A Legal Heir Certificate is an official document issued by the government that identifies the rightful living successors of a deceased person. It is similar to a formal introduction to the authorities, stating who is next in line to inherit the deceased's assets, liabilities, and responsibilities.

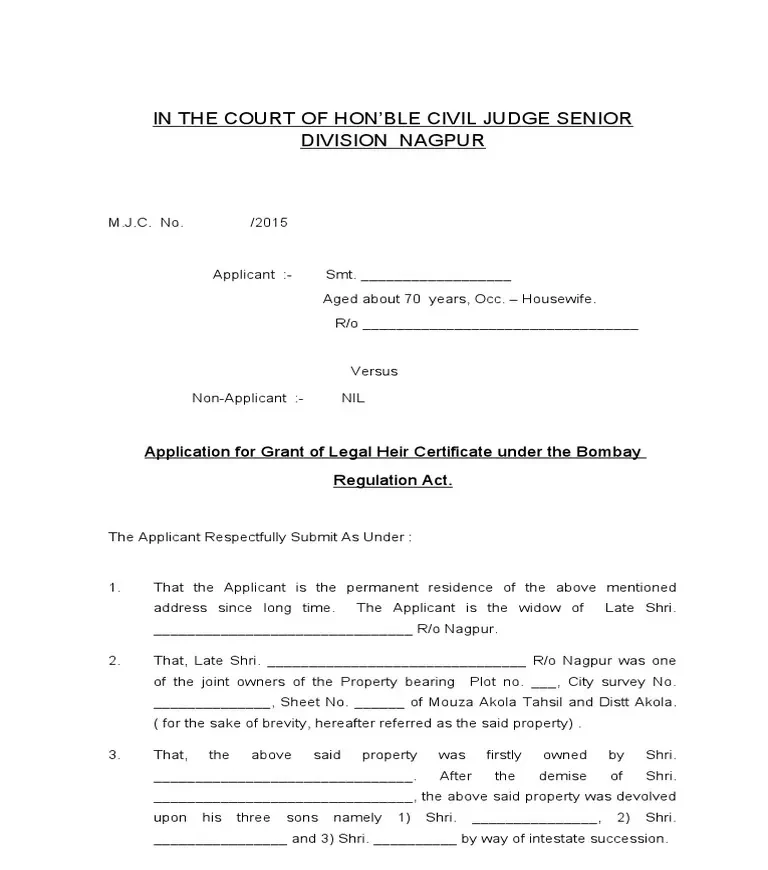

When a person passes away without leaving a will (this is known as dying 'intestate'), this certificate becomes vital. It establishes the relationship between the deceased and their legal heirs, paving the way for the transfer of property, bank balances, and other assets. The certificate is issued after a proper inquiry by the concerned government authorities, such as the Tehsildar or Talukdar (Sub-Divisional Magistrate – SDM) of the district.

Who are the Legal Heirs?

The law in India defines who is considered a legal heir based on the deceased person's religion. The rules of succession are governed by personal laws.

For Hindus, Buddhists, Jains, and Sikhs, the Hindu Succession Act, 1956, applies. The legal heirs are categorized into classes:

- Class I Heirs: These are the primary heirs and have the first right to the property. They inherit equally. Class I heirs include:

- Spouse (Wife or Husband)

- Sons and Daughters

- Mother

- Children of a predeceased son or daughter

- Class II Heirs: If there are no Class I heirs, the property goes to Class II heirs. This category includes:

- Father

- Grandparents

- Grandchildren

- Siblings (Brothers and Sisters)

- Other relatives

For Christians, the Indian Succession Act, 1925, governs the distribution of property. Generally, the spouse and children are the primary heirs. If there are no children, the spouse may share the assets with other relatives of the deceased, like the father or mother.

For Muslims, succession is governed by their law, which has its own distinct rules for identifying heirs and their respective shares. Islamic law defines specific shares for heirs (known as Sharers and Residuaries), which include the spouse, children, and parents. The distribution is based on a pre-defined framework within Sharia.

Note: Personal succession laws are complex. It is always advisable to consult a legal expert for specific cases.

Why is a Legal Heir Certificate Important: Key Benefits

A Legal Heir Certificate is crucial after the death of a loved one. It legally proves who the rightful successors are and helps in managing the person's financial and legal matters smoothly.

Here’s why it’s important and how it helps:

- To Claim Assets: You need this certificate to transfer or claim the deceased’s money, property, mutual funds, and bank accounts.

- For Banks and Insurance: Banks, insurers, and other institutions will ask for this certificate before allowing access to funds or processing claims.

- Government Dues: If the deceased was a government employee, the certificate is required to claim pension, PF, gratuity, and other dues.

- Property and Utility Transfers: It is needed to update ownership of real estate, electricity, water, and property tax records.

- Access to Funds and Investments: You can only manage the deceased’s bank accounts or investments with this certificate.

- Compassionate Job Appointments: In government jobs, this certificate is a must for heirs seeking employment on compassionate grounds.

- Legal Protection: It helps prevent future disputes by clearly naming all legal heirs.

- Proof of Claim: It officially validates your relationship and right to inherit.

In short, this certificate is not just a formality; it protects your rights, speeds up asset transfers, and prevents legal complications.

Rules & Regulations Governing Legal Heir Certificate

The issuance of a Legal Heir Certificate is primarily a state-level process, and the procedures may vary slightly from one state to another. There is no single central law governing its issuance. Instead, state revenue authorities issue the certificate based on applicable personal succession laws such as the Hindu Succession Law, Muslim Personal Law, or the Indian Succession Act, 1925 (for Christians and Parsis), and relevant state-specific rules.

The certificate is generally issued by the Revenue Department of the respective state. Key authorities involved in the process include the District Collector, Tehsildar, Talukdar, or Sub-Divisional Magistrate (SDM). Their role is to verify the legal heir claims through a proper inquiry before approving and issuing the certificate.