Partnership firm tax return filing refers to the process of submitting the Income Tax Return (ITR-5) for a partnership firm to the Income Tax Department of India. Regardless of whether the firm is registered or unregistered, every partnership firm is required to report its income, expenses, and tax liabilities annually. The return must be filed even if the firm has incurred losses or has no taxable income during the financial year.

Filing ensures compliance with the Income Tax Act, 1961, and is essential for claiming refunds, carrying forward losses, or maintaining proper financial records. Additionally, if the firm’s turnover exceeds the specified threshold limits, tax audit provisions under Section 44AB may also apply.

These firms primarily fall into two categories:

1. Registered Partnership Firm

A registered partnership firm has completed the formal registration process with the Registrar of Firms under the Indian Partnership Act, 1932, and possesses a registration certificate as proof of its legal standing.

2. Unregistered Partnership Firm

Conversely, an unregistered partnership firm is any partnership that has not obtained a registration certificate from the Registrar of Firms.

At its core, a partnership is an agreement between two or more individuals who have mutually agreed to share the profits or losses generated from a jointly operated business. The individuals in this arrangement are known as 'partners,' and together they form the 'firm'.

Partners must understand the partnership firm tax rate and its implications for profit distribution. Partners are obligated to act in the firm's best interest, ensure fair dealings, and maintain accurate and transparent records for the benefit of all involved.

Understanding Your Partnership Firm's Tax Duties

Under the Income Tax Act, 1961:

- A partnership firm is subject to a flat tax rate of 30% on its profits.

- A 12% surcharge is levied when the firm's taxable income exceeds Rs. 1 crore.

- A 4% health and education cess is also applicable to firms.

Note: Unlike individuals or Hindu Undivided Families (HUFs), no basic exemption limit applies to partnership firms. Tax is levied on the entire taxable income.

Why must You File a Tax Return Even with No Profit (Nil Income)?

Even if a partnership firm has no profit (or even a loss) in a financial year, filing an Income Tax Return (ITR) is mandatory in India.

1. Legal Obligation: Under the Income Tax Act, 1961, every partnership firm (whether registered or unregistered) is considered a separate taxable entity and is legally obligated to file an ITR (Form ITR-5) annually, regardless of its income or loss position. Failing to do so is a non-compliance.

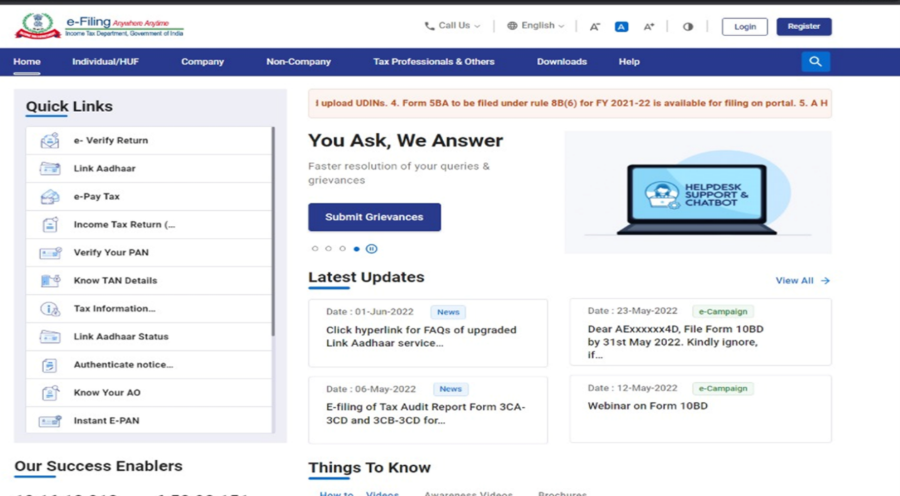

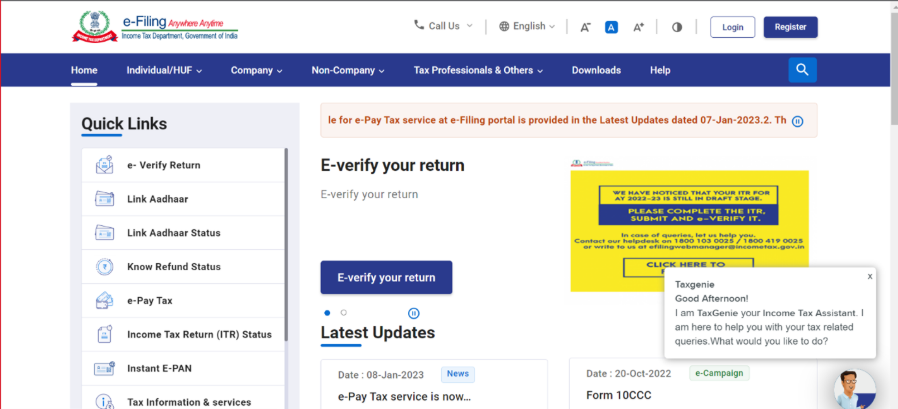

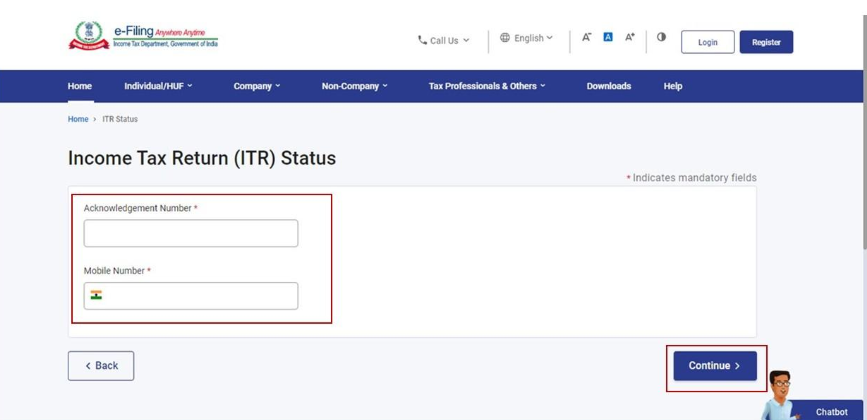

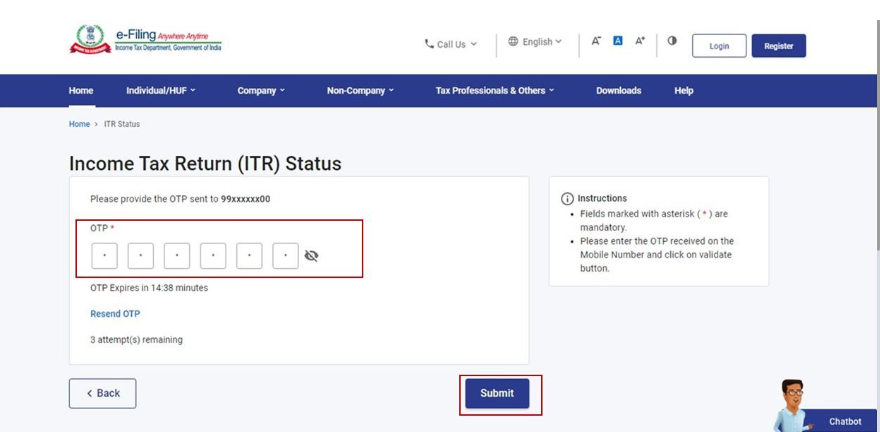

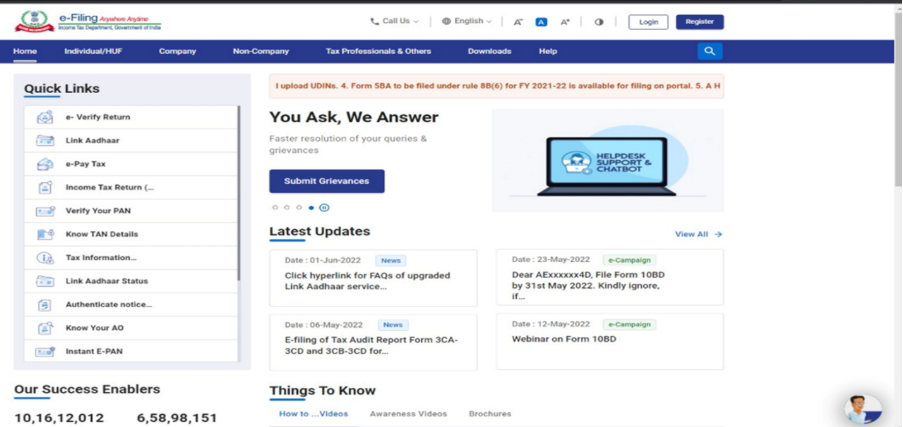

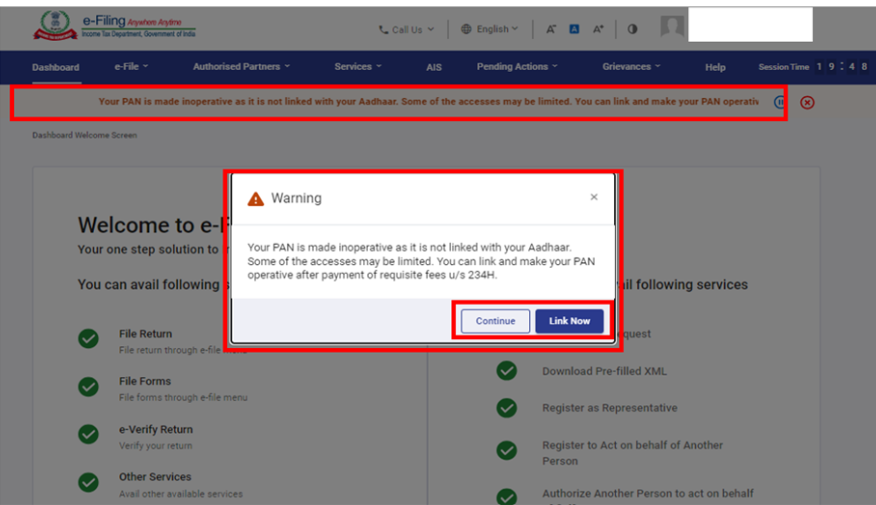

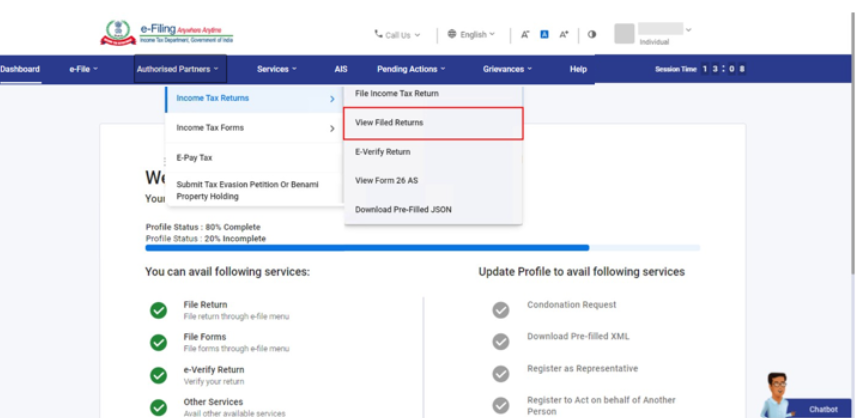

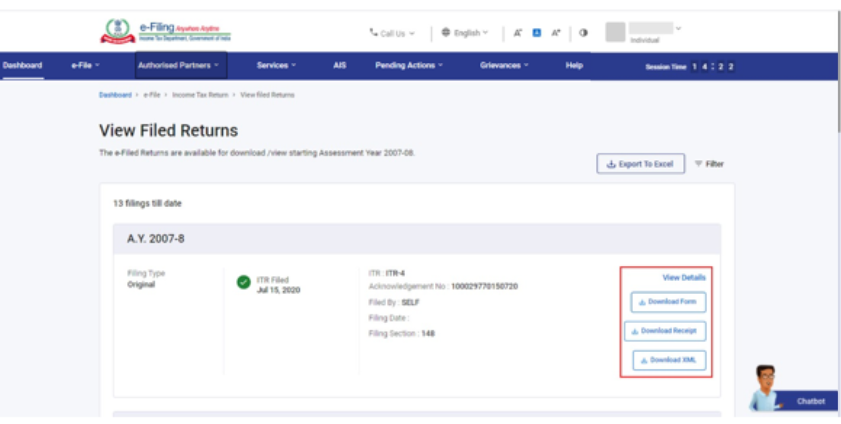

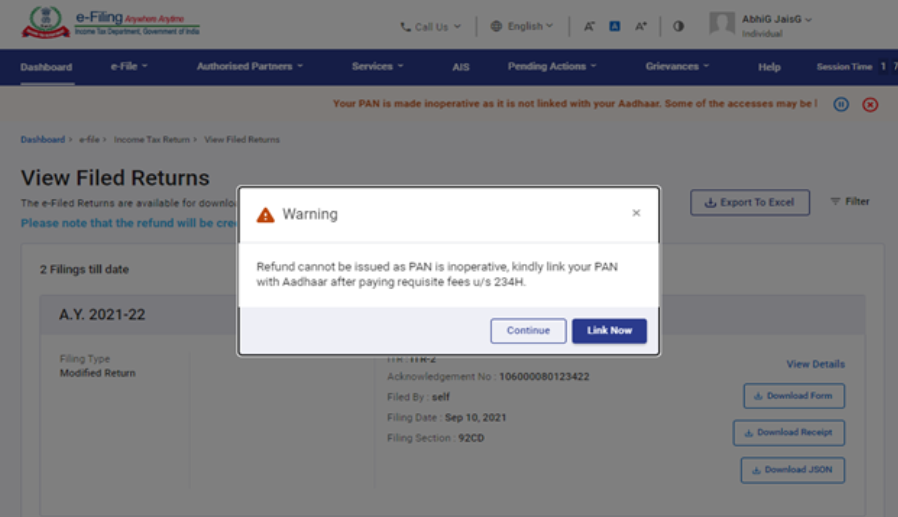

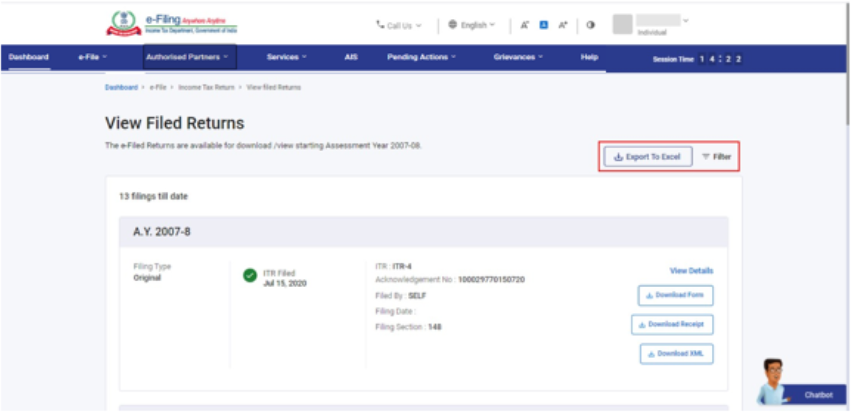

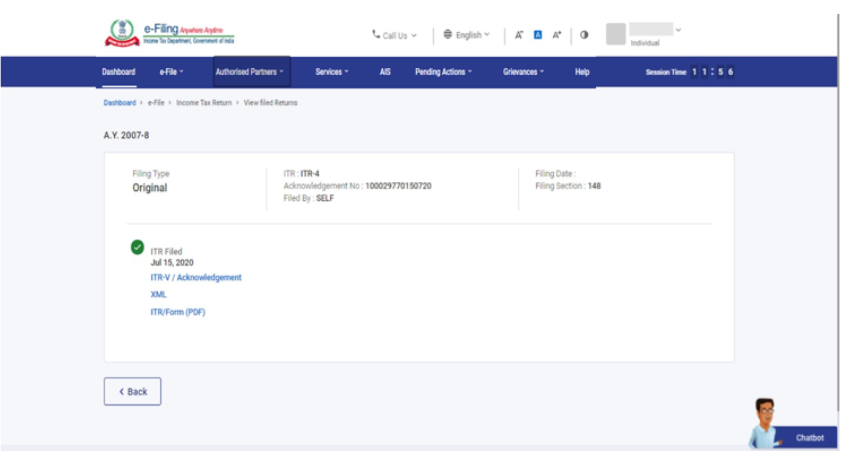

2. Electronic Filing Requirement: Form ITR-5 must be filed electronically through the Income Tax e-filing portal. If the firm is subject to a tax audit, filing must be done using a Digital Signature Certificate (DSC).

3. Carry Forward of Losses: This is a crucial benefit. If your firm incurs a loss in a financial year, you can only carry forward these losses to offset against future profits and reduce your tax liability in subsequent years if you file your ITR by the due date. If you don't file, you lose the ability to carry forward most types of losses (e.g., business loss, capital loss).

Example: Suppose your partnership firm reports a business loss of Rs. 2.5 lakhs in FY 2024–25. If you file your ITR on time, you can carry forward this Rs. 2.5 lakhs and adjust it against future profits in the next 8 years, reducing future tax burdens. However, if you fail to file the return, you lose this right, and the entire loss lapses.

4. Avoid Penalties and Consequences:

- Late Filing Fees: Even for a NIL return, a late filing fee of Rs. 5,000 is levied under Section 234F. However, if the firm's total income is Rs. 5 lakh or less, the fee is reduced to Rs. 1,000.

- Interest: If any tax was due (even if calculated to be zero after deductions but before filing), interest under Section 234A might be charged.

- Prosecution: In severe cases of non-compliance, particularly if there's a history of not filing, which could be viewed as tax evasion, or if the tax liability (even if unpaid) was substantial, the firm and its partners could face prosecution.

- Operational and Reputational Impact: Not filing can lead to a negative standing with tax authorities, potentially affecting other aspects of the firm's operations.

5. Proof of Financial History: ITRs serve as official proof of the firm's financial activities. This is invaluable for:

- Loan Applications: Banks and financial institutions often require ITRs for the past few years when applying for business loans, overdraft facilities, or even personal loans for partners.

- Visa Applications: When partners apply for international visas, embassies often request ITRs as proof of financial stability.

- Tender Applications: For bidding on government or private tenders, consistent ITR filing demonstrates compliance and financial transparency.

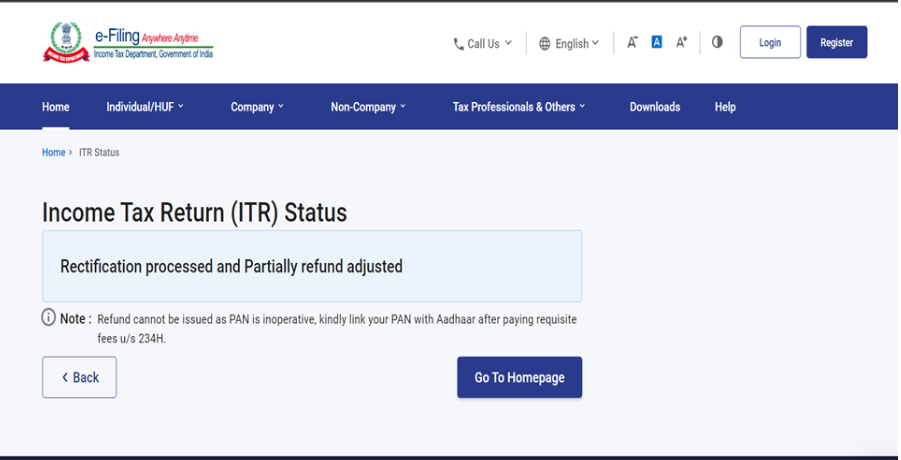

6. Claiming Refunds: If the firm had any Tax Deducted at Source (TDS) on its income (e.g., on interest received, or payments from clients), even if no final tax was payable, you can only claim a refund of this TDS by filing the ITR.

7. Maintaining Records and Transparency: Filing the ITR ensures that the firm maintains accurate financial records, which are essential for good governance, internal transparency among partners, and future financial analysis.