A Limited Liability Partnership (LLP) is a business structure that blends the flexibility of a partnership with the protection of a company. Partners can manage the business directly while keeping their personal assets safe from business liabilities.

Registering an LLP gives your business legal recognition. It builds credibility with clients, banks, and investors. You also gain access to government schemes and tax benefits. The process is also cost-effective, making LLPs a top choice for startups and small businesses. You get the advantages of limited liability and partnership flexibility without heavy financial risks.

Before you begin, it’s important to understand the full cost of LLP registration. The process includes:

- Government fees

- Professional charges

- Compliance costs

While this may seem confusing at first, knowing the details helps you plan better and avoid surprises.

In this guide, we break down all expenses related to LLP registration. From government fees and stamp duties to professional service charges, we cover everything you need to budget for. By the end, you’ll have a clear picture of how much it really costs to register an LLP in India.

What is Included in the LLP Registration Fee?

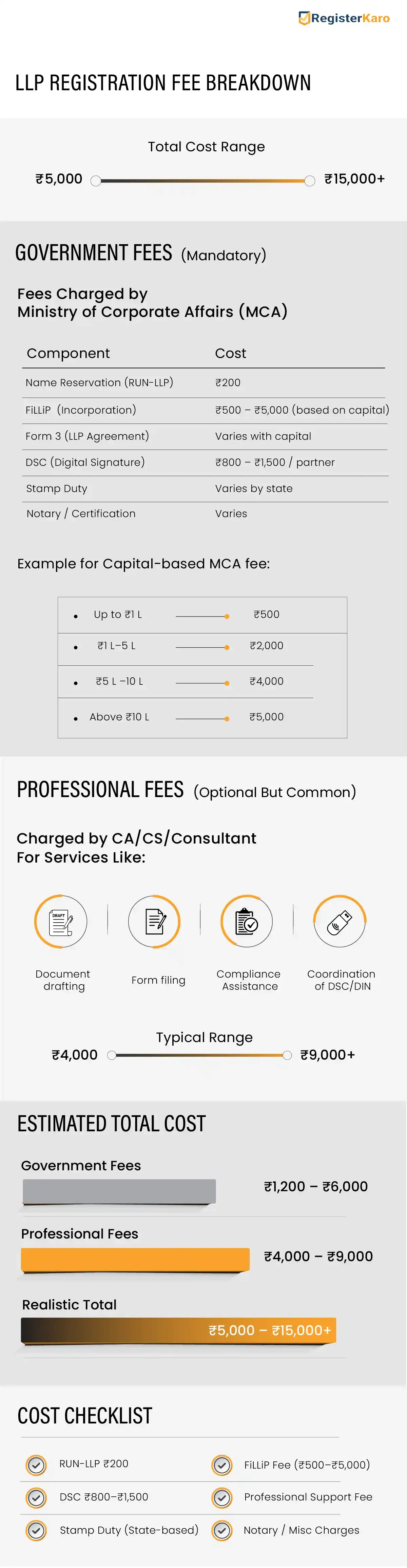

LLP registration costs in India come from two main sources: government fees and professional fees. Understanding both helps you plan your budget accurately.

1. Government Fees (MCA Fees)

These are mandatory charges paid to the Ministry of Corporate Affairs (MCA). They include:

- Name reservation for your LLP

- Filing of the incorporation form

- Submission of the LLC Agreement

- DIN and DSC charges (in some cases)

- Stamp duty (varies by state)

- Minor expenses like notary fees and official certification charges

These fees are fixed by the government and must be paid for your LLP to get legal recognition.

2. Professional Fees

These are charges paid to Company Secretaries, Chartered Accountants, legal professionals, or online platforms. They help with:

- Drafting documents and the LLP Agreement

- Preparing and submitting forms correctly

- Providing legal and compliance advice

- Coordinating DSCs and DINs

- Ensuring all registration steps meet statutory requirements

- Handling courier or incidental charges

Professional fees vary depending on the complexity of your LLP and the services you choose.

Government Fees for LLP Registration

Understanding government fees for LLP registration is essential for estimating the total cost. These are statutory charges paid to the Ministry of Corporate Affairs (MCA) and must be settled to complete the registration process.

| Component | Fee Description |

| RUN-LLP (Name Reservation) | Rs. 200 to reserve a unique LLP name |

| FiLLiP Form (Incorporation) | Fee varies with capital contribution (see below) |

| Form 3 (LLP Agreement) | Fees vary on the capital contribution |

| Director Identification Number (DIN) (for new partners) | Included in FiLLiP for up to 2 designated partners without existing DINs |

| Digital Signature Certificate (DSC) | Around Rs. 800 – Rs. 1,500 per DSC (issued by certifying authorities) |

| Stamp Duty | Varies by state; applicable to the LLP Agreement and registration |

| Notary and Certification Fees | Varies by state; applicable to LLP Agreement and registration |

FiLLiP & Form 3 Charges Based on Capital Contribution:

The FiLLiP Form is the main incorporation form used to register an LLP. It captures details like:

- Partner information

- Capital contribution

- Business address

Form 3 is submitted after incorporation to register the LLP Agreement, which defines the roles, rights, and responsibilities of partners.

The following are the charges based on capital contribution:

| Capital Contribution | MCA Filing Fees (Each Form) |

| Up to Rs. 1,00,000 | ₹500 |

| Rs. 1,00,001 to Rs. 5,00,000 | ₹2,000 |

| Rs. 5,00,001 to Rs. 10,00,000 | ₹4,000 |

| Rs. 10,00,001 and above | ₹5,000 |

Note: These fees cover most statutory charges, but small incidental costs like courier charges or additional certification fees may also apply. Being aware of all potential costs helps you budget accurately and avoid delays during registration.

What is the Total Cost of LLP Registration in India?

The total cost of registering an LLP in India generally ranges from Rs. 5,000 to Rs. 15,000 or more. The exact amount depends on your capital contribution, business type, and the state of registration.

This includes both government charges and professional fees. Here’s a quick summary:

- Government Fees: Rs. 1,200 to Rs. 6,000 (depending on capital contribution)

- Professional Fees: Rs. 4,000 to Rs. 9,000 (based on complexity and provider)

LLP registration costs cover filing all required forms, obtaining DSC and DIN, and other mandatory documentation.

Additional costs may arise if you hire legal, accounting, or professional consultants. These are usually minimal but ensure your registration is smooth, accurate, and compliant with all regulations.

Post-Registration Compliance Costs

After registering an LLP, you must comply with recurring legal and financial obligations. These costs are often overlooked but essential for smooth operations:

- Annual ROC Filing: File Form 11 (Annual Return) and Form 8 (Statement of Accounts & Solvency) every year.

- Income Tax Filing: Submit the LLP’s income tax returns on time to avoid penalties.

- Accounting and Audit: Maintain books of accounts; an audit may be required if your turnover exceeds Rs. 40 lakh or capital contribution exceeds Rs. 25 lakh.

Being aware of these costs helps you plan your budget beyond the initial registration and avoid surprises.

Factors Influencing Your LLP Registration Cost

Several factors determine the total cost of registering an LLP in India:

- Capital Contribution: Higher capital increases MCA filing fees for FiLLiP and Form 3.

- Number of Designated Partners: More partners may require additional DSCs and DINs.

- State of Registration: Stamp duty on the LLP agreement varies across states.

- Choice of Professional: Experienced consultants, lawyers, or CA/CS firms may charge higher fees.

- LLP Agreement Complexity: Customized agreements with special clauses involve higher drafting charges.

- Urgency of Registration: Expedited services or priority processing can add to the cost.

- Additional Compliance Needs: Extra services like notarization, document translation, or courier charges can increase expenses.

Being aware of these factors helps you plan your budget more accurately and avoid unexpected costs during registration.

What is Typically Included in an LLP Registration Package?

Most standard LLP registration packages include everything you need to start your business legally and efficiently:

- 2 Digital Signature Certificates (DSCs): Required for signing documents electronically.

- 2 Director Identification Numbers (DINs): Unique IDs for the designated partners.

- RUN-LLP Name Approval: Reservation of your LLP’s unique name with the MCA.

- COI: A Certificate of Incorporation (COI) is the official proof that your LLP is legally registered.

- Drafting & Filing of LLP Agreement (Form 3): Outlines the roles, rights, and responsibilities of all partners.

- PAN & TAN Application: PAN and TAN are essential tax registrations for your LLP.

Some packages may also include notarization, stamp duty payment, and document courier services, making the process seamless.

Get in touch with RegisterKaro and start your LLP journey with confidence!

Why Choose an LLP?

Limited Liability Partnerships (LLPs) have become a popular choice for startups, small businesses, professionals, and consultants across India.

Here’s why an LLP might be the smartest choice for your business:

- Lower compliance burden compared to a Private Limited Company

- No minimum capital required to get started

- Flexible ownership and profit-sharing options

- Protection of personal assets from business liabilities

Whether you’re launching a new business or transitioning to a more secure structure, registering an LLP helps you build a strong foundation for long-term growth.

Read More: How LLP Registration in India Can Help Reduce Your Tax Liability?

Frequently Asked Questions

The total LLP registration cost typically ranges from Rs. 5,000 to Rs. 15,000. It depends on factors like capital contribution, the number of partners, and the city of registration.

This amount includes government fees, professional charges, and other mandatory costs required to legally incorporate your LLP.