Applying for the 80-IAC exemption follows a clear process. Here's how to do it step-by-step:

Step 1: Secure Your DPIIT Recognition on the Startup India Portal

Before applying for the 80-IAC exemption, your startup must first obtain recognition from the Department for Promotion of Industry and Internal Trade (DPIIT). This recognition can be obtained through the official Startup India portal. During this process, you will be required to provide details about your company, its founders, and the nature of your business.

Obtaining DPIIT recognition is a crucial first step, as it grants access to various government benefits, including the 80-IAC tax exemption. Ensure that all information submitted is accurate and complete to avoid any delays or issues with your application.

Step 2: Gather All Required Documentation

Before starting your application, gather all the required documents (refer to the “Documents Required to Apply for 80-IAC” section for full details). This includes your Company or LLP formation papers, PAN card, and financial records.

These documents are very important for the Inter-Ministerial Board's review. Missing documents are a common reason for rejection.

Step 3: Crafting a Compelling Application with a Pitch Deck and Video

This step is key to showing your startup's innovation and ability to grow. Your application should clearly explain your product, process, or service. Show how it is new, better, or uses advanced technology.

- Pitch Deck: Your pitch deck should concisely cover the problem you're solving, your solution, market analysis, business model, team expertise, and financial projections, clearly highlighting your unique value proposition.

- Video: A short video (usually 2-3 minutes) can strongly show your startup's vision. Show your product or service working. Explain its effect and potential to create jobs or wealth. This helps the IMB members see your idea.

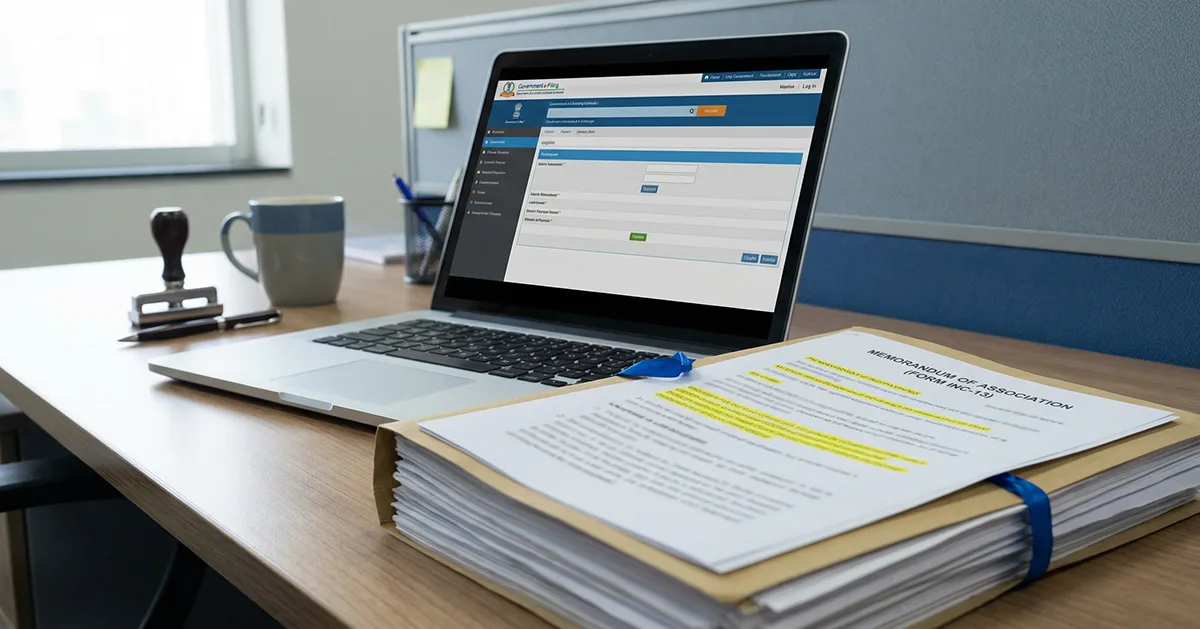

Step 4: Filing the Tax Exemption Form on the Portal

Once you have your DPIIT recognition and all documents are ready, go back to the Startup India portal. Find the section for applying for the Section 80-IAC tax exemption. Fill out the form with all the needed details. Upload your pitch deck, video, and supporting financial and legal documents. Check everything twice for correctness to avoid any delays.

Step 5: The Inter-Ministerial Board (IMB) Review Process

After you send it, your application will be reviewed by the Inter-Ministerial Board (IMB). This board has people from DPIIT, the Department of Biotechnology, and the Department of Science & Technology. The IMB checks if your business truly meets the rules for "innovation, development, or improvement of products, processes, or services, or a scalable business model with a high potential of employment generation or wealth creation."

They might ask for more details or information. The board’s decision is final, based on your application. DPIIT aims to review full applications within 120 days.

Step 6: Receiving Your Certificate and Claiming the Deduction

If the IMB approves your application, you will get an 80-IAC tax exemption certificate. This certificate proves you are eligible. With this, you can then claim the 100% tax deduction on your profits for any three years in a row. These years must be within your startup’s first ten years.

You must clearly show this exemption when you file your Income Tax Returns (ITR). Keep all records for future checks.