You can get your GST registration in Chennai easily through the official GST portal. The system allows you to track your application with an Application Reference Number (ARN), and the certificate is usually issued within 7 days.

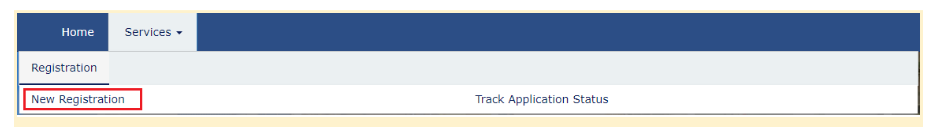

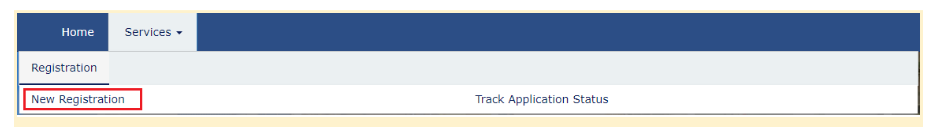

Step 1: Visit the GST Portal

Go to the GST Portal and navigate: Services → Registration → New Registration.

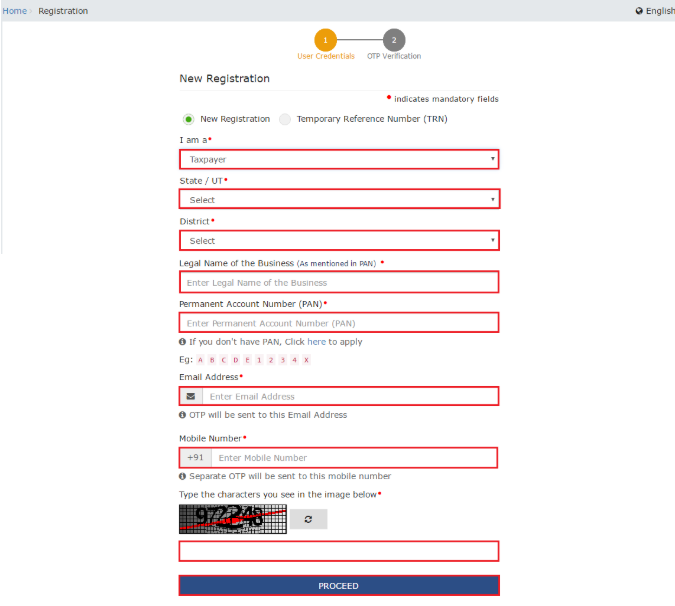

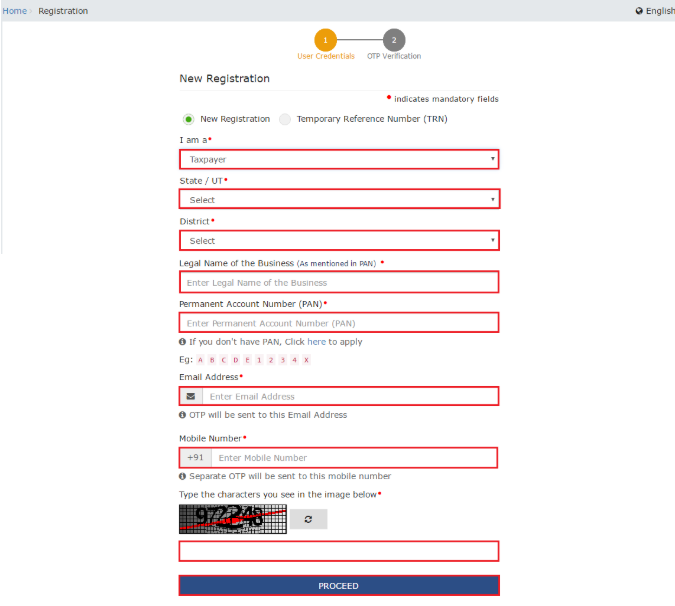

Step 2: Start New Registration & Generate TRN

On the registration page, choose New Registration. If you cannot finish the form in one go, you can continue later using your TRN.

- Select the Taxpayer type.

- Choose your State.

- Enter the legal name of the business as per the PAN database (details must match PAN).

- Enter the PAN of the business or proprietor. For companies/LLPs, enter the company/LLP PAN.

- Provide the email and mobile number of the Primary Authorized Signatory (to be verified next).

- Click PROCEED.

Note: The TRN is valid for 15 days from the date of generation.

An ARN (Application Reference Number) acknowledgement is generated immediately after submission, but the GST certificate will be issued only after approval by the tax officer.

Step 3: OTP Verification

You’ll see the OTP verification screen (OTP is valid for 10 minutes).

- Enter the Mobile OTP.

- Enter the Email OTP.

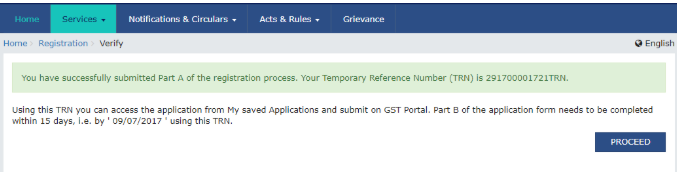

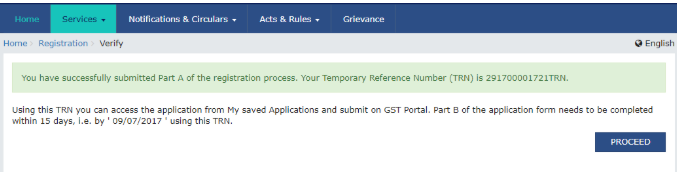

Step 4: TRN Generation

After OTP verification, a Temporary Reference Number (TRN) is generated. You will use this TRN to fill out and submit the full application.

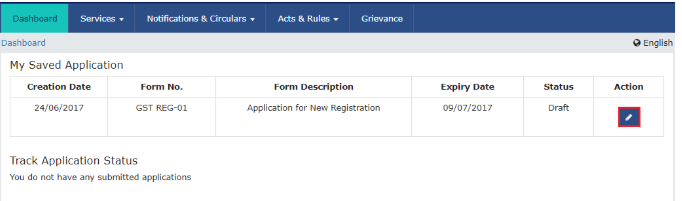

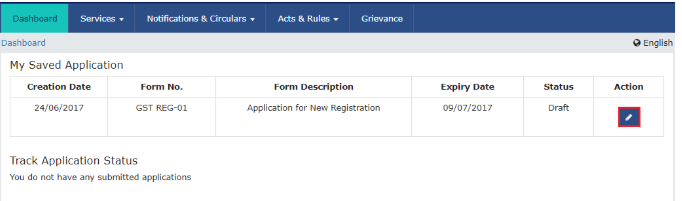

Step 5: Log in Using TRN

Enter your TRN and the captcha on the portal, then verify with the OTP sent to your email and mobile. Click the red-marked icon to start filling out the application.

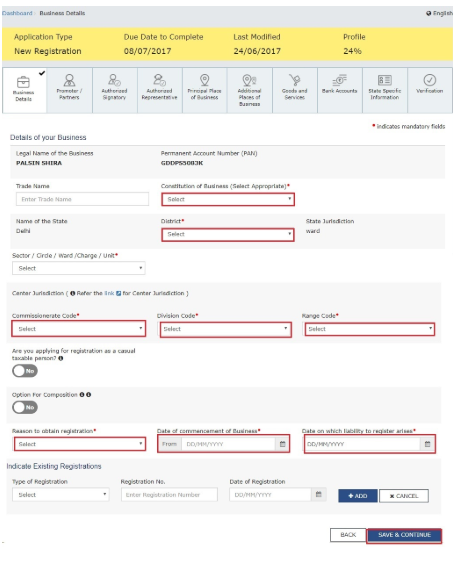

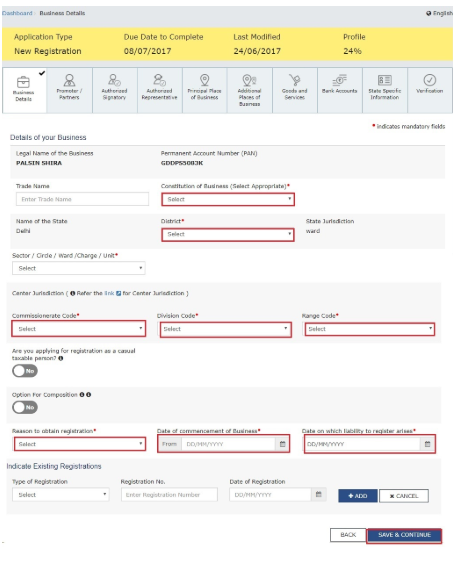

Step 6: Fill Business Details

Provide basic business information:

- Trade Name (if any).

- Constitution of Business (e.g., Proprietorship, Partnership, Company, LLP).

- District and Sector/Circle/Ward/Charge/Unit.

- Commissionerate, Division, and Range Codes (select from lists).

- Opt for the Composition Scheme if applicable.

- Date of commencement of business.

- Date on which liability to register arises (the day your turnover crossed the threshold). Apply within 30 days of this date.

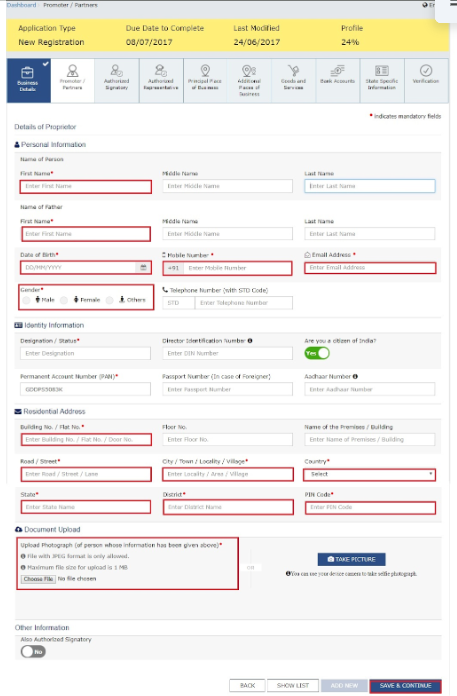

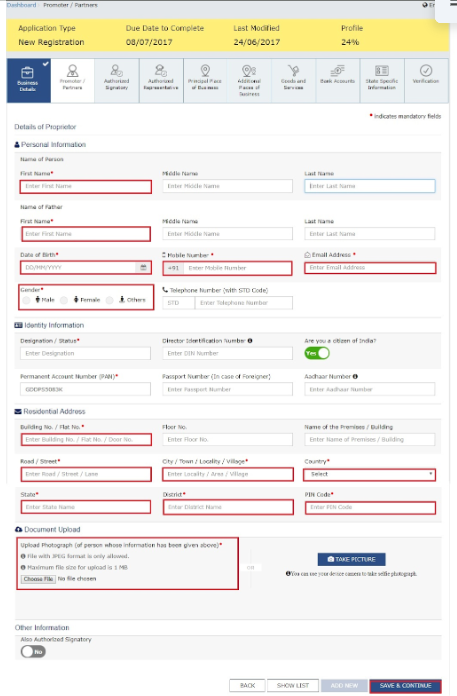

Step 7: Add Promoter/Partner Details

Enter details for the proprietor/partners/directors (up to 10 people):

- Personal info: name, DOB, address, mobile, email, gender.

- Designation of the person.

- DIN (only for Private/Public/PSU/Unlimited/Foreign Companies).

- Citizenship.

- PAN & Aadhaar.

- Residential address.

If Aadhaar is given, you can use Aadhaar e-sign for returns instead of a DSC.

Step 8: Add Authorized Signatory

Nominate an authorized signatory who will file GST returns and manage GST compliance. This person gets full access to the GST Portal and can act for the business.

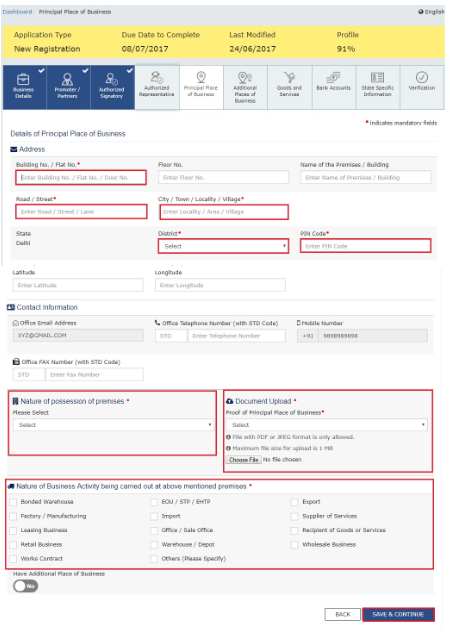

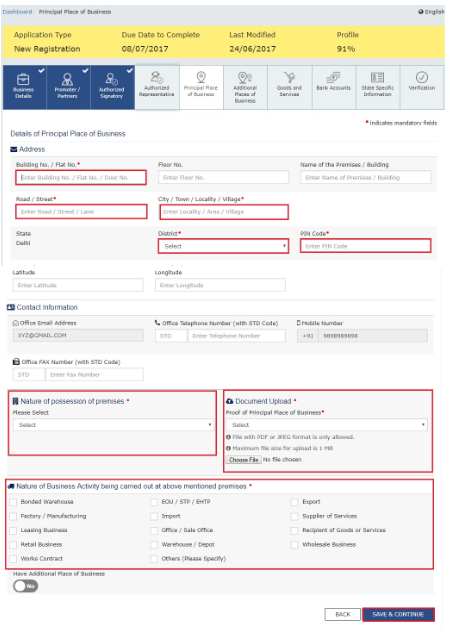

Step 9: Principal Place of Business

Give details of your main business location in the state (usually the registered office for a company/LLP):

- Full address.

- Official contacts: email, phone (with STD), mobile, fax (with STD).

- Nature of possession (owned, rented/leased, consent/shared, etc.).

- If in an SEZ or an SEZ developer, upload the required SEZ approvals (choose “Others” under the nature of possession and upload).

Upload proof of occupancy:

- Owned: Latest property tax receipt, municipal khata, or electricity bill.

- Rented/Leased: Rent/lease agreement + owner’s property tax/khata/electricity bill.

- Other/Shared/Consent: Consent letter + consenter’s khata/electricity bill.

Step 10: Additional Places of Business (if any)

If you operate from more than one location in the state, add each additional place of business with its address, contact details, and nature of possession. Upload supporting documents similar to the principal place.

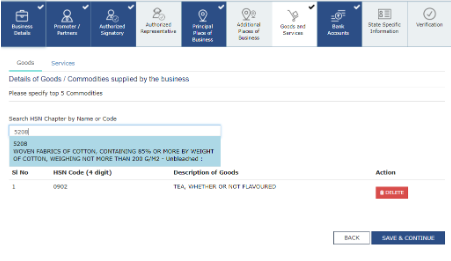

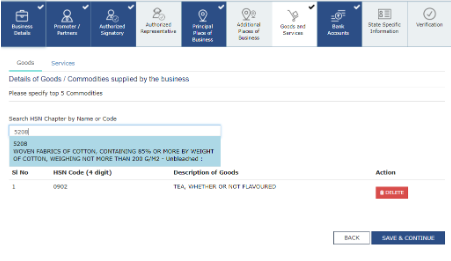

Step 11: Goods & Services Details

Provide what you sell/provide:

- Select relevant HSN codes for goods and SAC codes for services.

- List the top goods/services supplied (as asked in the form).

Click here to find HSN and SAC codes.

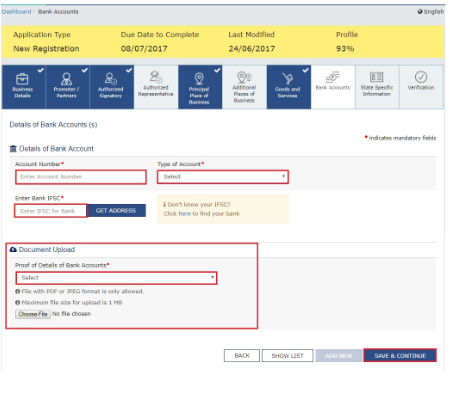

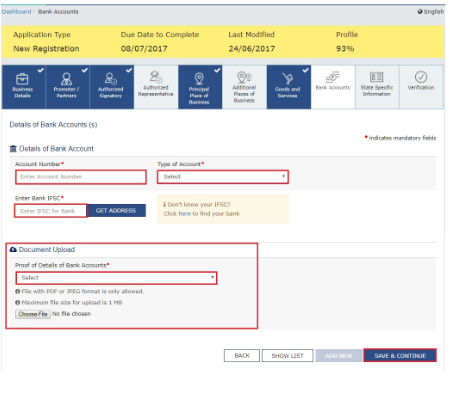

Step 12: Bank Account Details

Enter how many bank accounts you have for the business (e.g., 5 if you have five accounts). For each, provide:

- Account number

- IFSC

- Type of account

Upload a bank statement or a passbook copy as asked.

Step 13: Application Verification & Signing

Review all details carefully. Tick the verification checkbox.

- Choose the Name of Authorized Signatory from the dropdown.

- Enter the place of filing.

- Sign and submit using DSC, E-Sign, or EVC.

DSC is mandatory for Companies and LLPs.

Step 14: ARN Generation & Tracking

After successful signing, you’ll see a success message. You’ll also receive an acknowledgement on your registered email and mobile with the Application Reference Number (ARN). Use the ARN to track your application status.