A Section 8 company is a non-profit entity registered in India under the Companies Act, 2013. It is created for purposes such as promoting art, science, commerce, charity, sports, education, research, social welfare, religion, or environmental protection.

Unlike other companies, a Section 8 company's main objective is to use its profits and income to further its charitable goals, and it cannot distribute dividends to its members. These companies are licensed and regulated by the Central Government through the Registrar of Companies (RoC) under the Ministry of Corporate Affairs (MCA).

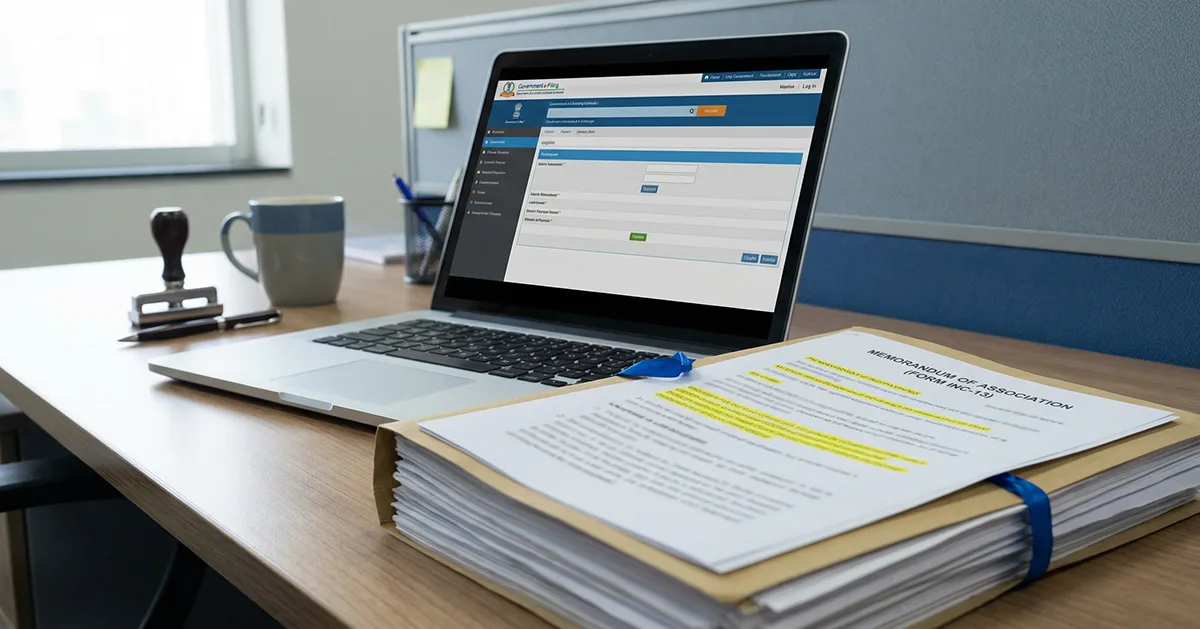

Section 8 companies can be registered in any Indian state or Union Territory through the respective RoC office, like RoC Delhi, RoC Mumbai, or RoC Bangalore. While compliance is mostly uniform nationwide, minor regional differences may arise due to state-specific stamp duty, though these are usually smaller than for private limited companies.

Strike Off a Company under Section 248 of the Companies Act, 2013

Section 248 of the Companies Act, 2013, governs the striking off of a company's name from the Register of Companies. This applies mainly to companies that are inactive or have never started their business activities.

Key points under Section 248:

- The company should not have carried on any business or operation for at least two consecutive financial years, or has never commenced business operations.

- Companies can apply voluntarily for striking off, or the RoC can initiate an involuntary strike-off if it finds the company inactive.

- Before removing the name, the RoC ensures that there are no pending liabilities, such as tax dues, loans, or legal disputes.

- Once the process is completed, the company’s name is deleted from the register, and it ceases to exist as a legal entity.

In simpler terms, striking off a company is the process of getting its name removed from the ROC. This section provides a simpler, faster, and more cost-effective way to close an inactive or defunct company compared to winding up.