The AOC-4 form is a vital compliance requirement under Section 173 of the Companies Act, 2013, mandating businesses in India to file their financial statements and related documents with the Registrar of Companies (RoC). Filing this form ensures transparency, legal adherence, and accountability in a company’s financial reporting. Missing the deadline or submitting incorrect information can attract penalties of Rs 100 daily, with legal complications.

Filing the AOC-4 form is not just a statutory obligation; it reflects a company’s commitment to good governance. By submitting accurate financial statements on time, businesses maintain credibility with stakeholders, including investors, creditors, and regulatory authorities. This process also helps the RoC monitor corporate activities and protect public interest.

In this guide, you will learn the full form along with the meaning of the AOC-4 form. Additionally, you will understand who is required to file it, know the due dates and penalties, and get a step-by-step guide to download and submit it online.

What is the AOC-4 form?

The AOC-4 Form is a mandatory annual e-form that every registered company in India must file with the Registrar of Companies (RoC) under the Companies Act, 2013. It is used to submit the company’s financial statements and related legal documents, ensuring transparency, accountability, and compliance with corporate laws.

This e-form can be filled out and submitted through both online and offline methods, making the process convenient for companies of all sizes.

Through Form AOC-4, companies are required to submit the following documents and reports:

- Balance Sheet

- Profit and Loss Account

- Cash Flow Statement (if applicable)

- Auditor’s Report

- Board’s Report

Accurate and timely submission of this form is essential to avoid penalties and maintain the company’s legal standing.

Full Form of AOC 4: AOC-4 form stands for “Form for Filing Financial Statements and Other Documents with the Registrar”.

Legal/Statutory Basis:

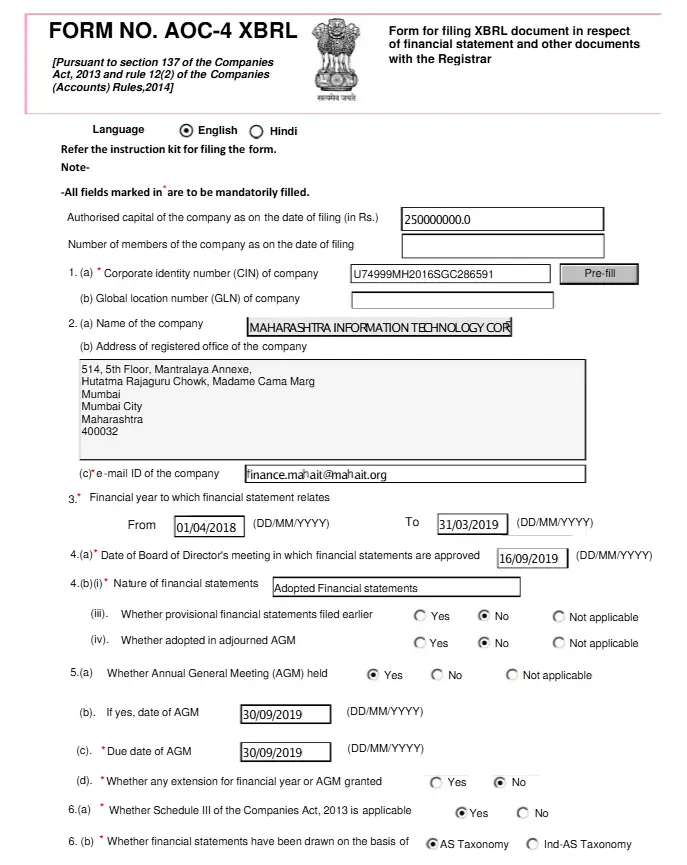

- Section 137 of the Companies Act, 2013 – Mandates every company to file its financial statements with the Registrar of Companies (ROC) in the prescribed format.

- Rule 12 of the Companies (Accounts) Rules, 2014 – Specifies the use of Form AOC-4 for filing the company’s financial statements and related documents with the ROC.

Submission is made through the Ministry of Corporate Affairs (MCA) portal (mca.gov.in), ensuring an official and verifiable record.

Purpose of the Form AOC 4:

- To provide a transparent and accurate record of a company’s financial statements.

- To help the RoC and stakeholders monitor a company’s financial health.

- To ensure legal compliance and avoid fines or penalties.

- To maintain a public record accessible to investors, creditors, and regulatory authorities.

For easy compliance and regulatory transparency, companies can access and file Form AOC-4 directly through the MCA portal, ensuring they maintain accurate financial records and fulfill statutory compliance effectively.

Why is Filing Form AOC-4 Important?

Filing Form AOC-4 is a crucial part of a company’s annual compliance process. It ensures that the company officially records its financial statements and reports with the Ministry of Corporate Affairs (MCA), maintaining transparency, accountability, and trust.

Here’s why the timely and accurate filing of Form AOC-4 matters for every company:

- Ensures transparency and accountability by disclosing the company’s financial performance and position.

- Provides a clear view of income, expenses, assets, and liabilities to assess financial health.

- Helps shareholders, investors, and lenders make informed financial and investment decisions.

- Prevents penalties and ensures legal compliance under the Companies Act, 2013.

- Builds trust and enhances the company’s credibility among stakeholders and regulators.

Note: Even if a company has not conducted any business during the financial year (i.e., it is dormant or inactive), it must still file “NIL” financial statements through Form AOC-4 to remain compliant.

Who Needs to File AOC-4?

Filing the AOC-4 form is mandatory for most companies in India. It ensures that financial statements are submitted to the Registrar of Companies (RoC) on time and in the correct format.

1. All Registered Companies

Every company registered under the Companies Act, 2013, must file its annual financial statements using the AOC-4 form, regardless of whether it carried out any business during the financial year.

Companies that must file include:

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPCs)

- Section 8 Companies (Non-profit companies)

- Companies with Subsidiaries

2. NBFCs under Ind AS

Non-Banking Financial Companies (NBFCs) registered with the Reserve Bank of India (RBI) and following Indian Accounting Standards (Ind AS) have specific filing obligations under the Companies Act. They must file:

They must file:

- Form AOC-4 NBFC (Ind AS) for standalone financial statements

- Form AOC-4 CFS NBFC (Ind AS) for consolidated financial statements, if applicable

3. Companies with CSR Obligations

Companies required to follow Section 135(1) of the Companies Act, 2013 (Corporate Social Responsibility provisions) must submit Form CSR-2 along with their AOC-4 filings.

- Form CSR-2 acts as an addendum to AOC-4, AOC-4 XBRL, or AOC-4 NBFC (Ind AS).

- For FY 2024–25, Form CSR-2 can be filed separately, with a deadline of 31st March 2026 (as per MCA notification dated 7th March 2024).

4. Companies Covered Under XBRL Rules

Some companies are required to file their financials in the AOC-4 XBRL format. This ensures standardization and easier processing of financial data.

Companies that fall under this category include:

- Listed companies and their Indian subsidiaries

- Companies with paid-up capital of ₹5 crore or more

- Companies with a turnover of ₹100 crore or more

- Companies preparing financial statements under Ind AS

As per the Companies Act, 2013, the following provisions apply for filing financial statements with the RoC:

| Position of the Company | Filing Requirement with the Registrar |

| Financial statements adopted at the AGM, along with consolidated financial statements and attached documents | Must be filed within 30 days of the Annual General Meeting (AGM), along with the prescribed fees/additional fees.Note: For One Person Companies (OPC), the time period is 180 days from the end of the financial year. |

| In case of an adjourned meeting | Must be filed within 30 days of the adjourned AGM, along with prescribed fees/additional fees. |

| If financial statements are unadopted | Must be filed within 30 days of the AGM.Note: These statements and documents will be considered provisional until the adopted financial statements are filed. |

| If AGM is not held | Must be filed within 30 days from the date the AGM should have been held, along with prescribed fees/additional fees.Note: Financial statements, related documents, and the reasons for not holding the AGM must be submitted. |

By fulfilling these filing requirements, companies demonstrate regulatory compliance, maintain financial transparency, and strengthen stakeholder trust in their operations.

When is the AOC-4 Form Due?

Filing the AOC-4 form on time is crucial to keep your company compliant and penalty-free. The due dates depend on the type of company and whether an Annual General Meeting (AGM) is held.

Normal Due Date

Most companies must file Form AOC-4 within 30 days of concluding the AGM to submit financial statements and related documents promptly to the RoC.

Special Cases

- One Person Companies (OPCs): OPCs must file Form AOC-4 within 180 days from the end of the financial year, as they are not required to hold an AGM.

- Companies not holding an AGM: Companies must file financial statements within 30 days from the scheduled AGM date and provide reasons for not holding the meeting.

Companies must calculate the due date from the end of the financial year or the AGM date, depending on their type. For example, if a company’s financial year ends on 31st March and it holds the AGM on 30th September, the company must file Form AOC-4 within 30 days of the AGM, unless an extension applies.

AOC 4 Filing Deadlines for FY 2025–26

| Type of Company | Purpose of Form | Filing Frequency | Due Date (FY 2025–26) | Remarks |

| One Person Company (OPC) | Filing of financial statements | Yearly | 27th September 2026 | Within 180 days from the financial year-end (no AGM required) |

| Private Limited Company | Filing of financial statements | Yearly | 31st December 2026 | Within 30 days from the conclusion of AGM (if AGM held on 30th September 2026) |

| Public Limited Company | Filing of financial statements | Yearly | 31st December 2026 | Same rule — 30 days from AGM |

| Section 8 Company | Filing of financial statements | Yearly | 31st December 2026 | AGM is usually held before 30th September |

| Company with Subsidiaries (AOC-4 CFS) | Filing of consolidated financial statements | Yearly | 31st December 2026 | File both AOC-4 and AOC-4 CFS separately |

Pro Tip: With RegisterKaro, you can get expert guidance to ensure timely filing, avoid penalties, and reduce unnecessary stress.

For assistance, contact RegisterKaro today to stay fully compliant with MCA regulations.

Which Documents do you need to file with Form AOC-4?

When filing Form AOC-4, companies must attach key documents to ensure compliance and present a complete picture of their financial position. These documents include:

- Balance Sheet with Notes – Shows assets, liabilities, and equity with explanatory notes. For deeper insights, refer to resources like Understanding Capital in Accounting.

- Profit and Loss Statement with Notes – Details income, expenses, and profits with clarifications.

- Cash Flow Statement – Highlights cash inflows and outflows to assess liquidity.

- Statement of Changes in Equity (if applicable) – Shows changes in equity during the financial year.

- Auditor’s and Board’s Report – Provides professional verification of financial statements and board insights.

- Corporate Social Responsibility (CSR) Report (if applicable) – Outlines CSR initiatives and expenditures. Companies must apply for CSR Registration to comply with Section 135.

- Authenticated Copy of Financial Statements – Includes the Board’s report, Auditor’s report, and related documents as per Section 134.

- Statement of Subsidiaries – Prepared using Form AOC-1 under Section 129 and attached with AOC-4, detailing subsidiary companies.

- Explanation for Not Adopting Financial Statements at AGM – Provides reasons if applicable.

- Explanation for Not Holding AGM – Gives reasons if the AGM was not held.

- Approval Letter for Extension – Attach official approval if the financial year or AGM was extended.

- Supplementary or Test Audit Report – Provided under Section 143 if additional auditing occurs.

- Company CSR Policy – Details CSR guidelines as per Section 135(4).

- Details of Other Entities – Information about associated or subsidiary entities.

- Related Party Transactions Details – Key features and justification, filed in Form AOC-2 as per Section 188(1).

- Comments from the Comptroller and Auditor General (CAG) – If applicable, include feedback from CAG.

- Secretarial Audit Report – Provides an overview of compliance with corporate laws.

- Directors’ Report – Insights into company activities and decisions under Section 134(3).

- Remaining CSR Activities – Details of ongoing or pending CSR initiatives.

- Any Other Relevant Documents – Any additional documents required for full disclosure.

Note: Form AOC-4 must be certified by a CA or CS for all companies except OPCs and small companies to ensure compliance. You can get professional help through our Online CA Services for expert certification and accurate filing.

How to File Form AOC-4: Quick & Easy Steps

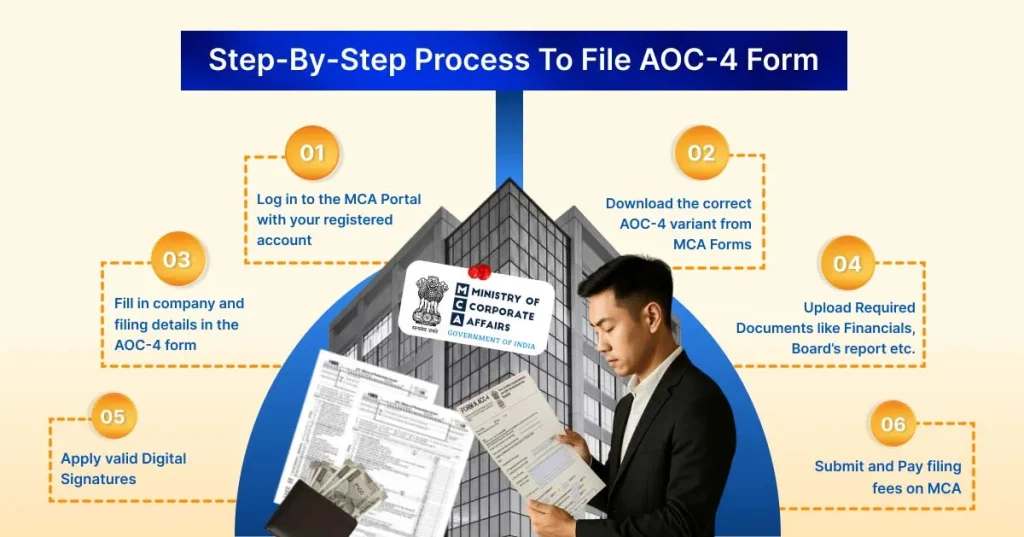

Filing Form AOC-4 may seem complicated at first, but the AOC-4 form filing procedure is actually simple when you know the process and have all the documents ready. Here’s a step-by-step guide to make it easy:

Step 1: Log In to the MCA Portal

Go to mca.gov.in (MCAs portal), click on the ‘Login’ button, and enter your credentials. Don’t have an account? You can sign up for free, which takes just a few minutes.

Make sure your company details are up to date before logging in.

Step 2: Download the Correct Form

Visit the MCA Forms section and download the correct version of the AOC-4 form that matches your company type—Standard, XBRL, or Ind AS (for NBFCs). Using the correct

Using the correct form prevents mistakes and saves time.

Step 3: Fill in Company Details

Enter all necessary information, such as company name, CIN, financial data, auditor details, and board information. Keep all your documents handy to avoid searching for files while filling out the form.

Step 4: Upload Required Documents

Upload all mandatory attachments like:

- Balance Sheet

- Profit & Loss Statement

- Board’s Report

- Auditor’s Report

- CSR Report (if applicable)

Missing any required document can lead to instant rejection, so double-check everything before uploading.

Step 5: Apply Digital Signature

Use a valid Digital Signature Certificate (DSC) of an authorized director or professional. This eliminates the need for printing or scanning. Just attach the DSC and sign digitally.

Step 6: Submit the Form and Pay Fees

Once the form and all necessary attachments are ready, submit it online through the MCA portal and pay the applicable filing fees. After submission, carefully review for any error messages and save the acknowledgment receipt for future reference. Once submitted, the MCA portal will generate an SRN (Service Request Number), which can be used to track the filing status.

Follow these steps, and filing Form AOC-4 will not only be straightforward but also quick and stress-free, helping your company stay compliant with MCA regulations.

If you’re wondering how to download the AOC-4 form from MCA, follow the steps below to get the right version for your company:

Go to the official MCA website: mca.gov.in.

This is the starting point for accessing all company-related forms and services.

- Click on the ‘Login’ button and enter your credentials.

- If you don’t have an account, click ‘Sign Up’ and complete the registration process.

Logging in ensures that you can access the forms applicable to your company and maintain a secure record of your filings.

- On the homepage, navigate to MCA Services → Company Forms Download → e-Forms (Active).

- You will see a list of all available forms.

This section provides all the downloadable forms in one place, making it easier to locate the exact form you need.

- Look for AOC-4 form download options in the list and make sure you select the correct version that applies to your business structure—Standard, XBRL, or Ind AS:

- Standard Form AOC-4 – for most companies

- XBRL Format – for companies required to file in XBRL

- Ind AS Form – for NBFCs or companies following Ind AS

- Standard Form AOC-4 – for most companies

Choosing the correct form ensures compliance and avoids unnecessary rejections during filing.

- Click on the ‘Download’ button next to the appropriate form.

- Save it to your computer. You can now fill it offline before uploading it back to the MCA portal.

Downloading the form allows you to complete it at your convenience and review it carefully before submission.

- MCA provides detailed instruction manuals for each form. It’s recommended to download and read the instructions to avoid errors during filing.

Following the instructions helps prevent mistakes, ensuring smooth processing and compliance with MCA regulations.

What Are the Fees for Filing Form AOC-4?

The Companies (Registration Offices and Fees) Rules, 2014, prescribe the filing fees for Form AOC-4, which vary based on the company’s nominal share capital.

| Nominal Share Capital | Fee Applicable |

| Less than Rs. 1,00,000 | Rs. 200 per document |

| Rs. 1,00,000 to Rs. 4,99,999 | Rs. 300 per document |

| Rs. 5,00,000 to Rs. 24,99,999 | Rs. 400 per document |

| Rs. 25,00,000 to Rs. 99,99,999 | Rs. 500 per document |

| Rs. 1,00,00,000 or more | Rs. 600 per document |

For companies without share capital, the fee is Rs. 200 per document.

What Happens If You File Form AOC-4 Late?

If you file your AOC-4 form after the due date, you will have to pay Form AOC-4 late fees of Rs. 100 per day of delay, as per Section 137(1) of the Companies Act, 2013. The late fees continue until filing is completed, so timely submission is crucial to avoid additional costs.

What Are the Penalties for Non-Filing of Form AOC-4?

If a company fails to file Form AOC-4, the following penalties are applicable:

| Defaulting Party | Penalty Imposed |

| Company | Rs. 10,000 for continuing failure + Rs. 100 for each day of default (up to a maximum of Rs. 2,00,000) |

| Managing Director / Chief Financial Officer | |

| If the MD/CFO is absent – any other director assigned by the Board | |

| If no such director, all directors of the company | Rs. 10,000 + Rs. 100 for each day of default (up to a maximum of Rs. 50,000) |

Note: Companies should aim to file Form AOC-4 before the due date to avoid compounding penalties and maintain a good compliance rating with the Ministry of Corporate Affairs (MCA).

Final Thoughts

By understanding the AOC-4 form filing procedure and ensuring timely submission, companies can easily maintain compliance and avoid unnecessary Form AOC-4 late fees or penalties. By keeping financial statements accurate and up to date, companies build trust with investors, creditors, and regulatory authorities.

For stress-free and timely filing of Form AOC-4, you can rely on RegisterKaro’s expert guidance. Our team prepares all documents correctly, meets deadlines, and ensures compliance, helping your business stay transparent, credible, and penalty-free. Contact RegisterKaro today to simplify your AOC-4 filing process.

Frequently Asked Questions

Form AOC 4 is a mandatory filing under the Companies Act, 2013, requiring companies to submit their annual financial statements and other relevant documents to the Registrar of Companies (RoC). Filing this form ensures transparency, legal compliance, and accountability. It is essential for maintaining proper records and avoiding penalties for delayed or incorrect submission.