Starting a business in India? One of the first questions every entrepreneur asks is: “How much does it cost to register my company?”

Unfortunately, the answer isn’t always straightforward. Many first-time founders face hidden charges, state-wise variations, and unclear fee structures, which often delay their launch.

The good news? With the right information, you can avoid unnecessary expenses, budget smartly, and start your company without surprises.

In this guide, we break down the complete cost of company registration in India: covering government fees, stamp duty, professional charges, and optional registrations, so you know exactly what to expect before you begin.

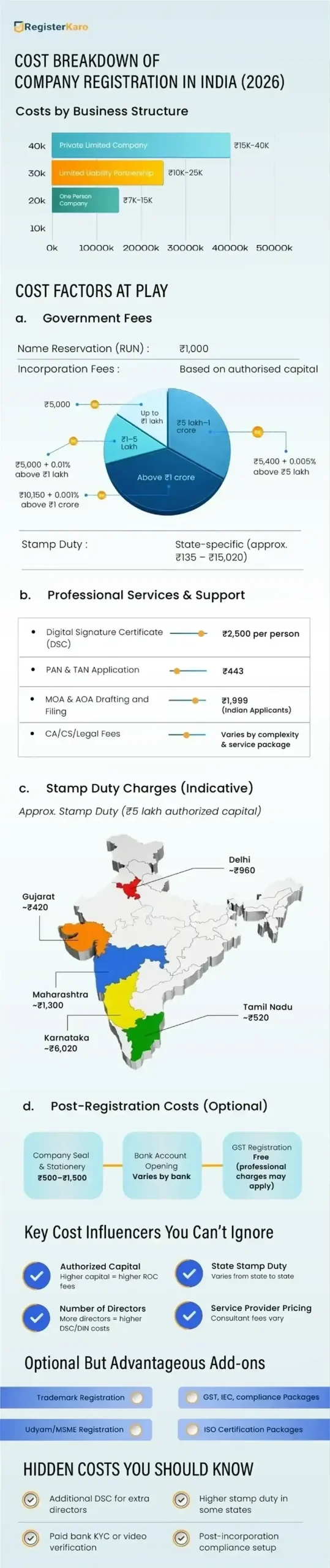

Cost of Company Registration in India: Business Entity Wise

The cost of company registration in India varies based on the type of business entity you choose. The primary expenses include government fees, professional charges, and compliance costs.

Below is a clearer presentation showing cost components for three common business structures: Private Limited Company (Pvt Ltd), Limited Liability Partnership (LLP), and One Person Company (OPC).

Private Limited Company Registration Cost

Private Limited Companies are the most popular business structure among startups and medium-sized businesses due to their credibility and limited liability protection. But what exactly does a Pvt Ltd company registration cost

The typical cost breakdown for Private Limited Company registration includes:

| Fee Category | Item | Cost/Range |

| Government Fees | Name reservation fee | Rs. 1,000 |

| Incorporation fees | – Up to Rs. 1 lakh: Rs. 5,000 – Rs. 1 lakh to Rs. 5 lakh: Rs. 5,000 + 0.01% of amount exceeding Rs. 1 lakh – Rs. 5 lakh to Rs. 1 crore: Rs. 5,400 + 0.005% of amount exceeding Rs. 5 lakh – Above Rs. 1 crore: Rs. 10,150 + 0.001% of amount exceeding Rs. 1 crore | |

| Stamp duty | Varies by state and capital (From Rs. 135 to Rs. 15,020 for capital up to Rs. 1 lakh) | |

| Professional Fees | Digital Signature Certificate (DSC) | Rs. 2,500 per DSC (depending on number of directors) |

| Professional service charges (MOA, AOA, filing) | Rs. 1,999 (for Indian clients) Varies for Foreign/NRI clients | |

| PAN & TAN Application Fee | Rs. 443 | |

| Post-Registration Costs | Company seal and stationery | Rs. 500 to Rs. 1,500 |

| Bank account opening charges | Varies by bank | |

| GST registration (if applicable) | Government fees: Free + Professional charges (if any) |

Learn more about Private Limited Company Registration Fees in India, including government charges, professional fees, and other costs.

LLP Company Registration Cost

Limited Liability Partnership (LLP) combines the benefits of a partnership with the limited liability protection of a company. Here’s the detailed cost breakdown:

| Fee Category | Item | Cost / Range (₹) |

|---|---|---|

| Government Fees | Authorized capital ≤ ₹1 lakh | ₹500 |

| ₹1 lakh – ₹5 lakh | ₹2,000 | |

| ₹5 lakh – ₹10 lakh | ₹4,000 | |

| Above ₹10 lakh | ₹5,000 | |

| Digital Signatures (DSC) | Per designated partner | ₹1,000–₹1,500 |

| DIN (Designated Partner Identification Number) | Per partner | ₹500 |

| Stamp Duty | LLP agreement | Varies by state (stamp paper cost variable) |

| Professional Fees | CA / CS / legal assistance | ₹5,000–₹15,000 depending on complexity |

| Other Costs | Name reservation, PAN/TAN, bank account | Additional nominal fees (state-specific) |

| Late Filing Penalty | For delayed LLP agreement (Form 3) | ₹100 per day after the due date |

Related Guide: Learn more about the detailed breakdown of LLP Registration Fees in India, including government & professional costs.

One Person Company (OPC) Registration Cost

One Person Company has gained popularity among solo entrepreneurs wanting corporate benefits. The cost structure includes:

| Fee Category | Item | Cost / Range (₹) |

|---|---|---|

| Government Fees | Authorized capital ≤ ₹1 lakh | ₹5,000 |

| ₹1 lakh – ₹10 lakh | ₹7,500 | |

| Above ₹10 lakh | ₹15,000 | |

| DSC (Digital Signature Certificate) | Per director / professional agent | ₹1,000–₹2,000 |

| DIN | Director Identification Number | ₹500 |

| Name Reservation | ROC name approval | ₹1,000 (approx.) |

| Stamp Duty | State-specific | ₹300–₹500 (typical) |

| Form Filing Fees | Incorporation filings | ₹500–₹2,000 depending on authorized capital |

| Professional Fees | CA / CS / legal assistance | ₹5,000–₹15,000 |

| Miscellaneous Costs | Notary, PAN/TAN, courier, office proof | ₹1,000–₹2,000 |

| Total Estimated Cost | All-inclusive registration expenses | ₹9,000–₹23,000 (approx.) |

Total Cost Range: ₹10,500 – ₹20,000 (excluding GST)

For a detailed cost breakdown specific to OPCs, read our OPC Registration Fees in India guide.

Factors Affecting the Cost of Company Registration

Several factors influence the cost of company registration in India:

- Type of Business Structure: Different entities, such as Private Limited Company, Public Limited Company, One Person Company (OPC), and Limited Liability Partnership (LLP), have varying registration costs.

- Authorized Share Capital: A higher authorized capital can result in increased registration fees.

- Number of Directors and Shareholders: More directors or shareholders may lead to higher costs due to additional documentation.

- Professional Fees: Charges by consultants, chartered accountants, or company secretaries assisting in the registration.

- Government Fees: Statutory fees charged by the Ministry of Corporate Affairs (MCA) and other authorities.

- Stamp Duty: Varies from state to state, affecting the overall cost of company registration.

Detailed Breakdown of Registration Fees

Understanding the detailed breakdown of the cost of company registration helps in effective financial planning.

1. Digital Signature Certificate (DSC)

● Purpose: Required for directors to sign electronic documents.

● Cost: ₹2,500 per DSC (on average). Total depends on the number of directors.

2. Director Identification Number (DIN)

● Purpose: A unique identification number allotted to company directors.

● Cost: No separate fee if applied through the SPICe+ form during registration.

3. Name Reservation Fee

● Purpose: To reserve your company’s name with the Registrar of Companies (ROC).

● Cost: ₹1,000 per name submission.

4. Stamp Duty

● Purpose: Mandatory fee for processing incorporation documents.

● Cost: Varies by state and authorised capital (approx. ₹135 to ₹10,000).

5. MOA and AOA Fee

● Purpose: Drafting the Memorandum of Association and Articles of Association.

● Cost: Professional fees range from ₹1,000 to ₹5,000.

6. Government Registration Fee

● Purpose: Filing and registration on the Ministry of Corporate Affairs (MCA) portal.

● Cost: Depends on the authorised capital of the company.

7. PAN and TAN Application Fee

● Purpose: For obtaining tax identification numbers needed for business operations.

● Cost: ₹443 total.

8. Professional Fees

● Purpose: For professional assistance from CAs or consultants during registration.

● Cost: ₹5,000 to ₹15,000 based on the service provider and complexity.

Additional Costs to Consider

Beyond the primary cost of company registration, consider these additional expenses:

- Registered Office Rental: Costs for leasing an office space, if required.

- Notary and Apostille Fees: For certifying documents.

- Company Seal and Stationery: May cost around INR 1,000 to INR 2,000.

- Trademark Registration: If you wish to protect your brand name/logo, it costs INR 4,500 to INR 9,000 per class.

- GST Registration: No government fee, but professional charges may apply.

Step-by-Step Guide to Estimating Registration Costs

To estimate the cost of company registration, follow these steps:

- Select Business Structure:

- Choose the type of company based on your business needs.

- Determine Authorized Share Capital:

- Decide on the initial capital; higher capital means higher fees.

- Calculate Government Fees:

- Refer to the fee schedule based on authorized capital.

- Add Professional Fees:

- Include estimated charges for consultants or legal advisors.

- Include Additional Expenses:

- Account for DSCs, stamp duty, PAN/TAN fees, etc.

- Sum Up Total Costs:

- Combine all expenses for the final estimate.

Example: For a Private Limited Company with an authorized capital of INR 5,00,000 and two directors:

- DSCs: 2 x INR 2,500 = INR 5,000

- Government Fee: INR 2,000

- Stamp Duty: Approx. INR 1,000 (varies by state)

- PAN/TAN Fees: INR 443

- Professional Fees: INR 10,000

- Total Estimated Cost: INR 18,443

Cost-Saving Tips for Registering Your Company

To minimize the cost of company registration, consider these tips:

- Start with Minimum Authorized Capital: This reduces government fees.

- Use SPICe+ Form: The integrated web form simplifies registration and reduces costs.

- DIY Documentation: If confident, prepare documents yourself to save on professional fees.

- Shop Around for Professional Services: Compare fees from different providers.

- Avoid Unnecessary Registrations: Only apply for what’s essential at the initial stage.

Conclusion

Understanding the cost of company registration in India is essential for entrepreneurs aiming to establish a legal business entity efficiently. By considering all factors, from government fees to professional charges, you can budget effectively and explore ways to minimize expenses.

Careful planning, choosing the right business structure, and being aware of potential pitfalls will help you navigate the registration process smoothly, setting a solid foundation for your company’s success.

Frequently Asked Questions

Yes, costs differ for Private Limited, LLP, OPC, and other structures due to varying compliance and documentation needs.