Did you know 15,000 Indian companies undergo winding-up procedures every year? An entrepreneur should know the meaning of winding up a company for better business decisions.

You built your business brick by brick, but winding up can tear it down overnight if you’re not prepared. The process of winding up a company helps businesses close operations legally and systematically.

What is the Winding Up of a Company?

Section 270 of the Companies Act, 2013 defines winding up of a company as the legal process through which a company’s existence ends. Companies sell their assets and pay creditors through this process. Shareholders receive leftover money based on their share ownership after debt clearance.

The winding up of a company under the Companies Act 2013 comes with a proper structure for closure. Lawmakers designed the Act to protect all stakeholders during company closure. Business owners get fair treatment and legal protection throughout the entire process.

Different Modes of Winding Up of a Company

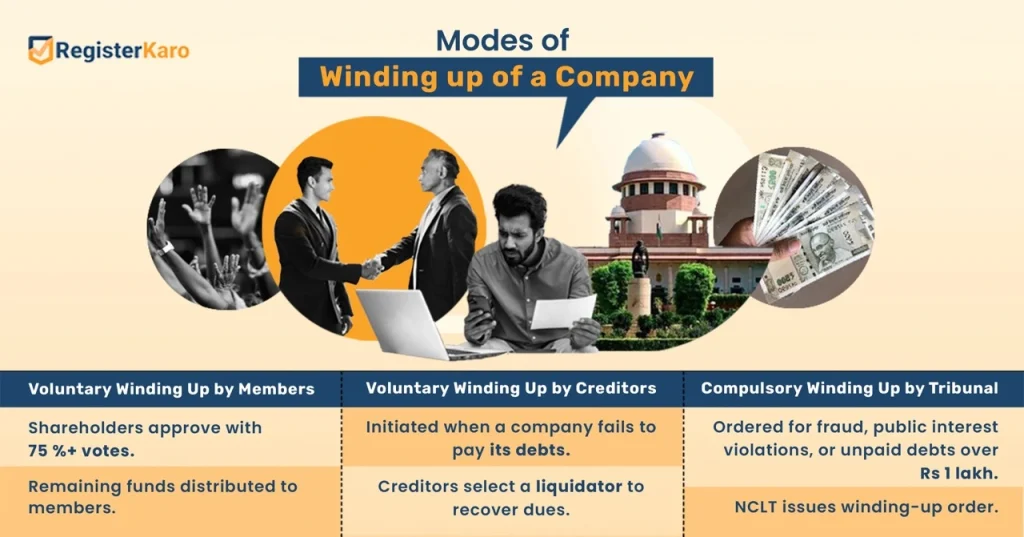

Among the various modes of winding up of a company, companies can choose from three options based on their situation.

Each structured mode ensures that business closure happens as systematically as the initial company incorporation process, maintaining legal clarity and financial transparency at every stage.

1. Voluntary Winding Up by Members

Shareholders can voluntarily wind up a company by passing a special resolution with at least 75% approval. The company must also demonstrate its ability to fully pay all outstanding debts.

Process Shareholder should follow:

- Shareholders select and appoint a qualified liquidator

- Liquidators take complete control of the company assets

- Members collect the remaining money after paying all obligations

Case Law: ABC Private Limited (NCLT Mumbai, 2019)

ABC Private Limited completed the voluntary winding up of the company successfully after the promoters chose retirement. The NCLT approved their resolution within six months. The company paid all creditors fully, showing proper voluntary winding-up execution.

2. Voluntary Winding Up by Creditors

When companies fail to pay debts on time, creditors initiate recovery proceedings. In such cases, banks and lenders have priority over shareholders in claims.

Key steps process for creditors:

- Companies call creditors’ meetings within legal deadlines

- Creditors choose their preferred liquidator for the job

- Liquidators work to recover the maximum money for creditors

Case Law: Videocon Industries Ltd. (NCLT Mumbai, 2022)

Videocon Industries faced creditor-initiated winding up owing Rs 87,000 crore to banks. The NCLT approved voluntary winding up after resolution attempts failed. Banks recovered 40% of dues through systematic asset liquidation under creditor supervision.

3. Compulsory Winding Up by Tribunal

Companies may be wound up if they act against public interest, commit fraud, or fail to start operations after incorporation. Additionally, the inability to pay debts over Rs. 1 lakh is a key ground for winding up.

Steps taken by the National Company Law Tribunal:

- NCLT orders compulsory winding up for serious violations.

- Courts appoint official liquidators to manage the process.

- Anyone can file a petition for winding up.

Case Law: Amrapali Group Companies (NCLT Allahabad, 2019)

NCLT ordered the compulsory winding up of Amrapali companies after homebuyers filed complaints. The tribunal found systematic money diversion and construction delays. Courts appointed official liquidators to protect 42,000 homebuyer investments and interests.

What is the Process of Winding Up a Company?

Let’s know about the structured procedure for winding up of a company while meeting all obligations.

1. Initial Decision and Approvals

- The board of directors evaluates the company’s financial position

- Shareholders must approve with a 75% majority vote

- Required documents: financial statements, creditor lists, and meeting minutes.

2. Liquidator Appointment

- A professional liquidator who holds a valid license issued by the Insolvency and Bankruptcy Board of India (IBBI) takes control

- Manages all company assets and operations

- Handles asset sales, debt collection, and legal matters.

3. Asset Distribution

- Secured creditors are paid first from the liquidation proceeds

- Employees receive statutory benefits next

- Unsecured creditors follow in priority

- Shareholders only receive the remaining funds after all debts are settled.

4. Pre-Closure Planning

- Complete tax audit to assess the true position

- Identify all outstanding obligations (taxes, employee benefits)

- Develop a communication plan for all stakeholders

- Establish transition arrangements for ongoing commitments.

5. Final Steps

- Liquidator submits closure reports to the authorities

- The company achieves legal dissolution after completing all requirements.

Note: A different business structure might have additional requirements for winding up under the Companies Law. Start knowing them in detail with the LLP Winding Up Process.

Consequences of Winding Up a Company

The closure process triggers significant legal, financial, and operational effects for all parties involved. Let’s understand how winding up affects a company:

1. Immediate Legal Effects

- Companies stop all business operations immediately after winding up starts

- Businesses lose legal authority to sign new contracts

- Existing contracts end automatically unless liquidators decide otherwise

- Company directors lose all decision-making powers completely

- Liquidators take full control of the company’s affairs

- Registrars dissolve companies after completing all formalities

2. Financial Impact on Employees and Stakeholders

- Workers lose jobs and face challenges recovering pending salaries

- Employee benefits become priority payments under labor laws

- Companies process gratuity and PF settlements before other payments

- Investors risk losing their entire investment in the company

- Shareholders receive money only after clearing all creditor dues

- Final payouts depend entirely on surplus availability after debt clearance.

Difference Between Winding Up and Dissolution of a Company

People often confuse these terms, but winding up is the process, while dissolution is the outcome.

So, we need to understand the difference between the two. The following is a comparison table for you to understand it better:

| Aspect | Winding Up | Dissolution |

| Definition | Process of settling affairs and liquidating assets | Final legal termination of the company’s existence |

| Timing | Occurs first in the closure sequence | Happens only after winding up is complete |

| Legal Status | The company still exists legally during this phase | The company no longer exists as a legal entity |

| Purpose | Settling debts and distributing remaining assets | Removing the company from the official register permanently |

| Finality | It can be reversed through court intervention | It cannot be reversed; it requires new incorporation |

Legal Developments for Winding Up of a Company

Here are the new changes that make closing a company faster and easier for business owners.

1. Fast Track Exit (FTE) Scheme For Small Businesses

Small businesses can benefit from expedited closure options with fewer requirements.

- Companies with paid-up capital below Rs. 50 lakhs qualify

- Businesses must have an average annual turnover under Rs. 2 crores for three years

- No outstanding loans from banks or financial institutions allowed

- Process completes within 90 days instead of the traditional timeline

- Companies face fewer compliance and documentation requirements.

2. Digital Filing Initiatives

Modern technology simplifies the winding-up process for all parties.

- Companies submit applications through digital platforms

- Shareholders can vote electronically on closure resolutions

- All stakeholders track application status through online portals.

Best Practices for Smooth Winding Up of a Company

The following are the best practices to ensure a smooth winding up of a company. So, you can plan carefully, keep clear records, and communicate openly.

- Initial Planning Strategy: Check your company’s money situation first – what you own and what you owe. Get an expert to help you follow all the rules correctly.

- Documentation Strategy: Get board approval and shareholder permission before starting anything. Make sure all your paperwork is correct and submit it on time.

- Communication Strategy: Tell everyone involved about the closure as soon as you decide. Keep sending updates so people know what’s happening.

- Asset Management Strategy: Sell company assets fairly and pay debts in the right order. Give leftover money to shareholders only after paying everyone you owe.

- Risk Management Strategy: Follow all legal steps to protect yourself from personal problems. Keep records of everything you do during the process.

Still struggling with winding up compliance? We’ve got you covered! Contact RegisterKaro now for clear answers and smooth closure!

Planning to start a new venture after closing your existing one? RegisterKaro also assists you in registering a private limited company online in just a few simple steps.

Frequently Asked Questions

The timeline for the winding up of a company largely depends on the mode of closure, the company’s financial position, and documentation accuracy. Typically, a voluntary winding up of a company takes around 6 to 12 months from the date of the special resolution to the final dissolution. However, if the company qualifies under the Fast Track Exit (FTE) Scheme, the process can be completed much sooner.

RegisterKaro ensures smooth execution by filing accurate documents and liaising with the Registrar of Companies (ROC) to speed up the process of winding up of a company.