What is the Penalty for Late Filing of TDS Return?

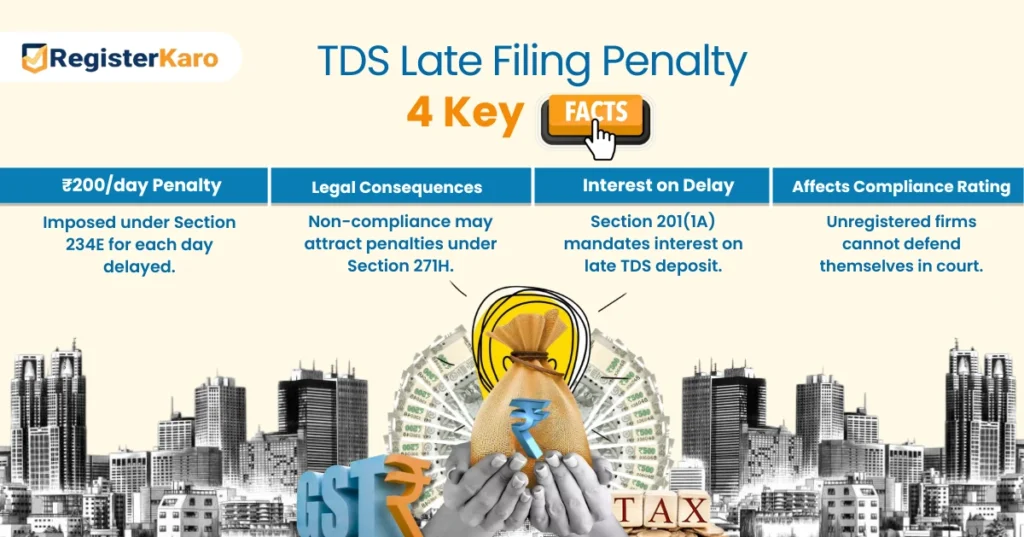

Missed your TDS return deadline? Brace yourself for serious financial consequences! The Income Tax Department imposes a strict penalty for late filing of TDS returns by filers. These penalties accumulate daily and can drain thousands from your accounts. With charges reaching up to ₹200 per day per return, this isn’t just an oversight it’s a costly mistake that businesses simply can’t afford.

Why Timely Filing of TDS Returns is Crucial

Filing TDS on time is not just a legal obligation—it reflects your responsibility as a trusted tax collector for the government. When you deduct tax at source, you act as a fiduciary, ensuring timely revenue collection. Delays in filing can disrupt the government’s cash flow, hinder credit reconciliation for taxpayers, and result in significant penalties and legal complications. Consistent and timely TDS filing helps avoid these issues and streamlines your overall tax compliance process.

Which Law Governs the TDS Filing Penalty?

The penalty primarily falls under Section 234E of the Income Tax Act. This provision came through the Finance Act of 2012 and became effective on July 1, 2012.

Additionally, several other sections play important roles.Like, Section 200(3) mandates the timely filing of returns. Section 271H provides for non-filing penalties & furthermore, Section 201(1A) deals with interest on delayed payments. All of these together, create the framework for TDS compliance in India.

TDS Late Filing Penalty Under Section 234E

What is Section 234E?

Section 234E specifically targets the delayed submission of TDS statements. This section was introduced in 2012 to ensure compliance. It applies to those responsible for deducting tax at source.

Under this section, penalties begin automatically after the deadline. No separate notice is required for this to take effect. The moment you miss your deadline, the penalty counter starts ticking. This creates a strict mechanism to ensure timely filing compliance.

How Much is the TDS Late Filing Penalty?

The TDS late filing penalty follows a simple calculation method. It costs ₹200 per day for each day of delay. The calculation begins immediately after the due date passes.

Moreover, each TDS statement carries its separate penalty. For instance, delaying both Form 24Q and 26Q costs ₹400 daily. This fee must be paid before filing the delayed return. There’s no option to waive or adjust this amount.

Maximum Penalty for Late Filing of TDS Return

The daily penalty adds up quickly but has a reasonable cap as the maximum penalty cannot exceed the TDS amount itself. This provides some relief for businesses with smaller deductions.

For example, if your TDS amount equals ₹15,000, your maximum penalty stops there. Even if your calculated penalty reaches ₹20,000, you’ll pay only ₹15,000. Therefore, this provision keeps penalties proportionate to the tax amounts involved.

Interest and Other Penalties Apart from Section 234E

What is the Interest Rate for Delayed TDS Payment?

Beyond late filing penalties, you face interest charges on delayed payments. Section 201(1A) imposes 1.5% monthly interest on late payments. This applies from the deduction date until the payment date.

Unlike the filing penalty, this interest has no maximum limit. For example, a ₹50,000 TDS payment delayed by three months incurs ₹2,250 interest. Furthermore, this obligation exists regardless of your filing status.

Difference Between Interest and Penalty

Understanding their differences helps with proper TDS compliance. Interest compensates the government for delayed tax payments. Conversely, penalties deter late filing behaviour.

Interest accrues at 1.5% monthly with no upper limit. Meanwhile, penalties charge ₹200 daily but cap at the TDS amount. Additionally, interest applies to late payments. In contrast, penalties target late filing actions. Both can apply simultaneously, creating a significant financial burden.

How to Calculate Late Filing Penalty for TDS?

TDS Late Filing Penalty Calculator Explained with Example

Calculating late filing penalties involves a straightforward formula. Multiply the days of delay by ₹200. Then compare this with the TDS amount. For example, filing Q1 returns 40 days late with ₹25,000 TDS? Your calculation would be 40 days × ₹200 = ₹8,000.

How to Use Penalty Calculator Effectively

Minimising errors to ensure accurate date entry in calculator and considering holidays that might affect due dates. Also, verify TDS amounts for proper cap calculation.

Moreover, perform separate calculations for each delayed form. Stay informed about possible deadline extensions. Many taxpayers use online calculators from TRACES or third-party portals. These tools automatically factor in relevant considerations.

How to Pay the Penalty for Late Filing of TDS Return?

Step-by-Step Process to Pay TDS Late Filing Penalty Online

- The payment process has been streamlined for convenience. you can visit RegisterKaro for easy payment after logging in with TAN credentials.

- Next, navigate to “e-Pay Tax” and select Challan 281. Choose the assessment year and payment type. Then select “(500) Other Receipts” as payment nature. Under “Others,” pick “(234E) Fee for default in furnishing statements.”

- Finally, complete the transaction using your preferred payment method. Save your payment receipt for reference. The system updates automatically within 2-3 working days.

TDS Late Filing Penalty Challan (Challan 281)

Challan 281 specifically handles TDS penalty payments. When filling it, ensure accurate TAN entry. Select payment code “400” and nature code “500.”

Choose the relevant assessment year for your filing. Select “234E” from the fee type dropdown menu. Each statement requires a separate challan payment. After payment, you’ll receive a Challan Identification Number (CIN).

This number proves your payment and enables late return filing. The system cross-verifies this before accepting your delayed submission.

How to Avoid TDS Late Filing Penalty?

Best Practices to File TDS Returns on Time

Create a comprehensive TDS compliance calendar with internal deadlines. Set them 7-10 days before the actual due dates. Configure automated reminders throughout the period.

Implement robust documentation systems for all deductions. Perform monthly reconciliation of payments and records. Address discrepancies immediately rather than at quarter-end. Delegate responsibilities to specific team members.

Leverage technology through automated calculation and filing software. These practices significantly reduce deadline-missing risks. They protect your business from unnecessary financial penalties.

Common Mistakes That Lead to Penalties and How to Avoid Them

Several common errors frequently cause filing delays. These include incorrect TAN details and missing deduction entries. Last-minute filing attempts often lead to problems, too.

Overlooking due date changes causes unnecessary penalties. System failures during peak filing times create issues. Challan mismatches and PAN validation errors complicate submissions. Organisations addressing these report fewer filing delays.

TDS Quarterly Return Late Filing Penalty

Penalty Calculation for Each Quarter

Penalties apply separately to each quarterly statement for the TDSs late filing penalty challan. Q1 covers April-June with a July 31 deadline. Q2 spans July-September with an October 31 due date.

Q3 encompasses October-December with a January 31 deadline. Q4 includes January-March, with May 31 as the final date. Missing these triggers ₹200 daily penalty. Different forms for the same quarter incur separate penalties.

Consequences of Repeated Defaults

Beyond immediate penalties, repeated defaults trigger serious consequences. These include potential prosecution under Section 276B. Greater scrutiny through detailed tax assessments often follows.

Your business reputation suffers from compliance failures. Banks increasingly check TDS compliance before processing loans. Interest compounds with each passing quarter. Consider compliance as a critical business practice, not merely a legal obligation.

Conclusion

Key Takeaways

Late filing costs ₹200 daily under Section 234E. This caps at your TDS amount. An additional interest of 1.5% monthly applies to delayed payments.

Each quarter has specific deadlines with separate penalties. Pay through Challan 281 before filing delayed returns. Professional assistance significantly reduces non-compliance risks.

Contact us today for a free consultation. Let us handle complex tax regulations while you focus on growth. RegisterKaro: Your partner for seamless tax compliance.

Frequently Asked Questions

The deadlines follow a simple pattern: Q1 (July 31), Q2 (October 31), Q3 (January 31), and Q4 (May 31).