Harmonized System of Nomenclature, aka HSN code, is an international product classification system. While it was initially proposed by the World Customs Organization (WCO), it is essential for seamless GST compliance as it serves as the classification for goods. With the help of HSN code, business owners can streamline tax processes through categorizing goods, facilitating efficient tax calculation, and documentation. One of the biggest advantages of the HSN code is its ability to deliver accurate determination of GST rates, simplify the process of GST return filing, and further reduce error risks. Moreover, HSN code makes inventory management much simpler and hassle-free than ever before, along with supply chain operations, which aid in improving the overall efficiency of business operations. Let’s look at the HSN codes under GST.

- Taxpayers with a turnover of 5 CR INR and above shall use a 4-digit HSN code.

- Taxpayers with a turnover between 1.5 CR to 5 CR shall use a 2-digit HSN code.

- Taxpayers with a turnover below 1.5 CR do not require any HSN code.

- Taxpayers can also view the draft list of HSN codes in the public domain through the government GST websites.

- Under the GST law, the services will be classified as per the service accounting code (SAC)

Any topic related to goods and services tax (GST) would be incomplete without mentioning the SAC code. Originally based on the concept of the United Nations Central Product Classification, this code has been modified in India by CBIC. SAC code focuses primarily on the Indian Taxation Framework. However, if a service or product is not listed in the SAC code, it automatically defaults to 18% GST tax. Let’s understand how the SAC code plays a vital role for businesses.

- Distinctive Classification

The SAC code allocates a unique code to different services, which provides a more accurate classification.

- GST Rate Identification

Here, the code assists GST taxpayers in identifying applicable GST rates for their services.

- Compliance Requirement

It is mandatory for GST taxpayers to mention SAC codes, invoices, and returns while registering on the GST portal. It ensures compliance with tax regulations.

- GST collection analysis

One of the major benefits of having a SAC code is that it enables the government to analyze GST collection efficiently for each service category. This helps towards a more effective tax administration and revenue management.

Now that we have covered the basics of these 2 codes and how they differ from each other. Let’s understand how these 2 codes differ from each other through a table.

| Aspect | HSC code ( Goods) | SAC code ( Services ) |

| Full form | Hamronized System of Nomenclature | Services Accounting Code |

| Purposes | Classification of goods | Classification of Services |

| Used Structure | 8 digits (Chapter, Heading, Sub Heading) | 6 digits (Service Catogery, Sub Catogery) |

| Used by | Manufacturers, Traders, Importers, | Service Providers |

| Example | 1006100 ( Rice) | 995412 ( Construction Service ) |

| GST determination rate | Helps with GST rate for goods | Helps with GST rates for services |

| Compliance requirement | Mandatory Based on Turnovers | Vital for all service providers |

| Global Usage | Used internationally | Mainly used in India |

| Implementation in India | Based on the turnover threshold | Applied for all services |

| Common Mistakes | Incorrect classification | Outdated Codes |

For business owners today, it becomes mandatory to understand the HSN SAC code full form for a more seamless understanding of GST filing in the country. It also becomes crucial to know the differences between these two codes for a simpler and accurate knowledge of the taxation process. Let’s delve into a deeper understanding of the topic.

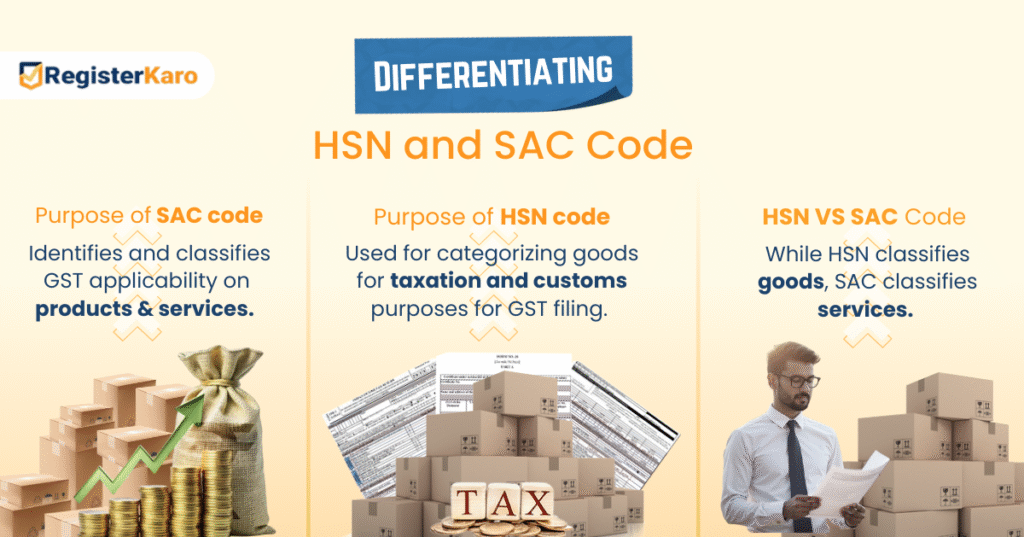

While HSN or SAC code can be best described as two sides of the same coin, they are distinguished firmly when it comes to their roles in GST filling.

- HSN code: This code is used for classifying the goods based on a standardized international system. It evaluates products and tangible items, hence providing a universal structure for a more accurate categorization of domestic and international trade.

- SAC code: Here, the focus is on the classification of services. Unlike HSN, Service Accounting Code is very specific to the nature of the service it provides. It comes with a more structured framework for a more accurate identification and taxation within the GST system.

Both these codes serve different purposes for entrepreneurs regarding their business and products.

- HSN code: Here, the primary usage for this code is to classify tangible goods like electronics, which facilitate international trade. This process takes place through a standardized system for product identification.

- SAC code: The services that come under the SAC code include education, finance, hospitality, etc.

While they both are necessary procedures towards GST filing, they both play diverse roles in the functioning of an accurate and seamless procedure of the same.

- HSN code: Here, the HSN code is necessary when it comes to import and export business dealings. This helps with a more accurate record of inventory and invoice generation.

- SAC Code: Being a mandatory procedure, towards filing a GSTR form, it ensures precise categorization and taxation of various services found under the GST guidelines.

Finally, as we conclude this topic, understanding the distinctive factors of SAC vs HSN code is an integral aspect of understanding the GST framework. Think of it as the two sides of same coin. The only factor which sets them apart is the purpose it serves. So while it may seem tricky at first, having a good knowledge and understanding on the subject can help business owners to comply with GST registration more effectively.

For any further doubts or questions regarding HSN & SAC code in gst billing, feel free to Get in touch with us today.

Frequently Asked Questions

A – This code is used as a unique identifier to categorize services that fall under Goods and Services Tax.