CPC in Income Tax: A Digital Powerhouse

Did you know? India’s CPC processes over 6.5 crore tax returns every year. That’s more than 2 returns every second! In the time it takes you to read this, over 10 taxpayers will have had their returns processed through this fast, digital system.

Ravi, a small business owner from Chennai, used to wait anxiously for 9 months for his tax refund in 2008. Today, he files his return online and receives his refund credit within 2 months, which allows him to reinvest in his business without financial strain.

It represents one of India’s most successful digital transformation stories and serves as a model for other government services that aim to achieve efficiency through technology. CPC has cut the average tax return processing time from 14 months to just 63 days.

What is CPC in Income Tax?

Many taxpayers wonder about the CPC full form in income tax. The complete expansion is “Centralized Processing Center”, which accurately describes its primary function.

The CPC is a facility set up by India’s Income Tax Department to simplify the handling of ITR. Established in 2009 in Bengaluru, it serves as a massive digital hub that processes income tax returns filed by taxpayers across the country.

It has centralized the processing of income tax returns, which was previously handled by assessment officers across different jurisdictions. Its role as a unified processing hub has revolutionized how the tax department handles millions of returns annually.

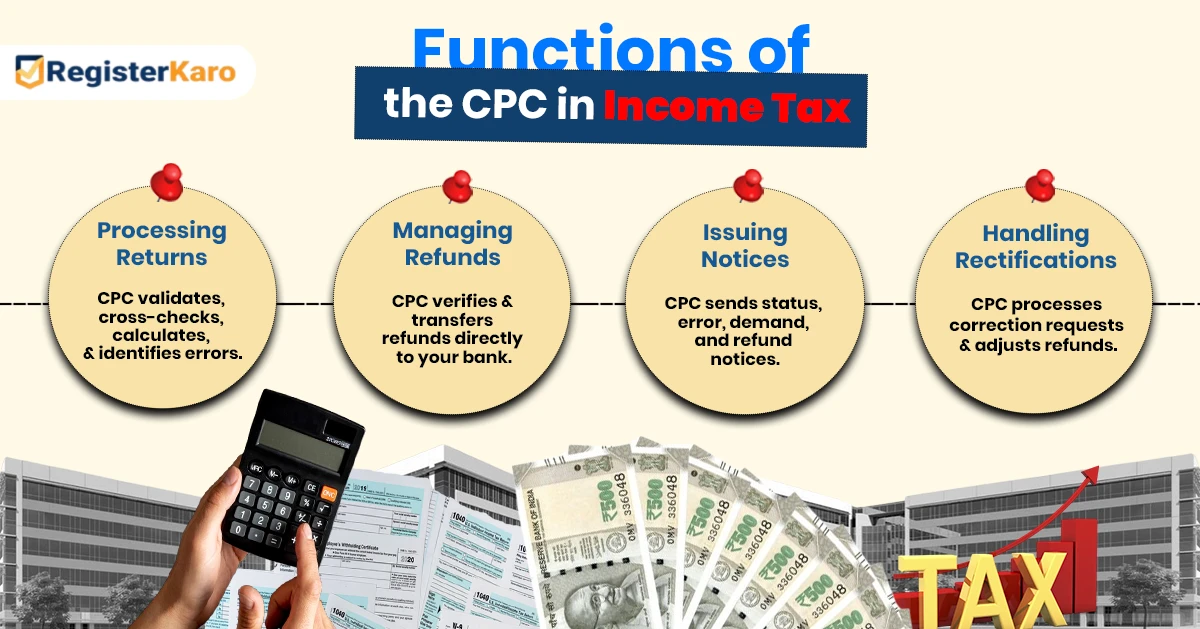

Functions of the CPC in Income Tax

The CPC serves several critical functions in India’s tax ecosystem:

1. Processing Income Tax Returns

The primary responsibility of the CPC in income tax involves processing all electronically filed returns and digitized paper returns. This processing includes:

- Validating the information provided

- Cross-checking data with third-party information (like Form 26AS)

- Calculating tax liability and determining refund amounts

- Identifying discrepancies or errors in returns.

2. Managing Refunds

When you’ve paid more tax than you owe, the CPC in income tax processes and issues refunds by:

- Verifying refund claims thoroughly

- Processing approved refunds electronically

- Transferring funds directly to your bank account

- Sending intimations about your refund status.

3. Issuing Notices and Intimations

The CPC in income tax communicates with taxpayers through:

- Intimation under section 143(1): Notifying you about your return’s processing status

- Defective Return Notice under section 139(9): Alerting you about errors in your returns

- Demand Notice: Informing you if an additional tax payment is required

- Refund Failure Communications: Notifying you about issues with refund processing.

4. Handling Rectification Requests

When errors appear in processed returns, the CPC in income tax manages:

- Processing rectification requests under section 154

- Making necessary corrections to tax calculations

- Adjusting demands or refunds accordingly.

Understanding “Income Tax Processed at CPC”

When you see the status “Income tax processed at CPC,” it means the Centralized Processing Center has completed reviewing your tax return. This status indicates:

- Your return has undergone initial validation

- The CPC has completed a detailed examination

- Tax calculation has been finalized

- An intimation under section 143(1) may have been generated

After the income tax is processed at CPC status, one of these outcomes will occur:

- Nil: No additional tax is payable, and no refund is due

- Demand: An Additional tax payment is required

- Refund: Excess tax paid will be returned to your bank account

What is CPC Number in Income Tax?

This number typically refers to one of these identifiers:

- Acknowledgment Number: Generated when you do an ITR filing.

- Assessment Year and PAN Combination: Often used to track your return

- Document Identification Number (DIN): Found on notices from the CPC

How to Find CPC Number in Income Tax?

You can find the CPC number by locating these important identifiers:

- Checking your ITR-V acknowledgment document

- Logging into the Income Tax e-filing portal

- Reviewing notices or communications received from the CPC

Having these numbers readily available helps you track the status of your return processing and any communications from the tax department.

Common Issues with CPC in Income Tax Processing

Despite the efficiency of the CPC, taxpayers sometimes encounter these issues:

1. Delayed Refunds

Refunds may face delays due to:

- Verification issues with bank account details

- High-value refunds requiring additional scrutiny

- System backlog during peak filing season

- Technical issues with the refund transfer process

2. Incorrect Demands

Tax demands raised by the CPC in income tax may sometimes be incorrect due to:

- System errors in processing certain types of income

- Failure to recognize legitimate tax exemptions

- TDS return filing data is not properly reflected in the system

- Errors in carrying forward losses from previous years

3. Communication Gaps

Taxpayers might face challenges like:

- Not receiving intimations or notices via email

- Difficulty understanding the technical language in notices

- Challenges in responding to CPC notices

- Issues with the online response system

If you’re facing issues with your tax return or registration, RegisterKaro is here to help. 👉 Resolve Your Issues with Us!

How to Check Your CPC in Income Tax Processing Status?

To check the status of your tax return processing at the CPC:

- Visit the Income Tax e-filing portal

- Log in using your PAN and password

- Navigate to the “Services” section

- Select “Income Tax Returns” and then “View Filed Returns.”

- Click on the acknowledgment number of the relevant return

- Check the status displayed on the screen

Alternatively, you can use the “ITR Status” feature on the portal’s home page without logging in by providing your PAN and acknowledgment number.

Income Tax CPC Bangalore Address and Contact Information

CPC Bangalore address is:

- Income Tax Department, Centralized Processing Center (CPC), Bengaluru – 560500,

Karnataka, India

Contact Information for CPC Bangalore address:

- CPC Call Center: 1800-103-0025 (Toll-free) or 080-2654-4753

- Email: aaykar(dot)sampark@incometax(dot)gov(dot)in

- Website: https://incometaxindiaefiling.gov.in

Keep this CPC Bangalore address information handy for any written communications or in-person visits you might need to make.

Tips for Smooth Processing at the CPC in Income Tax

To ensure CPC processes your tax return efficiently:

- File Electronically: E-filed returns receive faster processing than paper returns.

- Verify Promptly: Complete the verification process quickly.

- Provide Accurate Bank Details: Ensure your bank account information is correct for refund processing.

- Check Form 26AS: Reconcile TDS claims with Form 26AS before filing.

- Respond to Notices: Address any CPC notices promptly.

- Maintain Documentation: Keep all supporting documents for claims made in your return.

- Use Pre-filled Data Wisely: Verify pre-filled information before accepting it.

Conclusion

By staying informed about the CPC in income tax procedures and maintaining proper documentation, you can ensure a smooth tax filing experience and promptly receive any refunds due to you.

Frequently Asked Questions

The CPC verifies and processes refund claims, transferring excess tax paid directly to the taxpayer’s bank account.