“What keeps a nation’s financial pulse steady even in unpredictable times?” The answer lies with the government banks in India, the public-sector institutions anchoring the country’s banking system. These banks, where the government holds over 50% stake, operate with the trust, stability, and scale needed to serve millions. They drive financial inclusion, fuel small businesses, support farmers, and deliver welfare schemes directly to citizens’ doorsteps. They are also central to executing many government schemes for startups in India, helping entrepreneurs access credit and financial inclusion benefits.

In short, government banks, also known as Public Sector Banks (PSBs), are central to India’s economic engine. India now has 12 major PSBs, holding over 56% of total deposits and 57% of incremental credit in FY 2024–25.

Together, they don’t just manage money; they keep India’s economy moving forward. This blog covers what these government banks are, how they work, their key features, benefits, and why they matter today.

What are Government Banks in India?

Government banks in India are those in which the government holds a majority stake (usually over 50%). This gives them stability, credibility, and a mandate to serve the public interest. They provide savings and current accounts, loans, digital banking services, and implement government schemes (like the Kisan Credit Card and the PM Jan Dhan Yojana).

Here’s how government banks in India have grown and transformed over the years:

- Early Nationalization (1955): The Imperial Bank of India became the State Bank of India (SBI).

- First Phase (1969): The government nationalized 14 major commercial banks (like Canara Bank and Bank of Baroda) to increase access to banking.

- Second Phase (1980): Six more banks came under government ownership to expand reach.

- Recent Mergers/Consolidations: Several PSBs have merged to improve efficiency and reduce duplication. Examples include the merging of Punjab National Bank with Oriental Bank and United Bank, and SBI with its associate banks.

In FY 2024–25, PSBs’ loan portfolio grew by 13.1%, outpacing private banks. Meanwhile, deposits grew 9.3% YoY, reflecting both trust and continued expansion. In the modern era, these banks play a vital role in financial inclusion, extending banking into rural India and funding small enterprises.

They are also crucial in implementing government schemes like Jan Dhan Yojana, Mudra Loans, and Kisan Credit Cards.

Services Offered by Government Banks

Government banks provide a wide range of services for individuals, businesses, and government programs.

- Savings & Current Accounts: Easy-to-open accounts with low minimum balance requirements.

- Loans & Advances: Personal loans, business loans, agricultural loans, education loans, and housing loans.

- Deposits & Investments: Fixed deposits, recurring deposits, government bonds, and pension schemes.

- Digital & Mobile Banking: Online fund transfers, bill payments, UPI transactions, mobile wallets, and app-based banking.

- Government Transactions: Salary accounts, pensions, subsidies, and direct benefit transfers.

- International Banking Services: Foreign exchange, remittances, and overseas account services (available in select PSBs).

- Customer Support Services: 24/7 helplines, grievance redressal, and in-branch assistance.

Government banks combine traditional banking, modern digital solutions, and government-backed services to serve every segment of society.

Challenges Faced by Government Banks

Government banks play a key role in India’s economy, but they face several challenges:

- Non-Performing Assets (NPAs) / Credit Risk: High bad loans, especially in agriculture and MSMEs, affect profitability.

- Governance Issues / Political Interference: Decision-making can be influenced by political priorities.

- Slow Decision-Making: Bureaucratic processes can delay approvals and policy changes.

- Legacy Systems / Need for Modernization: Older technology slows operations; tech adoption is essential.

- Competition from Private and Foreign Banks: Faster services, advanced apps, and global standards attract customers.

- Operational Inefficiencies: Large workforce and complex hierarchies reduce efficiency.

- Limited Flexibility: Focus on social objectives sometimes limits profit-driven agility.

- Digital Adoption Challenges: Rural areas and older customers may struggle with online banking.

- Interest Rate Pressures: Government-mandated priority sector lending and low-interest schemes can reduce profits.

- Regulatory Compliance: Continuous RBI and government updates increase operational burden.

- Brand Perception: Some customers perceive PSBs as slower or less customer-friendly.

- Cybersecurity Threats: Growing digital banking usage increases vulnerability to attacks.

- Rural Infrastructure Limitations: Poor connectivity and low financial literacy slow adoption.

- Capital-Raising Requirements: PSBs often need additional capital to support growth and absorb NPAs.

Despite these challenges, government banks remain essential, supporting financial inclusion, economic growth, and national schemes across India.

Detailed Government Bank List in India

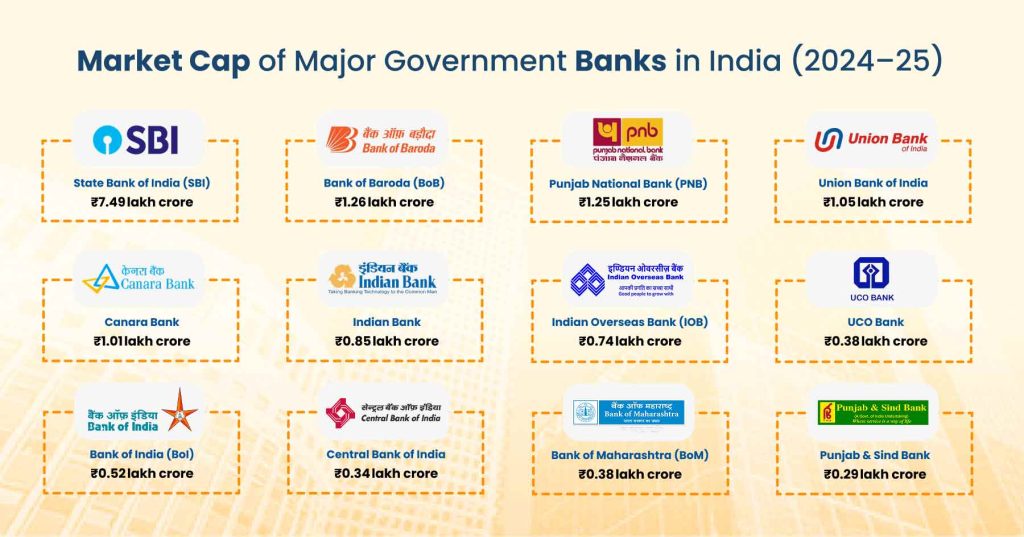

There are 12 major Public Sector Banks in India after recent mergers. Here’s a list of public sector banks in India:

| Bank Name | Founded | Headquarters | Key Features | Market Cap (2024–25) | Size |

| State Bank of India (SBI) | 1955 (from Imperial Bank) | Mumbai | Largest bank in India, pan-India presence, digital banking via YONO, priority sector lending; merged with 5 associate banks & Bharatiya Mahila Bank | ₹7.49 lakh crore | Very Large / Systemically Important |

| Bank of Baroda (BoB) | 1908 | Vadodara, Gujarat | Strong international presence, retail & corporate banking; merged with Dena Bank & Vijaya Bank | ₹1.26 lakh crore | Large |

| Punjab National Bank (PNB) | 1894 | New Delhi | Wide branch network, strong rural reach; merged with Oriental Bank & United Bank | ₹1.25 lakh crore | Large |

| Union Bank of India | 1919 | Mumbai | Focus on MSMEs, digital banking; merged with Andhra Bank & Corporation Bank | ₹1.05 lakh crore | Medium-Large |

| Canara Bank | 1906 | Bengaluru | Strong retail presence, priority sector loans, digital services; no recent merger | ₹1.01 lakh crore | Medium-Large |

| Indian Bank | 1907 | Chennai | Urban & semi-urban focus, government scheme support; merged with Allahabad Bank | ₹0.85 lakh crore | Medium |

| Indian Overseas Bank (IOB) | 1937 | Chennai | Southern India presence, international branches, retail & corporate banking; no recent merger | ₹0.74 lakh crore | Medium |

| UCO Bank | 1943 | Kolkata | Eastern India focus, retail & corporate banking; no recent merger | ₹0.38 lakh crore | Medium |

| Bank of India (BoI) | 1906 | Mumbai | International operations, priority sector lending; no recent merger | ₹0.52 lakh crore | Medium |

| Central Bank of India | 1911 | Mumbai | One of the oldest PSBs, strong rural reach, government schemes; no recent merger | ₹0.34 lakh crore | Medium |

| Bank of Maharashtra (BoM) | 1935 | Pune | Maharashtra & nearby states focus, rural banking, MSME support; no recent merger | ₹0.38 lakh crore | Smaller-Medium |

| Punjab & Sind Bank | 1908 | New Delhi | Northern India focus, MSME lending, digital banking adoption; no recent merger | ~₹0.29 lakh crore | Smaller |

Key Features of Government Banks

Government banks in India offer stability, trust, and wide access. They serve millions across urban and rural areas. Some of the key government bank features include:

- Government Ownership: The government holds a majority stake, ensuring reliability and credibility.

- Pan-India Reach: Branches and ATMs cover cities, towns, and villages.

- Financial Inclusion: They provide loans to farmers, small businesses, and underserved communities.

- Digital Banking: Mobile apps, net banking, UPI, and SBI platforms like YONO make banking easy.

- Secure Deposits: Government backing protects savings and investments.

- Support for Government Schemes: They implement PM Jan Dhan Yojana, Mudra Loans, Kisan Credit Cards, and Atal Pension Yojana.

- Priority Lending: They focus on agriculture, MSMEs, and other priority sectors.

Government banks combine trust, reach, and social responsibility with modern banking solutions.

Major Government Schemes Implemented Through Government Banks

Public Sector Banks play a crucial role in implementing government schemes across India. They help reach every citizen, boost financial inclusion, and support economic growth.

- PM Jan Dhan Yojana (PMJDY): PSBs open millions of zero-balance accounts for the unbanked. This ensures access to savings, insurance, and direct benefit transfers. PSBs have opened over 51 crore accounts as of 2025, guaranteeing access to savings, insurance, and DBT.

- Pradhan Mantri Mudra Yojana (PMMY): Banks provide loans to micro and small enterprises, helping entrepreneurs start or expand businesses.

- Kisan Credit Card (KCC): Farmers receive timely credit for agriculture needs, inputs, and equipment. PSBs enable easy access and flexible repayment.

- Atal Pension Yojana (APY): PSBs enroll workers in a government-backed pension scheme, promoting long-term financial security.

- Stand-Up India Scheme: Banks facilitate loans for women and SC/ST entrepreneurs, promoting entrepreneurship and inclusive growth.

- Direct Benefit Transfers (DBT): PSBs channel subsidies, pensions, and welfare payments directly to beneficiaries’ accounts, reducing leakages and delays.

- National Social Security Schemes: PSBs support schemes like Pradhan Mantri Shram Yogi Maan-dhan (PM-SYM) for workers’ social security.

Government banks act as critical links between the government and citizens, ensuring schemes are accessible, transparent, and effective. Their extensive branch network, digital platforms, and rural presence make implementation efficient and inclusive.

Government Banks vs Private Banks vs Cooperative Banks

Public Sector Banks differ from private and cooperative banks in ownership, reach, and focus. Here’s a clear comparison:

| Feature | Public Sector Banks (PSBs) | Private Banks | Cooperative Banks |

| Ownership | Majority government stake (>50%) | Owned by private companies or individuals | Owned by members of a cooperative society |

| Reach | Pan-India, urban & rural | Mostly urban & semi-urban | Local or regional |

| Focus | Financial inclusion, government schemes, and social responsibility | Profit, technology, customer experience | Serve local communities and small businesses |

| Trust & Stability | High (government-backed) | Moderate, relies on reputation | Moderate, community-backed |

| Digital Banking | Growing rapidly, government-supported apps | Advanced, tech-driven | Limited digital services |

| Loan & Credit Access | Priority sector lending, rural credit | Urban and profitable segments | Local business and member loans |

Need expert help in choosing the right banking structure for your business? RegisterKaro is here to assist you with reliable, end-to-end support.

Latest Developments in Government Banks (2024–25)

Some developments that are driving strategic growth and performance in government banks are:

- Record Profits: PSBs posted ₹1.78 lakh crore net profit in FY25, a year-on-year increase of around 26%.

- Dividend Growth: Dividend payouts to shareholders, including the government, rose 166% from FY22 to FY25.

- Improved Asset Quality: Gross NPAs dropped to 3.12% and net NPAs to 0.63% as of September 2024.

- Market Share Gains: In FY 2025, PSBs increased lending share in working capital, demand loans, and retail segments.

- Gold Loan Growth: In FY 2024-25, State Bank of India (SBI) witnessed a 53% increase in personal gold loans at ₹50,011 crore.

- Capital & Governance Strengthening: Improved CRAR levels; professional management and non-executive chairpersons enhance governance.

These developments highlight strong financial performance, improved efficiency, and better governance in government banks.

The Future of Government Banks in India

Government banks are rapidly modernizing to meet customer needs and support India’s economy.

- Digital-First Banking & AI: PSBs roll out mobile apps, UPI services, AI chatbots, and platforms like SBI YONO. AI improves fraud detection, credit scoring, and customer support.

- Fintech Collaborations: PSBs partner with fintechs to speed up payments, loans, and digital services for urban and rural users.

- Rural Expansion & Inclusion: PSBs expand rural banking, supporting PM Jan Dhan, Mudra Loans, and Kisan Credit Cards. By 2030, most villages may have full access to formal banking.

- Priority Sector & ESG Lending: Banks focus on agriculture, MSMEs, renewable energy, and sustainable projects, supporting climate goals.

- Cybersecurity Enhancements: PSBs strengthen systems to secure digital transactions.

- Global Expansion: SBI, BoB, and PNB grow overseas, serving NRIs, trade finance, and global clients.

- Customer-Centric Innovation: Personalized loans, digital wealth tools, and AI-driven advice improve banking experiences.

Government banks are set to remain pillars of India’s economy, driving modernization, sustainability, and inclusive growth by 2030.

How to Choose the Right Government Bank for You?

Choosing the right government bank depends on your needs, convenience, and services. Here’s how to decide:

- Evaluate Branch & ATM Access: Pick a bank with branches and ATMs near your home, office, or rural area. Convenience saves time.

- Check Services Offered: Consider what you need—savings accounts, loans, digital banking, or government schemes.

- Look at Digital Capabilities: Banks with strong mobile apps, UPI integration, and online services make transactions faster and easier.

- Compare Interest Rates: Check savings, fixed deposit, and loan interest rates to get better returns or lower borrowing costs.

- Consider Customer Support: Responsive support, grievance redressal, and helplines improve banking experience.

- Review Reputation & Stability: Choose banks with strong credit ratings, good financial performance, and government backing.

- Specialized Services: Some banks focus on agriculture, MSMEs, startup support, or NRI services. Choosing a bank that actively participates in government grants for startups can make it easier for new businesses to secure funding and scale faster.

- Scheme Accessibility: If you plan to use government schemes, ensure the bank actively supports them.

By assessing your requirements and comparing options, you can choose a government bank that balances convenience, trust, and financial benefits.

Frequently Asked Questions

A government bank in India, also called a Public Sector Bank (PSB), is a bank where the government holds a majority stake (usually over 50%). These banks provide savings, loans, digital banking, and implement government schemes. They focus on financial inclusion, supporting agriculture, MSMEs, and underserved communities across the country.