Introduction

Government schemes for startups in India play a crucial role in fostering economic growth and innovation. The Indian government has recognized the critical role startups play in driving progress and has introduced various government funding schemes for startups in India to eliminate traditional barriers faced by new businesses.

These schemes not only provide access to essential funds but also offer mentorship, networking opportunities, and regulatory relaxations to help startups thrive in a competitive environment. Whether you are looking for government grants for small businesses for startups in India or exploring government loan schemes for startups in India, understanding the specifics of each initiative can empower you to make informed decisions.

Detailed Overview of Key Government Schemes

Government Schemes for Startups in India offer a range of financial and operational support to foster innovation and growth. These schemes are designed to ease the challenges faced by entrepreneurs and enable them to scale their businesses efficiently.

1. Startup India

Government schemes for startups in India, such as Startup India, play a crucial role in creating a nurturing ecosystem for startups across the country. This scheme is part of various government funding schemes for startups in India and offers a multi-faceted support system, including financial assistance, mentorship, and regulatory benefits.

- Tax Benefits and Exemptions: Startups under this scheme are eligible for tax holidays, rebates, and exemptions that can significantly reduce the financial burden during the early years of operation. This provision allows entrepreneurs to reinvest savings back into the business and fuel further growth.

- Simplified Compliance and Regulatory Norms: To ease the process of starting and running a business, Startup India introduces reduced compliance norms and simplified procedures. This means fewer hurdles in business registration, reduced paperwork, and an overall more streamlined process for obtaining necessary approvals.

- Access to Mentorship and Networking Platforms: Entrepreneurs gain entry into a vast network of industry experts, investors, and mentors. This network facilitates strategic guidance, helps in building partnerships, and offers insights into market trends, all of which are crucial for sustainable growth.

- Innovation and Incubation Support: The initiative also promotes innovation by supporting incubators and accelerators that provide startups with office space, resources, and technical expertise. This ecosystem nurtures early-stage ideas and fosters research and development.

By addressing various aspects of business development, Startup India stands as a comprehensive solution among government schemes for startups in India.

2. Mudra Loan

The Mudra Loan scheme is tailored to provide financial support specifically for small businesses and startups under government schemes for startups in India. This program is structured to ensure easy access to credit, with a focus on minimal bureaucracy and prompt disbursement:

- Diverse Loan Categories: The scheme categorizes loans into three segments: Shishu (covering the initial stage), Kishore (for intermediate business expansion), and Tarun (for mature business stages). Each category is designed to match the evolving needs of a startup, providing the right level of support at each stage.

- Streamlined Application Process: Entrepreneurs benefit from an application process that emphasizes ease and speed. With reduced documentation requirements and clear eligibility criteria, the Mudra Loan scheme minimizes the typical delays associated with securing traditional loans.

- Wide Accessibility: This scheme is not restricted to a particular sector or region. Entrepreneurs across various industries and geographies can access the funds, making it one of the most inclusive government loan schemes for startups in India.

- Financial Flexibility and Support: Mudra Loans offer flexible repayment terms, which can be a critical factor for startups that are still in the phase of establishing a market presence. The financial assistance provided helps in covering operational costs, purchasing equipment, or scaling business operations.

This detailed approach to financing makes the Mudra Loan a cornerstone initiative under government schemes for startups in India, providing essential support for emerging businesses.

3. PMEGP (Prime Minister’s Employment Generation Programme)

The PMEGP is designed to stimulate entrepreneurship and generate employment, particularly in rural and semi-urban areas under government schemes for startups in India.

- Subsidized Financial Assistance: Under PMEGP, beneficiaries receive a subsidy on the cost of setting up a new business. This significantly reduces the initial investment burden and enhances the feasibility of launching new ventures.

- Focus on Skill Development: Beyond financial support, PMEGP integrates training programs that focus on building essential business skills. These training modules ensure that entrepreneurs are well-prepared to manage and grow their enterprises effectively.

- Emphasis on Employment Creation: One of the primary objectives of PMEGP is to create job opportunities. By encouraging the establishment of micro-enterprises, the scheme contributes directly to employment generation, which in turn supports broader economic development.

- Support for Diverse Business Models: Whether you are interested in traditional crafts, manufacturing, or service-based industries, PMEGP provides tailored support to suit various business models. This adaptability makes it a versatile option for a wide range of startups.

This initiative is a key example of government grants for small businesses for startups in India, as it combines financial support with skill development and employment generation. Additionally, it aligns with various government funding schemes for startups in India and government loan schemes for startups in India, providing comprehensive support for new businesses.

How to Apply for Government Funding Schemes

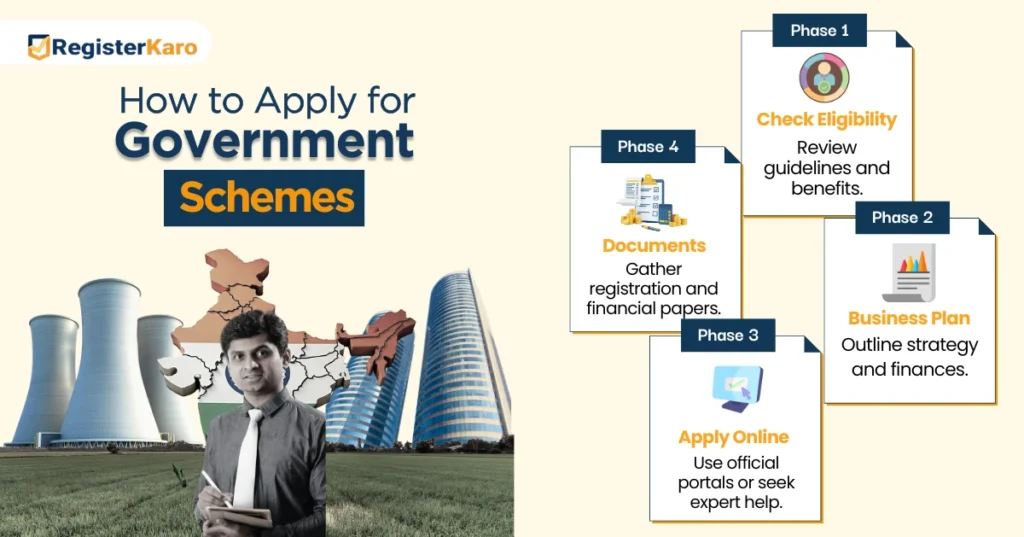

Securing funding through these government schemes for startups in India requires careful preparation and attention to detail. Below is a step-by-step guide to help you navigate the application process effectively.

- Research and Understand Scheme Requirements: Begin by thoroughly reviewing the official guidelines of each scheme. Understand the eligibility criteria, required documentation, and the scope of benefits provided. This initial research will help you determine which scheme aligns best with your startup’s needs.

- Develop a Comprehensive Business Plan: A detailed business plan is critical. Include your vision, market analysis, growth strategy, and financial projections. This plan not only serves as a roadmap for your business but also strengthens your application by demonstrating preparedness and strategic thinking.

- Collect and Organize Required Documents: Gather all necessary documents, such as identity proofs, business registration certificates, bank statements, and any other financial documents. Keeping these documents well-organized will streamline the application process and reduce the likelihood of errors or delays.

- Utilize Official Portals and Online Resources: Each scheme typically has an official portal where you can submit your application. Follow the instructions carefully, fill in the required fields accurately, and double-check all entries before submission.

- Seek Professional Assistance if Needed: If the application process seems overwhelming, consider reaching out to experts. Services like RegisterKaro offer personalized guidance, helping you prepare a robust application that adheres to all the necessary guidelines.

This comprehensive approach to the application process ensures that you can maximize your chances of securing funding under any government scheme for startups in India.

Eligibility Criteria & Benefits

Understanding the eligibility criteria and associated benefits is key to selecting the right scheme for your startup under government schemes for startups in India.

- Startup India Eligibility: Typically, a startup must be less than 10 years old, focused on innovation, and compliant with specific turnover limits. Meeting these criteria qualifies you for a host of benefits, including tax exemptions, reduced compliance requirements, and access to a vast network of mentors and investors.

- Mudra Loan Eligibility: This scheme is primarily aimed at micro and small enterprises in non-corporate, non-farm sectors. The focus is on businesses that require working capital to scale operations. Eligibility is based on the business’s current stage and financial health, ensuring that the loan is provided to those with viable business models.

- PMEGP Eligibility: PMEGP targets individuals looking to set up new micro-enterprises. The program is designed for both urban and rural applicants, with a particular emphasis on generating employment. The criteria often include factors such as the applicant’s background, the business model, and the potential for job creation.

Benefits Across Schemes:

Startup schemes play a pivotal role in fostering entrepreneurial growth by offering financial, regulatory, and networking support. These benefits are crucial for startups to overcome initial challenges and establish a strong foundation.

- Financial Assistance: Whether it’s through direct grants, subsidized loans, or tax benefits, these schemes provide much-needed financial relief to reduce the capital burden on startups.

- Regulatory Ease: Simplified registration and compliance processes allow entrepreneurs to focus more on business growth rather than administrative hurdles.

- Access to Expert Networks: Many of these schemes include provisions for mentorship and industry networking, which can be instrumental in scaling your startup successfully.

The financial assistance, regulatory ease, and access to expert networks provided by these schemes are essential in shaping the future success of startups. By carefully evaluating the benefits, entrepreneurs can make informed decisions that align with their business needs and growth objectives.

RegisterKaro’s Assistance with Government Funding

Navigating the maze of government schemes for startups in India can be challenging. This is where RegisterKaro comes in to provide expert assistance:

- Personalized Consultation: Our team conducts a detailed analysis of your startup to determine which government funding schemes align best with your business goals. This personalized approach ensures that you are matched with the most beneficial scheme.

- Comprehensive Documentation Support: We help you gather and organize all necessary documentation. Our support ensures that your application is complete, accurate, and meets all regulatory requirements, reducing the likelihood of delays or rejections.

- Streamlined Application Process: With our expert guidance, you can navigate the application process with ease. We provide step-by-step assistance, from initial application to final submission, ensuring that every detail is handled meticulously.

- Ongoing Support and Follow-Up: Beyond the application process, RegisterKaro remains available for any queries or additional support you might need. Our goal is to ensure that you can focus on growing your business while we take care of the bureaucratic details.

Leveraging our expertise means you have a dedicated partner in your journey toward accessing government funding schemes for startups in India.

Frequently Asked Questions

Government schemes for startups in India are programs designed to provide financial, regulatory, and networking support to help entrepreneurs start and grow their businesses.