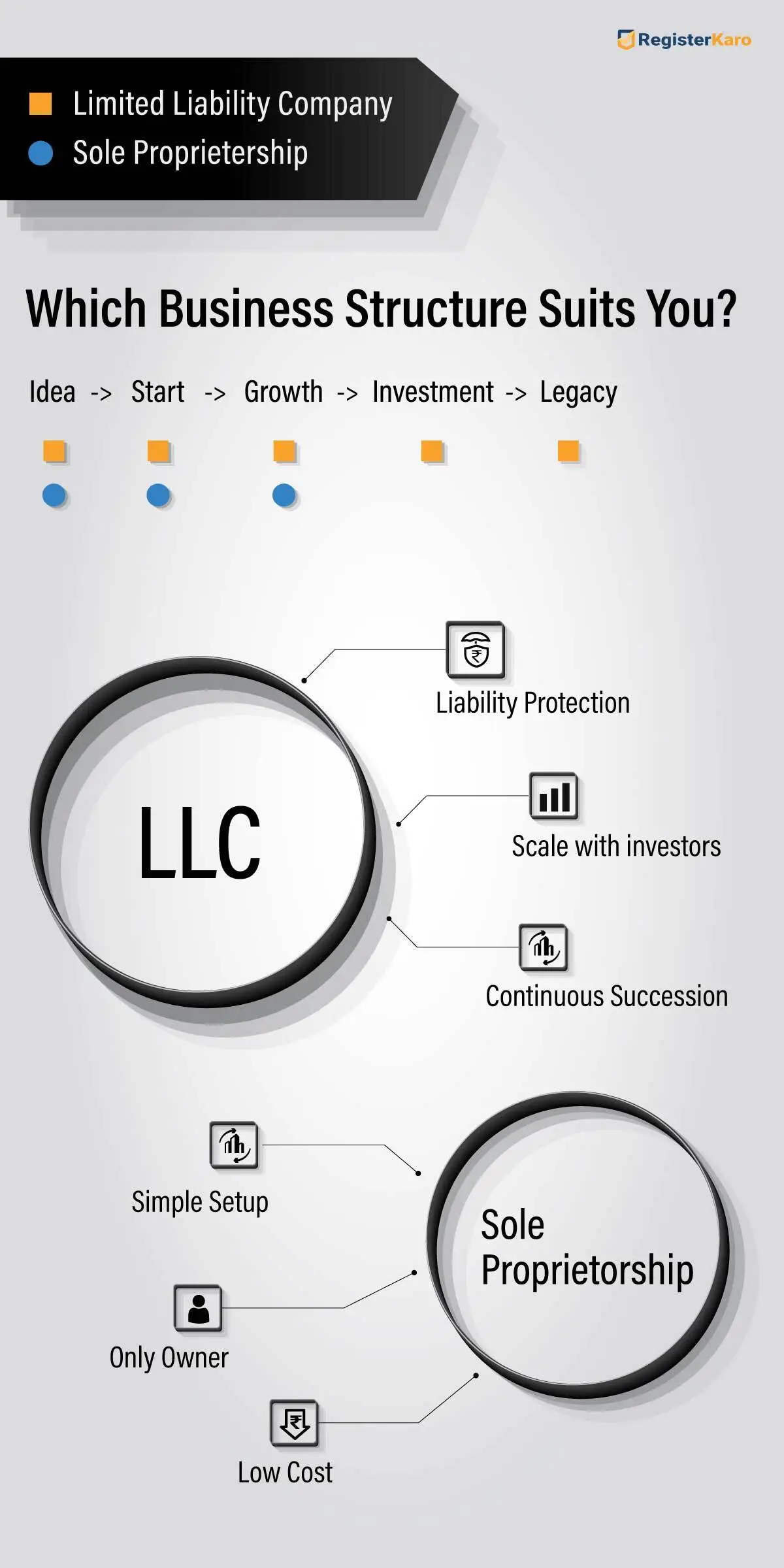

Before launching your business, you should always select the right legal structure. Envision your business foundation: will it be a streamlined structure for swift establishment (Sole Proprietorship), or a more robust framework (LLC) engineered with significant liability protection? Deciding between LLC vs Sole Proprietorship is crucial as the structure impacts how you run your business.

This guide offers a comprehensive analysis, moving beyond introductory concepts to explore the distinct architectural designs of the Sole Proprietorship and the Limited Liability Company. We will identify and explain their key differences through clear examples and practical insights.

What is a Sole Proprietorship? Key Features

A Sole Proprietorship is the simplest form of business structure, where the business is owned and operated by one individual. It is commonly chosen by small business owners, freelancers, and independent contractors due to its ease of setup and minimal costs.

Key Features of Sole Proprietorship

One of the most notable features of a sole proprietorship is single ownership and management. The owner independently handles profits, losses, and business strategies without the need to consult partners or shareholders. Similarly, other prime characteristics of sole proprietorship are:

- Complete Control: As a sole proprietor, you have full control over the business. You make all decisions regarding the operations. The structure also offers direct ownership of profits. All income earned belongs to the proprietor, and profits are taxed as personal income under individual income tax slabs.

- No Formal Registration Needed: It is the simplest and most affordable structure to start with, requiring minimal paperwork and regulatory compliance. Sole proprietorship registration is not a mandatory requirement; however, it’s suggested by legal authorities and experts in the field.

- Income Taxation: The owner directly reports profits from a sole proprietorship on their personal tax return and taxes them as personal income.

- No Separation Between Business and Owner: Legally, you and the business are the same. You get unlimited liability, meaning personal assets such as savings or property can be used to settle business debts or liabilities. While this increases risk, it also simplifies compliance and reporting requirements.

Read also: Benefits of Registering a Sole Proprietorship in India

Example of Sole Proprietorship

John, a graphic designer, chooses to start his freelance business as a sole proprietorship to avoid the complexities and costs of forming an LLC. He files his business income on his personal tax return and is free of any complex compliance requirements.

Important: One significant drawback of this structure is that the owner is personally liable for any debts or legal claims against the business, meaning personal assets like savings or property could be at risk. Hence, it’s crucial to understand the pros and cons of LLC vs sole proprietorship.

What is an LLC (Limited Liability Company)? Key Features

A Limited Liability Company (LLC) combines the simplicity and flexibility of a sole proprietorship with the legal protections of a corporation. LLCs are designed to offer limited liability protection to the owners (members), meaning personal assets are generally protected from business-related debts and legal actions.

Key Features of LLC

A Limited Liability Partnership (LLP) combines the flexibility of a traditional partnership with the benefits of limited liability. Below are the key features that make LLP a preferred business model in India:

- Limited Liability Protection: LLCs generally protect the owners’ personal assets (like homes, cars, and savings) from business debts and lawsuits.

- Flexible Taxation Options: LLCs can choose their taxation method, whether as a sole proprietorship (pass-through taxation), a partnership, or a corporation, which may offer tax advantages.

- Ownership Flexibility: LLCs can have one or more owners (members), and can even have corporations or other LLCs as members.

- Credibility and Trust: LLCs are often viewed as more professional and credible by banks, investors, and customers.

- Separate Legal Entity: An LLP has its own legal identity, separate from its partners. This means the LLP can own property, enter into contracts, sue, or be sued in its own name. Even if partners change, the LLP continues to exist without interruption.

- Reduced Compliance Burden: Compared to private limited companies, LLPs have fewer compliance requirements. Annual filings, board meetings, and statutory audits are simpler, helping businesses save time, effort, and compliance costs.

Example of LLC

A small e-commerce business in India might start as an LLC to gain credibility and protect the owners’ personal assets. The LLC can raise capital by bringing in investors, which would not be possible with a sole proprietorship.

Read Also: Demystifying Indian Taxes for Limited Liability Companies

LLC vs Sole Proprietorship – Comparison

When comparing a Limited Liability Company vs a Sole Proprietorship, several key differences can impact the future of your business:

a. Legal Liability

- Sole Proprietorship: No separation between business and owner, meaning you’re personally liable for business debts.

- LLC: Provides liability protection, separating the owner’s personal assets from business debts and lawsuits.

b. Taxation

- Sole Proprietorship: Income is reported on the owner’s personal tax return.

- LLC: LLCs have more flexibility in taxation and can opt to be taxed as a corporation, potentially reducing self-employment taxes.

c. Compliance and Costs

- Sole Proprietorship: Easy to set up with minimal paperwork and no registration fees.

- LLC: Requires state registration, potentially higher setup costs, and ongoing compliance with legal formalities.

d. Ownership

- Sole Proprietorship: Owned by a single individual.

- LLC: Can have multiple members (owners) and can even include corporations as members.

Similarities Between LLC and Sole Proprietorship

Although LLCs and Sole Proprietorships differ in structure and legal protections, they share a few fundamental similarities. Some of them are:

- Easy to Start: Both structures are relatively simple to set up compared to corporations, making them suitable for new entrepreneurs.

- Pass-Through Taxation: In both cases, business profits pass directly to the owner’s personal income tax return, avoiding double taxation.

- Owner Control: The business owner retains full decision-making authority in a Sole Proprietorship and significant control in a single-member LLC.

- Flexible Operations: Both allow flexible operations without strict requirements like board meetings or complex record-keeping.

- Suitable for Small Businesses: Both models work well for freelancers, consultants, and small businesses that prefer straightforward management and taxation.

LLC vs Sole Proprietorship: How to Decide What’s Best for You?

Choosing between a Limited Liability Company and a Sole Proprietorship depends on your business goals and your risk appetite.

- If you’re looking for simplicity and control, a sole proprietorship may be the way to go.

- However, if you plan on scaling your business, seeking investment, or needing liability protection, an LLC is a more suitable choice.

Questions to Consider

- Do you want personal asset protection?

If yes, an LLC offers this protection, unlike a sole proprietorship.

- Is your business expected to grow?

An LLC offers scalability that a sole proprietorship may not.

Example

A budding entrepreneur looking to establish a neighborhood café might opt for a sole proprietorship because of its ease and reduced expenses. In contrast, a proprietor of an online retail business aiming for growth would find an LLC structure more advantageous for liability protection and tax adaptability.

Single Member LLC: The Best of Both Worlds?

A Single Member LLC combines the simplicity of a sole proprietorship with the liability protection of an LLC.

Here’s why you should choose a Single Member LLC:

- Liability Protection: Enjoy the same personal asset protection as a multi-member LLC.

- Tax Flexibility: Similar to a sole proprietorship, but with more flexibility in how income is taxed.

This structure is ideal for solo entrepreneurs who want to protect their personal assets while keeping their operations flexible.

Comparison Table: LLC vs Sole Proprietorship

Here’s a comprehensive comparison table that outlines the differences between an LLC and a Sole Proprietorship across several key factors:

| Feature | Sole Proprietorship | LLC |

| Liability Protection | No | Yes |

| Taxation | Personal income tax | Flexible options: pass-through or corporate |

| Ownership | Single owner | Single or multiple owners (members) |

| Setup Cost | Minimal (simple registration) | Higher (state registration, legal formalities) |

| Ongoing Compliance | Minimal paperwork | Requires annual filings and regular compliance |

| Business Scalability | Limited scalability | Excellent scalability and funding options |

| Legal Separation | No separation between owner and business | Legal separation of business and personal assets |

| Raising Capital | Limited access to funding | Easier to raise capital through investors |

| Flexibility | High (simple, easy to manage) | High (tax flexibility and multi-member flexibility) |

When to Convert Sole Proprietorship to LLC?

If you’ve started with a sole proprietorship and your business is growing, it may be time to convert to an LLC. Signs that you might need to consider the switch include:

- Increased business debt or risk exposure.

- The desire for outside investment.

- Need for liability protection as your business expands.

How RegisterKaro Helps You Choose Between Sole Proprietorship vs LLC?

Choosing between two different business structures is a very essential choice. This one decision can later impact your business’s taxes, operations, compliance, and even ownership. So, to avoid making an incorrect choice, you should rely on expert service providers like RegisterKaro.

With 5+ years of providing company incorporation and compliance consultations, our professionals know the tricks to help you make that choice.

Whether you’re considering a limited liability company or sole proprietorship, we’ll guide you through the registration process with expert support and ensure full legal compliance.

Ending Note

In conclusion, the choice between a sole proprietorship and LLC depends on your business goals, risk tolerance, and growth plans. Sole proprietorships are great for solo entrepreneurs starting small, but LLCs provide protection, scalability, and tax flexibility that are better suited for businesses that plan to expand.

For further assistance, RegisterKaro is here to help you make the best decision and register your business hassle-free! Contact Us now!

Frequently Asked Questions

LLCs offer greater tax flexibility because they can choose how they want to be taxed; either as a sole proprietorship, partnership, S-Corp, or C-Corp (depending on the country’s regulations). This allows owners to select the tax structure that minimizes their overall liability. LLCs also benefit from pass-through taxation, where profits are taxed only once at the owner’s level. In contrast, sole proprietors must report all business income on their individual tax return, which may place them in a higher tax bracket with fewer deductibility options.