What is Form 9 LLP and Why is it Important for Designated Partners?

Form 9 LLP is a crucial document under the Limited Liability Partnership Act, 2008, which governs the establishment and operation of Limited Liability Partnerships in India. An LLP is a type of business that blends the benefits of a company and a partnership. It offers partners limited liability protection like a company, while keeping the flexibility and simplicity of a partnership. It enables professionals and entrepreneurs to operate with legal recognition while minimizing personal financial risk.

In the LLP formation process, formal consents and declarations from individuals intending to become partners or designated partners are mandatory. These consents ensure that every person taking up such a role is doing so voluntarily and is legally eligible. This is where Form 9 plays an essential role; it acts as a declaration of consent and a statement confirming that the individual is not disqualified from becoming a partner or designated partner under the LLP Act.

Form 9 is, therefore, a vital compliance document in the LLP lifecycle. Every proposed partner or designated partner must sign and submit it when registering an LLP or adding new partners later. Through this blog, you’ll gain a complete understanding of what Form 9 is, why it’s important, its structure, filing procedure, common mistakes to avoid, and best practices to ensure smooth MCA compliance.

What Does Form 9 LLP Do, and Why Do You Need It?

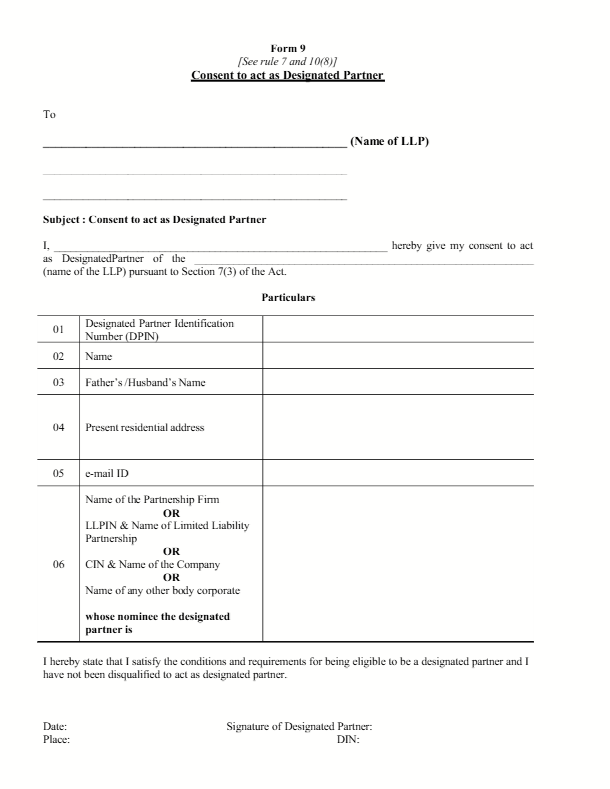

Form 9 LLP (also known as LLP Form 9 or Form 9 consent letter for LLP) is a statutory document that plays a vital role in the formation and modification of a Limited Liability Partnership. It is officially titled the “Consent to Act as Designated Partner/Partner”. It is officially titled “Consent to Act as Designated Partner/Partner.” Every individual who agrees to become a partner or designated partner in the LLP must sign this form.

This form serves as proof that the person has voluntarily consented to act in such capacity and meets all eligibility requirements under the Limited Liability Partnership Act, 2008. You must also file it as one of the mandatory incorporation attachments along with Form FiLLiP on the MCA portal during the LLP registration process.

Legal Basis for Form 9 in LLP

Section 7(3) of the LLP Act, 2008, establishes the legal foundation for Form 9 in LLP and requires individuals to give prior consent before being appointed as designated partners. Further, Rule 7 and Rule 10(8) of the Limited Liability Partnership Rules, 2009 outline the manner and Form 9 format for LLP submission to the Registrar. These provisions ensure transparency and legal compliance during the incorporation or reconstitution of the LLP.

When Do You Need to File Form 9 for LLP Incorporation?

You need Form 9 at two main stages in the LLP lifecycle:

- At the time of incorporation, every proposed or designated partner must submit Form 9 for LLP incorporation along with the incorporation documents.

- When you add a new partner or designated partner, you must obtain and file a new consent before the appointment takes effect.

Who Must Submit LLP Form 9?

Each individual who will act as a partner or designated partner in the LLP must sign Form 9.

By signing, they confirm:

- Their consent to act in that capacity.

- That they are not disqualified under the LLP Act or any other law.

- They authorize the inclusion of their details in the MCA database.

Foreign nationals or NRIs must notarize or apostille their consent in their home country before submission.

You must then digitally upload the signed Form 9 on the MCA portal as part of Form FiLLiP (for incorporation) or Form 4 (for changes in partners or designated partners).

What is the Difference Between a Partner and a Designated Partner in an LLP?

In an LLP, there are two types of members: Partners and Designated Partners. While both share profits and manage the business, Designated Partners handle statutory and compliance duties under the LLP Act, 2008. Form 9 mainly applies to Designated Partners, though ordinary partners may also use it to give their consent to join.

| Aspect | Partner | Designated Partner |

| Definition | A partner is any individual or body corporate who joins the LLP under its agreement to conduct business and share profits or losses. | A designated partner ensures the LLP’s legal and regulatory compliance. |

| Minimum Requirement | No statutory minimum is prescribed. | Every LLP must have at least two designated partners, and at least one must be a resident of India. |

| Role & Responsibilities | Primarily contributes capital, participates in management, and shares profits and losses. | Handles statutory duties like record-keeping, filing returns, and ensuring LLP Act compliance. |

| Liability | Limited to the amount agreed upon in the LLP agreement. | Same limited liability as partners, but additional liability for non-compliance under the law. |

| Legal Accountability | Limited involvement in legal filings or statutory reporting. | Legally accountable for filings with the Registrar (MCA), maintaining books, and annual compliance. |

| Applicability of Form 9 LLP | May be required when a person becomes a new partner, depending on LLP rules and Registrar requirements. | Mandatory for every proposed designated partner at the time of Form 9 for LLP incorporation or subsequent appointment. |

| Focus of Form 9 | Optional or conditional. | Primary focus, as they bear statutory and legal responsibilities of the LLP. |

| Digital Signature | Not mandatory for ordinary partners unless filing documents digitally. | Designated partners must file LLP forms digitally using a valid DSC on the MCA portal. |

What Information Does Form 9 LLP Contain and How Is It Structured? – Contents & Format Explained

We already know that Form 9 plays a vital role in the LLP incorporation process, but what exactly does this form include, and how do we structure it? Let’s break down its contents and format to ensure accurate and compliant filing.

Key Details Included in Form 9

A properly completed Form 9 for LLP incorporation generally includes:

- Name of the LLP – the official name of the Limited Liability Partnership for which consent is being provided.

- LLPIN (if available) – the LLP Identification Number, if the LLP already exists.

- Name of the Proposed Partner/Designated Partner – the full name of the individual providing consent.

- Father’s or Husband’s Name – used for identity verification and record purposes.

- Residential Address – the current address of the consenting individual.

- Email ID and Contact Number – for official communication and verification.

- DPIN/DIN (if applicable) – Designated Partner Identification Number or Director Identification Number, where already issued.

- Declaration of Eligibility – a statement confirming that the person is not disqualified or prohibited from acting as a partner or designated partner under any law.

- Statement of Consent – an explicit declaration of willingness to act as a partner or designated partner in the LLP.

Additionally, MCA Form 9 is available in PDF format and must strictly follow the prescribed layout provided on the MCA portal. Any deviation from the official format or omission of mandatory details may lead to rejection during e-filing.

Typical Clauses Found in Form 9 LLP

A standard Form 9 format for LLP usually contains declarations such as:

- “I hereby give my consent to act as a designated partner/partner of [Name of LLP].”

- “I have not committed any offense related to the promotion, formation, or management of an LLP or a company.”

- “I am not an undischarged insolvent and have not applied for adjudication as insolvent.”

These clauses confirm the individual’s eligibility, integrity, and compliance with the provisions of the LLP Act, 2008.

Signature & Authentication Requirements

The consenting individual must sign the Form 9 consent letter for LLP, mentioning the date and place of signing. When filing online through the MCA (Ministry of Corporate Affairs) portal, they must digitally sign the form (using DSC). If they keep a physical copy for records, they may use a handwritten signature.

Attachments (if any)

Form 9 LLP generally does not include supporting attachments, but you may sometimes enclose identification documents such as PAN, proof of residence, or DPIN allotment. All details in the form should match the information available on the MCA records to ensure a smooth incorporation or partner appointment process.

When Should Form 9 Be Filed?

Form 9 is a mandatory compliance under the LLP Act, 2008, as it records the consent of a designated partner (DP) to act in the LLP. Filing it on time ensures that the Ministry of Corporate Affairs (MCA) has an updated and accurate record of the LLP’s designated partners, helping the LLP avoid legal or regulatory issues.

At the Time of LLP Incorporation: During incorporation, Form 9 is submitted as part of FiLLiP (Form for incorporation of LLP). This records the consent of the designated partners to act in their roles. Without this, the LLP cannot list officially designated partners in the MCA records.

On Subsequent Appointment of a Designated Partner: If a new designated partner is added after incorporation, Form 9 must be filed within 30 days of the appointment.

- Legal Reference: LLP (Designated Partners and Partners) Regulations, 2009, Rule 5(2).

This ensures the MCA is updated with the new partner’s consent and details.

How is Form 9 Filed for an LLP? Step-by-Step Process

Filing Form 9 correctly is essential to ensure that the consent of the designated partner is officially recorded with the MCA. Proper filing prevents errors in LLP records, avoids penalties, and ensures legal recognition of the designated partners. The process involves preparation, verification, e-filing, and record maintenance.

Step 1: Prepare Form 9

- Collect all required information of the designated partner: full name, address, DPIN/DIN, PAN, and other details as required.

- The designated partner must sign the consent declaration, confirming willingness to act as a designated partner.

- Double-check all details for accuracy to prevent rejection by MCA.

Step 2: Verify Digital Credentials

Form 9 must be signed by the designated partner using their valid Digital Signature Certificate (DSC) and attached to the relevant form, Form 2 (for incorporation) or Form 4 (for adding a new partner), on the MCA portal.

Before proceeding, ensure the following:

- The DPIN/DIN of the designated partner is active.

- The Digital Signature Certificate (DSC) is valid and ready for use in e-filing.

- An inactive or expired DSC can lead to delays or rejection during the filing process.

Step 3: Check Other Related LLP Forms

- Depending on the changes, check if any other forms need to be filed simultaneously:

- Form 4: For the appointment or cessation of partners/designated partners.

- Form 5: For amendments to the LLP agreement.

- Form 4: For the appointment or cessation of partners/designated partners.

- Filing related forms together ensures compliance and reduces repeated submissions.

Step 4: Upload Form 9 on the MCA Portal

Form 9 is not uploaded as an independent form; instead, it must be attached to Form 2 or Form 4 while submitting through the MCA e-filing portal (mca.gov.in ).

Here’s what to ensure during this step:

- Attach the signed Form 9 along with the relevant form(s) during filing.

- Verify that all details, including partner names, LLPIN, and addresses, match the MCA records to prevent rejection.

- Review the form thoroughly and check for any portal errors before final submission to ensure a smooth and successful filing.

Step 5: Pay Filing Fees and Submit

- Pay any applicable filing fees as per MCA guidelines.

- Submit the forms electronically through the MCA portal.

- Save the acknowledgment receipt generated after successful submission; it serves as proof of filing.

Step 6: Maintain Records

Keep a signed copy of Form 9 in the LLP’s official records for future reference. As per Rule 24 of the LLP Rules, 2009, every LLP must maintain copies of all forms, consents, and related documents for a minimum of 8 years.

Maintaining accurate and complete records not only ensures compliance during audits but also helps avoid legal disputes or penalties. Regularly review and update your LLP’s documentation to ensure that all filings are accurately reflected in the MCA database.

Practical Tips to Follow While Filing Form 9

Filing Form 9 correctly requires you to not only complete the form but also ensure that you meet all compliance and documentation requirements. Paying attention to practical details can prevent rejections, delays, or legal issues, making the filing process smoother for the LLP and the designated partner.

1. Ensure DSC is Active and Properly Linked

- The Digital Signature Certificate (DSC) of the designated partner must be valid and linked to their DPIN/DIN.

- An inactive or improperly linked DSC can lead to form rejection on the MCA portal.

2. Check for Disqualifications

- Verify that the designated partner does not fall under any disqualifications listed in Section 7 of the LLP Act, 2008, such as insolvency, unsound mind, or other statutory restrictions.

3. Keep Required Documents Ready

- Maintain identity proof, address proof, and PAN of the designated partner.

- Having these documents ready ensures quick verification and reduces the risk of errors during filing.

4. Verify All Details Carefully

- Double-check that name, LLPIN, DPIN/DIN, and other details match MCA records exactly.

- Minor inconsistencies in spelling, address, or identification numbers can cause form rejection.

5. Regularly Review MCA Records

- After filing, review the MCA portal to confirm that all appointments and updates are accurately reflected.

- Regular reviews help identify and correct discrepancies early, maintaining compliance and avoiding penalties.

For detailed guidance on adding a designated partner and related filings, refer to the linked resource.

What are the Common Mistakes and Compliance Risks in Filing Form 9?

Filing Form 9 may seem straightforward, but small errors or omissions can lead to non-compliance, penalties, or delays. Understanding the common mistakes and associated risks helps LLPs maintain proper regulatory adherence and avoid issues with the MCA.

1. Submitting Without Consent

- Filing incorporation forms or appointment forms before obtaining the signed Form 9 from the designated partner.

- This can invalidate the appointment and may result in re-filing.

2. Incorrect or Missing Details

- Errors such as missing or wrong DPIN/DIN, incorrect name, or PAN can lead to rejection of the form.

3. Disqualified Partner Gives Consent

- If a partner who is disqualified under Section 7 of the LLP Act provides consent, it results in non-compliance and can jeopardize the LLP’s legal standing.

4. Unsigned Form 9

- Submitting Form 9 without a valid digital signature (DSC) of the designated partner will cause the MCA system to reject the submission immediately. Always ensure the form is digitally signed and verified before uploading.

Compliance Risks

- Invalid Appointment of Designated Partner: The LLP may not legally appoint the designated partner, exposing the LLP and its partners to penalties.

- Regulatory Scrutiny: Mistakes can trigger queries or notices from the MCA, requiring corrective filings and additional effort.

Best Practices to Mitigate Risks

- Maintain signed originals of Form 9 in the LLP’s records.

- Regularly check for updates in MCA rules and e-filing procedures.

- As per the LLP (Amendment) Rules, 2022, the MCA has made many forms, including Form 9, web-based, emphasizing accuracy during online filing.

When is Form 9 Not Required or Applicable?

Form 9 generally records the consent of designated partners, but certain situations and special cases may not require you to file it.

- No Change in Designated Partners

- If the individual is already a designated partner and there is no new appointment or cessation, a fresh Form 9 is not required.

- This avoids unnecessary filings for partners whose status remains unchanged.

- If the individual is already a designated partner and there is no new appointment or cessation, a fresh Form 9 is not required.

- Difference Between Form 9 and Form 4

- Form 9: Records the consent of the designated partner to act in the LLP.

- Form 4: Acts as a notice of appointment or cessation of a partner/designated partner.

- Form 9: Records the consent of the designated partner to act in the LLP.

Filing Form 4 alone does not substitute Form 9, unless the consent is already recorded.

Special Scenarios

In certain situations, the standard rules for filing Form 9 require clarification. These scenarios ensure that LLPs file the correct forms and record the consent of designated partners accurately, avoiding unnecessary compliance issues.

- Conversion of Partnership Firm into LLP

- Some resources suggest using Form 9 during conversion. However, the correct forms are Form 17 (Application for conversion) and Form 18 (Filing LLP agreement on conversion).

- Form 9 is not generally used for recording consent during conversion.

- Some resources suggest using Form 9 during conversion. However, the correct forms are Form 17 (Application for conversion) and Form 18 (Filing LLP agreement on conversion).

- Bodies Corporate as Nominee Designated Partners

- When a body corporate appoints a nominee as a designated partner, the individual nominee must still submit Form 9 to record their consent.

- This ensures that the MCA database accurately reflects the individual acting on behalf of the corporate entity.

- When a body corporate appoints a nominee as a designated partner, the individual nominee must still submit Form 9 to record their consent.

What is the Role of Service Providers and How Can RegisterKaro Help?

Filing Form 9 correctly is crucial for LLP compliance, but it involves several steps, from drafting the form to e-filing and maintaining records. Service providers like RegisterKaro can simplify this process, ensuring accuracy, timeliness, and adherence to MCA regulations.

- Drafting Form 9: We prepare Form 9 with all required details accurately, including DPIN/DIN, PAN, and partner information.

- Preparing the Consent of Designated Partner: Our team helps draft and obtain the signed consent of the designated partner in accordance with LLP rules.

- Verifying Eligibility: We check the eligibility of the designated partner under Section 7 of the LLP Act to prevent disqualification issues.

- E-Filing with MCA: RegisterKaro ensures error-free online submission of Form 9 along with any related forms (Form 4, Form 5) on the MCA portal.

- Maintaining Compliance Calendar: We track all deadlines for filing and regulatory compliance, helping the LLP avoid penalties and missed timelines.

Contact RegisterKaro today to ensure your LLP remains fully compliant with all statutory requirements.

Conclusion

Form 9 LLP is a critical compliance document that ensures every designated partner formally consents to act in the LLP and meets the eligibility requirements under the LLP Act, 2008. Timely and accurate filing of Form 9 LLP safeguards the LLP from legal disputes, regulatory penalties, and ensures smooth incorporation or partner addition processes. Maintaining proper records of Form 9 LLP is equally important for audits, inspections, and long-term compliance.

For stress-free and error-free filing of Form 9 LLP, professional services like RegisterKaro can assist in drafting the consent letter, verifying partner eligibility, and completing e-filing on the MCA portal.

Frequently Asked Questions

Form 9 LLP is mandatory for all designated partners to record their consent to act in the LLP. Without filing LLP Form 9, the MCA cannot officially recognize the partner. It is required both at LLP incorporation and for any subsequent appointment. Filing ensures compliance under the LLP Act. Always maintain a signed copy for internal records.