Did you know 9.19 crore people filed tax returns for the Assessment Year 2025-26? The tax office will issue an equal number of intimation notices after verifying every return to ensure that your return has been processed. This issuance is part of Intimation under Section 143(1) of the Income Tax Act.

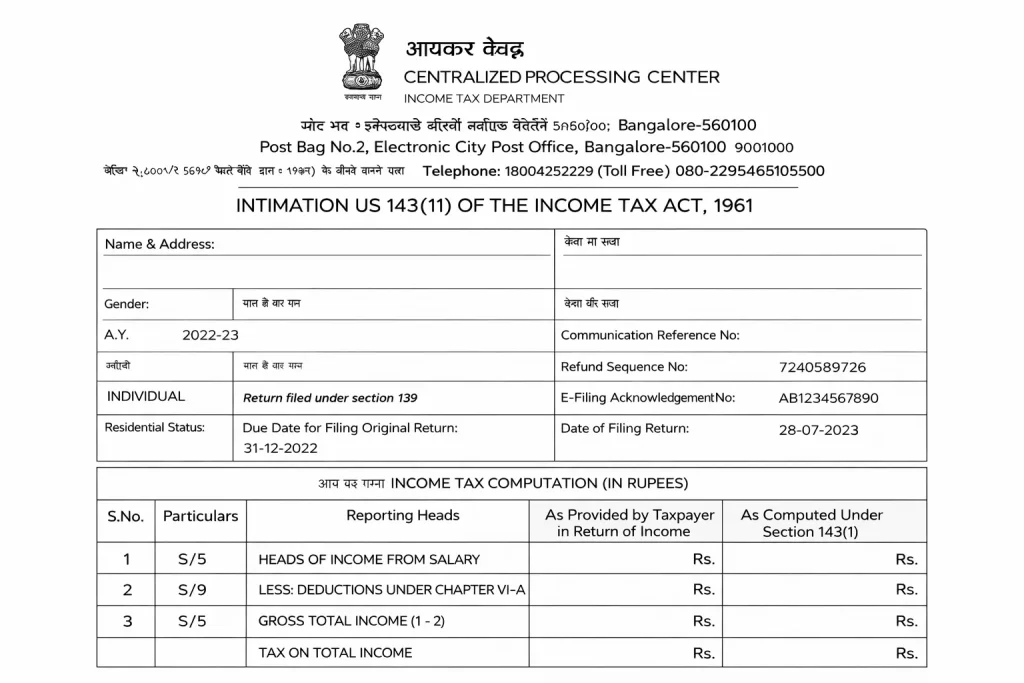

The Intimation under Section 143(1) provides a summary of the information submitted by the taxpayer and the details considered by the Income Tax Department while processing the return. The Intimation under Section 143(1) generally includes the following information:

- Tax calculations as declared in the filed Income Tax Return

- Refund sequence number, if applicable

- Taxpayer details such as name, PAN, and address

- Tax computed by the Income Tax Department under Section 143(1)

- Income tax return details, including the date of filing and acknowledgement number

So, if you have recently received a notice from the Income Tax Department, then no need to panic. These notices are just a routine confirmation. All you need to know is Section 143(1) of the Income Tax Act to handle the legal notices in the right way.

What is Section 143(1) of the Income Tax Act?

Section 143(1) of the Income Tax Act refers to the initial assessment that the tax department conducts on your return. This assessment happens automatically through computerized processing without manual intervention.

Key Aspects of Section 143(1) Intimation

- It flags any inconsistencies in your submitted information.

- It serves as the department’s first official communication.

- The system automatically verifies your calculations for accuracy.

The intimation under Section 143(1) means the department has completed its preliminary review and wishes to communicate its findings.

When Can You Get an Intimation Under Section 143(1) of the Income Tax Act?

When you receive an intimation under Section 143(1), it generally falls into one of these categories:

- Refund notification – Confirming your tax refund amount

- Demand notice – Requesting additional tax payment

- Adjustment notification – Informing you about modifications made to your declared figures

- Confirmation – Acknowledging your return has no discrepancies

This communication typically arrives within a few months after filing. It’s important to respond promptly to any notice under Section 143(1) to avoid penalties or additional scrutiny. It is communicated to the taxpayer via email on the registered email ID and is also made available on the income tax e-filing portal.

How to Access Your Intimation Notice Under Section 143(1)?

Here’s how to access your tax intimation notice:

1. Access Intimation Notice Via Email

- The tax department will send the notice to your registered email ID.

- You should also get an SMS alert about this email.

- The notice is a PDF attachment.

- To open it, use this password: your PAN in lowercase letters followed by your date of birth in DDMMYYYY format (e.g., abcde1234f01011990).

2. Access Intimation Notice From the Income Tax Portal

Visit the income tax website (incometax.gov.in) and log in with your credentials.

- Go to the ‘e-File‘ menu.

- Select ‘Income Tax Return‘.

- Then, click on ‘View Filed Returns‘.

- Choose the correct assessment year.

- Click on ‘Download Intimation Order‘ (or the acknowledgement number for that return).

- Use the same password (lowercase PAN + DDMMYYYY date of birth) to open the downloaded PDF.

Note: In case you’ve forgotten your password, select “Forgot Password.” You can regenerate a new password for the ITR file through your registered email or mobile number.

What to Check Before Replying to a Section 143(1) Intimation?

After accessing your intimation using your ITR password, examine it carefully. The notice under Section 143(1) of the Income Tax Act will indicate if any action is required.

If the department has raised a demand, you should:

- Verify their calculations thoroughly.

- Identify any differences between your records and their assessment.

- Check if they’ve adjusted your refund against previous liabilities.

- Ensure all income sources reported match with Form 26AS.

- Verify TDS Return credits have been properly reflected.

- Check for arithmetic errors in tax calculation.

- Review if any eligible deductions were missed or disallowed.

- Note the time limit (30 days) to respond if you disagree with the assessment.

- Submit your response with supporting documents if contesting the notice.

The tax department may adjust your refund if you have outstanding tax liabilities from previous assessment years.

What Happens If You Don’t Respond to Section 143(1) Intimation Within Time?

If you fail to respond to a Section 143(1) Income Tax Act notice within the 30-day timeframe:

- The tax department will consider the demand as valid and confirmed.

- You’ll be liable to pay the full demanded amount plus applicable interest.

- The department may initiate recovery proceedings to collect the outstanding tax.

- Your future refunds might get automatically adjusted against this demand.

- It could potentially trigger closer scrutiny of your returns in upcoming years.

Remember, ignoring a tax notice never makes it go away; it only complicates your tax situation further.

How to File a Response to Section 143(1) Income Tax Intimation?

To submit a response to the intimation notice:

- Log in to the Income Tax portal

- Go to “e-File” and select “Response to Outstanding Demand“.

- Select the relevant assessment year.

- Choose the appropriate response option: Agree with demand → Pay Now if unpaid, or Disagree with demand → Choose the specific reason(s) available.

- Provide necessary supporting documentation.

- Enter your remarks/explanation for disagreement.

- Verify details and submit.

- Download the Transaction ID for future tracking.

Keep your ITR intimation password accessible during this process. You’ll need it to reference details from your original tax return.

How to Track Your Response for Notice Under Section 143(1) of the Income Tax Act?

After submitting your response to a Section 143(1) Income Tax return, you can track its status:

- Log in to the Income Tax portal using your credentials.

- Go to the “Pending Actions” tab.

- Select “Response to Outstanding Demand”.

- Look for the “View Status” option next to your submitted response.

- The portal will show the current status (Processing, Accepted, Rejected, etc.)

- You can also check the “Demand Status” section to see if any amount remains outstanding.

The department typically processes responses within 30-60 days. Keep checking regularly, as the tax department doesn’t always send notifications about status changes.

Avoid Future Notices Under Section 143(1) of the Income Tax Act

To avoid receiving adjustment notices under Section 143(1) of the Income Tax Act:

- Verify all TDS/TCS credits before filing ITR returns.

- Report every income source accurately.

- Keep proper documentation for each claimed deduction.

- Reconcile Form 26AS with your income computation.

- Double-check all arithmetic calculations.

These practices significantly reduce discrepancies that trigger tax notices.

Facing problems in handling your 143(1) notice smoothly? We got you covered! Contact RegisterKaro and receive all answers to queries.

Conclusion

Understanding Section 143(1) of the Income Tax Act is fundamental for every taxpayer. The intimation is typically your first official correspondence after ITR filing. Maintain your password for the ITR file securely yet accessibly and respond promptly to any notice under Section 143(1) to avoid any future issues.

Frequently Asked Questions

If the Section 143(1) intimation confirms that your income, tax calculation, or refund amount matches what you filed, no action is required from your side. This means your return has been processed without any discrepancies. You should simply download the notice and keep it safely for future reference.