What is Section 43B of Income Tax Act?

Section 43B of the Income Tax Act regulates the timing of certain business expense deductions. It follows a “pay first, deduct later” approach, which contrasts with the regular accrual accounting method.

The fundamental principle is simple yet strict: businesses can claim deductions for specific expenses only while making payments, not when they record the liabilities in their books.

This provision aims to stop businesses from claiming tax benefits for unsettled liabilities, encouraging financial discipline, timely compliance, and preventing tax avoidance.

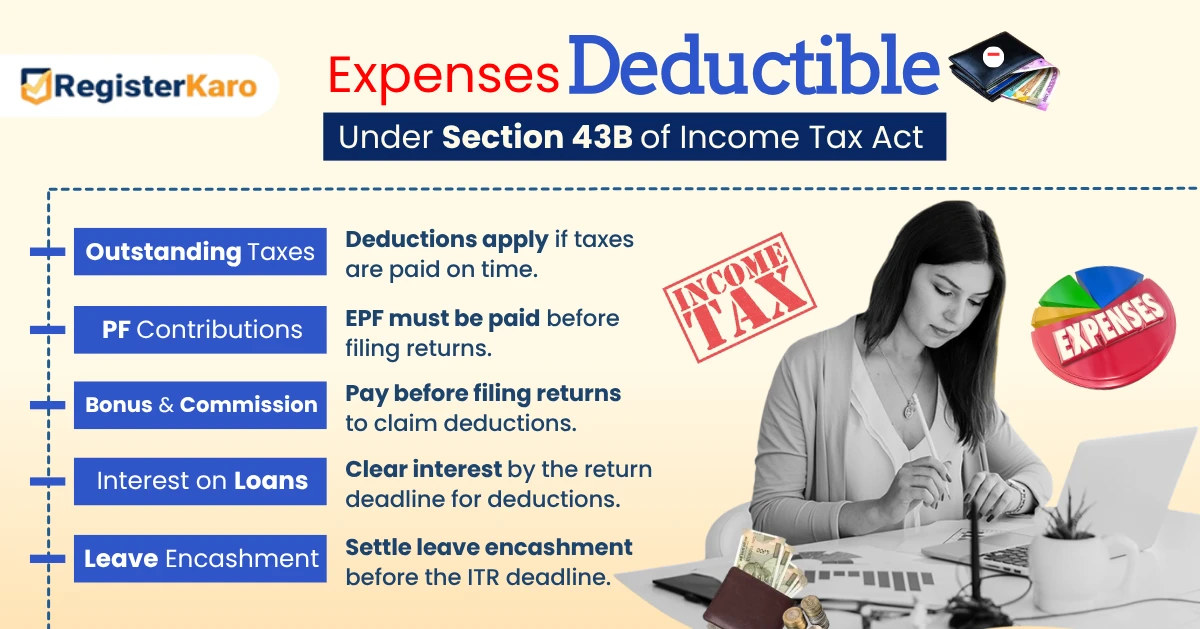

Expenses Allowed for Deduction Under Section 43B of Income Tax Act

Under Section 43B Income Tax Act following will be allowed as deductions if paid before the Income Tax Return filing:

Outstanding Taxes

The tax paid on GST, sales tax, and excise duties will qualify for a deduction when the business makes the payment on time.

Provident Fund Contributions

Employers must remit EPF contributions to the Employees’ Provident Fund Organization before filing their income tax return. If they pay after that date, then no deduction for that year.

Interest on Loans

Businesses must clear interest due to banks or financial institutions by the tax return due date. Paying late pushes the deduction into the year when the actual payment occurs.

Bonus and Commission

Companies must disburse all employee bonuses and commissions before filing their income tax return to secure the deduction.

Leave Encashment

Organizations must settle leave‑encashment liabilities with employees before the ITR deadline. Delaying payment invalidates the deduction for that financial year.

Understand Section 43B of Income Tax Act with Example

The examples below highlight the crucial timing aspects businesses must consider for tax planning.

Example 1: Tax Payment Timing

Company XYZ accrued Rs. 2,00,000 in GST liability for FY 2024-25. They record this expense in their books but don’t make the payment until May 2025.

- According to Section 43B of the Income Tax Act, XYZ cannot claim this Rs. 2,00,000 as a deduction in FY 2024-25.

- The deduction will only be allowed in FY 2025-26 when the actual payment is made.

Example 2: EPF Contributions

A company has monthly EPF contributions of Rs. 50,000. For March 2025, the company accrues this amount but pays it on April 20, 2025.

- Since the payment is made before the tax filing due date (July 31, 2025), the deduction will be allowed for FY 2024-25 under Section 43B of the Income Tax Act.

MSME Section 43B (h) Amendment Applicability and Relief

The government recognizes that MSMEs often face cash flow challenges, which led to a significant amendment in the MSME Section 43B (h). Some of the key reliefs include:

- For MSMEs, interest on loans from banks/financial institutions can be deducted when paid (instead of following the accrual basis).

- The MSME Section 43B provision gives small businesses flexibility when dealing with financial institutions.

The Section 43B MSME amendment applicability has been particularly helpful for small businesses managing cash flow during challenging economic periods.

Case Laws on Section 43B of Income Tax Act

Several important judicial decisions have shaped the interpretation of Section 43B:

Sulzer India Ltd vs. DCIT (ITAT Mumbai)

- In this case, Sulzer claimed accruals like bonus and leave pay under Section 43B even though it hadn’t paid them by year-end.

- ITAT ruled Section 43B applies only to expenses the law expressly lists, so Sulzer’s unlisted accruals got disallowed.

Excel Industries Ltd vs. CIT (Supreme Court)

- In this case, Excel Industries booked disputed liabilities (sales tax, excise) as provisions and sought Section 43B relief.

- The Supreme Court held that only liabilities that are finally determined and accepted qualify, so Excel must await settlement before deducting.

These case laws on Section 43B of Income Tax Act provide valuable guidance for businesses facing assessment challenges.

Expenses Disallowed Under Section 43B of Income Tax Act: Common Mistakes

Businesses frequently make mistakes in applying Section 43B, resulting in disallowed deductions:

Late Payments

The most common reason for expenses disallowed under Section 43B of Income Tax Act is simply paying after the tax filing deadline.

Improper Documentation

Failing to maintain proper payment evidence can lead to disallowance even if payments were made.

Conversion of Liability

Converting one form of liability to another (like converting unpaid tax to a loan) doesn’t qualify as payment under Section 43B.

How to Ensure Compliance with Section 43B of Income Tax?

To avoid surprise disallowances, you must proactively schedule and document every statutory payment before your ITR deadline.

- Track Liabilities Systematically: Implement a robust system to track all liabilities covered under Section 43B.

- Plan Cash Flows Accordingly: Align your cash flow planning to ensure timely payment of all statutory dues before the tax filing deadline.

- Maintain Proper Documentation: Keep comprehensive payment records with supporting documents like bank statements and receipts.

- Section 43B Amendment Updates: Stay informed about any new amendments that may affect your business.

Ready to stay 100% compliant? ☎️ Contact RegisterKaro today for end-to-end support on tax deduction and never miss a deadline.

Conclusion

Section 43B of the Income Tax Act serves as a critical control mechanism, ensuring businesses don’t claim tax benefits for unpaid liabilities. By understanding Section 43B thoroughly, businesses can better plan their cash flows and tax strategies.

Frequently Asked Questions

A: You must pay on or before your ITR due date that falls on July 31 of the assessment year.