Air travel has become essential for millions of Indians today. However, many passengers remain confused about GST on flight tickets and how it affects their travel costs. Understanding these tax implications helps you make informed decisions while booking flights.

The Goods and Services Tax significantly impacts airline pricing and passenger expenses. Different rates apply to domestic and international flights, creating varying cost structures.

This comprehensive guide explains everything you need to know about GST registration on flight tickets and their practical implications.

What is GST on Flight Tickets?

GST on flight tickets represents the tax levied on air transportation services in India. The government introduced this unified tax system to replace multiple indirect taxes. Airlines must collect this tax from passengers and remit it to the government.

The tax structure varies based on flight type, destination, and service category. Understanding how much GST on flight tickets applies helps passengers budget their travel expenses effectively. Airlines incorporate this tax into ticket prices, making it invisible to many travelers.

Discover how GST applies differently to domestic and international flights. Contact RegisterKaro for easy compliance guidance today!

GST Rates on Domestic Flight Tickets

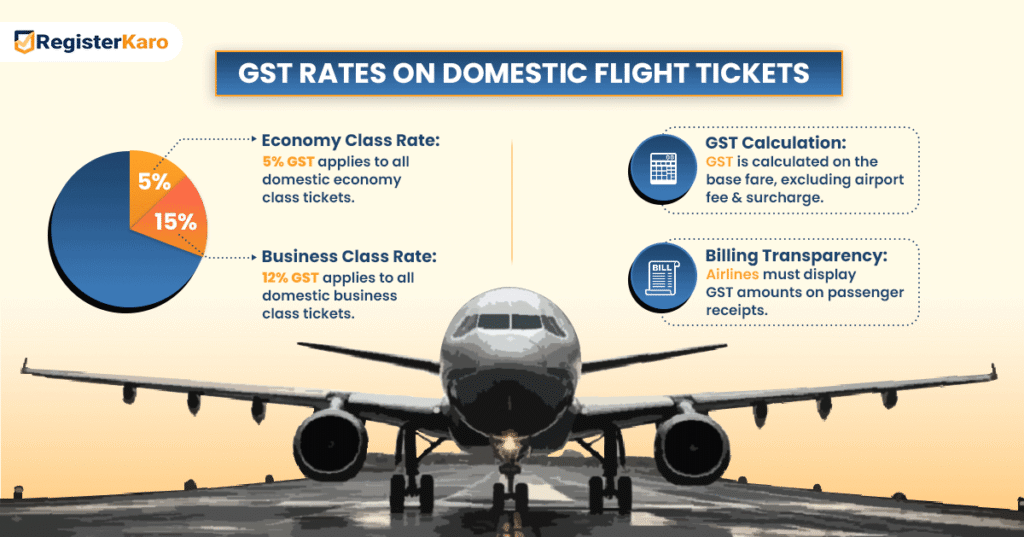

GST rates and rules apply uniformly to all domestic flights within India, regardless of the distance or airline operator. The following are the rates:

- Economy Class GST Rate: Domestic economy class flight tickets are subject to a 5% GST, applicable uniformly across all routes and airlines in India.

- Business Class GST Rate: Business class tickets on domestic flights attract a higher GST rate of 12%, consistent nationwide.

- GST Calculation Basis: GST is calculated on the base fare of the ticket, excluding additional charges such as airport fees and other surcharges.

- Transparency in Billing: Airlines are required to display the GST amount on passenger receipts, ensuring transparency and helping travelers understand their total tax liability.

GST on International Flight Tickets

Understanding these GST rules helps travelers accurately calculate total travel costs and ensures compliance with tax regulations.

- Economy Class GST Rate: International economy class tickets departing from India attract a 5% GST.

- Business Class GST Rate: Business and first-class international tickets from India are taxed at 12% GST.

- Tax Applies to Indian Leg Only: GST is levied solely on the portion of the journey within India; international segments beyond Indian borders are not taxed under Indian GST.

- Round-Trip Taxation: For round-trip tickets, GST is applied only to the outbound leg from India; the return leg is not subject to Indian GST.

- Complex Itineraries: Transit passengers and multi-city international itineraries may encounter varying GST implications, depending on the journey’s structure and points of departure.

Comparison of Pre & Post GST

The Goods and Services Tax (GST), implemented in India on July 1, 2017, revolutionized the indirect tax structure by replacing a complex web of central and state taxes with a unified tax system. One of the most debated aspects of GST has been its impact on prices across various sectors.

Here’s a comparative analysis of prices before and after the introduction of GST.

1. Pre-GST Tax Structure

Before GST, the tax system involved multiple indirect taxes such as:

- Central Excise Duty

- Service Tax

- Value Added Tax (VAT)

- Central Sales Tax (CST)

- Octroi, Entry Tax, Luxury Tax, etc.

2. Post-GST Tax Structure

GST subsumed most indirect taxes and brought a destination-based, multi-stage tax levied at every point of supply. The cascading effect was eliminated, and the input tax credit (ITC) mechanism allowed businesses to claim credit for taxes paid on inputs.

GST is levied under five major slabs: 0%, 5%, 12%, 18%, and 28%.

3. Sector-wise Price Comparison

| Category | Pre-GST Tax Rate | Post-GST Rate | Price Impact |

| FMCG Products | 22% – 25% (Excise + VAT) | 18% | Slightly Reduced |

| Restaurant Bills | 20.5% (Service Tax + VAT) | 5% or 18% | Reduced (non-AC) |

| Automobiles | 26% – 45% | 18% or 28% + Cess | Mostly Reduced |

| Mobile Phones | 13.5% – 15.5% | 12% | Reduced |

| Luxury Goods | 30% – 40% | 28% + Cess | Unchanged/Increased |

| Cinemas/Entertainment | 35% – 50% | 18% or 28% | Reduced in most states |

| Real Estate | 5% or 12% (on under-construction) | Earlier VAT + Service Tax | Simplified but Mixed Impact |

There is a difference between VAT and GST, where each of these taxes is levied at different stages, manufacturing, sale, or provision of service, resulting in tax-on-tax (cascading effect), which inflates prices.

4. Benefits of GST on Pricing

- Removal of the cascading tax effect reduced the cost of inputs.

- Increased transparency in pricing.

- Boost to logistics efficiency due to uniform tax rates across states, reducing transportation costs.

5. Concerns and Challenges

- Some sectors like real estate, petroleum, and alcohol were kept out of GST’s ambit, creating partial inefficiencies.

- Initial compliance costs for businesses increased due to the need for tech integration.

- Confusion due to frequent changes in rates and rules affected price stability temporarily.

Key Differences Between Domestic and International GST

Understanding these distinctions is crucial for travelers to accurately calculate total travel costs, ensure compliance with tax regulations, and claim eligible expenses.

Here is a comparative table highlighting the key differences in GST application between domestic and international flight tickets in India:

| Aspect | Domestic Flights | International Flights |

| Tax Application Scope | GST applies to the entire journey within India. | GST applies only to the portion of the journey within Indian territory. |

| GST Rates | Economy Class: 5%Business Class: 12% | Economy Class: 5%Business Class: 12% |

| Calculation Method | GST is calculated on the base fare, excluding airport fees and other charges. | GST is calculated only on the Indian leg of the journey; international segments beyond Indian borders are not taxed under Indian GST. |

| Uniformity Across Routes | GST rates are consistent across all Indian airports and airline operators. | GST applicability may vary based on the journey’s structure, especially for multi-city or transit itineraries. |

| Documentation Requirements | Standard GST invoice is provided; no additional compliance needed for domestic travel. | Additional documentation may be required for claiming Input Tax Credit (ITC) on international travel expenses. |

How to Calculate GST on Flight Tickets

The calculate GST rates on flight tickets, the following are the steps:

1: Identify the Base Fare

- The base fare is the ticket price before any taxes or additional fees are added. This is the amount on which GST is calculated.

2: Determine the Applicable GST Rate

- For economy class (domestic or international): GST rate is 5%.

- For business class (domestic or international): GST rate is 12%.

3: Calculate the GST Amount

- Multiply the base fare by the applicable GST rate:

- For economy: GST = Base Fare × 5%

- For business: GST = Base Fare × 12%

- For economy: GST = Base Fare × 5%

- Example: If the base fare of an economy class ticket is ₹10,000, GST = ₹10,000 × 5% = ₹500.

4: Add GST to the Base Fare

- The total ticket price shown to the passenger usually includes GST, but the breakdown is visible on the final receipt.

5: For Tickets with Multiple Segments calculation

- If your ticket includes multiple segments or fare components (like fuel surcharge, passenger service fees, etc.), GST is typically applied only to the base fare, not to government-imposed fees or airport charges.

6: Verify GST on Your Ticket

- Airlines provide a detailed breakdown of the fare and GST on the ticket receipt. Check this to ensure the GST has been calculated correctly.

7: Claiming Input Tax Credit for businesses (ITC)

- If the travel is for business purposes, provide your GST number during booking.

- Obtain a GST-compliant invoice from the airline.

- Use this invoice to claim ITC in your GST returns.

Calculation

Suppose you purchase a domestic economy ticket with a base fare of ₹10,000:

- GST = ₹10,000 × 5% = ₹500

- Total fare (excluding other charges) = ₹10,000 + ₹500 = ₹10,500

To calculate the GST amount included in a total fare, you can use the following formula:

GST Amount = (Total Fare) ÷ (1 + GST Rate) × GST Rate

For a GST-inclusive fare of ₹10,500 with a GST rate of 5%:

GST Amount = ₹10,500 ÷ 1.05 × 0.05 = ₹500

This means that ₹500 of the ₹10,500 fare is the GST component.

This calculation is particularly useful for businesses aiming to determine the Input Tax Credit (ITC) on travel expenses.

Who Can Claim ITC on Flight Ticket Fares?

Under India’s Goods and Services Tax (GST) framework, businesses can claim Input Tax Credit (ITC) on flight tickets, provided certain conditions are met:

- Business Purpose Travel: The travel must be for business purposes. Personal travel expenses, including those for employee vacations or home travel concessions, are not eligible for ITC.

- GST-Compliant Invoice: A GST-compliant invoice must be obtained from the airline or travel agent. This invoice should include the company’s GST Identification Number (GSTIN) and be issued in the company’s name.

- Proper Documentation: Maintain records such as boarding passes, payment receipts, and travel itineraries to substantiate the business nature of the travel.

- Booking Through Registered Entities: When booking through travel agents, ensure they are GST-registered and provide proper invoices, as businesses can claim ITC on both the airline fare and the agent’s service fees.

By adhering to these guidelines, businesses can effectively claim ITC on flight ticket fares, thereby reducing their overall tax liability.

Challenges in Claiming ITC on Flight Tickets

Claiming Input Tax Credit (ITC) on flight tickets under India’s Goods and Services Tax (GST) regime offers significant benefits for businesses, such as reducing overall tax liability and promoting transparency in airline pricing. However, several challenges can impede the seamless availing of these benefits.

Challenges in Claiming ITC on Flight Tickets

- Complex Fare Structures: Airfares often comprise various components like base fare, surcharges, and fees, each potentially attracting different GST rates. This complexity can make it challenging to calculate the exact GST applicable and, consequently, the correct ITC claim.

- Inconsistent Application Across Airlines: Different airlines may have varied approaches to integrating GST into their pricing structures. Such inconsistencies can lead to discrepancies between advertised and final ticket prices, complicating ITC claims.

- Documentation and Compliance Requirements: To claim ITC, businesses must ensure that flight bookings are made in the company’s name, providing the correct GST Identification Number (GSTIN) at the time of booking. Failure to obtain GST-compliant invoices or e-tickets can result in the denial of ITC benefits.

- Restrictions on Personal Travel: ITC is only claimable for travel expenses incurred strictly for business purposes. Travel undertaken for personal reasons, including employee vacations or home travel concessions, does not qualify for ITC, even if booked through the company.

- Issues with Cancelled Tickets: There have been instances where airlines collected GST on tickets that were later cancelled but did not remit the tax to the authorities. Businesses claiming ITC on such tickets may face scrutiny, as the tax was never actually paid to the government.

- Requirement for Accurate Data Submission: Businesses must provide accurate GSTIN details during booking to ensure that the airline issues a GST-compliant invoice. Inaccuracies or omissions can lead to complications in claiming ITC.

GST Benefits on Flight Tickets

GST benefits on flight tickets primarily apply to business entities and registered taxpayers. Input tax credit reduces the overall tax burden for eligible businesses. This system promotes transparency in airline pricing.

Unified taxation eliminates the complexity of multiple taxes previously applicable. GST benefits on flight tickets include simplified compliance and reduced tax cascading effects. Airlines also benefit from streamlined tax administration.

The digital tax system enables better tracking and compliance monitoring. This transparency benefits both airlines and government revenue collection.

Impact of Flight Cancellation on GST

The consequence of flight ticket cancellation on GST involves proportional GST reversal and impacts both passenger refunds and airline tax compliance.

- When a flight ticket is canceled, the GST component must be adjusted based on the refund amount.

- For a full refund, the entire GST amount is reversed by the airline, and Input Tax Credit (ITC) cannot be claimed by the business.

- For a partial refund or non-refundable tickets, GST is reversed only on the refunded portion, and ITC can be claimed on the non-refunded GST amount.

- Airlines must ensure GST returns are updated to reflect these reversals for compliance.

- The process of GST adjustment can delay the overall refund timeline for passengers.

- Proper documentation, including invoices and cancellation communication, is essential for businesses to claim or adjust ITC.

- If a flight is rescheduled and the fare difference is minimal, GST adjustment may not be required; however, significant fare changes trigger fresh GST calculations.

- GST is also applicable on cancellation charges, and the rate matches the original booking class (5% for economy, 12% for business).

- Airlines must provide GST-compliant invoices for both ticket and cancellation charges to ensure transparency and facilitate ITC claims.

Tips for Passengers

Smart travelers should always verify GST details on flight bookings to ensure accurate budgeting and maximize potential business tax benefits.

- Always check the GST amount on your flight ticket in the booking confirmation to avoid hidden costs.

- Compare total fares, including GST, when choosing flights across different airlines for a true cost comparison.

- Review airline websites for a clear fare breakdown, ensuring GST components are transparently listed.

- For business travelers, maintain GST-compliant invoices and proper documentation to support Input Tax Credit (ITC) claims.

- Provide your business GST number during booking to receive a valid GST invoice from the airline or travel agent.

- Booking through GST-registered travel agents can help you obtain detailed GST invoices, essential for business expenses and tax planning.

- Understanding the applicable GST rate (5% for economy, 12% for business class) helps in accurate travel budget planning.

- Consider GST implications when comparing domestic versus international routes, as rates and ITC eligibility may differ.

- Proper GST documentation not only aids in tax compliance but also streamlines business expense management.

Save on GST for Flight Bookings. Learn the GST implications on domestic vs. international flight tickets with Registerkaro. Start your GST registration.

Conclusion

GST on flight tickets significantly impacts both passengers and airlines in India’s aviation sector. The unified tax system brought transparency but added complexity to airline operations. Passengers benefit from clearer pricing while airlines gain from simplified tax administration.

GST on flight tickets will continue evolving as the government refines regulations. The aviation industry’s growth depends partly on balanced tax policies that encourage travel while generating government revenue. GST on flight tickets represents this balance in India’s tax framework.

Frequently Asked Questions

Domestic economy flight tickets attract 5% GST on the base fare. This rate applies uniformly across all Indian domestic routes regardless of airline or distance.