Did you know? Over 15 lakh Indian companies file compliance forms annually, but one stands out as the corporate transparency game-changer: the MGT 14 form! MGT-14 is one of the most important compliance forms for Indian companies. Both private and public companies need to file this form whenever they approve major resolutions. It helps the government track important changes transparently.

If you skip the MGT 14 deadline and face fines starting at Rs. 10,000, that keep growing! Smart business owners file on time to avoid trouble and stay compliant.

What is the MGT 14? Meaning & Full Form

MGT-14 is an e-form filed with the Registrar of Companies (ROC) to report specific resolutions passed at board meetings or general meetings. This online form provides a conduit between companies and regulatory bodies to make corporate governance transparent.

The form ensures transparency by updating the Ministry of Corporate Affairs about major decisions taken by the company. The form maintains public records of critical corporate actions and helps regulatory bodies monitor company activities effectively.

Form MGT 14 Purpose

The MGT 14 form’s purpose centres on maintaining transparency and regulatory compliance. Companies file this form to:

- Notify ROC about special resolutions

- Report board resolutions required by law

- Record changes in the company structure or operations

- Maintain transparency under the Companies Act

- Update public records used by investors and creditors

MGT-14 ensures that major company decisions remain traceable and compliant with MCA regulations.

MGT-14: Applicable Law and Legal Provisions

The MGT 14 form derives its legal foundation from several provisions of the Companies Act, 2013, and related rules:

1. Section 117 – Filing Resolutions with ROC

According to Section 117 of the Companies Act, 2013, companies must file specific resolutions and agreements with the ROC. This includes special resolutions and other decisions that must be reported for legal compliance.

2. Section 179(3) – Board Resolutions That Must Be Filed

Section 179(3) of the Companies Act, 2013 lists powers of the Board of Directors that must be exercised through board resolutions, such as borrowing funds, investing funds, or approving financial statements.

3. Rule 24 – Companies (Management and Administration Rules), 2014

Rule 24 requires companies to file the MGT-14 form within 30 days of passing specified board or special resolutions, along with a certified true copy, as per the Companies Act, 2013.

Types of Resolutions for Filing Form MGT 14

Companies are required to file the MGT 14 form for different types of resolutions. Each type carries specific approval thresholds and serves distinct purposes. Such as:

1. Ordinary Resolutions

Ordinary resolutions are used to address routine business decisions related to the day-to-day functioning of the company.

To pass an ordinary resolution:

- At least 50% of the board members must approve it.

- A simple majority of the shareholders must also support it.

Companies typically use ordinary resolutions for decisions such as:

- Approving financial accounts

- Appointing auditors

- Declaring dividends

- Routine appointments or operational matters

These resolutions ensure smooth governance without requiring a high threshold of approval.

2. Special Resolutions

Special resolutions are necessary when the company intends to make substantial changes or decisions with long-term impact. These resolutions require a higher level of agreement due to the significance of the matters involved.

To pass a special resolution:

- At least 75% of the board members must approve it.

- A three-fourths majority of shareholders must also agree.

Situations that require a special resolution(As per Section 117(3)(a) of the Companies Act):

- Amending the Memorandum of Association (MOA)

- Altering the Articles of Association (AOA)

- Changing the registered office from one state to another

- Conducting a private placement of securities

- Initiating a buy-back of shares

- Reducing the company’s share capital

These decisions often have long-term implications for the company’s structure, strategy, or legal standing.

3. Written Resolutions

A written resolution allows the company to make formal decisions without holding a physical board or shareholder meeting. This method offers flexibility and efficiency, especially when urgent decisions are required.

To approve a written resolution:

- At least 75% of the board members must support the decision.

- All members or shareholders involved must sign the resolution.

However, written resolutions must be accompanied by specific annexures when submitted to regulatory authorities to ensure legal compliance and transparency:

- Annexure A is mandatory for all Board Resolutions.

- Annexure B must be attached to every Special Resolution.

- Annexure C is required alongside all Ordinary Resolutions.

4. Board Resolutions Specific to Public Companies

Public companies must pass board resolutions for several critical business operations as required under Section 179(3) of the Companies Act. These decisions require formal board approval, often documented in board meetings.

Such resolutions cover:

- Making calls for unpaid share capital from shareholders

- Authorizing buy-back of securities under Section 68

- Issuing securities, including debentures

- Borrowing funds beyond prescribed limits

- Investing corporate funds in other ventures or instruments

- Granting loans or issuing guarantees

- Approving the company’s financial statements and board reports

- Deciding on business diversification strategies

- Approving amalgamations, mergers, or reconstructions

- Acquiring controlling interests in other entities.

Each of these requires a formal resolution to safeguard accountability and ensure strategic alignment.

5. Other Specified Resolutions

Some decisions require special resolution treatment by nature or statutory mandate, even if they are passed unanimously. These include:

- Unanimous member resolutions that the act deems equivalent to special resolutions.

- Appointment or reappointment of a Managing Director.

- Changes to the terms and conditions of a Managing Director’s employment.

- Entering into specific agreements as prescribed under the Companies Act.

Such resolutions demand careful consideration, higher approval thresholds, and proper documentation.

MGT-14 Form Applicability for Public & Private Companies

The MGT 14 form applicability varies between company types:

1. Public Companies

Public limited companies must file for:

- All special resolutions passed in general meetings

- Board resolutions listed under Section 179(3), including:

- Borrowing funds

- Investing company funds

- Granting loans or giving guarantees

- Approving financial statements

- Appointing or removing Key Managerial Personnel (KMP)

- Borrowing funds

2. Private Companies

Private limited companies must file MGT-14 for:

- All special resolutions passed by shareholders

- Some board resolutions, unless exempted under specific conditions

Exemptions for Private Companies

Private companies are exempt from filing MGT-14 for board resolutions under Section 179(3)(g) if they meet all the following conditions:

- It is not a subsidiary of a public company

- It has no filing defaults

- It qualifies under MCA notification G.S.R. 464(E)

Important: These exemptions are not fixed. Companies must regularly check updates issued by the Ministry of Corporate Affairs (MCA) to stay compliant.

When Do Companies Need to File MGT-14?

Companies must file the MGT 14 form immediately after passing any resolution specified under Section 117(3) of the Companies Act, 2013.

Specific scenarios requiring MGT 14 filing include:

- Passing special resolutions in general meetings

- Board resolutions covered under Section 179(3) for public companies

- Entering into agreements specified under Section 117(3)

- Making structural changes to the company

- Authorizing significant financial transactions.

Due Date for Filing MGT 14

The MGT 14 form must reach the Registrar of Companies within 30 days from the date of passing the resolution or making the agreement. This timeline applies universally regardless of company type or resolution category.

Late filing attracts additional fees as prescribed in the Companies (Registration Offices and Fees) Rules, 2014. The 30 days are calculated from the resolution date, not the meeting date.

MGT-14 Filing Fees

The MCA form MGT-14 filing fee depends on the company’s authorized share capital:

| Authorized Share Capital | Normal Fee (INR) |

| Less than Rs 1,00,000 | Rs. 200 |

| Rs.1,00,000 to Rs.4,99,999 | Rs. 300 |

| Rs.5,00,000 to Rs.24,99,999 | Rs. 400 |

| Rs.25,00,000 to Rs.99,99,999 | Rs. 500 |

| Rs 1,00,00,000 or more | Rs. 600 |

Additional Fees for Late Filing:

| Period of Delay | Additional Fee Requirement |

| Up to 15 days | 1 time normal fees |

| 16 to 30 days | 2 times the normal fees |

| 31 to 60 days | 4 times the normal fees |

| 61 to 90 days | 6 times the normal fees |

| 91 to 180 days | 10 times the normal fees |

| 181 to 270 days | 12 times the normal fees |

It is essential to file on time to avoid heavy penalties and ensure compliance with MCA regulations.

MGT 14 Penalties for Non-Compliance

Non-filing or late filing of the MGT 14 form attracts penalties under Section 117(2):

| Defaulting Party | Penalty Structure |

| Company | Rs. 10,000 initial penalty + Rs. 100 per day for continuing failure (Maximum: Rs 2,00,000) |

| Officer in Default | Rs. 10,000 initial penalty + Rs. 100 per day for continuing failure (Maximum: Rs 50,000) |

The penalty calculation begins from the 31st day after the resolution date. Both the company and the responsible officers face separate penalty proceedings.

Documents Required for Form MGT-14

Filing the MGT 14 form requires several supporting documents:

Mandatory Attachments:

- Certified true copy of the resolution(s) passed

- Explanatory statement under Section 102 (for special resolutions)

- Notice of the meeting

- Minutes extract where the resolution appears

Additional Documents (where applicable):

- Altered MOA or AOA copies

- Agreement copies (if the filing relates to agreements)

- Board meeting attendance record

- Proxy forms and voting details

- Any other relevant supporting documents

All documents must be self-attested by the authorized signatory and uploaded in PDF format.

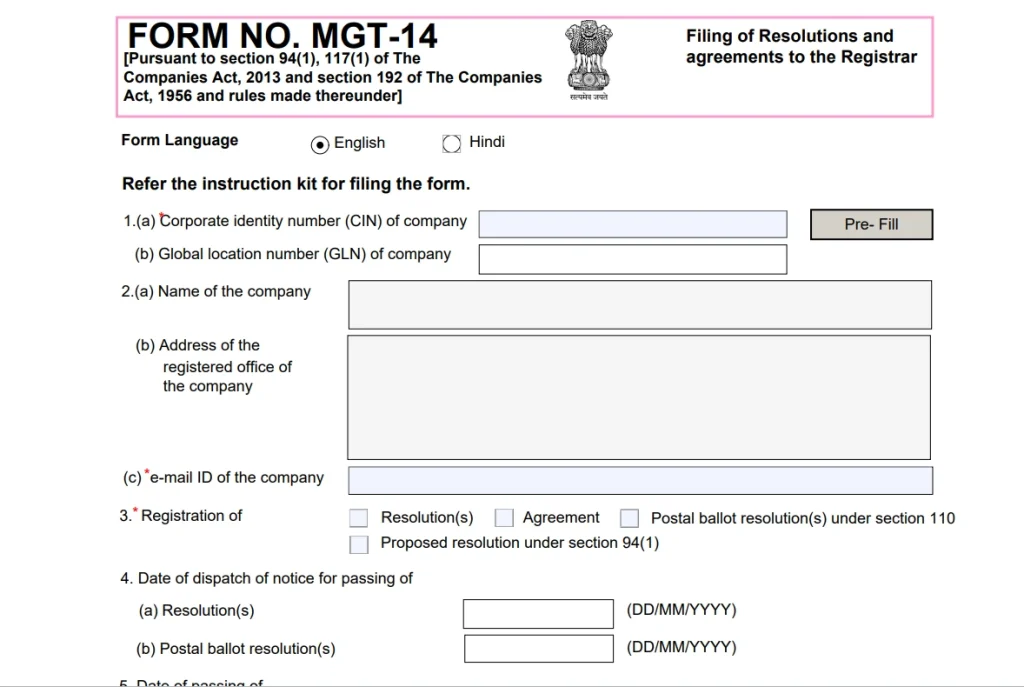

Details Required for Filing MGT 14 Form

The form requires comprehensive information:

Basic Company Details:

- Corporate Identification Number (CIN)

- Registered office address

- Email and telephone contact

Meeting Information:

- Meeting type and date

- Notice the dispatch date

- Quorum details

- Chairman information

Resolution Specifics:

- Resolution number and date

- Resolution type classification

- Complete resolution text

- Voting details and results

Supporting Form References:

- Service Request Number of related forms (like INC-28 for condonation)

- Cross-references to other compliance filings.

How to File MGT-14 Form on MCA (Step-by-Step)

Follow these steps to file the MGT 14 form:

Step 1: Download the Form and Fill in the Details

Download MGT 14 from the official MCA website (mca.gov.in) under the Company Forms section. Complete all mandatory fields in the e-form MGT 14, including company information, resolution details, and meeting specifics.

Step 2: Attach Documents and Do a Pre-scrutiny Check

Upload scanned copies of all required documents in PDF format, ensuring clear readability and proper file sizes. Use the pre-scrutiny feature to identify and correct basic errors before final submission.

Step 3: Apply DSC for Online Submission

Apply the Digital Signature Certificate (DSC) of the authorized director or company secretary. Log in to the MCA portal using authorized credentials and complete the online submission.

Step 4: Complete Fee Payment & Receive SRN

Pay applicable fees through the online payment gateway using net banking, debit card, or credit card. Receive the Service Request Number (SRN) for tracking submission status and future reference.

How to Download MGT Form 14 Online

To get the MGT 14 form, follow these steps:

- Visit the official MCA website at www.mca.gov.in

- Go to ‘MCA Services’ in the main menu

- Click on ‘Company Forms Download’

- Search for ‘MGT-14’ in the form list

- Download the latest version in PDF format

- Save the form on your computer for completion

The form MGT 14 is available free of charge from the official MCA portal. Always ensure you download the most recent version to avoid submission issues.

Procedure for Condonation of Delay in Filing Form MGT-14

When the MGT 14 form filing exceeds 300 days from the resolution date, companies cannot file directly. Follow this procedure:

1: Apply for the Condonation File

Form CG-1 with the Regional Director requesting condonation of the delay. Include detailed reasons for the delay and supporting documents.

2: Pay Prescribed Penalty

Pay the penalty amount as determined by the Regional Director. The penalty varies based on delay duration and company circumstances.

3: Obtain Condonation Order

The Regional Director will review the application and issue a condonation order if satisfied with the reasons provided.

4: File Form INC-28

Submit Form INC-28 with the ROC within the timeline specified in the condonation order, attaching the condonation order copy.

5: File Form MGT 14

After INC-28 approval, file the MGT 14 form mentioning the approved INC-28 SRN in the relevant field.

This process requires professional assistance due to its complexity and potential legal implications.

Common Mistakes to Avoid While Filing MGT-14

Avoid these frequent errors when filing the form:

Common Filing Errors:

- Filing unnecessary resolutions or missing mandatory ones due to misclassification or misunderstanding of exemptions for private companies.

Form and Document Issues:

- Entering incorrect details such as Corporate Identification Number (CIN), dates, or incomplete fields.

- Submitting mismatched resolution texts, missing certified copies, unsigned, illegible, or improperly formatted documents.

Technical and Compliance Mistakes:

- Late filing without proper fees, using expired digital signatures, skipping pre-submission checks, and misunderstanding form requirements or exemptions.

Careful attention to these details ensures smooth MGT 14 form processing and prevents costly rejections or penalties.

Need Expert Help with Form MGT-14 Filing? Connect with RegisterKaro today for reliable, accurate, and timely assistance in filing Form MGT-14.

Frequently Asked Questions

Companies file Form MGT-14 primarily to inform the Registrar of Companies (ROC) about specific resolutions they have passed. This action promotes transparency and keeps the ROC updated on significant corporate decisions and structural changes within the company. It forms a crucial part of regulatory compliance.