Form ADT-3 allows an auditor to notify the RoC when they resign or need to submit a statement under Section 140(2) of the Companies Act, 2013. It formally informs the regulator of the auditor’s exit and the reasons behind it, helping maintain transparency and updated audit records.

Filing this form is not just a formality. It is legally required under the Companies Act, 2013. If a company skips it:

- Authorities may mark the auditor’s appointment as invalid.

- The company and its officers can face penalties.

- Stakeholders may lose trust in the company’s financial reports.

Recent update: The revised ADT-3 form, effective from 14 July 2025, comes with important changes:

- The form is now a web-based e-form on the MCA V3 portal.

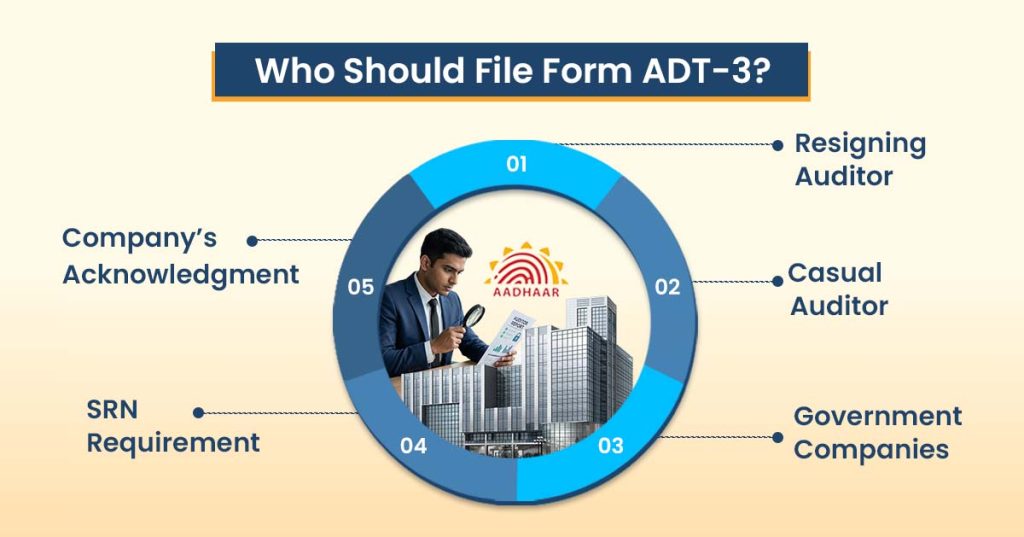

- You must include the Service Request Number (SRN) of the original ADT-1 form.

In this blog, we will explain everything you need to know about Form ADT-3, step by step.

Purpose and Legal Framework Behind Form ADT-3

The ADT-3 form’s purpose is to maintain transparency by officially notifying the RoC whenever an auditor resigns or submits a statement under Section 140(2). Filing this form ensures proper auditor resignation compliance in India. In this section, we discuss the statutory provisions, rules, and recent MCA updates that every company must follow.

1. Relevant Statutory Provisions

The law specifies how companies must appoint, re-appoint, or accept the resignation of auditors. Understanding this helps avoid fines and mistakes.

- Section 140 of the Companies Act, 2013 states that an auditor must file a statement explaining their resignation.

- Section 140(3) says that companies and auditors who do not comply can face penalties.

These provisions ensure that companies officially record and track the auditor’s actions.

2. Rules under Companies (Audit and Auditors) Rules, 2014

The Companies (Audit and Auditors) Rules, 2014, give step-by-step guidance for auditor-related filings.

- Rule 8: Requires companies to file Form ADT-3 whenever an auditor is appointed, re-appointed, or resigns.

This rule makes filing the ADT-3 form mandatory, helping companies maintain transparency and accountability. Filing it correctly avoids legal trouble and keeps records updated.

3. MCA’s 2025 Amendment

The Ministry of Corporate Affairs made some important updates to make filings easier and more transparent.

- E-form update: All ADT-3 filings are now web-based on the MCA V3 portal (mca.gov.in).

- Mandatory SRN: Companies must include the Service Request Number (SRN) of the original ADT-1 form to link the auditor appointment and resignation.

These changes make it easier to track auditor appointments and ensure compliance. Using the ADT-3 form from MCA correctly links both the appointment and resignation records.

When and Who Should File Form ADT-3?

Filing at the right time keeps the company compliant and avoids penalties. In this section, we explain the reasons for auditor resignation, responsibility for filing, timelines, and special cases.

1. Reasons for Auditor Resignation: An auditor may need to resign for several reasons. Some common ones are:

- Personal reasons or health issues.

- Conflicts of interest with the company.

- Disagreement over accounting practices or financial reporting.

Filing Form ADT-3 ensures the resignation is officially recorded and linked to the auditor’s appointment.

2. Responsibility for Filing: The resigning auditor is responsible for filing the ADT-3 form MCA with the Registrar of Companies (RoC). This makes sure the resignation is legally recognized and avoids any future disputes.

3. Time Limit for Filing: The law sets a strict timeline for filing 30 days from the date of resignation to submit Form ADT-3. Filing within this period is crucial to avoid penalties for both the auditor and the company.

4. Special Cases: Government Companies: In government companies or companies involving the Comptroller and Auditor General (CAG):

- Additional rules may apply for auditor resignation.

- Filing Form ADT-3 must follow these extra guidelines to remain compliant.

How to File ADT-3: Step-by-Step Filing Process

Form ADT-3 can be filed easily when you follow a clear and structured process. The MCA offers two filing options: downloading the ADT-3 form or using the web-based e-filing system to quickly notify the government about an auditor’s resignation or required statement.

Next, we will go through each step clearly so you can file without mistakes:

Step 1: Get the Form

Using the web-based e-form on the MCA V3 portal (mca.gov.in) is faster and reduces errors, so it is recommended.

- Downloadable form: Fill offline, then submit online

- E-filing: Fill and submit directly on the MCA portal

Step 2: Fill in Company and Auditor Details

Accurate details are important for compliance and linking the resignation or appointment correctly.

- Corporate Identity Number (CIN) of the company

- Company details: Name, registered address, email

- Category of auditor: Individual or firm

- PAN of the auditor or firm

- Membership/registration number

- Auditor’s contact details: Address, city, state, pin, email

Step 3: Provide Reasons for Resignation

Giving clear reasons ensures the government and company have proper records of the resignation.

- Include the reason for resignation

- Add “other relevant facts” if needed

- Mention whether the resignation letter is attached (Yes/No)

CARO Impact: During a change of auditor, ensure resignation does not affect pending CARO reporting. Proper handover prevents compliance issues or incomplete disclosures.

Step 4: Attach Required Documents

Make sure you attach both mandatory and optional documents to ensure smooth filing of Form ADT-3.

Mandatory Documents:

- Auditor’s resignation letter (if any)

- Copy of Board Resolution approving the auditor’s resignation (if applicable)

- Proof of Service Request Number (SRN) of original ADT-1 (to link appointment and resignation)

Optional / Supporting Documents:

- Any communication between the auditor and the company regarding resignation

- Any other relevant documents supporting the resignation reason

The role of auditors is important here: reviewing all details, attachments, and reasons for resignation before submission helps prevent errors, ensures clarity, and reduces the risk of rejection by the MCA.

Step 5: Link with Original Appointment

You must include the Service Request Number (SRN) from ADT-1 to connect the records.

Include the SRN of the original ADT-1 form as per the 2025 MCA amendment

Step 6: Verification and Digital Signature

A digital signature is required to make the form legally valid.

- Verify all details

- Submit with the digital signature

- Download acknowledgement for records

Step 7: Pay Fees

The fee for the ADT-3 form MCA depends on your company’s capital, and if you file late, the charges go up a lot.

- For normal (on-time) filing, the fee is as per the company’s nominal share capital:

- Less than ₹1,00,000 → ₹ 200

- ₹1,00,000 to ₹4,99,999 → ₹ 300

- ₹5,00,000 to ₹24,99,999 → ₹ 400

- ₹25,00,000 to ₹99,99,999 → ₹ 500

- ₹1,00,00,000 or more → ₹ 600

- Less than ₹1,00,000 → ₹ 200

Filing Form ADT-3 on time ensures compliance under the Companies Act 2013 and avoids penalties.

Want a stress-free way to file Form ADT-3? With RegisterKaro, you can complete your filing online quickly and safely. Get your ADT-3 form MCA processed without any stress today. Apply for Free Consultation!

Consequences When an Auditor Does Not File ADT-3 on Time

Filing Form ADT-3 on time is very important. Late or non-filing can lead to heavy penalties for both the company and the auditor.

1. Penalty for Non-Filing or Delay

If a company or auditor does not file Form ADT-3 on time:

- Minimum penalty: ₹50,000

- Maximum penalty: ₹5,00,000

- Continued default / daily penalty: Additional fees can apply for continued non-compliance

Late filing (beyond 30 days) incurs extra charges as a multiple of the normal fee :

Here is the information in a clean table format:

| Delay in Filing ADT-3 | Additional Fee Applicable |

| Up to 30 days delay | 2 × normal fee |

| 30–60 days delay | 4 × normal fee |

| 60–90 days delay | 6 × normal fee |

| 90–180 days delay | 10 × normal fee |

| More than 180 days delay | 12 × normal fee |

2. Disciplinary Issues for Auditors

Auditors who fail to file Form ADT-3 may face professional consequences:

- Disciplinary action from the ICAI Disciplinary Committee

- Considered professional misconduct, which can affect an auditor’s license and reputation

3. Company’s Compliance Obligations Post-Resignation

Even after an auditor resigns, the company has responsibilities:

- Board meeting: Must convene a meeting to acknowledge the resignation

- Appointment of new auditor: The company must appoint a new or casual auditor to serve until the next AGM

4. Reporting in Annual Returns / Disclosures

Companies must report the auditor’s resignation and the appointment of a new auditor in their annual returns. Proper reporting keeps records updated with the ROC and avoids penalties.

- Include auditor resignation details in annual filings

- Mention casual or new auditor appointments in Form MGT-7/AOC-4

5. Communication with Stakeholders

Clear communication ensures transparency with shareholders, regulators, and other stakeholders.

- Notify shareholders in the next meeting or via official notice

- Inform the Registrar of Companies (ROC) about the resignation and new appointment

- Update other stakeholders, such as lenders, partners, or auditors, if required

Following these steps ensures full compliance under the Companies Act 2013 and avoids heavy fines or legal issues.

Practical Scenarios and Use Cases of Form ADT-3

Auditors may resign due to workload issues, health problems, disputes with management, or conflicts of interest. When this happens, companies must act quickly, file Form ADT-3 within 30 days, record the resignation in a board meeting, and appoint a new or casual auditor without delay. These steps help maintain compliance and avoid penalties.

How Does the 2025 MCA Revision Affect Form ADT-3?

The MCA V3 revision (effective 14 July 2025) brought important changes to Form ADT-3. Companies and auditors must understand these changes to stay compliant.

- Key Changes in the Revised ADT-3: The form is now a web-based e-form on the MCA V3 portal. It also requires the Service Request Number (SRN) of the original ADT-1, linking the auditor’s appointment and resignation. Some fields and attachments have been updated to make the form clearer and easier to track.

- Reasons for the Changes: The main goal is to improve governance, traceability, and accountability. Now, it’s easier to track auditor resignations, link them to appointments, and reduce errors or delays in compliance.

- How Companies and Auditors Should Adapt: Companies and auditors should now use the ADT-3 form MCA e-filing system instead of the old forms. Companies must correctly mention the SRN from ADT-1 and update their internal processes to ensure smooth filing under the new rules.

- Transition Issues: Moving from old forms to the new MCA process may cause minor issues. Some fields are different, so double-check details during migration. Proper guidance or training can help avoid mistakes and ensure timely filing.

Final Thoughts

Filing Form ADT-3 correctly and on time is crucial for both auditors and companies. It ensures compliance with the Companies Act 2013, maintains transparency, and avoids heavy penalties. Staying updated with the 2025 MCA revisions and following proper filing steps keeps your records accurate and your company legally protected.

For a smooth and stress-free filing experience, contact RegisterKaro to complete your ADT-3 form MCA online quickly and securely. Get professional guidance and ensure your company stays fully compliant without any stress.

Frequently Asked Questions

The resigning auditor is responsible for filing Form ADT-3 with the MCA. Filing ensures that the resignation is officially recorded and linked to the auditor’s appointment. While the company must acknowledge the resignation in a board meeting, the legal responsibility to submit the ADT-3 form MCA lies with the auditor.