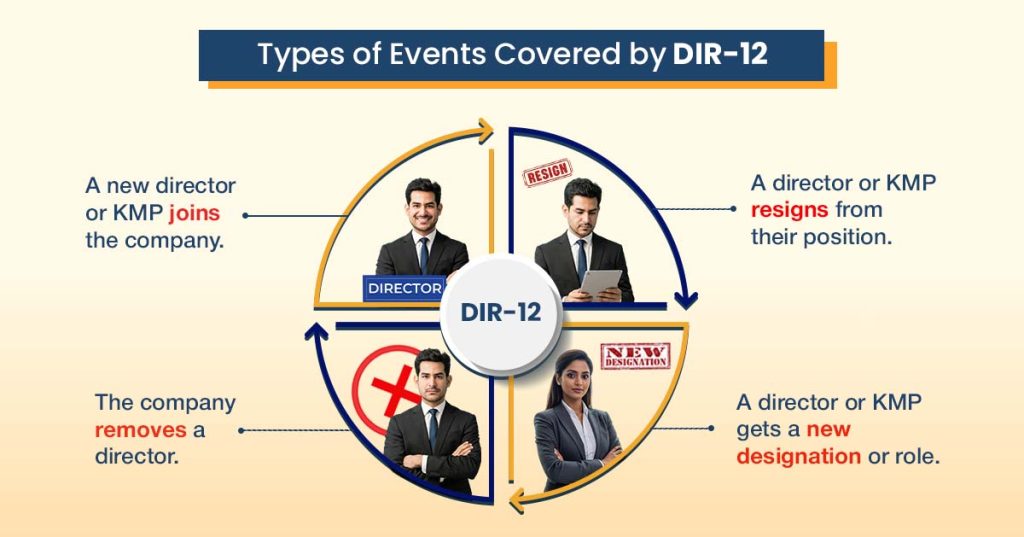

Have you ever thought about how companies keep their leadership records accurate and transparent? That’s exactly where Form DIR-12 comes in. Introduced in 2015, it keeps your company’s director records accurate. It notifies the Registrar of Companies (RoC) when a director is appointed, resigns, removed, or changes designation. Filing DIR-12 on time ensures compliance with the Companies Act, 2013. It also protects the company and directors from penalties.

Whether you run a startup, a private limited company, or a public limited company, timely DIR-12 filing is essential for smooth corporate governance.

What is the DIR-12 Form?

Form DIR-12 is an official e-form issued by the Ministry of Corporate Affairs (MCA) for reporting changes in directors or key managerial personnel (KMP) to the RoC. It keeps statutory records accurate and helps companies follow good governance.

DIR-12 replaced Form 32 for all director-related updates under the Companies Act, 2013, which was used earlier. The MCA now strictly mandates DIR-12 for appointments, resignations, removals, or designation changes of directors and KMPs. Some older state filings may still reference Form 32, but DIR-12 is the standard for compliance today.

Some of its key features include:

- Purpose-Specific Form: You must use Form DIR-12 only to report changes in directors or key managerial personnel; you cannot use it for other filings.

- Standardized Format: The form follows a fixed structure issued by the MCA. Companies must fill all required fields correctly.

- Electronic Filing (Mandatory): DIR-12 is an MCA e-form. Companies must submit it online.

- DIN-Based Identification: Each director listed in the form is identified using their Director Identification Number (DIN).

- Attachment of Supporting Documents: The form requires supporting documents such as board resolutions, consent letters (DIR-2), and resignation letters.

- Certification with Digital Signature: Authorized signatories must sign DIR-12 using a valid Digital Signature Certificate (DSC).

- Official Record for RoC: Once filed, DIR-12 updates the official records at the Registrar of Companies.

- Legally Binding: Filing DIR-12 fulfills statutory obligations under Sections 7, 168, and 170 of the Companies Act, 2013.

Note: DIR-12 cannot be used for updates unrelated to directors or KMP, such as address changes or other company details. Using it incorrectly may result in rejection.

Statutory Provisions Governing DIR-12

The Companies Act, 2013, establishes the key legal framework for filing DIR-12. These provisions ensure companies accurately report all changes in directors to the RoC and promote transparency and good corporate governance.

- Section 7(1)(c): This section requires companies to notify the RoC whenever there is a change in company particulars, including directors. It ensures official records always reflect the current leadership.

- Section 152: Section 152 governs the appointment, reappointment, and resignation of directors. It requires directors to provide their DIN and a declaration that they are not disqualified under the Companies Act.

- Section 168: Section 168 covers the resignation process for directors. Companies must report the resignation to the RoC, and DIR-12 serves as the official filing to update the company records.

- Section 169: This section regulates the removal of directors through board or shareholder resolutions. Any such removal must also be communicated to the RoC via DIR-12.

- Section 164: Section 164 lists conditions under which a director is disqualified. While not directly filed in DIR-12, companies must ensure that newly appointed or reappointed directors are eligible under this section.

- Section 170(2): This section mandates filing returns of all directors and key managerial personnel. DIR-12 fulfills this requirement by submitting the updated director information to the RoC.

Relevant Rules for DIR-12 Filing

Several rules under the Companies (Appointment & Qualification of Directors) Rules, 2014, and Companies (Incorporation) Rules, 2014, guide the preparation and submission of DIR-12. Companies must stay updated with the latest MCA notifications, as some older rules, like Rule 17, have been superseded in certain contexts. Key points include:

- Director Consent (Rule 8): Directors must provide written consent (Form DIR-2) before assuming office, and the company must attach this consent when filing DIR-12.

- Filing Timeline (Rule 15): The company must file DIR-12 within 30 days of receiving a director’s resignation notice.

- Event Reporting (Rule 18): The company must file DIR-12 for any appointment, resignation, or change in director/KMP details to maintain accurate statutory records.

Companies should refer to the latest MCA circulars and V3 portal updates for guidance on e-form filing, fees, and document requirements.

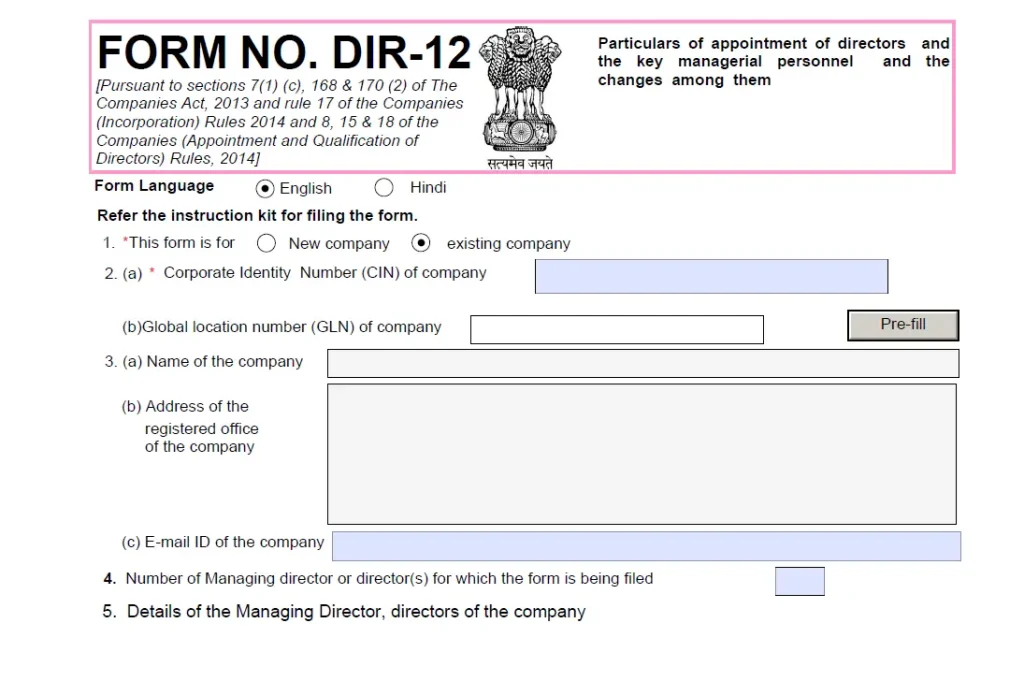

What Information Does the DIR-12 Form Capture?

DIR-12 records all essential information about a company and its directors. Accurate filing ensures compliance with the Companies Act, 2013, and helps maintain up-to-date records with the RoC. As specified in the official DIR-12 PDF issued by the MCA, the form contains the following fields in order:

1. Company Details

- Corporate Identification Number (CIN)

- Company name

- Registered office address

- Official email ID

These details identify the company submitting the form.

2. Director / KMP Particulars

- Full name of director/KMP

- Director Identification Number (DIN)

- Father’s name

- Date of Birth (DOB)

- PAN

- Correspondence address

- Category (executive or non-executive)

- Designation (e.g., director, managing director)

This ensures the RoC has complete and accurate records of all directors and key managerial personnel.

3. Event Details

- Type of event (appointment, resignation, removal, or change in designation)

- Date of the event (in DD/MM/YYYY format)

This section specifies the director-related event being reported.

4. Supporting Documents

- For Appointment: DIR-2 (consent), appointment letter, and board resolution

- For Resignation: Resignation letter and board resolution noting acceptance

These documents validate the information provided and make the filing legally compliant.

Note: You cannot use the DIR-12 form for changes unrelated to directors or KMP, such as address updates or other company details.

Who Needs to File DIR-12?

Every company registered under the Companies Act, 2013, must file DIR-12 when there is a change in its board of directors. This includes private limited companies, public limited companies, and One Person Companies (OPCs).

- Appointment of a New Director: When the company appoints a new director, it must file DIR-12 within 30 days of the board resolution. This updates the RoC with the director’s details.

- Resignation of a Director: If a director resigns, the company must file DIR-12 to notify the RoC. This removes the director from statutory records.

- Change in Director’s Designation: The company must file DIR-12 if a director’s role changes, such as from director to managing director. The RoC records the updated designation.

- Removal of a Director: If the board or shareholders remove a director, the company must notify the RoC via DIR-12 to keep statutory records accurate.

- Reappointment of Directors: When the company reappoints a director for a new term, it must file DIR-12 to maintain up-to-date records with official approval.

Not sure if your company needs to file DIR-12 for a director change? RegisterKaro can help you determine filing requirements and submit the form quickly online. Contact us today.

How to File DIR-12?

Filing DIR-12 is a straightforward process if you follow the steps carefully. Companies must complete it online through the MCA portal.

1. Convene a Board Meeting

- The company must hold a board meeting to approve director appointments, resignations, or role changes.

- Prepare the board resolution and minutes.

2. Collect Required Documents

Gather all supporting documents before filing:

- Board resolution

- Director consent letter (Form DIR-2)

- Resignation letter (if applicable)

- Director’s PAN and DIN

3. Download and Fill the DIR-12 Form

- Download DIR-12 from the MCA portal. The portal now provides pre-filled data for existing directors, reducing manual errors.

- Enter the company CIN, director details, and other required information.

4. Attach Supporting Documents

- Upload all documents in PDF format.

- Each file must be less than 2 MB. Ensure documents are clear, legible, and digitally signed or verified as needed.

- Ensure each attachment is signed or verified digitally, as needed.

5. Sign Using DSC

- Authorized signatories must apply their valid DSC.

- Without DSC, MCA will reject the form.

6. Submit the Form

- Submit the completed form online.

- Note the Submission Reference Number (SRN) for tracking.

7. RoC Verification

- The RoC reviews the form and attached documents.

- Once approved, the changes are updated in the official records.

8. Update Company Records

- After approval, update the company’s internal registers.

- Keep copies of board resolutions, DIR-2, and acknowledgment from MCA.

Filing DIR-12 online requires accuracy and timing. RegisterKaro handles the entire process, from board resolutions to MCA submission, so you don’t miss deadlines.

Documents Required for DIR-12 Filing

Filing DIR-12 requires specific documents to support director-related changes, including:

| Document | Purpose |

| Board Resolution | Approves appointments, resignations, removals, or designation changes |

| DIR-2 Consent | Confirms consent of newly appointed directors/KMP |

| Director Resignation Letter | For resigning directors, it matches the board resolution |

| DIN | Required for all listed directors |

| PAN & Address Proof | For new directors/KMPs |

| Shareholder Resolution | For appointment/removal as managing/whole-time director |

| Declaration of Non-Disqualification | Confirms eligibility under Section 164 |

| DSC | Sign form and attachments digitally |

These documents ensure that DIR-12 filing is complete, accurate, and legally compliant.

Consequences & Penalties for Non-Compliance With DIR-12 Filing

Failing to file DIR-12 on time can lead to serious consequences for both the company and its directors. Key penalties include:

- The company may pay fines for delayed or non-filing under Sections 168, 170, and 172 of the Companies Act, 2013.

- Directors may be personally liable to pay fines if they fail to ensure timely filing.

- Daily penalties can accrue for continued non-compliance, with caps up to Rs. 3 lakh for the company and Rs. 1 lakh per defaulting officer.

- Non-filing of DIR-12 for resignations or removals can lead to penalties of up to Rs. 5 lakh in some MCA adjudications.

- Repeated non-compliance may trigger legal action, including prosecution or imprisonment in extreme cases.

- Delayed filings can cause scrutiny during audits, inspections, or MCA investigations.

- Failure to comply can negatively impact the company’s reputation and demonstrate weak corporate governance to regulators, investors, and stakeholders.

Tip: Always file DIR-12 within 30 days of the board resolution or director change to avoid penalties and maintain smooth corporate governance.

Common DIR-12 Filing Mistakes and Practical Tips to Avoid Them

Filing DIR-12 accurately and on time is essential to staying compliant and avoiding penalties. Follow these practical tips and avoid common mistakes for a smooth process:

- Prepare Documents in Advance: Collect board resolutions, DIR-2 consents, resignation letters, PAN, and DIN before starting the filing.

- Verify Director Details: Double-check DIN, name, address, and designation for accuracy. Wrong or inactive DINs often cause rejections.

- Stick to the Deadline: File within 30 days of the board resolution or director change to avoid fines.

- Use a Valid Digital Signature: Ensure the authorized signatory’s DSC is active. Filing without DSC will be rejected.

- Coordinate with Professionals: If using a CS or CA, provide all documents early and review the form together.

- Check Event Type Carefully: Select the correct DIR-12 form purpose (appointment, resignation, removal, or change in designation). Choosing the wrong type can delay approval.

- Maintain Internal Records: Keep copies of all resolutions, letters, and MCA acknowledgments for audits and compliance.

- Avoid Last-Minute Filing: Submitting at the last minute may cause portal errors or delays.

- Stay Updated: Follow MCA notifications, rules, and fee changes to remain compliant.

Tip: Treat DIR-12 filing as part of good corporate governance. Accurate and timely submission protects both the company and its directors from penalties and reputational risks.

Related Forms and How They Connect to DIR-12

DIR-12 works alongside other director-related forms to keep company records accurate and up to date. The table below summarizes key related forms, who files them, and how they connect to DIR-12:

| Form | Who Files It | Purpose | Connection to DIR-12 |

| DIR-11 | Resigning Director | Notify the company of resignation to initiate internal updates | The company relies on the resignation letter and board resolution (derived from DIR-11) to file DIR-12 with the RoC. DIR-11 itself is not attached. |

| DIR-2 | Newly Appointed Director / KMP | Provide written consent to act as director/KMP | The company attaches DIR-2 when filing DIR-12 to confirm that the new director has consented to the appointment. |

| DIR-3 KYC | All Directors | Submit KYC details to MCA | Ensures MCA has up-to-date KYC info. Filing DIR-12 for appointments may require verifying that KYC is updated. |

| DIR-3 KYC-Web | Directors updating KYC online | Update KYC information electronically | The company or director ensures MCA master records are current, supporting accurate DIR-12 filings. |

What’s New: Regulatory & MCA Portal Updates for DIR‑12

Here are some recent updates from the Ministry of Corporate Affairs (MCA) around DIR‑12 compliance, driven by its new portal features and circulars:

- On 14 July 2025, MCA launched the final set of 38 company e-forms on its V3 portal, marking the full migration from V2.

- From 18 June 2025, the authorities disabled e‑filings on the old V2 portal, and from 8 June 2025, they discontinued the “Pay Later” option for offline payments.

- The V3 portal experienced downtime between 9 July and 13 July 2025, so stakeholders had to plan their filings around this window.

- On 15 October 2025, MCA issued General Circular No. 05/2025, extending the fee-free deadline for filing DIR‑3 KYC and DIR‑3 KYC‑WEB to 31 October 2025.

- The V3 portal now supports pre-filled data based on existing MCA master records and offers enhanced validation logic, which reduces manual errors and speeds up filings.

MCA rules and portal updates change frequently. Stay compliant effortlessly- let RegisterKaro keep track of all updates and files DIR-12 correctly for you.

Final Thoughts

DIR-12 plays a crucial role in reporting director changes and keeping company records accurate with the RoC. Filing it on time ensures compliance with the Companies Act, 2013, avoids penalties, and strengthens corporate governance. By preparing documents in advance and following best practices, companies can complete DIR-12 filing smoothly, efficiently, and without risk.

Frequently Asked Questions

Companies use Form DIR-12, an official e-form, to notify the Registrar of Companies (RoC) about any changes in directors or key managerial personnel (KMP). Filing DIR-12 keeps statutory records accurate, maintains corporate governance, and protects the company and its directors from legal penalties for non-compliance.