How to File LLP Annual Return in India – Guide For Form 11

Filing the LLP Annual Return is an essential aspect of maintaining business compliance for any Limited Liability Partnership (LLP) operating in India. The process not only ensures that the business meets its legal obligations but also supports transparency in registering and ongoing filing practices. With the latest regulatory updates in the Indian landscape, understanding and adhering to the compliance requirements has become even more critical for every LLP.

In this article, we break down the concept and process of filing the return, specifically focusing on Form 11. We discuss what LLP return filing is, the various types of returns that an LLP must file, a step-by-step guide to completing the annual return, the documents required, penalties for late filing, common mistakes to avoid, and conclude with a FAQ section that addresses common queries. This comprehensive guide is tailored to the Indian context and aims to simplify a process that can seem daunting to many.

What is LLP (Limited Liability Partnership) Return Filing?

LLP annual return filing refers to the mandatory submission of financial and management information to the Ministry of Corporate Affairs (MCA) by all LLPs in India. This process is a key component of filing and is crucial for maintaining business. Filing the return is not just a formality but an important requirement that helps ensure that the LLP’s operations are transparent and accountable.

The LLP annual return form provides a detailed account of its financial performance, changes in partners, and other significant events during the financial year. This step confirms that the LLP remains in good standing with the regulatory authorities and helps prevent any potential legal complications in the future.

2. Compliance Returns

Apart from the annual return, LLPs must also file periodic compliance returns that report changes such as alterations in partner details, capital contributions, or the registered office address. These returns ensure continuous business and adherence throughout the year.

Both types of returns are integral to the ongoing filing process, ensuring that the LLP remains up-to-date with statutory requirements and avoids any penalties associated with non-compliance.

Every Limited Liability Partnership (LLP) must submit its Annual ROC (Registrar of Companies) Forms each financial year to remain compliant with the Ministry of Corporate Affairs (MCA). Regardless of whether the LLP has carried out business or not, annual filing is mandatory.

An LLP is required to file the following two essential ROC forms every year:

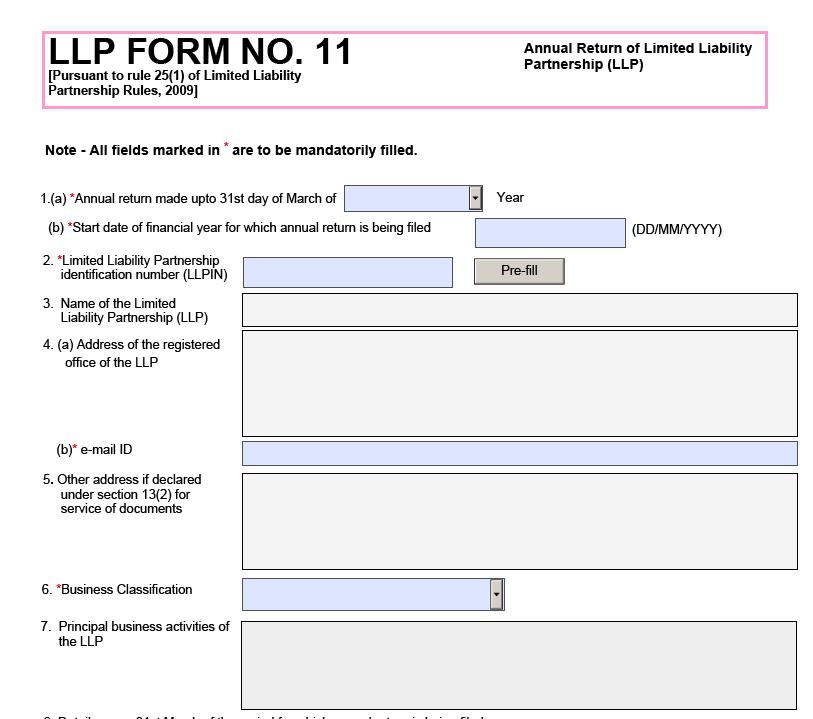

1. Form LLP 11 – Annual Return

This form contains details of all partners and any changes in management or structure during the year. It must be filed within 60 days from the end of the financial year. This return is crucial for maintaining transparency and serves as an important record for legal purposes.

The LLP annual return due date is typically 60 days from the close of the financial year. Timely filing is crucial for all LLPs regardless of the business type, size, or industry.

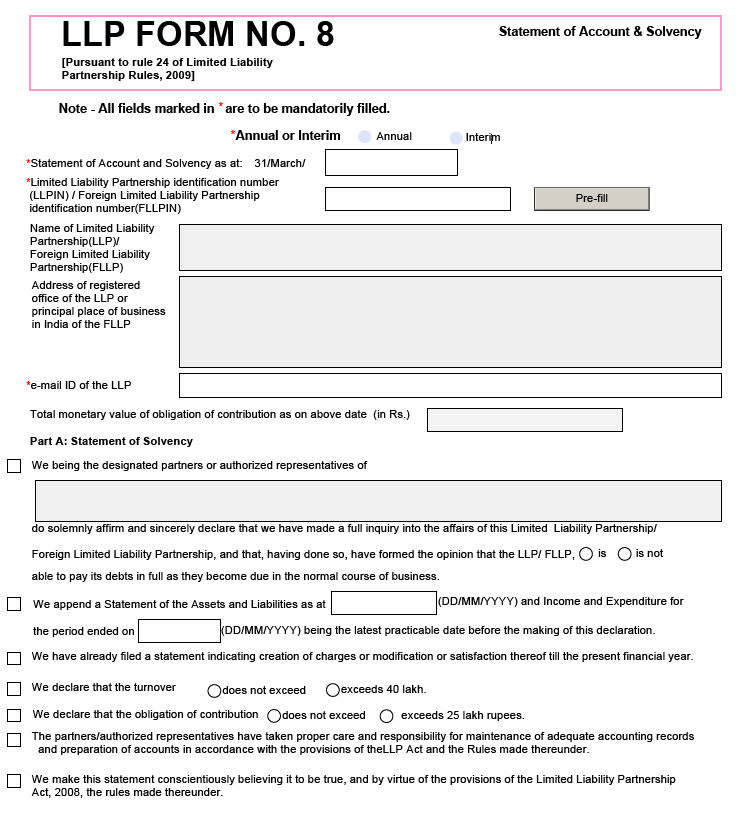

2. Form LLP 8 – Statement of Account & Solvency

LLP annual return form 8 includes information about the company’s financial position, assets, liabilities, and solvency declaration. It must be filed within 30 days from the end of six months after the close of the financial year.

Just like companies, LLPs must maintain their financial year from April 1 to March 31. It’s also essential to file the Annual Return, Income Tax Return, Profit & Loss Account, and Balance Sheet every year to ensure full legal compliance and avoid penalties.

It’s paramount to take the assistance of a Business Consultant like RegisterKaro for smooth operations and avoiding penalties. Contact now!

How to File an Annual Return for LLP?

Filing the return using Form 11 might seem complex at first, but breaking it down into systematic steps can simplify the process:

Before starting the filing process, prepare all relevant information and supporting documents, including:

- Details of all partners and designated partners

- Registered office address and contact information

- Financial statements, assets, and liabilities

- Profit and Loss Account and Balance Sheet

- Any changes made during the financial year (partners, contributions, or business activity)

- A valid Digital Signature Certificate (DSC) of the designated partner

Make sure all details are updated and accurate to prevent form rejection.

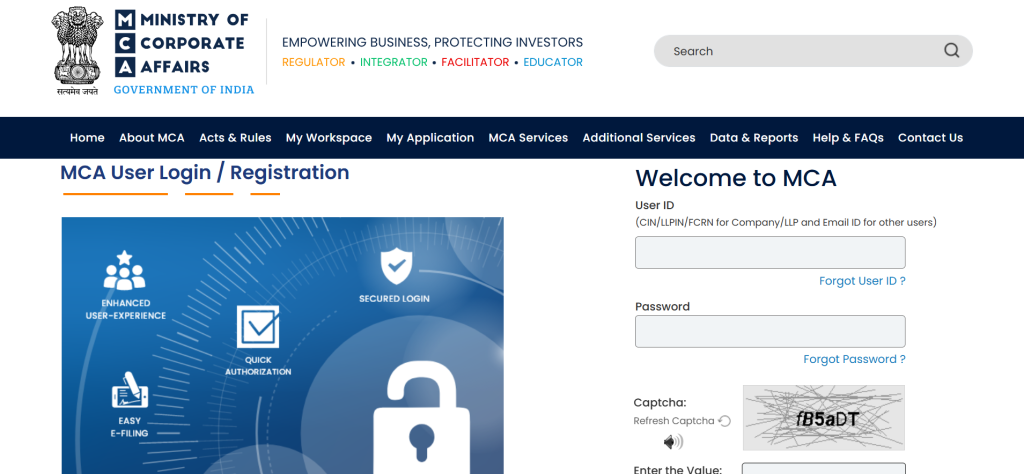

Step 2: Log in to the MCA Portal

Log in to the MCA portal using your credentials. Ensure that your registration details are current. Check that your profile and DSC are active, as both are required for uploading and signing the forms.

The MCA portal is the official gateway for all compliance activities related to return filing.

Step 3. Select the Appropriate Form

- For the Annual Return, download Form 11 from the LLP forms section.

- For the Statement of Account & Solvency, download Form 8.

Always use the latest version available on the MCA portal to ensure compliance with updated filing rules.

Step 4. Filling in the Details

Carefully enter all the required information into the form. This includes partner details, financial data, and any changes that have occurred during the financial year.

Include:

- Basic LLP details (name, LLPIN, address, email)

- Information about partners and designated partners

- Contribution details and changes during the financial year

Form 8 (Statement of Account & Solvency)

Include:

- Declaration of solvency and financial stability

- Statement of assets, liabilities, income, and expenditure

- Certification by a designated partner

It is important to be meticulous during this step to avoid errors that could lead to delays or penalties.

Step 5: Attach Supporting Documents and Pay the Fees

Attach the necessary supporting documents, such as:

- Financial statements

- List of partners and contributions

- Auditor’s report (if applicable)

- Any resolutions or approvals, if required

After attaching the documents, pay the prescribed ROC filing fee based on the LLP’s total contribution. Check out the total LLP fee before filing.

Step 6. Verification and Digital Signature

Once the form is filled out, verify all the information. The final step involves signing the form digitally. Ensure that the Digital Signature Certificate (DSC) used is valid and matches the one registered with the MCA.

Step 7. Submission and Acknowledgment

After signing, submit the form electronically. The portal will generate an acknowledgment receipt confirming that your return has been filed successfully. Save this receipt for your records as proof of compliance.

Each step in this process is designed to facilitate smooth business and adherence, ensuring that your LLP remains in good standing with regulatory bodies.

Documents Required for LLP Annual Return Filing

When filing the LLP return, it is essential to have all the relevant documents at hand to ensure a smooth and error-free process. The following documents are typically required:

- Financial Statements: Balance sheet, profit and loss account, and cash flow statement for the financial year.

- Partner Details: Updated list of all partners along with their roles, contributions, and any changes during the year.

- Changes in LLP Agreement: Documentation of any amendments to the LLP agreement, if applicable.

- Digital Signature Certificate (DSC): Valid DSC for the authorized signatory responsible for filing the return.

- Proof of Registered Office: Documents verifying the current registered address of the LLP, including any virtual office address if present.

Maintaining a proper record of these documents is part of filing and helps ensure that your logs remain current. Accurate documentation is a cornerstone of effective business and helps mitigate any potential issues with authorities.

Penalties for Late Filing of LLP Returns

Failure to file the LLP return on time can attract significant penalties under Indian law. The Ministry of Corporate Affairs imposes fines to encourage timely annual filing and uphold the business. Some key points to consider include:

- Monetary Fines: A fixed fine of Rs. 100 is levied for each day of delay beyond the stipulated deadline. This financial penalty can quickly add up, especially for larger firms.

- Increased Scrutiny: Delayed registration filings and non-compliance can lead to closer monitoring and audits by regulatory authorities, potentially resulting in further complications.

- Reputational Damage: Consistent delays in filing the return can tarnish the LLP’s reputation among investors and stakeholders, undermining trust and business compliance.

Adhering to the filing deadlines is a vital part of the annual filing process and ensures that your LLP avoids unnecessary financial and reputational repercussions.

Common Mistakes to Avoid While Filing LLP Returns

Even a minor error during the LLP return filing process can lead to complications. Here are some common mistakes to avoid:

- Incomplete or Incorrect Data: Ensure that all sections of Form 11 are completed accurately. Missing or incorrect information can lead to rejection of the return.

- Delayed Submission: One of the most common issues is not submitting the return by the deadline. Timely annual filing is essential to avoid penalties.

- Errors in Digital Signature: Make sure that the digital signature used is valid and correctly applied. Mismatches or expired certificates can result in the rejection of your filing.

- Ignoring Regulatory Updates: Regulatory guidelines are subject to change. Regularly review updates from the MCA to ensure your filing process adheres to the latest requirements.

- Poor Record-Keeping: Inadequate maintenance of financial and partner records can lead to discrepancies during the filing process. Proper documentation supports smooth registration and business compliance.

Being vigilant about these potential pitfalls is crucial for error-free annual filing and maintaining your LLP’s good standing with the authorities.

Ending Note

Filing the return via Form 11 is not just a statutory obligation; it is a critical step in ensuring that an LLP operates with complete business compliance in India. By following the prescribed steps, maintaining accurate records, and staying updated with regulatory changes, LLPs can ensure that their annual filing and registration processes are smooth and hassle-free.

In the ever-evolving landscape of Indian legal regulations, the importance of timely and accurate return filing cannot be overstated. It upholds transparency, boosts investor confidence, and supports the overall health of the business environment. Whether you are a seasoned entrepreneur or a new entrant in the market, understanding and executing this process diligently will ensure that your LLP remains compliant and ready to meet any regulatory challenges.

Frequently Asked Questions

Filing the LLP return is crucial for maintaining business compliance and ensuring that the LLP meets its legal obligations. It provides updated information on the LLP’s financial performance and management, thereby supporting transparent registration practices.