Filing your Income Tax Return (ITR) becomes a seamless process when you understand the relationship between your tax documents. Two critical documents that often confuse taxpayers are Form 16 and Form 26AS. Understanding the difference between Form 16 and 26AS can save you from costly mistakes and ensure accurate tax filing.

Many taxpayers struggle with mismatched information between these documents, leading to ITR rejection or scrutiny from tax authorities. This comprehensive guide will help you navigate through the complexities of both documents and ensure your tax return is filed correctly.

What are Form 16 and Form 26AS?

These forms are key tax documents that help you track TDS and income details for accurate tax filing.

Understanding Form 16

Form 16 is a TDS certificate issued by your employer that shows the tax deducted from your salary. Your employer provides this document annually, typically before July 31st. The form contains details about your salary structure, deductions claimed, and TDS amount.

This certificate serves as proof that your employer has deducted tax at source from your income. It includes both Part A (containing TAN details and tax deduction information) and Part B (showing salary breakup and exemptions claimed).

What is Form 26AS?

Form 26AS is your Annual Information Statement (AIS) available on the Income Tax portal. This comprehensive document shows all tax-related transactions linked to your PAN during the financial year. It includes TDS deducted by various deductors, advance tax payments, and self-assessment tax payments.

The document provides a consolidated view of all taxes paid or deducted on your behalf. Banks, employers, and other entities report TDS information directly to the Income Tax Department, which is reflected in your Form 26AS.

Key Differences Between Form 16 and 26AS

The difference between Form 16 and 26AS lies primarily in their scope and source.

Scope and Source:

Form 16 covers salary TDS by your employer, while Form 26AS includes TDS from all income sources.

- Form 16 covers only salary-related TDS deducted by your employer.

- Form 26AS includes all tax deductions from various sources like banks, mutual funds, and property transactions.

Issuer:

Form 16 is issued by your employer, whereas Form 26AS is generated by the Income Tax Department.

- Form 16 is issued by your employer and focuses on employment income.

- Form 26AS is generated by the Income Tax Department, reflecting TDS from all deductors.

Timeline of Information:

Form 16 shows annual TDS details from your employer, while Form 26AS reflects real-time updates from all deductors.

- Form 16 shows the employer’s records for the financial year.

- Form 26AS provides real-time data reported by all deductors to the tax department.

Format and Presentation:

Form 16 follows a standardized format for salary details, whereas Form 26AS presents data in a tabular, consolidated format.

- Form 16 follows a standardized format specific to salary income.

- Form 26AS is presented in a tabular format covering multiple income sources.

Ensure your tax returns are accurate by matching Form 26AS with Form 16. RegisterKaro offers expert assistance to help you cross-verify your documents. Get started today for a smooth filing experience!

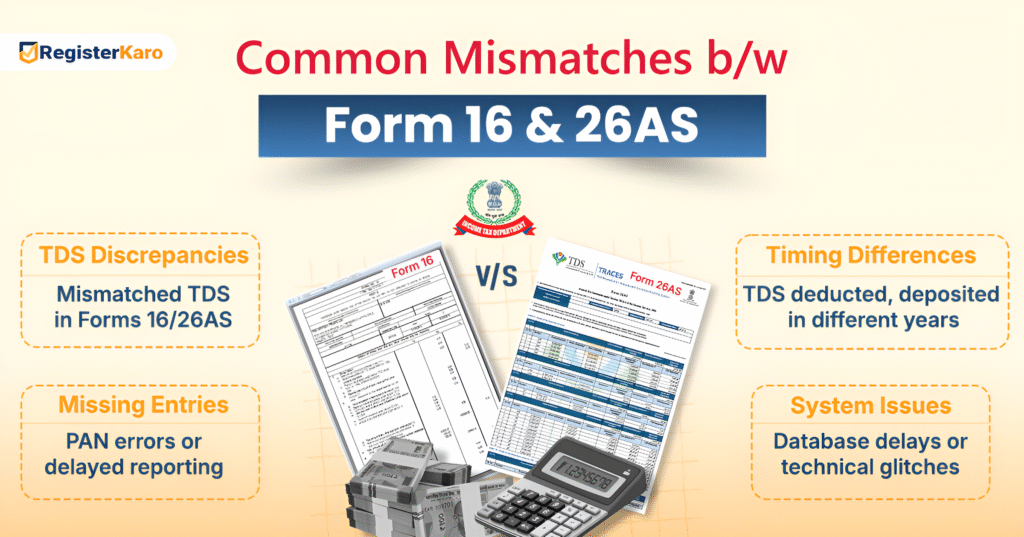

Common Mismatches Between Form 16 and 26AS

System delays or technical glitches can also cause temporary mismatches. The Income Tax Department’s database might not reflect recent TDS deposits immediately.

1. TDS Amount Discrepancies:

Differences arise when the TDS in Form 16 doesn’t match the amount in Form 26AS.

- Mismatches occur when TDS amounts don’t align.

- Causes include delayed TDS deposits by employers or calculation errors.

- Such discrepancies can result in incorrect tax calculations in your Income Tax Return (ITR).

2. Timing Differences:

TDS may be deducted in one financial year but reflected in the next due to delayed deposits.

- Employers might deduct TDS in one financial year (e.g., March) but deposit it in the next (e.g., April).

- This timing lag causes amounts to appear in different financial years, leading to mismatches.

3. Missing Entries:

TDS may not appear in Form 26AS due to incorrect PAN or reporting delays by the deductor.

- TDS entries from your employer may be missing in Form 26AS due to incorrect PAN linking or delayed reporting.

- This confuses when comparing Form 16 with Form 26AS, showing missing transactions.

4. System Delays and Technical Issues:

- Temporary mismatches can occur due to delays or glitches in the Income Tax Department’s database.

- Recent TDS deposits might not be immediately reflected in Form 26AS.

How to Match Form 16 and Form 26AS?

Learn the simple steps to accurately match Form 16 and Form 26AS for error-free tax filing with the following steps:

1. Step-by-Step Verification Process

Start by comparing the total TDS amount shown in both documents. Check if your employer’s TAN appears correctly in Form 26AS with matching deduction amounts. This initial verification helps identify major discrepancies.

Next, verify the quarterly TDS amounts. Form 16 shows annual figures, while Form 26AS displays quarterly breakdowns. Ensure the quarterly amounts in Form 26AS sum up to the annual figure in Form 16.

2. Handling Discrepancies

When you find mismatches, first contact your employer’s HR or accounts department. They can verify their records and provide clarification about any discrepancies. Most mismatches resolve through employer verification.

If the employer confirms their records are correct but Form 26AS shows different figures, file a grievance on the Income Tax portal. The tax department will investigate and update the records accordingly.

How to Download Form 16 and Form 26AS?

The following are the ways to download for your tax filing needs:

1. Downloading Form 16

Contact your employer’s HR department to obtain Form 16. Most companies provide digital copies through employee portals or email. Ensure you receive both Part A and Part B of the form for complete information.

Some employers use the TRACES portal to generate and share Form 16 electronically. Check if your company follows this process and request access to download your certificate.

2. Accessing Form 26AS

Log in to the Income Tax e-filing portal using your PAN and password. Navigate to the ‘View Form 26AS’ section under the ‘My Account’ menu. Select the relevant assessment year and download the PDF version.

You can also access Form 26AS through the new AIS (Annual Information Statement) feature, which provides more comprehensive information than the traditional Form 26AS.

Moving from document verification to practical filing considerations, let’s explore how these forms impact your ITR preparation.

Impact on ITR Filing Without Form 16 and 26AS

Filing your Income Tax Return without Form 16 and Form 26AS can increase the risk of inaccuracies, delayed processing, and potential scrutiny from tax authorities.

| Topic | Details |

| Filing Without Form 16 | – You can file ITR without Form 16 using salary slips and bank statements showing TDS deductions. |

| – Form 16 simplifies the process and reduces errors. | |

| – Manually calculate salary income and TDS amounts, then cross-check with Form 26AS for accuracy. | |

| – Requires careful attention to detail. | |

| Managing Without Form 26AS | – Filing ITR without both Form 16 and Form 26AS is challenging but possible. |

| – Use bank statements, TDS certificates from various sources, and salary slips to gather tax info. | |

| – Keep detailed records of all TDS certificates received during the year. | |

| – Documentation helps verify income and tax deductions when Form 26AS is unavailable. |

Best Practices for Document Management

The following are the practices to adopt to maintain organized records, ensuring quick retrieval, reducing errors, and supporting regulatory compliance.

1. Regular Monitoring

Check your Form 26AS quarterly to identify discrepancies early. This proactive approach prevents last-minute complications during the ITR filing season. Regular monitoring also helps track all income sources and corresponding TDS.

Set up email alerts for Form 26AS updates through the Income Tax portal. These notifications keep you informed about new entries or changes in your tax records.

2. Record Keeping

Maintain digital copies of all TDS certificates along with Form 16 and Form 26AS. Organize these documents by financial year for easy access during ITR filing. Proper documentation supports your tax return claims.

Create a simple spreadsheet tracking all income sources, TDS amounts, and certificate numbers. This master sheet helps reconcile information across different forms and identifies missing documents.

Technology Solutions for Form 16 and 26AS Matching

Technology solutions matching automate data reconciliation, ensuring accurate tax reporting and compliance.

Automated Verification Tools

Several tax software solutions now offer automated matching features for Form 16 and Form 26AS. These tools highlight discrepancies and suggest corrections, making the verification process more efficient.

Professional tax preparation software can import data directly from both forms and flag inconsistencies. This technology reduces manual errors and speeds up the ITR preparation process.

Understanding these technical aspects leads us to the critical question many taxpayers ask about document similarity.

Are Form 16 and Form 26AS the Same?

Is Form 16 and Form 26AS the same is a common question with a clear answer – no, they are not the same. While both documents deal with tax deductions, they serve different purposes and contain different information scopes.

Form 16 is employer-specific and covers only salary-related transactions, while Form 26AS is comprehensive and includes all tax-related transactions from various sources linked to your PAN. Recognizing the difference between Form 16 and 26AS is essential to ensure that all your tax details are correctly accounted for.

The difference between Form 16 and 26AS extends to their legal standing as well. Form 16 is a certificate issued by your employer, while Form 26AS is an official statement from the Income Tax Department.

Matching Form 26AS and Form 16 is key to error-free tax returns. Let RegisterKaro simplify the process with expert help at every step. Sign up today and stay compliant!

Common Mistakes to Avoid while Filing Form 16 and 26AS

Avoid common mistakes like mismatched documents and missed deadlines to ensure smooth tax filing and compliance, among others, as follows:

| Issue | Details |

| Ignoring Quarterly Mismatches | – Many taxpayers focus only on annual totals, overlooking quarterly breakdowns. |

| – This can miss timing differences impacting tax calculations. | |

| – Always verify quarterly figures for complete accuracy. | |

| – Quarterly mismatches often signal deposit delays or employer calculation errors. | |

| – Promptly addressing these prevents complications during tax assessments. | |

| Incomplete Verification | – Rushing verification without checking all details causes errors. |

| – Verify PAN numbers, TAN details, and deduction amounts across both Form 16 and Form 26AS. | |

| – Incomplete checks especially affect taxpayers with multiple income sources. | |

| – Each TDS entry requires individual attention to ensure accuracy. |

Consider professional help when dealing with complex mismatches or multiple income sources. RegisterKaro have experience handling discrepancies and can navigate the resolution process efficiently.

Professional assistance becomes valuable when a mismatch in Form 26AS and Form 16 involves significant amounts or multiple financial years. Chartered accountants can represent you before tax authorities if needed.

Available Resources for Form 16 and 26AS

The Income Tax Department provides detailed guides and FAQs about Form 16 and Form 26AS on their official website. These resources offer step-by-step instructions for common issues.

Taxpayer service centers in major cities provide in-person assistance for document-related queries. Online helpdesks also offer support for technical issues with form downloads.

Understanding the difference between Form 16 and 26AS is essential for accurate ITR filing. These documents complement each other and provide comprehensive tax information when used together. Regular verification and proper matching prevent costly errors and ensure smooth tax compliance.

Ready to file your ITR with confidence? Start by downloading today, and follow our matching guidelines to ensure error-free tax return submission.

Frequently Asked Questions

Contact your employer first to verify their records and TDS deposit details. If discrepancies persist, file a grievance on the Income Tax portal for investigation.