How to Sell on Meesho?

Embarking on an e-commerce journey can be a game-changer for businesses of all sizes, and Meesho stands out as a promising platform for Indian sellers. This guide will walk you through everything you need to know about how to sell on Meesho, from setting up your account to maximizing your sales.

Whether you're a budding entrepreneur, a small business owner, or simply someone with unique products to share, understanding the nuances of this dynamic marketplace is crucial. This comprehensive guide aims to equip you with the knowledge and strategies needed to navigate the Meesho ecosystem effectively, ensuring you not only list your products but also thrive in the competitive e-commerce landscape.

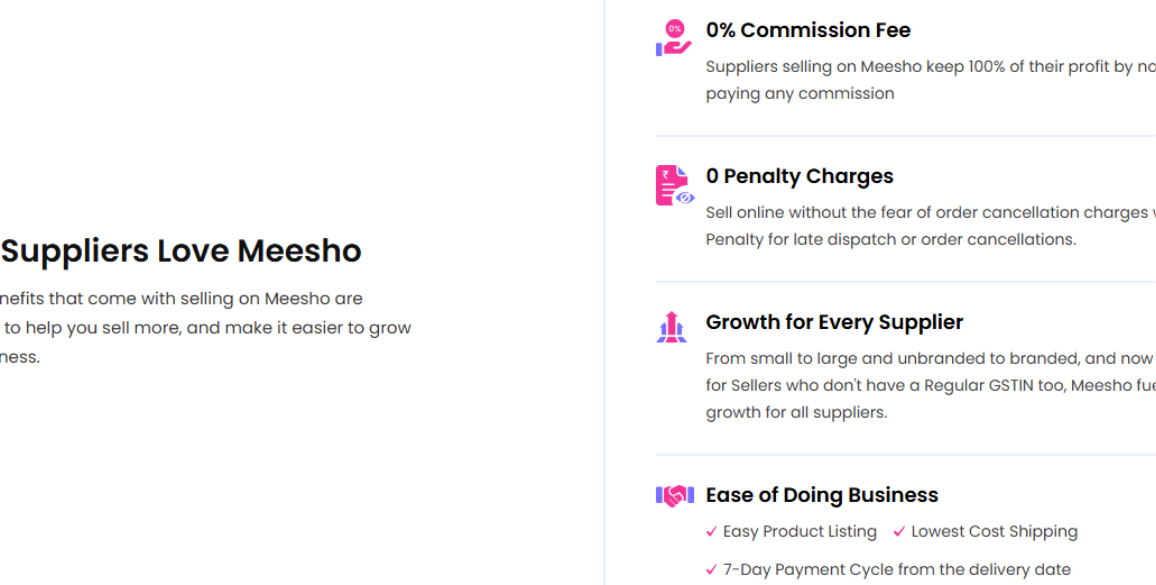

Why Sell Products on Meesho?

Meesho has rapidly emerged as a leading e-commerce platform in India, offering a unique set of advantages for sellers, as follows:

- 0% Commission Model: You keep 100% of your profits because Meesho doesn't charge any commission on your sales.

- Massive Customer Reach: Access a vast customer base all over India, including buyers in smaller cities and towns (Tier 2 and Tier 3 cities).

- Affordable Shipping: Benefit from cost-effective shipping solutions for your orders.

- Fast Payment Cycle: Receive your earnings quickly with a 7-day payment cycle from the date of order delivery.

- Ease of Business: Enjoy a platform designed for simple operations, making selling straightforward.

- Robust Seller Support: Get strong assistance and resources to help you succeed as a seller.

Contact a professional and get expert guidance to start earning wealth from Meesho.

Step-by-Step Guide - How to Start Selling on Meesho

Getting started on Meesho is a straightforward process. Here’s a detailed guide on how to sell on Meesho:

1. Visit the Meesho Supplier Panel

Your journey begins at the official Meesho supplier portal. Simply go to the website: ‘supplier.meesho.com’ and prominently click on the "Start Selling" button. This is your gateway to becoming a Meesho seller.

2. Enter Your Mobile Number and OTP

Once you start the process, you'll be prompted to provide your active Indian mobile number. A One-Time Password (OTP) will be sent to this number for verification. Enter the OTP precisely to proceed to the next step, ensuring your account is linked to a valid contact.

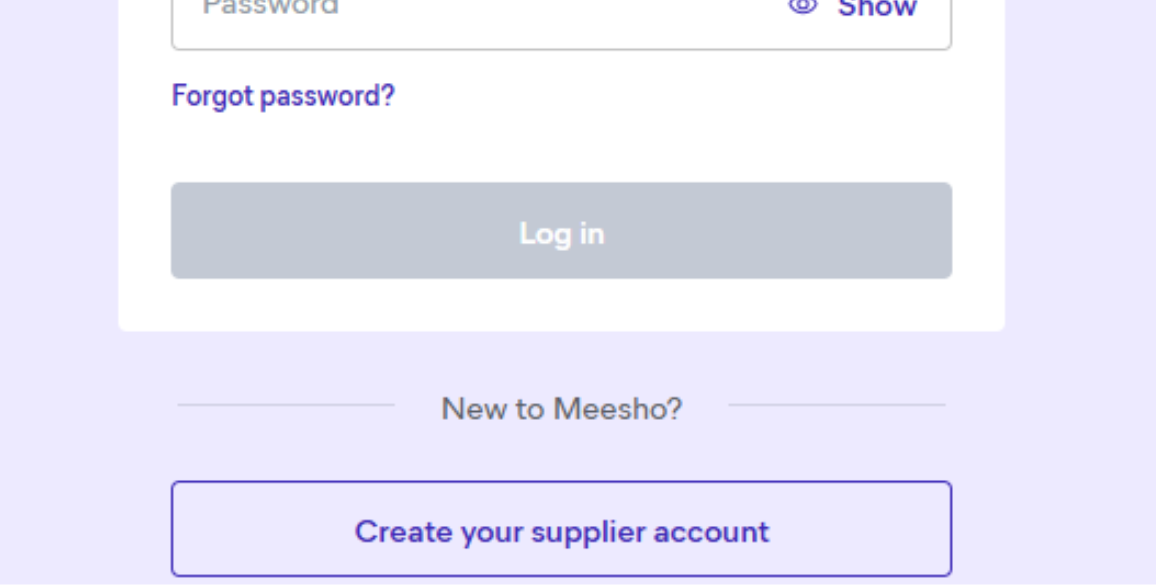

3. Create Your Account

With your mobile number verified, you'll move on to setting up your login credentials. Enter a valid email ID that you regularly access, and then create a strong, memorable password.

Click "Create Supplier Account" to finalize this initial setup. This email and password will be your primary means of accessing your Meesho Supplier Panel.

4. Provide GSTIN (if applicable)

For most businesses operating in India, a Goods and Services Tax Identification Number (GSTIN) is a standard requirement. If you are already GST registered, enter your 15-digit GSTIN here. Meesho will then verify these details with the government database. If you're pondering how to sell on Meesho without GST, don't worry, Meesho offers provisions for that, which we will delve into in the next section, providing a clear path for new sellers.

We understand that navigating legal and compliance requirements can feel daunting. So, we break down everything you need to know about GST requirements, including the current turnover limits for exemptions, how to obtain your Enrollment ID (UIN) if needed, and what steps to take if your business grows and GST registration becomes mandatory.

5. Enter Pickup Address

When you sell on Meesho, the pickup address is the location you provide from where Meesho's logistics partners will collect the packed orders.

Here's what you need to know about your pickup address for Meesho:

- During Registration: You'll enter your pickup address details when you set up your seller account on the Meesho Supplier Panel. This is a mandatory step.

- Matching GST Address (if applicable): If you have a GSTIN, Meesho often allows you to auto-fill the pickup address if it's the same as the address registered on your GSTIN. The state in your pickup address must match the state mentioned on your GSTIN.

- Your Location: This should be the physical location where you store your products and where you will pack them once an order comes in. It could be your home, a small office, or a warehouse.

- Logistics Partner Pickup: Once you accept an order on your Meesho Supplier Panel and prepare it for dispatch (which might include packaging, depending on Meesho's current policy, like the "No-Pack Policy"), Meesho's designated logistics partner will come to this registered pickup address to collect the package.

- Accuracy is Key: Ensure the pickup address is accurate and complete, including pincode, landmark, and contact person details, to avoid any delays or failed pickups.

- Changing Pickup Address: If you ever need to change your pickup address, you can do so through your Meesho Supplier Panel. There are resources and videos available that guide you through this process.

6. Add Bank Account Details

To sell on Meesho, you'll need to provide your bank account details so they can directly deposit your earnings.

Here's what's typically required:

- Bank Account Number: This is your primary account number where payments will be settled.

- IFSC Code: The Indian Financial System Code for your bank branch. You can usually find this on your chequebook, the bank's website, or by searching online.

- Account Holder Name: The name on the bank account must match the registered business name (if you have one) or your name if you're selling as an individual.

- Bank Name and Branch: The name of your bank and the specific branch where your account is held.

- Account Type: Whether it's a Savings Account or a Current Account. While a savings account can work, a current account is often preferred as your business scales.

Important points to remember:

- Active Bank Account: Ensure the bank account is active and operational.

- Matching Details: The bank account holder's name should ideally match the name on your GSTIN (if you have one) or your identity documents.

- 7-Day Payment Cycle: Meesho typically follows a 7-day payment cycle from the date of order delivery.

7. Name Your Store

When picking your Meesho store name, think of something unique and memorable that tells customers what you sell. This name will be the first thing buyers see!

Tips for Naming Your Meesho Store

- Keep it Short & Simple: Easy to remember and type.

- Be Unique: Stand out from the crowd. Check if the name is already in use.

- Reflect Your Products: Does the name give a hint about what you sell?

- Easy to Pronounce & Spell: Avoid complex words or spellings.

- Consider Your Target Audience: Who are you selling to? What names resonate with them?

- Check Availability: Ensure the name isn't trademarked or too similar to a famous brand.

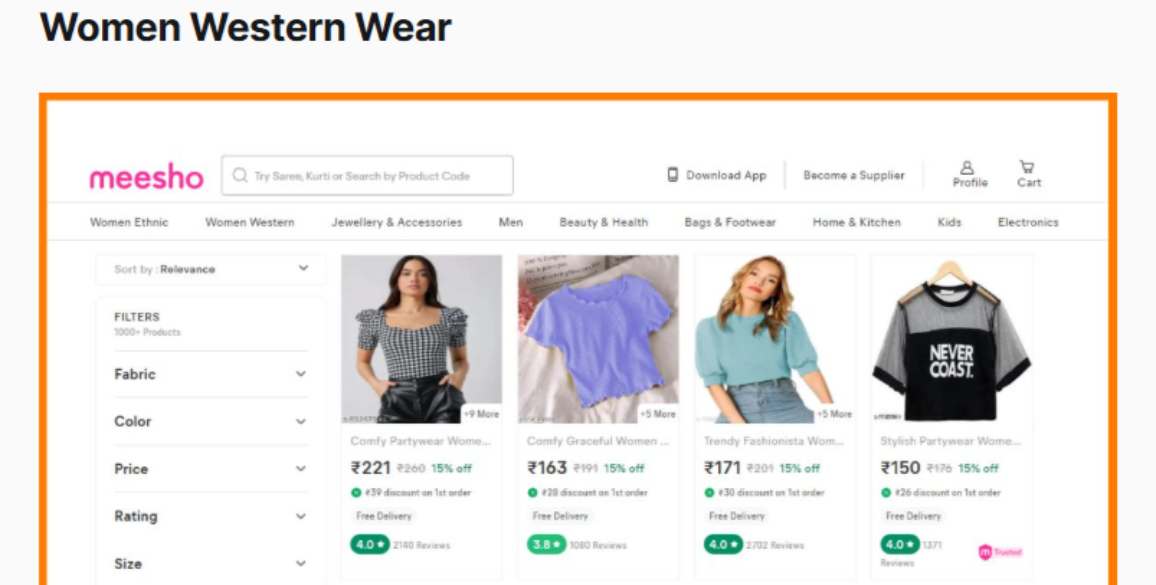

8. Start Listing Products

Your seller account is now active. This is the exciting part where you begin to showcase your products. You can start uploading your product catalogs, which involve adding high-quality, clear images from various angles, writing detailed and accurate descriptions that highlight features and benefits, and setting competitive and accurate pricing.

This crucial step directly impacts customer perception and is fundamental to learning how to sell my product on Meesho effectively and attracting buyers.

Get Your Company Registered Today

Free consultations for MCA approvals to help you get started with your business.

Legal & Compliance Framework to Sell on Meesho in India

Selling on Meesho requires adhering to India's e-commerce laws and intellectual property rights, ensuring a compliant and trustworthy online business, which are as follows:

- GST Registration: For most businesses selling goods online in India, a GSTIN (Goods and Services Tax Identification Number) is mandatory. The general threshold for GST registration is an annual turnover exceeding Rs. 40 lakhs (or Rs. 20 lakhs for specific special category states). While Meesho uniquely offers provisions for sellers to engage in intra-state sales without a GSTIN if their turnover is below this threshold, GST registration becomes mandatory for those exceeding these limits and for all inter-state sales, regardless of turnover.

- PAN Card: A Permanent Account Number ( PAN ) card is essential. It is a mandatory requirement for both individual sellers and all types of business entities operating in India, primarily for tax purposes.

- Bank Account: You must have a valid bank account for receiving payments. This account should be in the name of your business (if you have formally registered one) or in your name if you are operating as a sole proprietor.

- Business Registration: Depending on the legal structure you choose for your business, whether it's a sole proprietorship , a partnership , or a private limited company , you may need specific registration documents. This could include a Shop Establishment Certificate , a Partnership Deed, or a Certificate of Incorporation, among others.

- Principal Place of Business (PPOB) and Additional Place of Business (APOB): For GST-registered sellers, it's vital to accurately register your Principal Place of Business (PPOB) with the GST authorities. This is your primary location of operation. If you conduct business or store inventory from multiple locations, registering each as an Additional Place of Business (APOB) under your GSTIN is also crucial for compliance. Any changes to these addresses must be promptly updated with the GST authorities and on Meesho.

- Product Information: You are legally obligated to provide accurate and complete product information to consumers. This includes essential details such as the Maximum Retail Price (MRP), accurate dimensions, country of origin, and for perishable goods, clear expiry dates and manufacturing dates. Misleading information can lead to severe penalties.

- Intellectual Property Rights (IPR): Strictly avoid infringing on the intellectual property rights of others. This means you must not use copyrighted images , designs, trademarks , or product descriptions that belong to other businesses or brands without explicit permission. Doing so can lead to legal action, hefty fines, and suspension from the platform.

- Consumer Protection: As per the Consumer Protection (E-Commerce) Rules, 2020, Meesho and its sellers are jointly obligated to ensure consumers receive accurate product information and have access to robust grievance redressal mechanisms. This includes clear return, refund, and cancellation policies.

- Meesho's Terms and Conditions: Beyond statutory regulations, you must strictly adhere to Meesho's specific terms and conditions. These encompass their internal policies on order fulfillment, cancellation, returns, refunds, product listing guidelines, and seller code of conduct. Failure to comply can result in account suspension or termination.

- Data Protection: The handling of personal data, belonging to both sellers and customers, is governed by significant legislation, including the Digital Personal Data Protection Act, 2023, and the Information Technology Act, 2000. Sellers must ensure they comply with data privacy principles, protecting sensitive information from unauthorized access or misuse.

- Brand Registration: If you intend to sell products under a specific brand name that you own or are authorized to represent, you will typically need to get your brand officially approved or registered on the Meesho platform. This process verifies your legitimacy to sell branded goods.

- Product Compliance: Beyond specific labeling, all products you list must generally comply with relevant Indian regulations and quality standards. This involves ensuring your goods meet safety norms, specific material requirements, and any other industry-specific regulations that apply.

How to Sell on Meesho Without GST?

This is a common question, especially for small businesses and individuals just starting their online selling journey. Meesho offers a significant advantage here. You can sell on Meesho without GST registration if your annual turnover is below the specified threshold of Rs. 40 lakhs (Rs. 20 lakhs for special category states) and you are selling within your state.

For sellers who don't have a regular GSTIN , Meesho requires an Enrollment ID or UIN (Unique Identification Number) during the registration process. This makes it easier for new and small-scale sellers to begin their e-commerce venture without the immediate burden of GST compliance.

So, if you're wondering how to sell on Meesho without GST, rest assured that Meesho provides a pathway for you. However, it's crucial to keep track of your sales. If your annual turnover crosses the Rs. 40 lakh limit, you will then be required to register for GST.

Get Your Company Registered Today

Free consultations for MCA approvals to help you get started with your business.

Managing Your Meesho Orders and Inventory

Once you start receiving orders, efficient order and inventory management becomes paramount for a successful selling experience on Meesho.

- Order Processing: Meesho provides a dedicated Supplier Panel where you can view and manage all your orders. You'll need to accept orders promptly and ensure timely dispatch. Meesho also offers logistics support, arranging for pickups from your specified location.

- Packaging: Proper packaging is crucial to prevent damage during transit and ensure customer satisfaction. Meesho often provides guidelines for packaging.

- Inventory Tracking: Regularly update your inventory levels on the Meesho Supplier Panel to avoid overselling. Running out of stock on popular items can lead to missed sales opportunities and negative customer experiences. Conversely, overstocking can tie up your capital. Utilize Meesho's inventory tools to keep a close eye on your stock.

- Returns Management: Be prepared to handle returns efficiently. Meesho has its return policy, and understanding it is key to managing customer expectations and maintaining good seller ratings.

Challenges in Selling on Meesho

While Meesho offers many benefits, sellers might encounter some challenges:

- Intense Competition: The 0% commission model attracts a large number of sellers, leading to intense competition, especially in popular categories.

- Price Sensitivity: Meesho's customer base is often highly price-sensitive, which can put pressure on profit margins.

- Returns Management: While Meesho facilitates returns, managing them efficiently and minimizing their impact on your business can be a challenge.

- Dependence on Meesho's Logistics: While convenient, reliance on Meesho's logistics means less control over the shipping process for sellers.

- Policy Changes: Like any e-commerce platform, Meesho may introduce policy changes that sellers need to adapt to.

Get Your Company Registered Today

Free consultations for MCA approvals to help you get started with your business.

Strategies to Increase Your Sales and Succeed on Meesho

Knowing how to sell on Meesho is just the beginning. To truly succeed, you need effective strategies to boost your sales.

1. Master Competitive Pricing

Meesho is a price-sensitive marketplace. Research competitor pricing for similar products to ensure your prices are attractive yet profitable. While Meesho has a 0% commission, remember to factor in your product cost, packaging, and shipping charges to set a price that yields a healthy margin. Utilize Meesho's price recommendation tools to make informed decisions.

2. Create High-Quality Listings

Your product listings are your virtual storefront. Use clear, high-resolution images from multiple angles, preferably with a white background. Write detailed and accurate product descriptions that highlight key features, materials, and benefits. Use relevant keywords in your product titles and descriptions to improve search visibility. This is vital for showing customers how to sell my product on Meesho effectively.

3. Manage Your Inventory

As discussed, efficient inventory management prevents stockouts and overstocking. Keep popular products consistently in stock and regularly update your inventory on the Meesho platform. This ensures you can fulfill orders promptly and avoid cancellations, which can negatively impact your seller rating.

4. Participate in Meesho's Sales and Promotions

Meesho frequently runs sales events and promotions. Actively participating in these campaigns can significantly boost your product visibility and sales volume. These events often attract a large number of buyers looking for deals.

5. Use Meesho Ads to Boost Product Visibility

Consider using Meesho's advertising features to give your products an extra push. Meesho Ads allow you to promote your catalogs and get them featured in top search results and discovery pages. This can dramatically increase your product's visibility to potential customers, especially when you're focusing on how to sell on Meesho.

6. Maintain High Ratings and Good Reviews

Customer reviews and ratings are crucial for building trust and attracting new buyers. Provide excellent customer service, process orders efficiently, and resolve any issues promptly. Encourage satisfied customers to leave positive reviews. A high seller rating and positive feedback will enhance your credibility and lead to more sales.

Ending Note

Selling on Meesho presents a fantastic opportunity for Indian entrepreneurs to tap into a vast online market with minimal initial investment. By understanding how to sell on Meesho, leveraging its unique advantages like the 0% commission, and implementing effective strategies for product listing, pricing, and customer service, you can build a successful and sustainable online business.

Consistent effort and a customer-centric approach are key to thriving on Meesho. If you're still considering how to sell my product on Meesho, this guide should provide a solid foundation for your journey.

Get Your Company Registered Today

Free consultations for MCA approvals to help you get started with your business.

Frequently Asked Questions (FAQs)

Is GST mandatory to sell on Meesho?

−No, GST is not mandatory for all sellers on Meesho. You can sell on Meesho without GST registration if your annual turnover is below Rs. 40 lakhs (Rs. 20 lakhs for special category states) and you are selling within your state. If your turnover crosses this threshold, GST registration becomes compulsory.

What documents are required to become a Meesho seller?

+How does Meesho's 0% commission model work?

+How long does it take to get paid by Meesho?

+Can I sell any product on Meesho?

+How do I manage shipping on Meesho?

+How can I increase my product visibility on Meesho?

+What if a customer returns a product?

+Is Meesho suitable for small businesses and individuals?

+How important are customer reviews and ratings?

+Can I sell multiple products from different categories?

+How do I update my product inventory on Meesho?

+Are there any hidden charges on Meesho?

+Can I promote my Meesho store on social media?

+What if I face an issue with an order or payment?

+How can I optimize my product titles and descriptions for search?

+What are the common reasons for order cancellation on Meesho?

+