What is the Dissolution of a Partnership Firm? Documents & Process

Dissolution of a partnership firm means the legal closure of a business. It brings an end to the firm’s legal existence and to the partnership relationship among all the partners. A partnership firm may dissolve by mutual agreement between the partners, due to the insolvency of a partner, or through court order.

The Indian Partnership Act, 1932, governs and regulates the entire process of partnership firm registration and dissolution. Upon dissolution, the firm’s assets are sold, its liabilities are settled, and the remaining amount is distributed among the partners.

This distribution follows the terms stated in the partnership deed. If no partnership deed exists, the Indian Partnership Act applies. This blog will provide detailed information about the dissolution of a partnership firm, its legal process, and implications.

Who is Affected by the Dissolution of a Partnership Firm?

The dissolution of a partnership firm affects the following stakeholders connected with the business:

- Partners: All partners are directly affected by the dissolution of a partnership firm. As the firm’s assets, liabilities, and mutual agreement come to an end, partners become liable to follow certain legal rules and regulations.

- Creditors and Lenders: When a partnership firm dissolves, creditors and lenders are affected due to unsettled financial commitments.

- Employees: Due to the dissolution, employees may face abrupt termination; hence, the firm must settle salaries, gratuities, and other pending benefits.

- Clients and Customers: Dissolution impacts customers, as existing contracts and service obligations may no longer continue.

- Government Authorities: Regulatory departments, including the Income Tax and GST authorities, and the Registrar of Firms may become involved. These departments oversee final filings and compliance after a partnership firm’s dissolution.

The dissolution of a partnership firm brings financial, legal, and operational changes for partners, employees, creditors, and other stakeholders. A well-planned approach for dissolution saves trouble for all the involved parties.

Difference Between Dissolution of Partnership and Dissolution of a Firm

The dissolution of a partnership and the dissolution of a partnership firm are not the same. Both have different meanings and implications for the firm. The table below details the difference between the two:

| Basis | Dissolution of Partnership | Dissolution of Partnership Firm |

| Legal Existence | In this case, only the partnership between certain partners ends, but the firm itself may continue to operate under the remaining or new partners. The firm’s legal existence is not affected. | Here, the dissolution completely ends the firm. The business loses its legal status, and the partnership firm ceases to exist entirely. |

| Partners | Only some partners may leave, retire, or be added. The changes affect the partnership arrangement but do not end the firm. | All partners exit the business. No partner remains, and the firm is permanently closed. |

| Business Operations | The business continues its activities with the remaining or new partners. Ongoing contracts and operations are maintained. | All business operations stop permanently. Assets are sold, liabilities are settled, and the firm is permanently closed. |

Understanding this difference ensures proper legal compliance and helps partners manage the process smoothly.

Modes of Dissolution of Partnership Firm in India

A Partnership firm registration in India can be dissolved in various ways. Each mode has different legal requirements and procedures, as defined by the Indian Partnership Act, 1932.

The following modes are legally valid to dissolve a partnership firm:

1. Dissolution by Mutual Agreement (Section 40)

Section 40 of the Partnership Act allows partners to dissolve a partnership firm by mutual consent. The partnership deed usually outlines the procedure and conditions for dissolution. In some cases, a fresh dissolution deed is prepared to formally record the agreement, settle accounts, and distribute assets among partners. This is the most straightforward method that avoids disputes during the dissolution process.

2. Compulsory Dissolution (Section 41)

Section 41 mandates the dissolution of the partnership firm in the event of the insolvency of any partner or if the business becomes illegal to continue. Compulsory dissolution ensures that the firm does not continue under illegal or unsustainable conditions. It protects both partners and creditors.

3. Dissolution on the Happening of Certain Contingencies (Section 42)

Section 42 applies when dissolution happens due to predefined specific events mentioned in the partnership deed. Common contingencies include:

- Expiry of a fixed term

- Completion of a specific project

- Death of a partner

This mode ensures that the firm ends naturally once its purpose is completed or circumstances change.

4. Dissolution by Notice (Section 43)

In a partnership at will, any partner has the right to dissolve the firm by giving a mandatory written notice to the other partners. The firm is considered dissolved once the notice is properly delivered. This method provides flexibility for partners who wish to exit without waiting for a fixed term or agreement.

5. Dissolution by Court Order (Section 44)

A court can order dissolution under certain circumstances, including misconduct by a partner, continuous losses, or a breach of agreement. This method protects the interests of partners and third parties when the partnership cannot continue fairly or lawfully.

Note: Sections 45-49 define how assets are distributed, liabilities settled, and partners’ rights are protected after the dissolution.

What is the Procedure for Dissolution of a Partnership Firm in India?

Dissolving a partnership firm requires following a legal and organized process. The following steps need to be followed to get a dissolution deed for a partnership firm:

Step 1: Decision to Dissolve

The process begins with the consent of all partners to dissolve the firm. The partnership deed is then referred to for any specific conditions, procedures, or approvals required for dissolution.

Step 2: Execution of Dissolution Deed of Partnership Firm

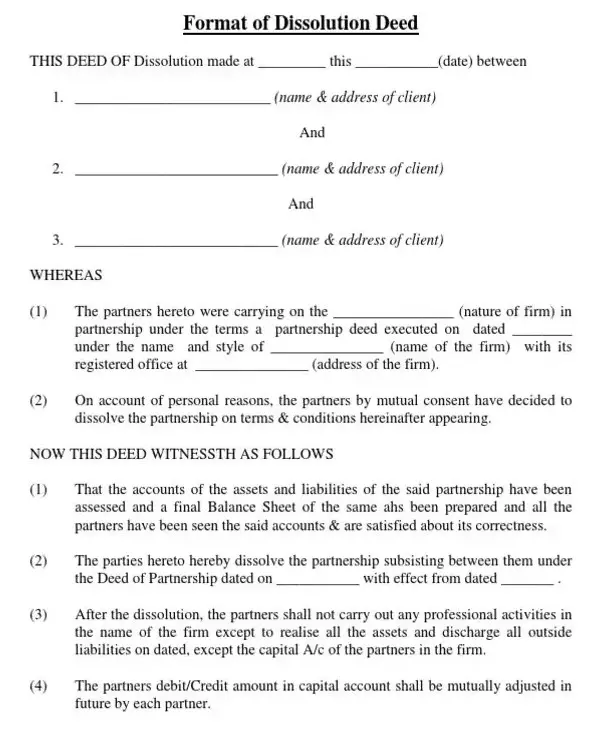

This is a sample image of Form V, which is filed to legally dissolve a partnership firm.

Prepare a dissolution deed to officially record the firm’s closure. It details the following information:

- Terms of dissolution

- Settlement of accounts

- Distribution of assets

The cost of Stamp duty for a dissolution deed varies by state, and the deed must comply with legal formalities to be valid.

Step 3: Notice of Dissolution

Partners must issue an internal notice to inform all stakeholders about the dissolution. Additionally, a public notice may be published in newspapers or relevant platforms to alert creditors, customers, and the general public. This ensures transparency and limits future liabilities.

Step 4: Settlement of Accounts

All financial matters of the firm are settled in an orderly manner:

- Third-party creditors are paid first to clear outstanding liabilities.

- Partner loans or advances are repaid next.

- Capital contributions of partners are returned.

- Profits and losses are shared among partners according to the partnership deed or applicable law.

Step 5: Intimation to Registrar of Firms

If the firm is registered, a formal intimation must be filed with the Registrar of Firms (RoF) using the prescribed form. This step legally updates the dissolution in government records.

Step 6: Cancellation of Registrations

Partners must cancel all the following statutory registrations related to the firm:

- GST registration

- Shops & Establishment license

- MSME / Import-Export Code, if applicable

Canceling registrations ensures that the firm is no longer liable for taxes or regulatory compliance.

Step 7: Closure of Bank Accounts

Finally, partners close the firm’s bank accounts after they obtain a no-dues confirmation from the bank. This prevents unauthorized transactions and completes the firm’s financial closure.

Following the correct dissolution process reduces the risk of disputes and legal complications. To dissolve your partnership firm without any trouble or legal complications, take professional help. Contact RegisterKaro today to ensure an effective and compliant dissolution process.

Which Documents are Required for the Dissolution of a Partnership Firm?

Dissolving a partnership firm requires proper documentation to ensure legal compliance and a smooth closure. The key documents typically include:

- PAN Card of the Firm

- Address Proof of the Firm

- Original Partnership Deed & Amendments.

- Dissolution Deed

- Accounting Records

- Details of Assets & Liabilities

- GST Cancellation Certificate (if applicable)

If a firm has all these documents, it can dissolve smoothly without any legal complications or delays.

Post-Compliance After Dissolution of a Partnership Firm

After partners dissolve a partnership firm and complete all formalities, they must carry out certain post-compliance steps. It includes:

- Final Tax Filings: File any pending income tax, GST, or other statutory returns related to the firm.

- Closure of Registrations: Cancel GST, Shops & Establishment, MSME, or Import-Export Code registrations, if applicable.

- Bank Account Closure: Partners must close all firm bank accounts after clearing all dues and completing all pending transactions.

- Retention of Records: Maintain copies of the dissolution deed, accounting records, and tax filings for future reference and legal compliance.

- Notification to Stakeholders: Inform clients, suppliers, and creditors about the firm’s closure to prevent any confusion or disputes.

- Settlement of Liabilities: Partners must fully settle all third-party creditors, partner loans, and statutory dues.

Completing these post-compliance steps protects partners from future legal or financial claims.

Consequences of the Dissolution of a Partnership Firm

It is important to understand the following consequences of a partnership firm’s dissolution to avoid future disputes:

- Loss of Business Continuity: Dissolving the partnership firm results in the loss of its legal identity and terminates all ongoing business operations.

- Impact on Partners’ Rights: Partners lose their authority to act on behalf of the firm, except for completing winding-up activities.

- Financial Liability: Partners remain responsible for any debts or obligations they incurred before dissolution.

- Effect on Clients and Customers: The firm may cancel existing contracts, and services may face interruptions.

- Creditors’ Claims: Creditors can claim outstanding dues, and partners may face personal liability if they do not settle obligations.

- Legal Disputes: Partners may disagree over asset distribution or liability settlement, which can lead to legal disputes.

Properly understanding these consequences ensures partners can close the firm efficiently and remain compliant with legal obligations.

Common Mistakes to Avoid During Dissolution of a Partnership Firm

Avoid the following common mistakes to ensure a trouble-free closure:

- Not Issuing a Public Notice: Partners must issue a public notice under Section 72 of the Indian Partnership Act, 1932. This notice protects them from liabilities that may arise after they dissolve the firm. If they fail to notify the public and creditors about the dissolution, it can lead to future claims or disputes.

- Ignoring GST Cancellation: If the partners register the firm under GST, they must cancel the GST registration. Neglecting this step can make them liable for continued taxes and penalties even after closing the firm.

- Improper Settlement of Liabilities: Settling accounts incorrectly or ignoring certain debts, partner loans, or statutory dues can lead to legal issues and disputes.

Careful attention to these steps ensures that the dissolution process is legally compliant and minimizes future risks.

Frequently Asked Questions

No, the Indian Partnership Act, 1932, does not require partners to register a partnership firm. However, if the partners register the firm, they must inform the Registrar of Firms (RoF) about the dissolution to update official records. Registration primarily provides the firm with legal recognition and helps partners complete post-dissolution compliance smoothly.