Filing income tax returns and conducting audits in India now requires a Digital Signature Certificate (DSC). A DSC is required to audit and file income tax to prove your identity online and ensure that all submissions are secure and legally valid. It guarantees authenticity and compliance under the Information Technology Act, 2000.

Businesses, firms, and professionals, especially those under audit obligations, must use a DSC to submit returns, sign audit reports, and complete e-forms. Without it, digital filings and approvals are not valid.

This blog covers DSC: who needs it, how to get & use it, and tips for renewal & maintenance. By the end, you will be ready to manage your tax compliance smoothly.

What is a DSC, and Why Is It Required for Income Tax Purposes?

A Digital Signature Certificate (DSC) is an electronic certificate that proves your identity online. It allows you to digitally sign documents in a secure and legally recognized way. A Digital Signature Certificate (DSC) for income tax ensures that all filings and submissions are authentic and legally valid.

Role of DSC in Income Tax E-Filing

A DSC lets you sign Income Tax Returns (ITRs), audit reports, statutory forms, and responses to notices. The Income Tax Department treats DSC-signed documents as equivalent to handwritten signatures. It protects your filings from tampering and speeds up the submission process.

When DSC is Mandatory

You must use a DSC if you are:

- A director of a company.

- A partner in a firm or LLP filing returns.

- Undergoing a tax audit under Section 44AB.

You can use a DSC optionally if you file a simple ITR without audit obligations. Even then, it adds security and compliance.

Benefits of Using a DSC Class for Income Tax

Using a Digital Signature Certificate (DSC) class offers several advantages for income tax filing and audits:

- Enhanced Security: A DSC encrypts your data, keeping it safe from tampering or unauthorized access.

- Verified Identity: It proves your identity online, making every submission legally valid.

- Legal Compliance: DSC fulfills the requirements under the Information Technology Act, 2000, ensuring your filings meet all legal standards.

- Time-Saving: Digital signatures eliminate the need for physical paperwork and manual verification.

- Convenience: You can sign multiple forms and audit reports from anywhere, anytime.

- Trust and Credibility: Authorities and clients recognize DSC-signed documents as authentic and reliable.

In short, a DSC protects your data, simplifies compliance, and speeds up tax and audit processes.

Who Needs a DSC for Income Tax Filing & Audit?

A DSC is required for certain individuals and entities to file income tax returns and complete audits. The requirements differ based on whether you are an individual or a business entity.

1. Individuals vs. Business Entities

- Individuals: Most salaried or self-employed taxpayers can e-verify returns using OTP or net banking. A DSC is optional unless filing audit reports or forms requiring digital signatures.

- Business Entities: Companies, LLPs, and firms must use a DSC for filing returns and signing statutory forms. Directors or authorized signatories digitally sign documents on behalf of the entity.

2. Tax-Audit Scenario

If a business or professional falls under Section 44AB of the Income Tax Act, a tax audit is mandatory. This typically applies to:

- Businesses with annual turnover exceeding Rs. 1 crore, or Rs. 10 crore if 95% or more transactions are digital.

- Professionals with gross receipts exceeding Rs. 50 lakh.

In such cases, the audit report, including Form 3CA/3CB and 3CD, must be signed using a DSC. This digital signature ensures that the report is authentic, secure, and legally valid.

Using a DSC for tax audits also helps:

- Prevent tampering with financial data.

- Prove the identity of the auditor submitting the report.

- Streamline submissions on the Income Tax Department e-Filing portal.

Without a valid DSC, the audit report cannot be filed online, and the submission may be rejected.

Other Specific Users

DSC is also required for:

- Professionals signing forms like 15CA/15CB.

- Authorized representatives submitting responses to notices electronically.

- Certain high-value transactions or e-tendering submissions.

Situations Where DSC is Optional

Some individuals can e-verify using OTP, net banking, or Aadhaar, so DSC is not strictly required. Even then, using a DSC adds security, authenticity, and full legal validity to submissions.

A DSC ensures that all filings and audit reports are secure, authentic, and fully compliant with the law.

Types of DSC and How to Choose the Right One

A DSC comes in different classes and functional types. Choosing the right one ensures smooth income tax filing, audit submissions, and other digital compliance.

Types of DSC by Class

Choosing the right DSC ensures smooth income tax filing, audit submissions, and other digital compliance. For income tax filing and audit purposes, a Class 3 DSC issued by a licensed Certifying Authority (CA) under the Controller of Certifying Authorities (CCA) is required.

- Earlier, Class 2 DSC for income tax was commonly used by individuals, proprietors, and small businesses for filing ITRs and minor e-forms. However, Class 2 DSC has now been discontinued, though some existing certificates may still be functional until their expiry.

- For larger entities and professionals, a Class 3 DSC for income tax is mandatory. This class provides higher security and is required for signing audit reports, certain e-tendering submissions, and complex statutory filings.

Functional Types of DSC

DSCs also come in different functional types, depending on how you intend to use them for income tax filing and audit purposes.

- Sign DSC: For digitally signing documents and forms, including ITRs and audit reports.

- Encrypt DSC: Used for secure communication and encrypting emails or documents.

- Combo DSC (Sign + Encrypt): Provides both signing and encryption functionality. Recommended for businesses handling sensitive financial data or multiple compliance tasks

How to Choose the Right DSC?

When selecting a DSC, consider these key factors:

- Use-Case:

- For income tax filing or audit reports- utilize Class 2 or Class 3, Sign DSC, or Combo DSC

- For e-tendering or other government compliances- use Class 3 DSC with Combo functionality.

- Validity Period: DSCs are generally valid for 1–2 years. Check renewal terms to avoid last-minute issues.

- Hardware Token vs Software-Based DSC:

- Hardware token: Portable, more secure, required for Class 3 DSC.

- Software DSC: Installed on a computer, suitable for simple filings.

- Ease of Use: Ensure compatibility with the Income Tax e-Filing portal (eportal.incometax.gov.in) and other digital platforms you use regularly.

Selecting the right DSC ensures legal compliance, secure submissions, and smooth digital filing for all income tax and audit requirements.

How to Get a Digital Signature Certificate for Income Tax?

Follow these steps on how to obtain DSC for income tax quickly and start filing your returns and audit reports securely:

- Choose a Certifying Authority (CA): Pick a CCA-recognized CA like eMudhra, Sify, or Capricorn.

- Prepare Documents: PAN, Aadhaar or ID, address proof, and a passport-size photo.

- Apply Online: Fill out the CA’s form, select the DSC type, and upload documents. You can also link and test your DSC directly through the Income Tax e-Filing portal for smooth future submissions.

- Pay Fees: Pay online. Fees vary by DSC class and validity.

- Verification: CA verifies your details via video or in-person check.

- Set Up Token: Install the USB token or file certificate with the CA’s software (e.g., eSigner).

- Activate DSC: Follow instructions to activate. Test on the Income Tax e-Filing portal for signing ITRs or audit reports.

Ready to get your DSC hassle-free? RegisterKaro can help you obtain, activate, and register your digital signature certificate for income tax quickly and securely.

How to Register the DSC on the Income Tax e-Filing Portal?

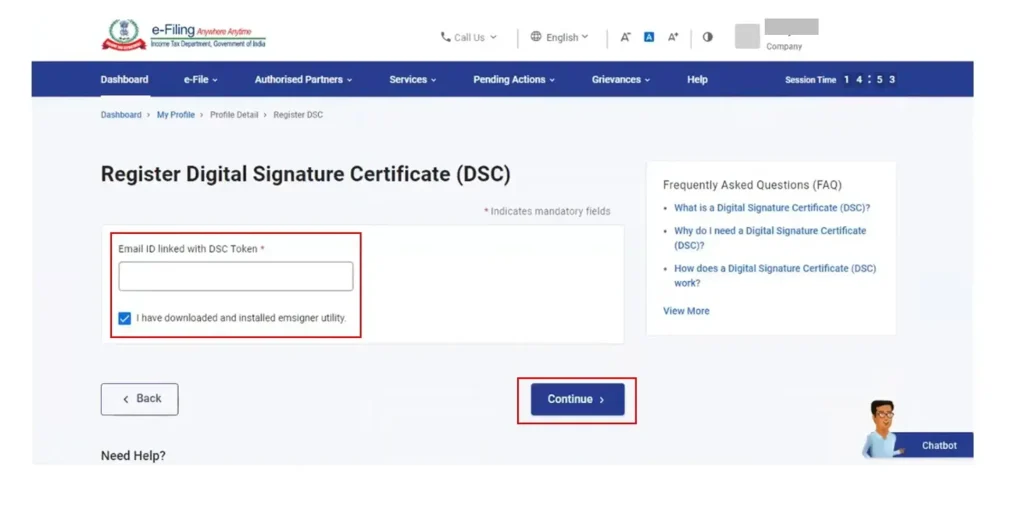

Before you start registering the DSC on the income tax e-filing portal (eportal.incometax.gov.in), make sure:

- You have installed the Income Tax DSC utility.

- You have your Income Tax e-Filing user ID and password.

- Your DSC token is plugged in.

- You are using the latest version of EmSigner and Java, as outdated versions can lead to signing errors.

Step-by-Step Registration Guide

To begin income tax DSC registration:

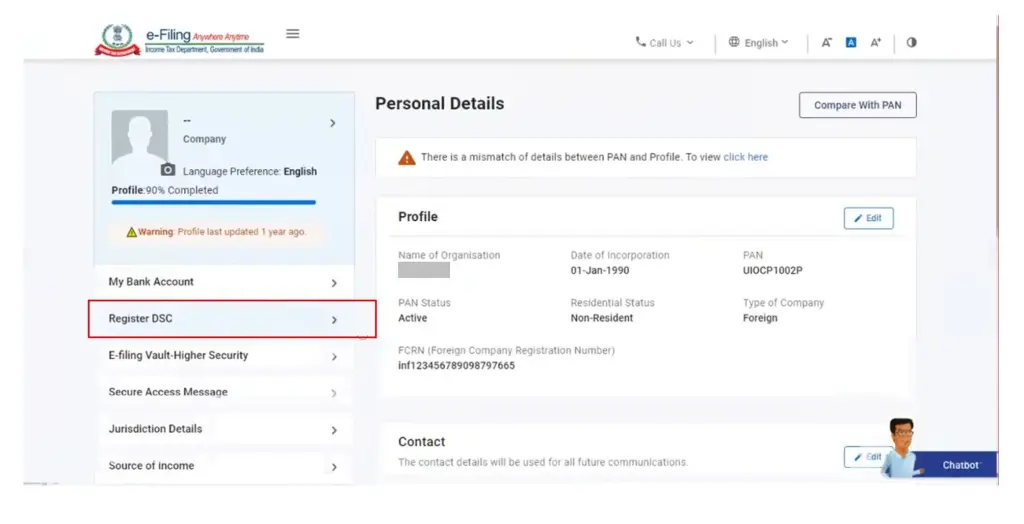

- Login: Go to the e-Filing portal and log in using your credentials.

- My Profile: Click on “My Profile” from the dashboard.

- Register DSC: Select “Register Digital Signature Certificate.”

- Select Provider & Certificate: Choose your Certifying Authority and DSC from the list.

- Sign: Click “Sign” to complete the registration using your DSC.

Handling Special Cases

- Re-registration: If your DSC has expired, re-register following the same steps.

- Token change: Update the portal when your DSC token changes.

- Principal Contact DSC: Register the DSC of the company’s Principal Contact separately if required.

Troubleshooting Tips For DSC Registration

- Ensure the token is plugged in and detected by the system.

- Update EmSigner or the browser if DSC is not recognized.

- Check that your CA/provider is listed on the portal.

- Try a different browser if registration fails.

Proper registration ensures that your DSC works smoothly for filing ITRs, audit reports, and other e-forms.

Using the DSC for Income Tax Filing & Audit

A DSC is essential for companies, firms, and professionals when filing ITRs, audit reports, or e-form responses. It confirms your identity and keeps submissions secure.

How to Use Your DSC?

- Log in to the Income Tax e-Filing portal.

- Select or attach your DSC while submitting the return, audit report, or notice response.

- Sign digitally to complete the submission. The portal instantly verifies your DSC.

How DSC Verification Works?

The e-Filing system checks the DSC to:

- Confirm your identity.

- Ensure the document is not altered.

- Validate legal compliance under the IT Act.

Tips to Avoid Pitfalls

- Ensure the PAN and email match the DSC details.

- Renew or replace an expired DSC.

- Choose the correct certifying authority/provider.

- Use a compatible browser like Chrome or IE.

Correct usage of a DSC guarantees secure, legally valid, and hassle-free submissions for all income tax filings and audit requirements.

Renewal, Maintenance, and Expiry of DSC

A DSC is valid for 1, 2, or 3 years, depending on the type you choose. You must renew it before expiry to continue filing ITRs or submitting audit reports.

If your DSC expires, you cannot digitally sign filings. All submissions requiring a DSC will be rejected. You must re-register or renew your certificate immediately to resume compliance.

Safe Practices for DSC

- Keep the USB token secure.

- Backup certificate details in case of loss or system issues.

- Update your email and mobile number linked to the e-Filing portal if they change.

Record-Keeping for Compliance

Maintain copies of your issued certificate and token details. This is important for audit trails and compliance verification.

Following these practices ensures your DSC remains valid, secure, and ready for seamless income tax filing and audits.

A Digital Signature Certificate (DSC) ensures that your income tax filings and audit reports are secure, authentic, and legally valid. It is essential for companies, firms, and professionals under audit obligations. By knowing who needs a DSC, obtaining it from a certified authority, registering it on the e-Filing portal, and using it correctly, you can stay fully compliant.

Regular renewal, safe storage, and proper maintenance keep your submissions smooth, reliable, and hassle-free.

Frequently Asked Questions

Yes, individuals not under audit obligations can e-verify their ITR using OTP, net banking, or Aadhaar. A DSC is optional for them. However, using a DSC adds extra security and legal validity, especially if signing multiple forms or maintaining consistent compliance across different submissions.