MGT-7 is the annual return that Indian companies are required to file under the Companies Act, 2013. It provides a detailed snapshot of a company’s structure, management, shareholders, and compliance status for a financial year, ensuring transparency and regulatory oversight.

Filing MGT-7 is mandatory for all types of companies, including Private Limited, Public Limited, and One Person Companies (OPCs). Timely and accurate filing helps businesses stay compliant, maintain credibility with investors, and avoid penalties or legal issues. Recent amendments have introduced specific changes for OPCs and revised attachment requirements, making it important to stay updated with MCA rules.

Filing MGT-7 is mandatory for all companies, including Private Limited, Public Limited, and One Person Companies (OPCs). Timely and accurate filing helps businesses stay compliant, maintain credibility with investors, and avoid penalties or legal issues. Recent amendments have introduced specific changes for OPCs and revised attachment requirements, making it crucial to stay updated with MCA rules.

We at RegisterKaro simplify the entire filing process, ensuring that your MGT-7 submissions are accurate, complete, and compliant with the latest regulations.

What is the MGT-7 Form and its Legal & Regulatory Background?

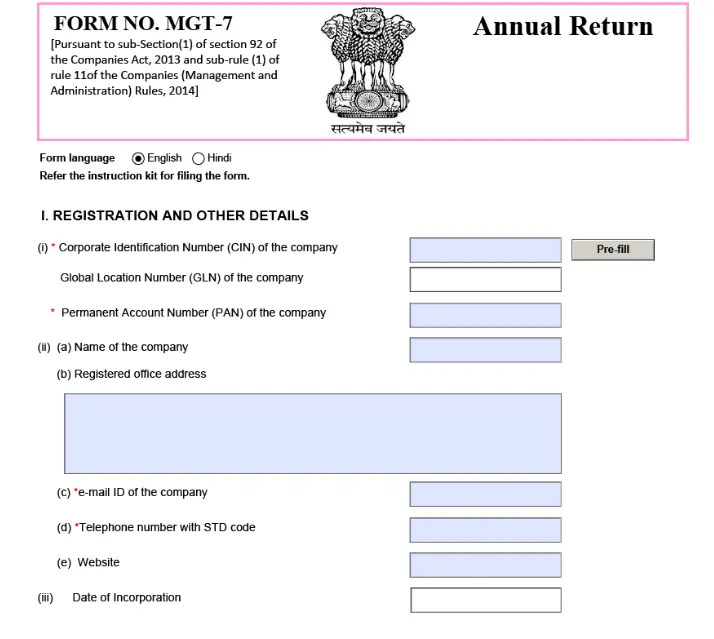

MGT-7 is an annual return filed by all Indian companies under Section 92 of the Companies Act, 2013, and Rule 11 of the Companies (Management and Administration) Rules, 2014. It records key details like the company’s directors, shareholders, and management structure for a financial year.

In 2020, the MCA introduced Form MGT-7A for One Person Companies (OPCs) and Small Companies to simplify compliance.

Understanding its legal basis and regulatory framework helps companies ensure proper submission and avoid penalties.

1. Provision Under the Companies Act, 2013

The MGT-7 form is mandated under Section 92 of the Companies Act, 2013, and governed by the Companies (Management and Administration) Rules, 2014. This makes filing the MGT-7 form compulsory for all applicable companies in India.

2. What “Annual Return” Means

An annual return is a comprehensive statement that provides key information about a company for a financial year. It typically includes:

- Registered office address and business activities

- Shareholding pattern

- Details of management and directors

- Information on meetings, remuneration, and indebtedness

Filing the MGT-7 form allows the Ministry of Corporate Affairs (MCA) and stakeholders to verify that the company is operating in compliance with Indian corporate laws.

What is the Difference Between MGT-7 and MGT-7A?

All companies file MGT-7 as their annual return under the Companies Act, 2013, while the MCA introduced MGT-7A in 2020 as a simplified version specifically for One Person Companies (OPCs) and Small Companies.

Key distinctions include:

- Applicability: MGT-7 is for all companies, whereas MGT-7A is only for OPCs and Small Companies.

- Simplified Format: MGT-7A requires fewer details and attachments, making compliance easier for smaller entities.

- Regulatory Compliance: Both forms ensure transparency, but MGT-7A is designed to reduce the compliance burden on smaller businesses.

What is the Purpose of the e-Form MGT-7?

Every company registered in India is required to prepare and file the MGT-7 form annually. The MGT-7 form’s purpose is to maintain transparency, ensure regulatory compliance, and provide a complete snapshot of the company’s financials, management, and shareholding for a financial year.

Key details captured in eForm MGT-7 include:

- Registered Office & Business Activities: Provides the company’s registered office, principal business activities, and business activity codes for MGT-7.

- Holding, Subsidiary & Associate Companies: Lists all companies under the corporate group.

- Share Capital & Securities: Details of shares, debentures, other securities, and the shareholding pattern.

- Indebtedness: Captures loans, borrowings, and other financial obligations.

- Members & Debenture-Holders: Includes details of members and debenture-holders with changes during the year.

- Promoters, Directors & KMPs: Shows names, designations, and alterations in promoters, directors, and key managerial personnel.

- Meetings: Records meetings of members, Board, and committees, along with attendance.

- Remuneration: Information on salaries, perquisites, and other benefits of directors and KMPs.

- Penalties & Legal Matters: Details of penalties, punishments, compounding of offences, and appeals filed.

- Certifications & Disclosures: Includes compliance certifications and other mandatory disclosures.

- Shareholding Pattern & Other Matters: Provides the company’s complete shareholding pattern and additional information required under the MGT-7 instruction kit.

Companies must comply with the MGT-7 due date, which is within 60 days from the date of the Annual General Meeting (AGM). Late submission may attract penalties and MGT-7 late fees. The form can be submitted online via the MCA portal (mca.gov.in), and the MGT-7 form download link is available along with the instruction kit for guidance.

Who Must File MGT-7: Understanding Its Applicability

All active Indian companies are required to file MGT-7 to ensure statutory compliance and transparency in corporate governance.

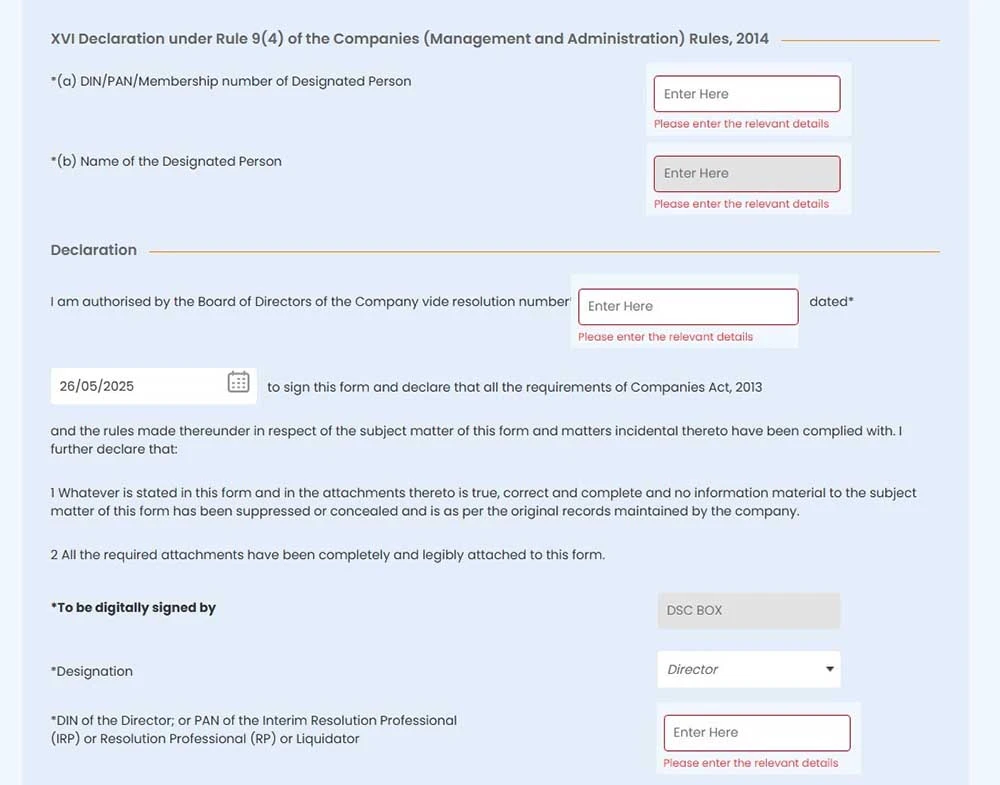

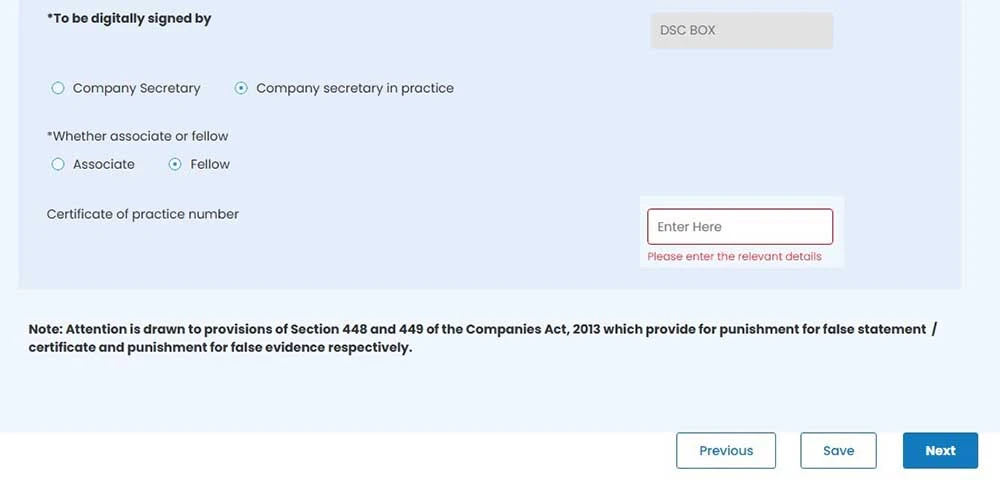

- Companies with a paid-up share capital of ₹10 crore or more or a turnover of ₹50 crore or more must get Form MGT-7 certified by a Practicing Company Secretary in Form MGT-8.

- One Person Companies (OPCs) are also required to file MGT-7A following amendments in the Finance Act, 2021.

- Ensures statutory compliance and transparency in corporate governance.

Exemptions and When Filing Ceases

- Companies officially classified as dormant may be exempt from filing.

- Companies that are struck off or under liquidation do not need to file MGT-7.

- Only active, operational entities are required to submit this annual return.

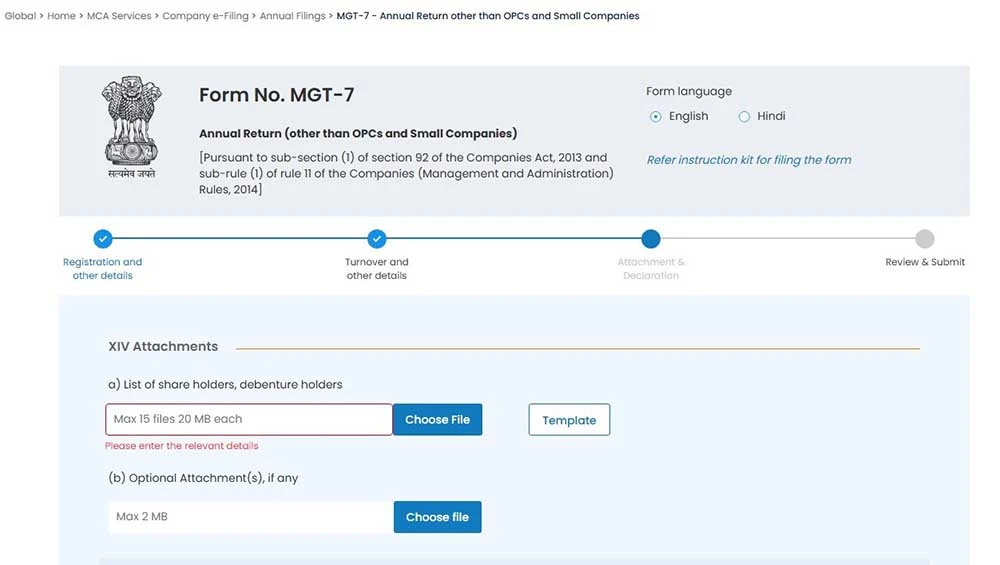

Which Attachments are Required to File MGT-7?

When filing the MGT-7 form, companies must attach scanned copies of relevant documents under the Attachments section at the end of the e-form. These attachments ensure that all information submitted is verified and compliant with the Companies Act, 2013.

The key attachments required for MGT-7 include:

- List of Shareholders and Debenture Holders: A complete record of all members and debenture holders as per the financial year. You can follow the list of shareholders for MGT-7 provided in the MCA guidelines.

- Approval Letter for Extension of AGM (if applicable): If the company held its AGM after the due date, a formal approval letter must be attached.

- Copy of MGT-8 (Certificate from Practicing Professional): For listed companies or those having paid-up share capital of ₹10 crore or more or turnover of ₹50 crore or more, the MGT-7 form must be certified by a practising Company Secretary in Form MGT-8.

- Optional Attachments: Any other supporting documents, if relevant, such as revised lists or additional disclosures.

Additional Notes:

- All attachments should be in scanned PDF or JPEG format as per MCA instructions.

- Companies should follow the MGT-7 instruction kit for proper naming, size, and format of attachments.

- Proper attachments help avoid errors, MGT-7 late fees, and potential MGT-7 penalties.

The MGT-7 form download option and instruction kit are available on the MCA portal, making it easier to file online.

Note: Smaller companies and One Person Companies (OPCs) that file Form MGT-7A are not required to obtain certification in Form MGT-8.

What is the Due Date for Filing MGT-7?

The MGT-7 due date is within 60 days of the date of the company’s Annual General Meeting (AGM). This ensures that the MGT-7 annual return is submitted on time and in compliance with the Companies Act, 2013.

Key points about the due date for filing MGT-7:

- The AGM of a company must be conducted on or before 30th September following the close of every financial year.

- Based on this, the last date to file MGT-7 is generally 29th November of the same year.

- Companies missing the MGT-7 due date may be liable to pay late fees or penalties.

- Proper planning ensures compliance with MGT-7 applicability, protects the company from fines, and maintains a clean MCA compliance record.

- The MGT-7 instruction kit and form download links are available on the MCA portal to help companies file the form accurately and on time.

Filing the MGT-7 form by the due date not only avoids penalties but also upholds transparency and accountability for stakeholders.

What Are the Consequences of Non-Filing MGT-7?

Filing the MGT-7 form on time is mandatory for all companies under Section 92 of the Companies Act, 2013. Failure to file the annual return in MGT-7 before the due date can lead to financial penalties and legal complications.

Key consequences include:

- Daily Penalty: As per amendments in 2018, companies face a penalty of Rs. 100 per day of default for late filing of MGT-7. This is commonly determined as the MGT-7 late fees.

- Non-Compliance Record: Late or non-filing is recorded in MCA records, which can affect the company’s compliance status and credibility.

- Legal Implications: Directors and Key Managerial Personnel (KMPs) may be held responsible for non-compliance under the MGT-7 Companies Act 2013.

- Additional Consequences: Continuous non-filing may attract stricter action, including fines or penalties on the company, affecting its MGT-7 applicability for future filings.

To avoid penalties, companies should:

- Keep track of the MGT-7 due date every year.

- Use the MGT-7 instruction kit for accurate filing.

- Ensure all MGT-7 attachments are complete and in the correct format.

- Download the MGT-7 form from the MCA portal and file it online on time.

Filing the MGT-7 annual return promptly not only avoids penalties but also ensures transparency, regulatory compliance, and protection of stakeholder interests.

How Can Companies Prepare a Checklist for Filing MGT-7?

Filing MGT-7 requires accurate preparation to comply with the Companies Act, 2013, and avoid late fees.

Checklist for Companies:

- Company Details: Confirm type, financial year-end, and AGM date.

- Registers Update: Verify members/shareholders and directors/KMPs.

- Capital & Securities: Confirm share capital, debentures, and shareholding changes.

- Financial & Business Info: Check principal business activity, business activity code for MGT-7, turnover, net worth, and indebtedness.

- Attachments: Prepare shareholder list, MGT-8, AGM minutes/approval, optional declarations.

- Filing: Fill e-Form MGT-7, attach documents, pay MGT-7 fees, submit online, and save acknowledgment.

- Support: Use templates from RegisterKaro; download the MGT-7 form and instruction kit.

How Can Service Providers Like RegisterKaro Help with MGT-7 Filing?

Filing MGT-7 can be complex, requiring accurate data, proper attachments, and timely submission to avoid MGT-7 late fees and penalties. Companies can simplify the process by leveraging compliance service providers like RegisterKaro, who ensure precise, on-time filing while maintaining confidentiality.

- Data Collection: RegisterKaro helps organize all company records, including shareholder details, KMP information, financial statements, and other compliance-related documents required for MGT-7 form submission.

- Form Preparation: The team accurately fills out e-Form MGT-7, includes all mandatory attachments, and ensures compliance with MCA rules, thereby reducing the risk of errors and rejection.

- Submission & Follow-Up: RegisterKaro files submissions online through the MCA portal, tracks their status, and securely records acknowledgement receipts for the company’s compliance records.

- Record-Keeping: The team securely maintains filed MGT-7 forms, attachments, and confirmations for audits, future reference, and compliance verification, ensuring the company’s regulatory records stay up-to-date.

For seamless, error-free, and on-time MGT-7 filing, companies can contact RegisterKaro to leverage professional support and simplify their compliance journey.

Final Thoughts

Filing MGT-7 is a crucial compliance requirement under the Companies Act, 2013, ensuring transparency, accountability, and accurate reporting of a company’s structure, shareholders, and financials. Timely submission not only avoids MGT-7 late fees and penalties but also strengthens the company’s credibility with regulators, investors, and stakeholders. By understanding the purpose, contents, applicability, and due dates, companies can efficiently manage their annual return obligations.

Partnering with professional service providers like RegisterKaro simplifies the filing process, offering support in data collection, form preparation, attachments, submission, and record-keeping. Leveraging such expertise ensures accurate, timely, and fully compliant filing of the MGT-7 form, allowing companies to focus on growth while maintaining complete regulatory adherence.

Frequently Asked Questions

MGT-7 is the annual return that companies registered in India must file under Section 92 of the Companies Act, 2013. It provides a detailed snapshot of a company’s management, shareholders, shareholding pattern, and compliance status for a financial year. Filing MGT-7 ensures transparency, accountability, and statutory compliance with the Ministry of Corporate Affairs (MCA).