When you register a company in India, you must file several statutory forms. One important form among those is Form INC-9. The form ensures that all subscribers and first directors declare their eligibility and compliance with the Companies Act, 2013.

Many founders overlook its nuances, especially those involving NRIs, apostille requirements, or electronic filing exceptions. Overlooking these details can delay the incorporation of a company.

In this blog, we will explain what Form INC-9 is, who needs to sign it, when and how to submit it, and recent updates or amendments. We will also cover the consequences of non-compliance. Understanding this form ensures a smooth and hassle-free company registration.

What is Form INC-9?

Form INC-9 is a declaration that every subscriber of the Memorandum of Association (MoA) and every first director of a company must sign. It falls under Section 7(1)(c) of the Companies Act, 2013, and Rule 15 of the Companies (Incorporation) Rules, 2014. Form INC-9 serves as a declaration of compliance, confirming that all requirements of the Act have been fulfilled before incorporation.

The form ensures that all subscribers and directors declare they are eligible to hold their positions. They confirm they are not disqualified, have no convictions or fraud cases, and that all information submitted to the Registrar is true and correct.

The Form INC-9 format is structured, with sections for company details, individual subscriber/director information, and declaration statements. The clear layout ensures all required information is captured systematically, reducing errors during filing.

Filing the INC-9 form helps the Ministry of Corporate Affairs (MCA) maintain corporate transparency. It also prevents ineligible persons from becoming company directors or subscribers.

The latest version includes updates from the May 2022 amendment, adding checkboxes for FEMA compliance, non-debt instruments, and land-border security clearance. Always use the current version from the MCA portal.

When to File Form INC-9?

You must file Form INC-9 during company incorporation. It is a part of the SPICe+ (INC-32) filing process. As per MCA’s SPICe+ (INC-32) process, Form INC-9 is auto-generated in electronic format and submitted online through AGILE-PRO (if applicable).

All subscribers and directors must submit it before the company receives its Certificate of Incorporation (COI). Filing it early ensures the MCA recognizes all key individuals as legally eligible.

Special cases require attention:

- NRIs and foreign nationals must submit the form along with notarized or apostilled documents during incorporation. If you sign documents outside India, get them notarized in your home country. Then, either apostille them (for Hague Convention countries) or have them consularized by the Indian Embassy or Consulate.

- Individuals without DIN or PAN must complete the required declarations electronically at the same time.

Timely filing of Form INC-9 helps avoid unnecessary delays and ensures smooth legal processing. Do not wait until after incorporation, as the form cannot be submitted separately later.

Who Must File Form INC-9?

Form INC-9 is a mandatory declaration for certain key individuals involved in starting a company. Filing this form ensures that all subscribers and directors confirm they are not disqualified from becoming directors and that they comply with the Companies Act, 2013. Missing this form can delay your company’s incorporation.

The following individuals must file Form INC-9:

- Subscribers to the MoA: These are the first people who agree to start the company and invest in it. By filing INC-9, they declare that they are legally eligible to become company shareholders and are not barred under any law from holding such a position.

- First Directors of the Proposed Company: These are the directors listed in the Articles of Association (AoA) at incorporation. Filing INC-9 allows them to declare that they meet all legal requirements to act as directors and have not been disqualified under the Companies Act.

- NRIs or Foreign Nationals: Non-resident Indians and foreign nationals must follow additional requirements. This may include notarization, apostille of documents, or compliance with electronic filing rules. Filing INC-9 correctly ensures that cross-border incorporation does not face legal hurdles.

- Individuals without DIN or PAN: People who do not yet have a Director Identification Number (DIN) or Permanent Account Number (PAN) need to follow the prescribed exceptions. They must obtain these identification numbers or submit required declarations electronically to comply with statutory requirements.

Properly filing Form INC-9 confirms that all key individuals are legally eligible and aware of their responsibilities. It helps prevent rejection of incorporation applications and ensures a smooth registration process.

What Does the INC-9 Form Contain?

Form INC-9 collects essential information about the company and its key individuals. It ensures all subscribers and directors declare their eligibility and compliance.

The form includes:

- Company Details – Name of the company and the total number of subscribers, and directors.

- Subscriber/Director Details – For each subscriber or first director, the form asks for:

- Name and address

- DIN, PAN, or Aadhaar (as applicable)

- Declarations by Subscribers and Directors – Each individual confirms that they:

- Have not been convicted of any offence related to promotion, formation, or management of a company in the past five years.

- Have not been found guilty of fraud, misfeasance, or breach of duty under any company law in the past five years.

- Believe that all documents filed with the Registrar are true, correct, and complete to the best of their knowledge.

- Additional/Recent Updates – The 2022 amendment added new declarations for:

- Subscription of shares under FEMA (Foreign Exchange Management (Non-debt Instruments) Rules, 2019).

- Persons from land-border countries who require security clearance before subscription.

Filing Form INC-9 with accurate details and declarations ensures that the company incorporation process remains smooth and legally compliant.

How to File Form INC-9?

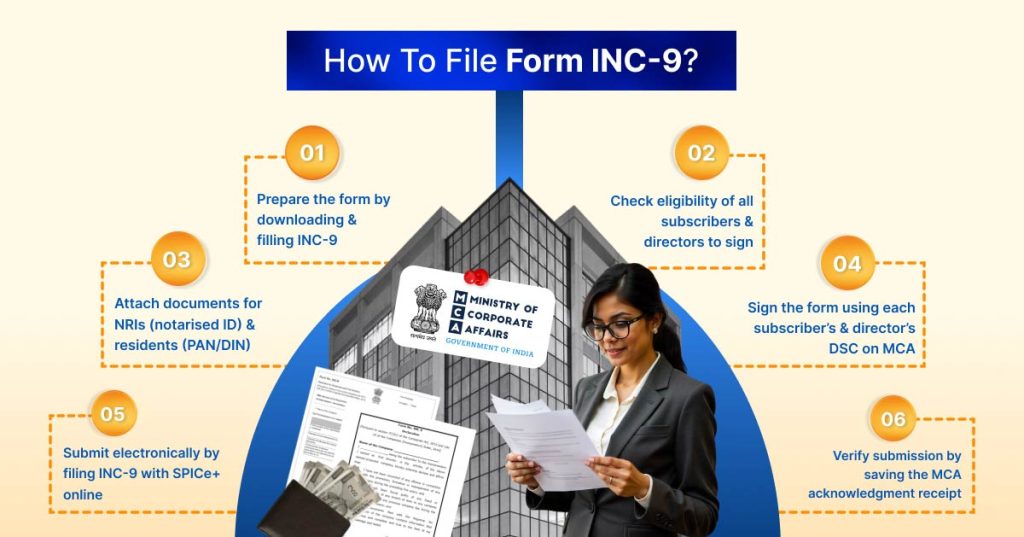

You must file Form INC-9 carefully to avoid delays in company incorporation. Follow these steps:

- Prepare the Form: Download Form INC-9 from the MCA portal. Fill in details like name, address, DIN/PAN (if applicable), and declaration statements.

- Check Eligibility: Make sure all subscribers and directors can legally sign the form. NRIs or individuals without DIN/PAN must follow special requirements.

- Attach Documents: Attach notarized or apostilled documents for NRIs and foreign nationals. Indian residents attach PAN or DIN copies.

- Sign the Form: Each subscriber/director with a DSC must sign Form INC-9 electronically through the MCA portal (mca.gov.in).

- Submit Electronically: File Form INC-9 along with SPICe+ (INC-32) during company incorporation. Submit directly on the MCA portal.

- Verify Submission: Download the acknowledgment receipt from the MCA portal. Keep it safe for future reference.

Filing Form INC-9 correctly confirms eligibility and prevents incorporation delays. Double-check all details and attachments before submission. In most cases, Form INC-9 is auto-generated by the MCA system when you file SPICe+ (INC-32) for company incorporation.

Need help with filing Form INC-9 or company incorporation? Let RegisterKaro, one of India’s top CA and incorporation service providers, handle the process for you quickly and accurately. Contact us today to get started.

Consequences of Non-Compliance with Form INC-9

Failing to file Form INC-9, or filing it incorrectly, can create serious problems for a company.

- Delay or Rejection of Incorporation: The MCA may reject the incorporation application or delay the issuance of the Certificate of Incorporation.

- Legal Penalties for Directors and Subscribers: Individuals who submit incorrect or incomplete declarations may face penalties under the Companies Act, 2013.

- Resubmission of Forms: Incorrect filings require resubmission, which wastes time and increases administrative effort.

- Impact on Future Filings: Errors in Form INC-9 can lead to complications in subsequent filings, such as changes in directors or shareholding.

- Loss of Credibility: Non-compliance may affect the company’s credibility with banks, investors, or regulatory authorities.

Filing Form INC-9 accurately prevents delays, avoids penalties, and ensures smooth incorporation.

Common Mistakes to Avoid When Filing Form INC-9

Filing Form INC-9 correctly is essential for smooth company incorporation. Here are common mistakes, why they happen, and how to fix them:

- Using an outdated version of the form: Some founders download old templates that do not reflect the latest amendments.

Always download the latest version from the MCA portal before filing. - Missing signatures of subscribers or directors: Sometimes a subscriber or director forgets to sign, which makes the form invalid.

Ensure all subscribers and directors sign the form. Use digital signatures if filing online. - Not providing notarized/apostilled documents for NRIs or foreign nationals: Many NRIs or foreign nationals submit incomplete documents, causing delays.

Attach all required notarized or apostilled documents to comply with MCA rules. - Incorrect DIN, PAN, or Aadhaar details: Entering the wrong identification numbers can lead to rejection.

Double-check all numbers before submission and correct errors immediately. - Incomplete or inaccurate declarations: Skipping or incorrectly filling declaration statements can result in non-compliance.

Fill all declaration fields carefully, confirming that information is accurate.

Following these steps prevents delays, avoids penalties, and ensures smooth company incorporation.

Form INC-9 is a critical part of company incorporation in India. It ensures that all subscribers and directors are legally eligible and aware of their responsibilities. Filing it correctly prevents delays, avoids penalties, and ensures smooth registration.

By understanding who must file, when to submit, and how to complete the form, founders can navigate the incorporation process confidently and stay compliant with the Companies Act, 2013.

Tip: If you’re incorporating your company through RegisterKaro, our experts ensure your Form INC-9 and other incorporation documents are correctly prepared, digitally signed, and submitted in one go.

Frequently Asked Questions

Form INC-9 is a mandatory declaration that every subscriber of the Memorandum of Association (MoA) and every first director must sign during company incorporation. It confirms that all individuals are eligible, not disqualified, and have no convictions or fraud cases. Filing this form ensures legal compliance and smooth company registration with the MCA.