Before 2020, company registration in India meant filing separate applications for registrations like GSTIN, EPFO, ESIC, Professional Tax, and even a bank account. This made the process time-consuming and complex. To streamline this, the Ministry of Corporate Affairs (MCA) launched a single integrated system, the SPICe+ form, with its linked e-form AGILE-PRO-S (INC-35).

The system allows multiple registrations through one filing, reducing duplication and speeding up approval.

This blog explains what the AGILE-PRO-S form is, when it was introduced, its legal basis, and how it simplifies company incorporation in India.

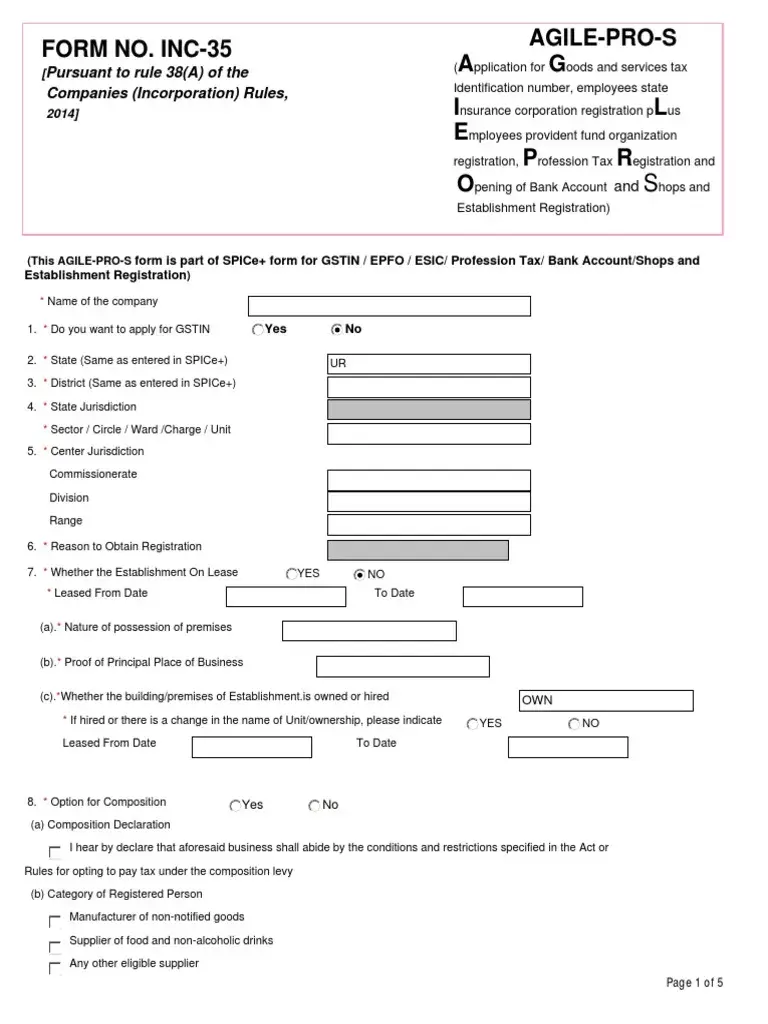

What is AGILE-PRO-S (Form INC-35)?

AGILE-PRO-S stands for:

A– Application for GSTIN

G– Goods and Services Tax registration

I– Income Tax

L– Plus labour welfare (ESIC) registration

E– Employee Provident Fund Registration

PRO-S – Profession tax Registration and Opening of bank account, and Shop and establishment registration

It is an integrated e-form filed with SPICe+ Part B during company incorporation.

The Ministry of Corporate Affairs introduced this form under the Companies (Incorporation) Fourth Amendment Rules, 2021, effective from June 7, 2021. It replaced the earlier AGILE-PRO form notified in 2019. Through Rule 38A, the MCA made it mandatory to file AGILE-PRO-S, along with the SPICe+ form, for new company registrations.

The form replaced the earlier version, AGILE-PRO (INC-35). The upgraded AGILE-PRO-S added new options like Shops & Establishment registration and Profession Tax registration, expanding its coverage beyond GST, EPFO, ESIC, and bank account openings.

In short, AGILE-PRO-S offers a single-window solution for multiple statutory registrations, ensuring every new company becomes compliant from the moment it is incorporated.

Why is AGILE-PRO-S Important for Company Incorporation?

The AGILE-PRO-S form plays a crucial role in company incorporation because it makes six statutory registrations part of a single, streamlined process. The MCA has made it a linked and mandatory e-form under the SPICe+ system, ensuring that new companies are fully registered and compliant from the start.

The form enables new companies to start operations immediately; hire employees, pay statutory dues, and manage finances, without additional filings. It saves significant time and administrative effort during incorporation.

Download the AGILE-PRO-S form to review the structure and required fields before submission.

However, AGILE-PRO-S applies only to new incorporations through SPICe+. Existing businesses and certain entities like tax deductors, collectors, Input Service Distributors (ISDs), and factories must follow their separate registration processes.

Partnering with RegisterKaro makes filing AGILE-PRO-S simple and stress-free. Our experts handle documentation, compliance, and submission accurately, ensuring quick approval and a smooth incorporation process. Contact us today.

Registrations Covered Under the AGILE-PRO-S Form

The AGILE-PRO-S (INC-35) form lets new companies apply for multiple registrations in one go. Each registration fulfills a key legal or compliance need, making the company ready to operate from day one.

1. GSTIN Registration (Goods and Services Tax Identification Number)

GST registration lets a company collect and pay GST on goods or services. It’s required for businesses crossing the turnover limit or operating across states. AGILE-PRO-S allows companies to get a GSTIN during incorporation, avoiding a separate GST filing later.

2. EPFO Registration (Employees’ Provident Fund Organisation)

The EPFO registration covers employee provident fund contributions. It’s mandatory for establishments with 20 or more employees. Filing through AGILE-PRO-S automatically generates an EPFO Establishment ID for seamless PF compliance.

3. ESIC Registration (Employees’ State Insurance Corporation)

ESIC registration ensures health and insurance benefits for employees. It’s required for units with 10 or more workers earning wages under the prescribed limit. The ESIC code is allotted immediately when the company files AGILE-PRO-S.

4. Profession Tax Registration (State-Specific)

This registration applies in select states like Maharashtra, Karnataka, and West Bengal. Through AGILE-PRO-S, companies in these states can register automatically for Profession Tax. States and UTs without Profession Tax include Delhi, Haryana, Punjab, Rajasthan, Himachal Pradesh, Uttar Pradesh, Uttarakhand, Goa, and all Union Territories (except Puducherry).

5. Company Bank Account Opening

AGILE-PRO-S integrates account opening with banks such as ICICI, HDFC, Axis, Kotak, and PNB. The company selects a bank in the form, and the account opens after incorporation approval.

6. Shops & Establishment Registration (State-Wise)

This registration is needed for most offices and shops under state laws. AGILE-PRO-S enables companies to apply during incorporation, removing later visits to local authorities. Currently, Delhi is the only state where Shops & Establishment registration is fully integrated with the SPICe+ and AGILE-PRO-S forms (as per the notification dated 28 May 2021).

In other states like Maharashtra, Karnataka, Tamil Nadu, and West Bengal, the registration is still handled separately through respective state labor departments and is not yet available through AGILE-PRO-S. Integration is expected to expand gradually to more states in the coming years.

In short, AGILE-PRO-S unites tax, labor, and banking registrations into one process, making company setup faster and fully compliant.

Who Must File AGILE-PRO-S?

The AGILE-PRO-S (INC-35) form is mandatory for all new companies being incorporated through the SPICe+ (INC-32) e-form route on the MCA portal. This includes:

- Private Limited Companies

- Public Limited Companies

- One Person Companies (OPC)

- Section 8 companies incorporation

Filing this form ensures that all major statutory registrations are applied for at the same time, making the company compliance-ready from day one.

The form does not apply to existing entities or certain types of organizations. Businesses that already exist must register separately for GSTIN, EPFO, ESIC, and other registrations through their respective portals. Other entities outside AGILE-PRO-S’s applicability include:

- Factories governed under the Factories Act

- Tax deductors and collectors under GST

- Input Service Distributors (ISDs)

Documents Required to File AGILE-PRO-S Form

Filing the AGILE-PRO-S (INC-35) form requires several supporting documents for the multiple registrations it covers. Some documents required are:

1. Proof of Principal Place of Business

You must provide proof of the company’s registered office. Acceptable documents include:

- Property tax receipt

- Municipal khata

- Electricity bill

- Lease or rent agreement with No Objection Certificate (NOC) from the owner

- Legal ownership documents

2. Authorized Signatory Appointment

For banking and statutory purposes, you need to appoint an authorized signatory:

- Board resolution approving the signatory

- Or a letter of authorization

3. Identity & Address Proof of Authorized Signatory

For bank account opening, submit:

- PAN card

- Aadhaar card or Passport

- Ensure the signatory is a resident of India

4. Specimen Signature for EPFO

A specimen signature is required for the authorized signatory to complete EPFO registration. This helps EPFO verify the authorized person for handling provident fund contributions. The signature should be clear, consistent, and match the board resolution. It is scanned and uploaded during filing and used for all official EPFO correspondence.

5. Additional Documents for Specific Registrations

Each registration included in AGILE-PRO-S may require extra documentation beyond the common documents above:

| Registration Type | Additional Documents Required |

| GSTIN | No extra documents are usually needed beyond proof of the principal place of business. |

| EPFO | Specimen signature and board resolution. |

| ESIC | Employee details such as the number of employees and their wage structure. |

| Profession Tax (if applicable) | Minimal documents; generally covered within SPICe+ filings. |

| Bank Account | Identity and address proof of the authorized signatory, along with a board resolution. |

| Shops & Establishment | Proof of office address, usually the same as the registered office. |

How to File AGILE-PRO-S?

Filing the AGILE-PRO-S form is an integrated process linked with SPICe+, designed to make multiple registrations simpler and faster. Here’s how to complete it:

1. Incorporate Your Company via SPICe+

Start by filing SPICe+ (INC-32) for company incorporation. Attach the required documents, including:

- INC-33 (MOA): Memorandum of Association

- INC-34 (AOA): Articles of Association

- URC-1, if applicable

Once SPICe+ is approved, the Registrar of Companies issues your Certificate of Incorporation.

2. Access AGILE-PRO-S (INC-35)

After SPICe+ approval, the AGILE-PRO-S form becomes linked and accessible on the MCA portal (mca.gov.in).

3. Fill in Required Details

Enter all necessary information, including:

- Business activity and goods/services HSN codes

- State and city jurisdiction

- Bank account details

- Director and authorized signatory details

Note: You can choose from MCA-integrated banks such as ICICI, Punjab National Bank, Kotak Mahindra, Bank of Baroda, or Axis Bank for automatic bank account creation.

4. Upload Required Documents

Upload all supporting documents for the registrations, including:

- Proof of principal place of business (utility bills, rent/lease agreement, property ownership documents)

- Board resolution or letter of authorization

- Identity and address proof of authorized signatory for the bank account

- Specimen signature for EPFO

Refer to the section “Documents Required to File AGILE-PRO-S Form” for complete details.

5. Apply Digital Signature

The proposed director or authorized signatory must sign the form digitally, using the same Digital Signature Certificate (DSC) applied for SPICe+.

6. Submit the Form

Submit AGILE-PRO-S along with SPICe+ and any other linked e-forms. The Registrar of Companies (ROC) and relevant authorities then process the application.

Note: There is no additional fee for filing AGILE-PRO-S beyond the standard incorporation fees. This makes it a cost-effective way to obtain multiple registrations in one go.

Filing AGILE-PRO-S requires accuracy and attention to detail, as even small mismatches can delay approval. RegisterKaro can handle every step for you, ensuring a smooth, fast, and error-free filing so you can focus on growing your business.

Common Mistakes to Avoid When Filing AGILE-PRO-S

Filing AGILE-PRO-S (INC-35) requires accuracy. Small errors can cause delays or rejections. Common mistakes include:

- Mismatch in Director or Signatory Details: Ensure names, PAN, and DIN match across SPICe+, AGILE-PRO-S, and supporting documents.

- Incorrect Address Proof: The registered office address must match in all documents, like rent agreements or utility bills.

- Blurry or Incomplete Documents: Scan documents clearly and upload all required pages.

- Wrong Selection of Registrations: Select only the applicable registrations. Avoid adding unnecessary ones like ESIC if not required.

- DSC Issues: Use a valid DSC of the proposed director or authorized signatory.

- Ignoring State-Specific Rules: Check requirements for Profession Tax or Shops & Establishment in your state to avoid resubmission.

Tip: Partnering with RegisterKaro can make the process smoother. Our experts handle all documentation, prevent common errors, and complete your AGILE-PRO-S filing quickly and accurately

Difference Between AGILE-PRO and AGILE-PRO-S

The AGILE-PRO-S form, introduced on 7 June 2021 through the Companies (Incorporation) Fourth Amendment Rules, 2021, replaced the earlier AGILE-PRO (INC-35). Both forms are filed along with SPICe+ for multiple registrations, but there are many key differences:

| Feature | AGILE-PRO (INC-35) | AGILE-PRO-S (INC-35) |

| Registrations Covered | GSTIN, EPFO, ESIC, Bank Account Opening | GSTIN, EPFO, ESIC, Bank Account, Profession Tax (where applicable), Shops & Establishment Registration |

| Legal Basis | Part of MCA’s initial SPICe+ integration | Introduced via Companies (Incorporation) Fourth Amendment Rules, 2021; Rule 38A mandates linked filing |

| Scope | Limited to core registrations | Broader coverage for compliance, including state-specific registrations |

| Purpose | Simplified multiple registrations | Comprehensive compliance-ready solution for new companies |

| Applicability | New companies incorporating under SPICe+ | New companies incorporating under SPICe+, with additional state-level registrations included |

Conclusion

The AGILE-PRO-S (INC-35) form streamlines company incorporation by combining multiple registrations in a single process. It helps new companies become compliant from day one, saving time and reducing paperwork.

With AGILE-PRO-S, businesses can secure GSTIN, EPFO, ESIC, bank account, Profession Tax, and Shops & Establishment registration quickly, ensuring a smooth start to operations.

Choose RegisterKaro and get expert help with your AGILE-PRO-S filing to ensure a fast, error-free, and fully compliant incorporation process.

Frequently Asked Questions

Companies file AGILE-PRO-S as a linked e-form along with SPICe+ during incorporation. It allows new companies to apply for multiple registrations simultaneously, including GSTIN, EPFO, ESIC, bank account, Profession Tax (where applicable), and Shops & Establishment registration, making the incorporation process faster and compliance-ready from day one.