Partnership Firm Registration Process in India: Documents and Fees

A Partnership Firm Registration process in India allows two or more individuals to combine their skills, resources, and capital to run a business together. Partners share profits, losses, and responsibilities according to the partnership deed, making it a flexible and collaborative business structure. The firm suits small to medium-sized enterprises, family businesses, and startups that want shared management and decision-making.

Partnership Firm Registration gives legal recognition to the business, protects partners’ rights, and allows them to enforce agreements in court. It also enables the firm to access loans, government schemes, and financial benefits that unregistered firms cannot claim.

Whether you’re an entrepreneur, an MSME owner, or a startup, this blog will walk you through each step to start a partnership firm in India. You will also learn about the required documents, applicable fees, and the benefits of having a legally recognized firm.

What is a Partnership Firm Registration?

A partnership firm is a business where two or more individuals join to run a venture and share profits. Partners contribute capital, skills, or resources and divide profits, losses, and responsibilities as per the partnership deed. The Indian Partnership Act, 1932, governs the partnership firm registration process and operation across India.

Some of the key features of a Partnership Firm are:

- Minimum Partners: A partnership firm must have at least two partners to operate.

- Unlimited Liability: Partners are personally accountable for the firm’s debts.

- Profit Sharing: The profit-sharing ratio is set by mutual consent, as stated in the partnership agreement.

- Joint Responsibility: Partners are jointly responsible for the firm’s debts and obligations.

- Legal Recognition: Registered partnership firms gain legal standing, whereas unregistered firms face challenges in legal matters.

Once partners register a partnership firm, the business gains legal recognition under Indian law. This recognition helps them enforce agreements, resolve disputes, and run operations smoothly. Unregistered firms face challenges in enforcing contracts and protecting their business interests. Completing the partnership firm registration process accurately ensures legal compliance and supports sustainable business growth.

How to Register a Partnership Firm in India? Step-by-Step Process

Registering a partnership firm in India involves a series of legal and administrative steps. Here is a step-by-step process for registering your partnership firm in India:

1. Choose a Partnership Firm Name

First, select a unique name for your company. Ensure the name does not conflict with any existing trademarks or businesses.

Rules for naming:

- The name must not be identical to an existing business name.

- Avoid using words that violate trademarks.

- The name should reflect the nature of the business.

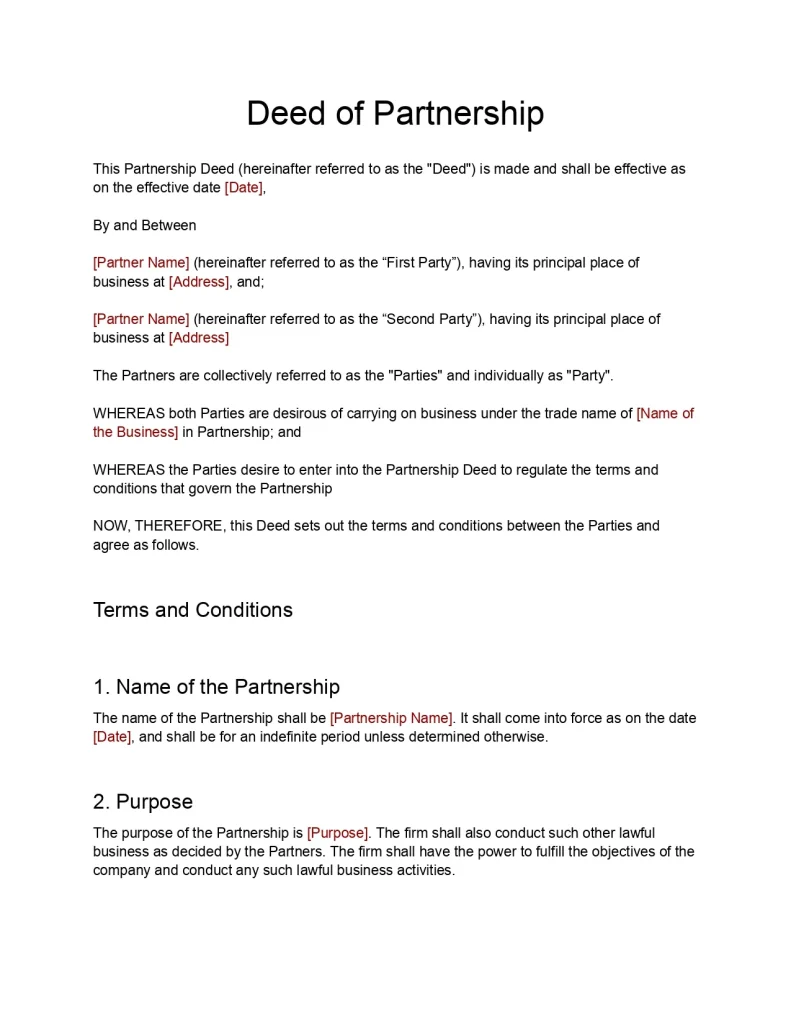

2. Draft a Partnership Deed

A partnership deed is a legal document that outlines the terms of the partnership. It is a critical part of the firm registration process.

- Mandatory clauses include:

- Name and nature of the business.

- Capital contribution of each partner.

- Profit-sharing ratio among partners.

- Duration of the partnership.

- Optional clauses:

- Dispute resolution procedures.

- Terms for admitting or retiring partners.

Note: The deed must be signed by all partners and notarized. This legally binds the partners to the terms of the agreement.

3. Prepare the Required Documents

You must gather several documents to complete the registration process. Required documents for partnership firm registration include:

- Signed partnership deed (notarized).

- Identity proof (Aadhaar card, PAN card) of all partners.

- Proof of address for all partners (utility bills, rental agreements).

- Proof of the business address (rental agreement or utility bill).

- Passport-sized photographs of the partners.

4. File the Application with the Registrar of Firms

The next step is to file the application with the Registrar of Firms in your state. This involves submitting the application form, required documents, and the partnership deed.

- Form required: Form I (available on the Registrar’s website). Form I is state-specific, and its format may vary depending on your state’s requirements.

- Submission process: Can be done online or offline, depending on the state.

- Payment of registration fee: This fee varies from state to state.

Once the registrar processes the application, they will verify the documents and register your partnership firm.

5. Verification and Certificate

The Registrar of Firms reviews the application and the partnership deed. If everything is in order, they issue the Certificate of Registration. This certificate serves as legal proof that your partnership firm is officially recognized and authorized to operate.

The partnership firm registration process usually takes 7 to 15 days, depending on your state and the completeness of your documents. Delays can occur if the documents are incomplete or need verification.

The registration procedure involves multiple steps and legal formalities, which can feel complex and time-consuming. RegisterKaro can simplify the entire process for you, from drafting the partnership deed to filing the application and obtaining your Certificate of Registration. Contact us today!

How Much Does it Cost to Register a Partnership Firm in India?

The cost for registering a partnership firm ranges from ₹5,000 to ₹30,000, depending on the region and the professional services you select. The registration fee in India depends on various factors, such as firm capital, services used, and state regulations. Below is an overview of the general fees involved in the partnership firm registration process:

| Fee Type | Amount (₹) |

| Partnership Deed Stamp Duty | ₹200 – ₹2,000 |

| Registration Fee | ₹200 – ₹1,000 |

| Name Search and Reservation | ₹100 – ₹500 |

| Drafting Partnership Deed | ₹3,000 – ₹8,000 |

| Legal Consultation | ₹2,000 – ₹5,000 |

| Registration Assistance | ₹5,000 – ₹15,000 |

| PAN Card Application | ₹110 (online) / ₹225 (physical) |

| GST Registration | Free + professional charges (if applicable) |

These fees may increase if you opt for expedited processing or additional services.

The benefits of registering a partnership firm include getting business legal recognition, protecting partners’ rights, and making it easier to enforce agreements. It also helps firms access loans, government schemes, and other financial advantages while enhancing credibility with clients, vendors, and investors. To explore all the advantages in detail, check out a detailed blog on the benefits of a Partnership Firm.

Conclusion

The partnership firm registration process in India ensures legal recognition, protects the partners, and helps in business growth. By following the steps outlined, you can easily register a partnership firm in India.

This registration offers numerous benefits such as legal recognition, access to loans, and enhanced credibility. Whether you are starting a new firm or expanding an existing one, registering your partnership firm will set the foundation for success.

Frequently Asked Questions

The partnership firm registration process in India involves selecting a firm name, drafting a partnership deed, and filing the application with the Registrar of Firms. Once registered, the firm gains legal recognition, allowing partners to enforce contracts and access loans. The process varies by state, and registration fees differ as well.