The Provident Fund (PF) is a government-backed retirement savings scheme that provides financial security to employees in India. Employees and employers contribute a fixed portion of their salaries to PF, which can be withdrawn later. PF claims allow employees to withdraw this accumulated balance either fully or partially, depending on eligibility. Employees can also track the PF claim status online using their PF Tracking ID on the Employees’ Provident Fund Organization (EPFO) portal (epfindia.gov.in).

A PF Tracking ID (e.g., EPF/2026/1234567890) is a unique reference number generated when you submit your PF claim online. It lets you check the status of your claim quickly without having to repeatedly contact the PF office.

This blog is intended for employees, ex-employees, and first-time PF claimants. It also applies to freelancers with EPF accounts. It will help them monitor their PF claims efficiently and ensure smooth PF processing.

What is PF Claim Status, and Why is it Important to Check it?

PF claim status indicates the current stage of your PF withdrawal request. After you submit a claim, the EPFO updates its status so you can monitor progress. Common statuses include:

- Payment Under Process: Your claim has been approved, and EPFO is initiating payment. It typically takes 2-3 working days.

- Settled: EPFO has sent the money via NEFT. You should check your bank in 1-3 days.

- Pending at Employer: Your claim is awaiting your employer’s digital signature or approval. The timeline is indefinite until HR completes the action.

- DA or AO Pending: Your claim is under review by the Dealing Assistant (DA) or Accounts Officer (AO) at EPFO. This usually takes 3-7 working days.

- Rejected: The status shows your PF claim was denied due to incomplete documents, mismatched details, or non-eligibility. In this case, you may need to resubmit your PF claim.

Monitoring online PF claim status ensures you are aware of delays and can take action if needed.

Note: If you have linked your mobile number with your Universal Account Number (UAN), you can receive updates on your PF claim via SMS notifications.

Why Check Your PF Claim Status?

Keeping an eye on your PF claim status is important for several reasons:

- Enable you to stay informed about your withdrawal progress.

- Helps you plan your expenses better by providing an expected credit timeline.

- It allows you to spot delays or errors early and take quick action.

- It ensures you get your PF amount without unexpected interruptions, especially if you rely on it for expenses.

Regularly checking your PF claim status also helps first-time claimants stay informed and reduces dependency on offline inquiries.

Learn more about PF claim eligibility, documents required, and the complete registration process in our detailed guide on ESI Employer Registration in India.

Pre-Requisites Before Checking Your PF Claim Status

Before you check your PF claim status online, make sure you have the required details ready. It includes:

1. Documents and Details You Must Have

To perform a smooth PF claim status check, keep the following information handy:

- UAN (Universal Account Number): This is required to log in to the EPFO portal and check detailed PF claim status information. The UAN connects all your PF accounts in one place.

- Registered Mobile Number: The mobile number linked to your UAN is required for OTP verification. Without it, you cannot access your claim details.

- PF Account/Member ID: This helps identify your specific employment record, especially if you changed jobs.

- PF Tracking ID (if available): If you have already submitted a claim, you can track the PF claim status with the tracking ID directly without navigating multiple sections.

Having these details ensures you can quickly check your online PF claim status without interruption.

2. Ensure KYC Details Are Updated

Before you check or submit a claim, verify that your KYC details are correctly updated in the EPFO portal. This includes:

- Aadhaar number

- PAN card details

- Bank account information (linked and verified)

If your KYC is incomplete or mismatched, your PF claim status may remain under process for a long time or even get rejected. Many delays in PF withdrawal claim status happen due to incorrect bank details or unverified Aadhaar.

Tip: Always update and verify your KYC in the EPFO portal before submitting or tracking your claim. This reduces the chances of rejection and speeds up the settlement process.

How to Check PF Claim Status Online in India?

To check your PF claim status online, follow these steps:

1. Check PF Claim Status Using UAN

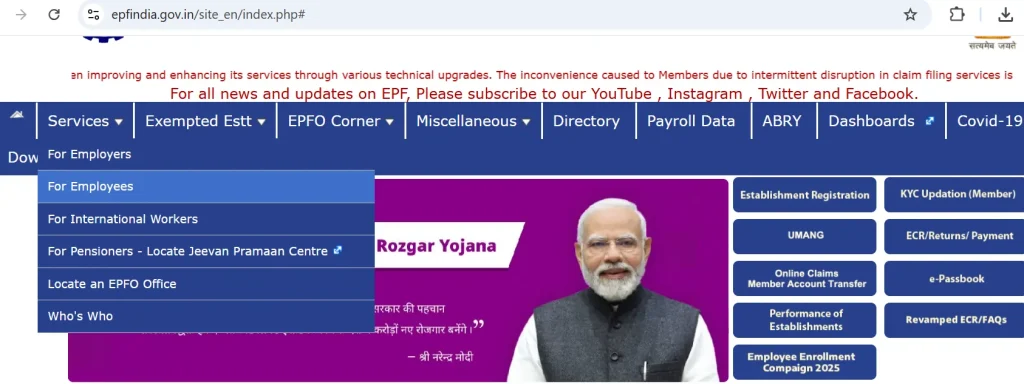

Visit the EPFO official website (epfindia.gov.in) and follow the steps mentioned below to check your PF claim status online:

Step 1: Open Employee Services

- Click on Services in the top menu.

- Select For Employees.

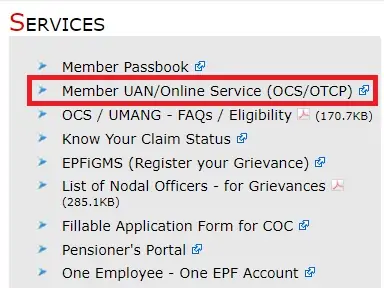

- Click on Member UAN/Online Services (OCS/OTCP).

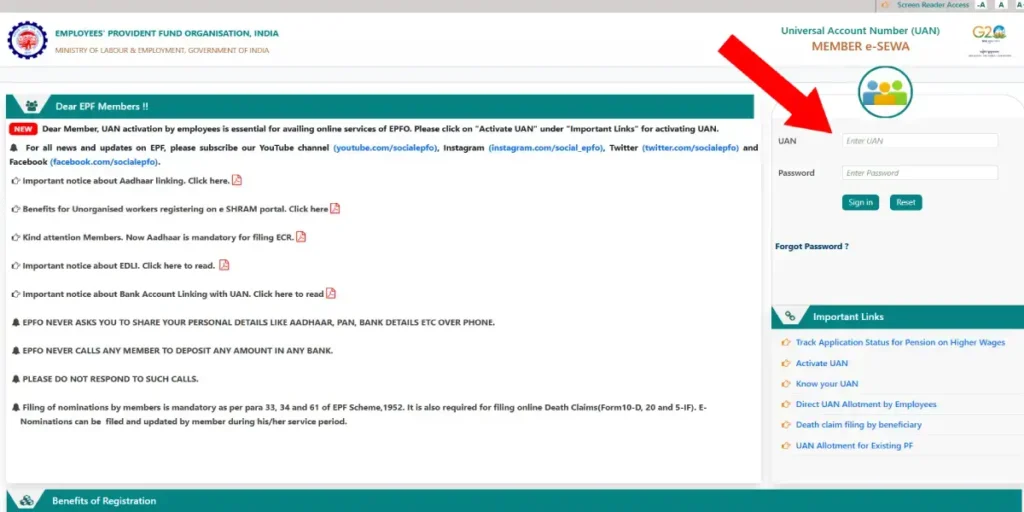

Step 2: Log in with UAN

Enter the following details:

- Your UAN (Universal Account Number)

- Password

- CAPTCHA code

Then Click Sign In. After logging in, go to the top menu to find the online services option and select Track Claim Status to view PF claim details.

Step 3: View Claim Details

You will see a list of submitted claims. Click the relevant claim to view:

- Current PF claim status

- Claim submission date

- Claim type (Form 19, 10C, 31)

- Member ID

- Settlement amount (if approved)

- Bank account (last 4 digits)

2. Track PF Claim Status Without UAN (Through Tracking ID Method)

If you do not have login access but have your PF Tracking ID, you can still track progress. Refer to the following steps:

Step 1: Visit the EPFO Website

Go to epfindia.gov.in to get started and follow these steps:

- Click Services, then select the Employees option.

- Select Know Your Claim Status or Track Claim Status (as available).

Step 2: Enter Required Details

Provide the following details:

- PF Tracking ID

- Member ID (if asked)

- CAPTCHA code

After providing all these details, click on Submit.

Step 3: Check Status

The system will display your current online PF claim status, such as:

- Under Process

- Settled

- Rejected

This method allows you to quickly track PF claim status using the tracking ID, but it does not provide full account access.

Note: UAN is required to complete a full PF claim status login on the EPFO member portal. Without a UAN, you cannot access your account dashboard or view detailed claim information. A tracking ID can only show the brief PF claim status. It is strongly recommended to get a UAN beforehand.

Also read: How to Withdraw PF Amount Online from EPFO Portal?

Alternate Ways to Track PF Claim Status in India

Apart from the official EPFO portal, there are several alternative ways to conveniently track your PF claim status. These include:

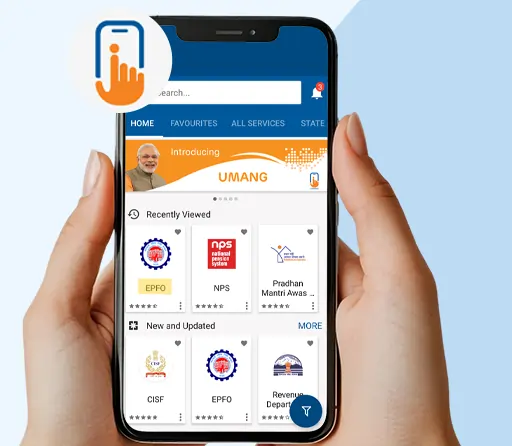

- UMANG App: The UMANG app lets users check their PF claim status directly on their mobile devices. After logging in with a registered mobile number and verifying the UAN through OTP, users can access EPFO services and view complete claim details.

- SMS Service: Send the SMS (EPFOHO UAN

) to 7738299899 from your registered mobile number to receive PF details and basic claim updates.

SMS Code example, EPFOHO UAN

- Missed Call Service: Give a missed call from your UAN-linked mobile number to 9966044425 to receive your PF account and claim details via SMS.

- EPFO Toll-Free Number: Call 1800 118 005 and speak with EPFO support staff to manually check your PF claim status if you face issues online.

Choose the method that suits you best and keep your UAN & registered mobile number updated for accurate claim updates.

Typical Timelines for PF Claim Approval

In most cases, EPFO usually processes PF claims within 7 to 15 working days. However, the timeline may vary depending on:

- Completion of KYC (Aadhaar, PAN, bank details)

- Employer verification delays

- Regional EPFO office workload

- Accuracy of submitted details

If your PF claim status remains under process beyond the usual timeframe, EPFO verification may still be ongoing.

What to do if the PF Claim Status is Not Updating?

If your PF claim status under process continues for more than 15 working days, take these steps:

- Check KYC Details: Log in and confirm your Aadhaar, PAN, and bank details are verified. Incorrect KYC often delays the PF claim status update.

- Verify Bank Account: Ensure the bank account linked to your PF is active and matches your EPFO records. Name mismatches can hold payment.

- Confirm Employer Approval: Some claims require employer verification. Contact your HR department to check if approval is pending.

- Raise an EPFO Grievance: Use the EPFO grievance portal to submit a complaint and track resolution. Mention your claim details clearly.

- Call EPFO Helpline: Contact the toll-free number for direct assistance if your online PF claim status does not change.

Taking quick action helps resolve delays and speeds up your PF withdrawal process. To ensure accuracy with any compliance-related query, you can also take professional assistance from RegisterKaro. We provide expert support for ESI employer registration and other compliance services. Contact us today for more information.

Frequently Asked Questions

Yes, you can check the status of a limited PF claim using your PF account number or Member ID, depending on the case. However, full access to your online PF claim status usually requires a UAN login. Without UAN, the information shown may be basic and not include complete settlement details.