What are the Fees of Registering a Private Ltd Company in India?

For startups and entrepreneurs, understanding the costs and fees associated with registering a Private Limited Company is a critical step in financial planning. This knowledge allows for accurate budgeting and prevents unexpected expenses that could strain initial capital.

A Private Limited Company offers benefits like limited liability, separate legal identity, and greater credibility, but these advantages come with specific registration costs.

The total cost to register a company is not a single fee but a combination of several components. These can be broadly categorized as:

- Government Fees: Includes ROC filing fees, name reservation charges, stamp duty (varies state to state), and incorporation form fees.

- Professional Charges: Covers drafting of MOA & AOA, filing of incorporation forms, DSC/DIN applications, PAN/TAN registration, and consultancy fees.

- Optional Expenses: Additional costs such as GST registration, company seal, stationery, bank account opening, and notary/courier charges.

These costs vary depending on factors such as the company’s authorised share capital, the state of registration, and the professional service provider you choose.

What is Included in the Government Fee for Company Registration?

The Government of India removed the incorporation fee for company registration from 26th January 2019 to promote ease of doing business. Earlier, the fee ranged from ₹2,000 to over ₹2,06,000, based on company type, authorised share capital, and members.

However, other government charges still apply, such as ROC filing fees, stamp duty, form submission charges, and fees on applications to the Central Government. The detailed breakup is given below.

Filing Fees for OPC and Small Companies

- If the company’s share capital is up to Rs. 10,00,000 → Fee is Rs. 2,000

- If share capital is between Rs. 10,00,000 to Rs. 50,00,000 → Fee is Rs. 2,000 + Rs. 200 for every Rs. 10,000 or part of it

- If share capital is between Rs. 50,00,000 to Rs. 1 crore → Fee is Rs. 1,56,000 + Rs. 100 for every Rs. 10,000 or part of it

- If share capital is more than Rs. 1 crore → Fee is Rs. 2,06,000 + Rs. 75 for every Rs. 10,000 or part of it, up to a maximum of Rs. 250 crore

Filing Fees for Other Companies

- If share capital is up to Rs. 1,00,000 → Fee is Rs. 5,000

- If share capital is between Rs. 1,00,000 to Rs. 5,00,000 → Fee is Rs. 5,000 + Rs. 400 for every Rs. 10,000 or part of it

- If share capital is between Rs. 5,00,000 to Rs. 50,00,000 → Fee is Rs. 21,000 + Rs. 300 for every Rs. 10,000 or part of it

- If share capital is between Rs. 50,00,000 to Rs. 1 crore → Fee is Rs. 2,06,000 + Rs. 100 for every Rs. 10,000 or part of it

- If share capital is more than Rs. 1 crore → Fee is Rs. 2,06,000 + Rs. 75 for every Rs. 10,000 or part of it, up to a maximum of Rs. 2.50 crore

Charges for Companies Without Share Capital

- If the company has up to 20 members (as per MOA) → Fee is Rs. 2,000

- If members are more than 20 but up to 200 → Fee is Rs. 5,000

- If members are more than 200 (but not unlimited as per AOA) → Fee is Rs. 5,000 + Rs. 10 for every member after 200, up to a maximum of Rs. 10,000

Fee for Filing, Submitting, or Registering Documents with ROC

For Companies with Share Capital

- Share capital up to Rs. 1,00,000 → Fee is Rs. 200

- Share capital between Rs. 1,00,000 to Rs. 5,00,000 → Fee is Rs. 300

- Share capital between Rs. 5,00,000 to Rs. 25,00,000 → Fee is Rs. 400

- Share capital between Rs. 25,00,000 to Rs. 1 crore → Fee is Rs. 500

- Share capital of Rs. 1 crore and above → Fee is Rs. 600

For Companies without Share Capital

- Fee is fixed at Rs. 200 (irrespective of turnover)

Extra Fee for Delay in Filing Forms

If companies file forms late (except for an increase in share capital), extra charges apply:

- Delay up to 15 days → Normal filing fee

- Delay 16 to 30 days → 2 times the normal fee

- Delay 31 to 60 days → 4 times the normal fee

- Delay 61 to 90 days → 6 times the normal fee

- Delay 91 to 180 days → 10 times the normal fee

- Delay more than 180 days → 12 times the normal fee

Note: In 2018, MCA changed the penalty for late filing of annual returns to Rs. 100 per day per form.

Check out the overall charges required for incorporating a company in India by reading the detailed blog on “Cost of Company Registration in India“.

Fee on Applications to the Central Government

For Companies with Authorized Share Capital:

- Up to Rs. 25,00,000 → Fee is Rs. 1,000 for OPC/Small Companies, and Rs. 2,000 for others

- Between Rs. 25,00,000 to Rs. 50,00,000 → Fee is Rs. 2,500 for OPC/Small Companies, and Rs. 5,000 for others

- Between Rs. 50,00,000 to Rs. 5 crores → No fee for OPC/Small Companies, and Rs. 5,000 for others

- Above Rs. 10 crores → No fee for OPC/Small Companies, and Rs. 20,000 for others

What is the Entity-Wise Cost of Company Registration in India?

The cost of registering a company in India depends on the type of business entity you choose. The main expenses include government fees, professional charges, and compliance-related costs.

1. Private Limited Company Registration Cost

A Private Limited Company is the most common choice for startups and growing businesses because of its credibility and limited liability benefits.

Here’s the usual cost split for Pvt. Ltd. registration:

| Fee Category | Item | Cost / Range (₹) |

| Government Fees | ₹2,500 per DSC (based on the number of directors) | ₹1,000 |

| Incorporation fees | – Up to ₹1 lakh: ₹5,000 – ₹1 lakh to ₹5 lakh: ₹5,000 + 0.01% of amount above ₹1 lakh – ₹5 lakh to ₹1 crore: ₹5,400 + 0.005% of amount above ₹5 lakh – Above ₹1 crore: ₹10,150 + 0.001% of amount above ₹1 crore | |

| Stamp duty | Varies by state & capital (₹135 to ₹15,020 for capital up to ₹1 lakh) | |

| Professional Fees | Digital Signature Certificate (DSC) | ₹2,500 per DSC (based on no. of directors) |

| Professional service charges (MOA, AOA, filing) | ₹1,999 (for Indian clients, higher for foreign/NRI) | |

| PAN & TAN application fee | ₹443 | |

| Post-Registration | Company seal & stationery | ₹500 – ₹1,500 |

| Bank account opening charges | Depends on bank; may require minimum balance or service charges | |

| GST registration (if required) | Govt. fee: Free + professional charges (if applicable) |

2. LLP Registration Cost

The cost of registering an LLP in India generally ranges from ₹7,000 to ₹15,000, depending on government fees, professional charges, and stamp duty.

If you want to explore the complete cost breakdown and process in detail, check out a detailed guide on LLP registration cost.

3. One Person Company (OPC) Registration Cost

The cost of registering an OPC in India usually falls between ₹10,500 and ₹20,000 (excluding GST), depending on government fees, stamp duty, and professional charges.

What Key Requirements Affect Pvt. Ltd. Company Registration Costs?

The overall cost of registering a Private Limited Company (Pvt Ltd) depends on factors like government fees, stamp duty, and professional charges.

Along with the Documents Required for Company Registration in India, additional approvals and compliance documents also impact the cost.

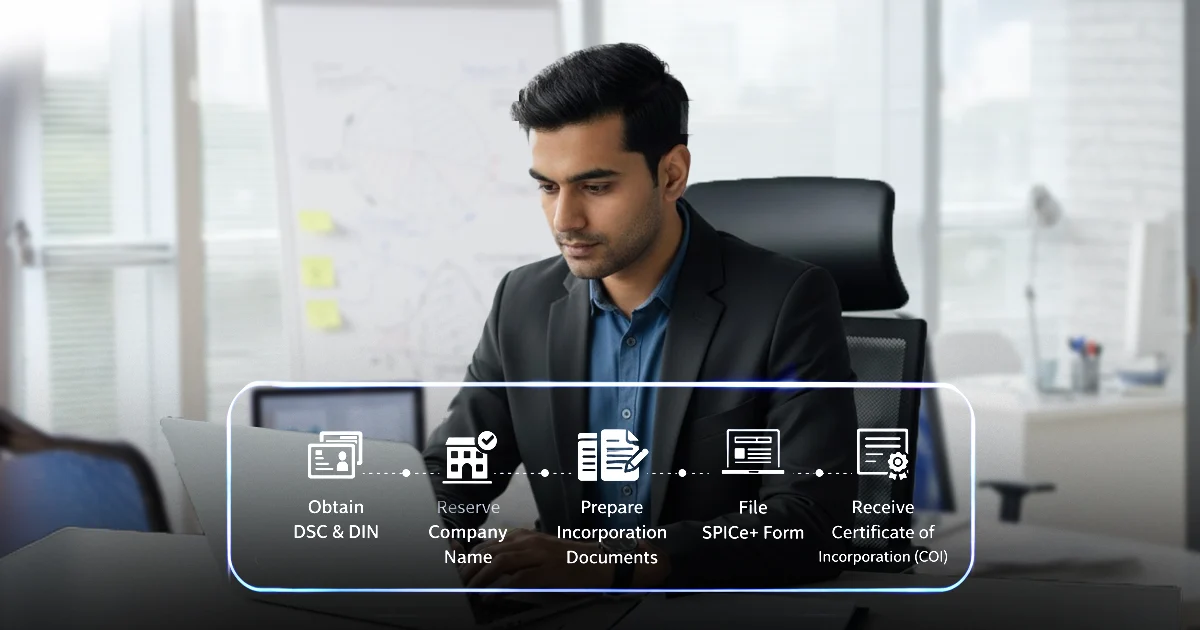

1. DSC & DIN

To start the registration process, you need a Digital Signature Certificate (DSC). It is essential to file all online forms, and without a DSC, you cannot complete the registration process.

Another requirement is the Director Identification Number (DIN), which is necessary for every company director. Getting a DIN is simple, but if you need it quickly, a Chartered Accountant (CA) or Company Secretary (CS) has to digitally certify your application.

2. Company Name Approval

Before registering your Pvt Ltd company, the proposed name must be approved by the Ministry of Corporate Affairs (MCA).

The cost of name approval is quite low. For this, you need to file e-Form INC-1 on the MCA’s official website and pay the required fee online.

3. Incorporation Documents & Forms

The final step in registering your company is filing documents with the Registrar of Companies (RoC). This is where most of the registration cost is involved, and the amount depends on your company’s authorised share capital.

The costs at this stage include:

- Fee for Memorandum of Association (MOA), ₹1,000 for every ₹10,00,000 of authorised capital or part thereof.

- Fee for Articles of Association (AOA), ₹500 for every ₹10,00,000 of authorised capital or part thereof.

- Fee for SPICe Form, Standard filing fee of ₹500 (additional charges may apply if share capital is higher).

Reminder: Each state has its own Stamp Act that decides the rate of stamp duty. This can be a fixed fee or based on the authorised capital of your company. So, it is important to check the stamp duty rates for MOA, AOA, and SPICe forms in the state where you want to register your business.

Conclusion

The overall cost of Pvt Ltd company registration depends on several factors like DSC & DIN, name approval, incorporation forms, and state-wise stamp duty. While government fees are mostly fixed, the authorised share capital and stamp duty rates can significantly influence the final amount.

Taking professional assistance is highly recommended as it helps in saving time, avoiding mistakes, and ensuring smooth registration.

Get your Pvt Ltd company registered with RegisterKaro starting at just ₹1999. Contact us today to begin your journey with expert guidance!

Get your Pvt Ltd company registered with RegisterKaro starting at just ₹X. Contact us today to begin your journey with expert guidance!

Frequently Asked Questions

The fees for registration of a private limited company in India generally range between ₹10,000 and ₹20,000. The exact amount depends on factors like government filing fees, professional service charges, stamp duty (which varies from state to state), and the number of directors involved. Startups with minimal authorised capital usually pay on the lower side of this range.